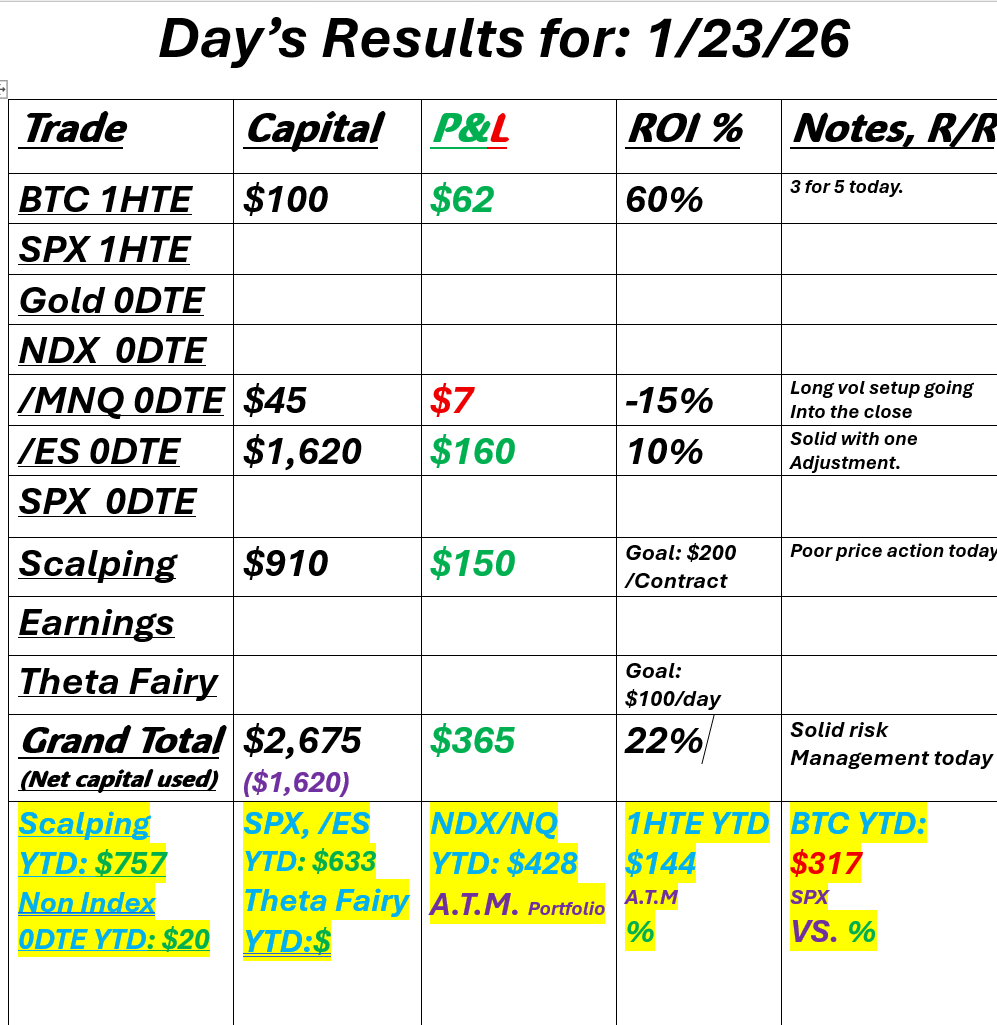

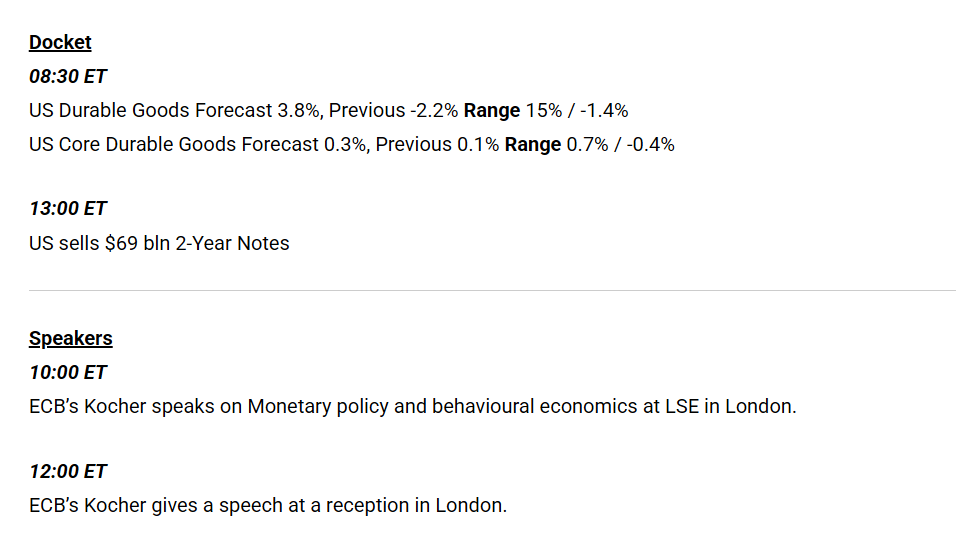

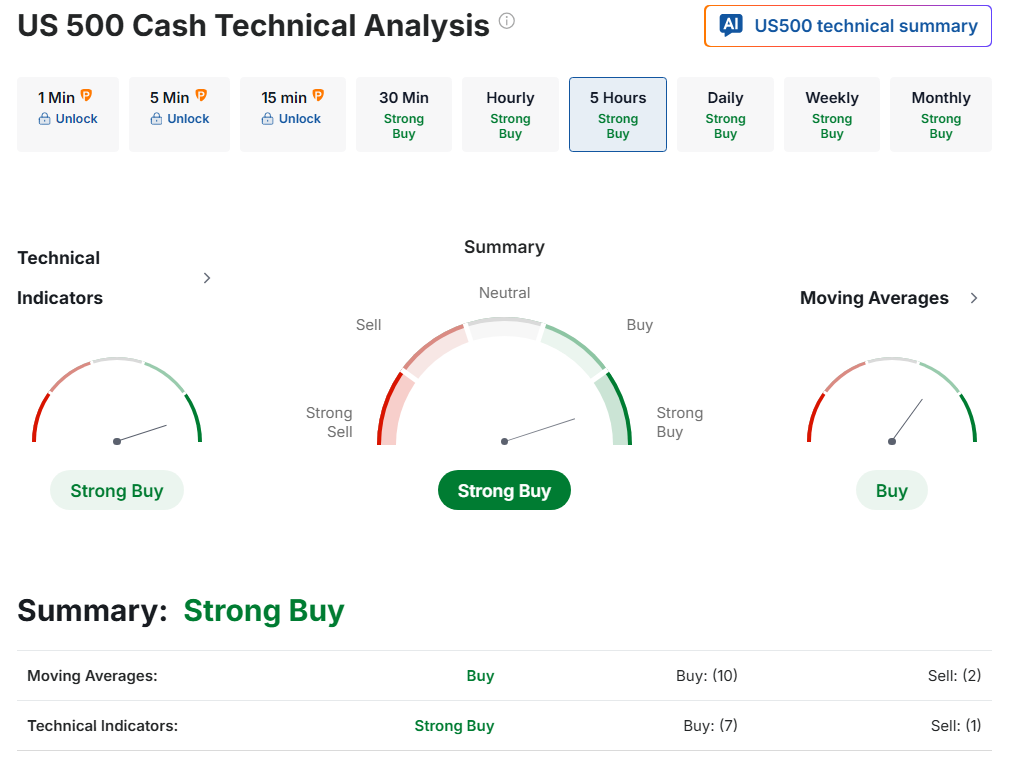

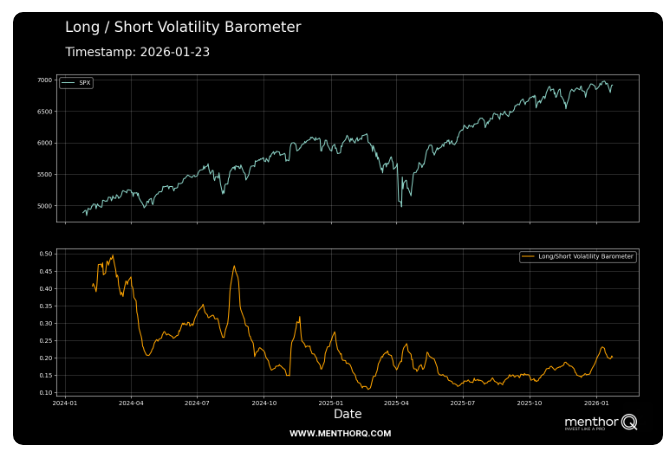

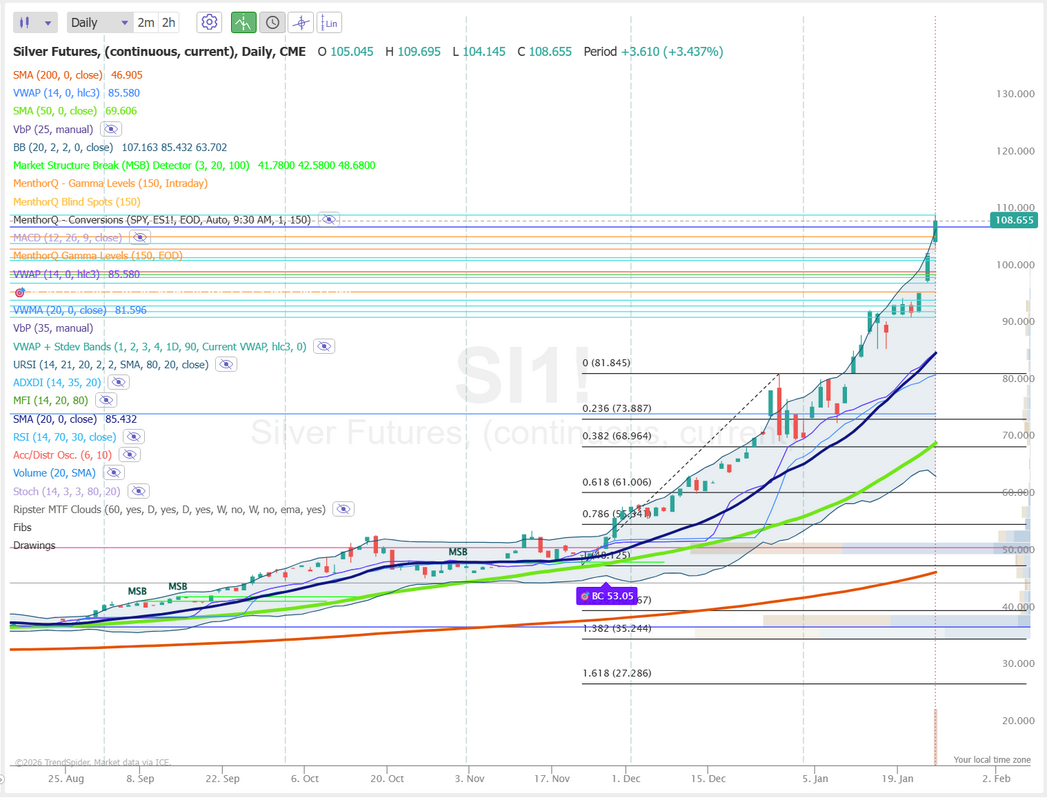

Big earnings. FOMC. Govt. Shutdown.Welcome back, traders, to a new week. I hope your weekend was relaxing. This week is busy. We've got some big names reporting along with a FED decision and statement on Weds. We've also got a deja vu happening with another potential Government shutdown looming. Didn't we just do this? Add the threat of new tariffs to Canada, and we've got a lot to watch this week. Fridays resuls were solid for us. We did quite well on scalping, even though it wasn't necessarily a great day for that. Here's a look at our day. Here are the planned news items that may be market movers today: Let's take a look at the markets to start the new week. Futures are a bit soft, as I type, still absorbing the tariff talk but technicals still point bullish. The SPY and QQQ are both coiled tightly around their respective 50DMA's. It's just guesswork right now as to the next directional move. Keep an eye on that 50DMA. On the IWM, we are close to initiating a short on that in our ATM portfolio. IMHO it's a bit stretched to the upside. Powell's comments this coming Weds. on future interest rates could be a catalyst for this rate sensitive