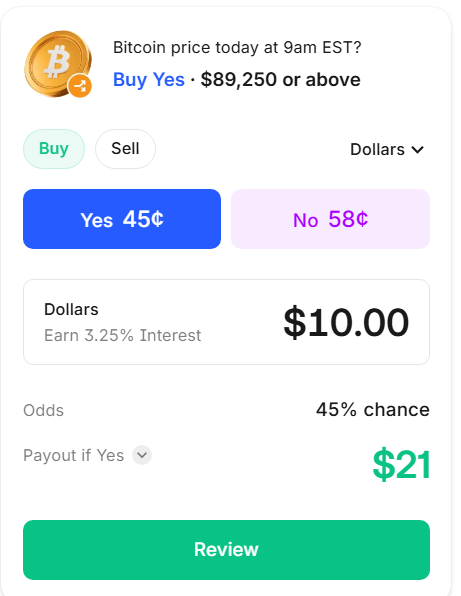