index. March S&P 500 E-Mini futures (ESH26) are down -0.18%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.32% this morning as President Trump’s tariff threats against Canada and the looming risk of a partial U.S. government shutdown weighed on sentiment at the start of a busy week. U.S. President Donald Trump on Saturday threatened Canada with 100% tariffs on all its exports to the U.S. if it strikes a trade deal with China. Trump said in a social media post that if Canadian Prime Minister Mark Carney “thinks he is going to make Canada a ‘Drop Off Port’ for China to send goods and products into the United States, he is sorely mistaken.” He added, “China will eat Canada alive, completely devour it, including the destruction of their businesses, social fabric, and general way of life.” Meanwhile, worries about a partial U.S. government shutdown intensified over the weekend after Senate Democratic leader Chuck Schumer pledged to block a sweeping spending package unless Republicans remove funding for the Department of Homeland Security. Schumer’s announcement followed an incident in which a Border Patrol agent shot and killed an American intensive care unit nurse in Minnesota during protests over the state’s immigration crackdown. Without Senate approval of the funding package by Friday, the federal government will enter a partial shutdown this weekend. This week, market participants look ahead to earnings reports from major tech names, the Federal Reserve’s interest rate decision, and a slew of U.S. economic data. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Most members of the Magnificent Seven stocks climbed, with Microsoft (MSFT) rising over +3% and Amazon.com (AMZN) gaining more than +2%. Also, gold mining stocks advanced after gold prices climbed to a record high, with Newmont Mining (NEM) and Freeport-McMoran (FCX) rising over +2%. In addition, Fortinet (FTNT) surged more than +5% and was the top percentage gainer on the Nasdaq 100 after TD Cowen upgraded the stock to Buy from Hold with a price target of $100. On the bearish side, Intel (INTC) tumbled over -17% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chipmaker issued disappointing Q1 guidance. “Stocks are consolidating. The laggards are catching up, and the winners are giving back a little,” said Louis Navellier at Navellier & Associates. Economic data released on Friday showed that the University of Michigan’s U.S. January consumer sentiment index was revised upward to a 5-month high of 56.4, stronger than expectations of no change at 54.0. Also, the U.S. S&P Global manufacturing PMI rose to 51.9 in January, in line with expectations. At the same time, the U.S. January S&P Global services PMI came in at 52.5, unchanged from the prior month and below expectations of 52.9. Fourth-quarter corporate earnings season hits full throttle, and investors await fresh reports from major companies this week, including Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), Apple (AAPL), Lam Research (LRCX), Texas Instruments (TXN), KLA Corp. (KLAC), International Business Machines (IBM), Visa (V), Mastercard (MA), UnitedHealth Group (UNH), RTX Corporation (RTX), Boeing (BA), Lockheed Martin (LMT), AT&T (T), Verizon (VZ), Caterpillar (CAT), Exxon Mobil (XOM), Chevron (CVX), and American Express (AXP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. Market participants will also keep a close eye on the Fed’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. Focus will center on the number of dissenting votes and the Fed’s accompanying comments as investors assess the likely timing and pace of further rate cuts. Mr. Powell is likely to signal that policy is well-positioned for now. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by year-end. In addition, market watchers will monitor a fresh batch of U.S. economic data. A delayed report on December wholesale inflation will be the main highlight this week. Other noteworthy data releases include the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, Initial Jobless Claims, Nonfarm Productivity, Unit Labor Costs, Trade Balance, Factory Orders, Wholesale Inventories, and the Chicago PMI. On Friday, the Fed’s blackout period ends, with Fed officials Bowman and Musalem set to deliver remarks. Today, investors will focus on U.S. Durable Goods Orders and Core Durable Goods Orders data, set to be released in a couple of hours. Economists expect November Durable Goods Orders to climb +3.1% m/m and Core Durable Goods Orders to rise +0.3% m/m, compared to the prior numbers of -2.2% m/m and +0.2% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.205%, down -0.83%. Today's training will focus on the 6/20 MA setup that closely mimics the same feedback we get from the audible order flow tickstrike. For those of you who don't use TickStrike, this is a good alternative. SPX continues to grind higher while the long/short volatility barometer remains compressed, signaling a market still leaning toward volatility selling rather than protection. In the short term, this combination typically supports range-bound strength and shallow pullbacks, as lower realized volatility keeps dips contained. However, the recent uptick in the barometer suggests sensitivity is starting to rise, making the index more reactive to shocks. Near-term price action looks constructive as long as volatility stays subdued, but a sharper turn higher in the barometer would be an early signal that short-term risk is shifting toward wider intraday swings rather than smooth upside follow-through. Silver: The story today is silver. Really it's been the story all month. The move has been absolutely parabolic. Futures on silver are screaming higher this morning by another 8.3%!!!! It's been absolutely incredible to watch. We've have some good positions on it lately in our ATM portfolio. /SI only has monthly options. The Jan. cycle expires tomorrow. I'm looking at focusing our trades today on that expiraton. Implied volatility is over 100%! Take a look at how that compares over time. Key Historical Trends in Silver Futures IV

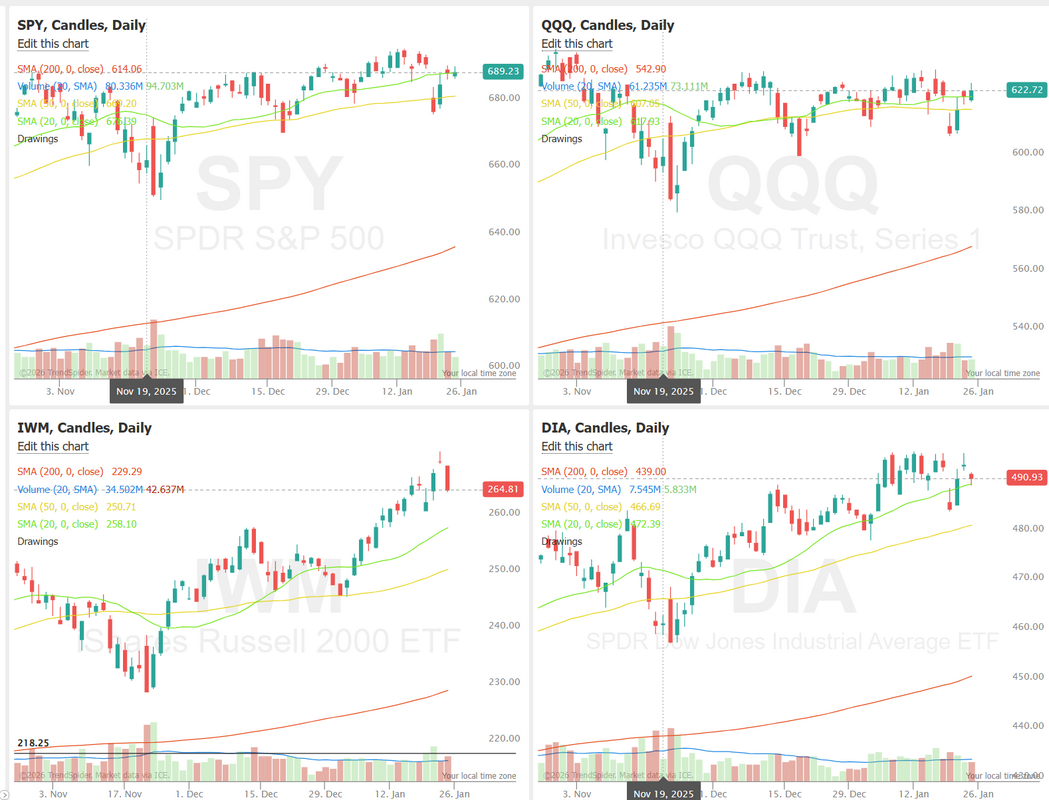

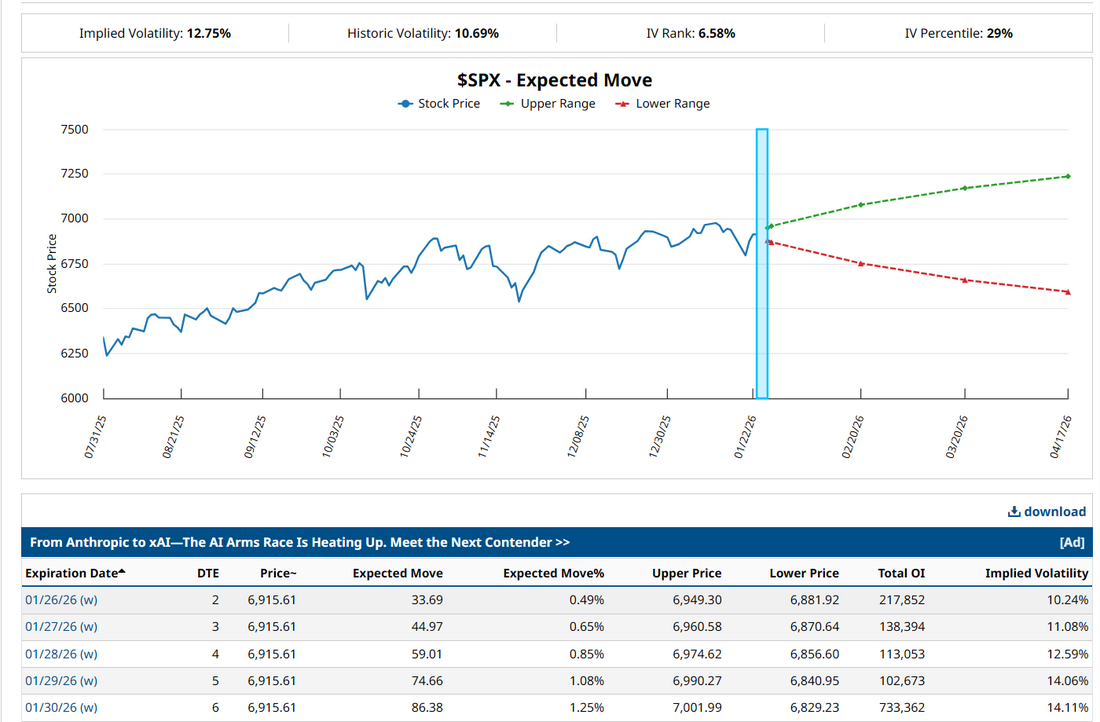

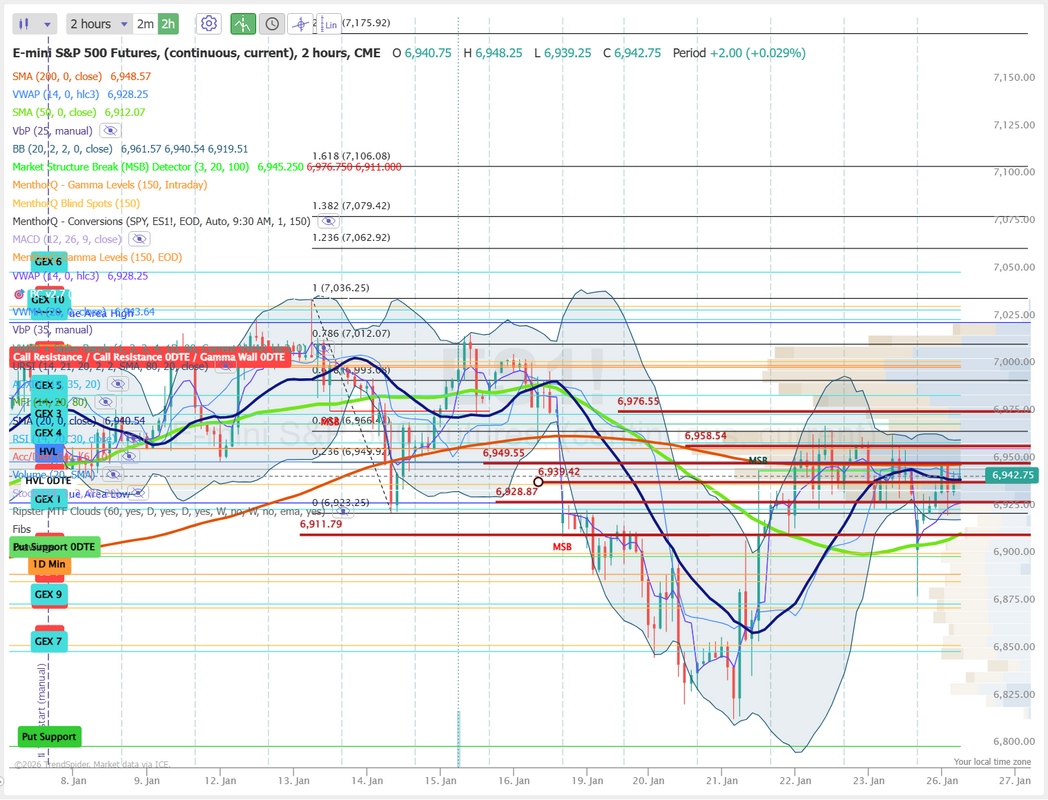

This looks like the right time to attempt another silver entry. SPY closed the week slightly lower at $689.23 (-0.35%), with support at the LinkLine indicator continuing to hold. However, each bounce off this level has coincided with a bearish divergence on the RSI Divergences lower indicator, suggesting momentum may be fading. This week’s earnings should offer clearer direction as traders assess whether support holds or cracks under pressure. The Nasdaq-100 outperformed the S&P 500 slightly last week, with QQQ closing up at $622.72 (+0.24%). The index remains in a choppy range but has bounced cleanly off LinkLine support. As a result, momentum remains muted, with no bearish RSI divergences being flagged due to the lack of new highs. With several major tech names reporting this week, earnings could be the catalyst that determines whether the Nasdaq-100 regains upside traction or stays range-bound. The IWM ETF slipped slightly last week, closing at $264.81 (-0.36%), marking the end of its recent streak of outperformance versus large caps. After hitting a new all-time high on Thursday, a bearish RSI divergence emerged, followed by a sharp sell-off into Friday’s close. With the FOMC meeting ahead and markets pricing in a 98% chance of no rate change, this rate-sensitive ETF may have already fully priced in prior rate cut expectations. Let's take a look at the expected move this week. Coming in at 1.25% it's better than we've had lately. Premium looks decent to start the week. Let's take a look at the levels we'll be watching today on the /ES. Levels have tightened up since Friday. Resistance sits at 6949, 6958, 6976. Support levels sit at 6939, 6928, 6911. These levels are all tight. There's a good chance we'll move outside these ranges. We'll look at some expanded ranges in our Zoom session. I'll see you all in the live trading room shortly! Keep your eye of silver. That's our likely go to today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |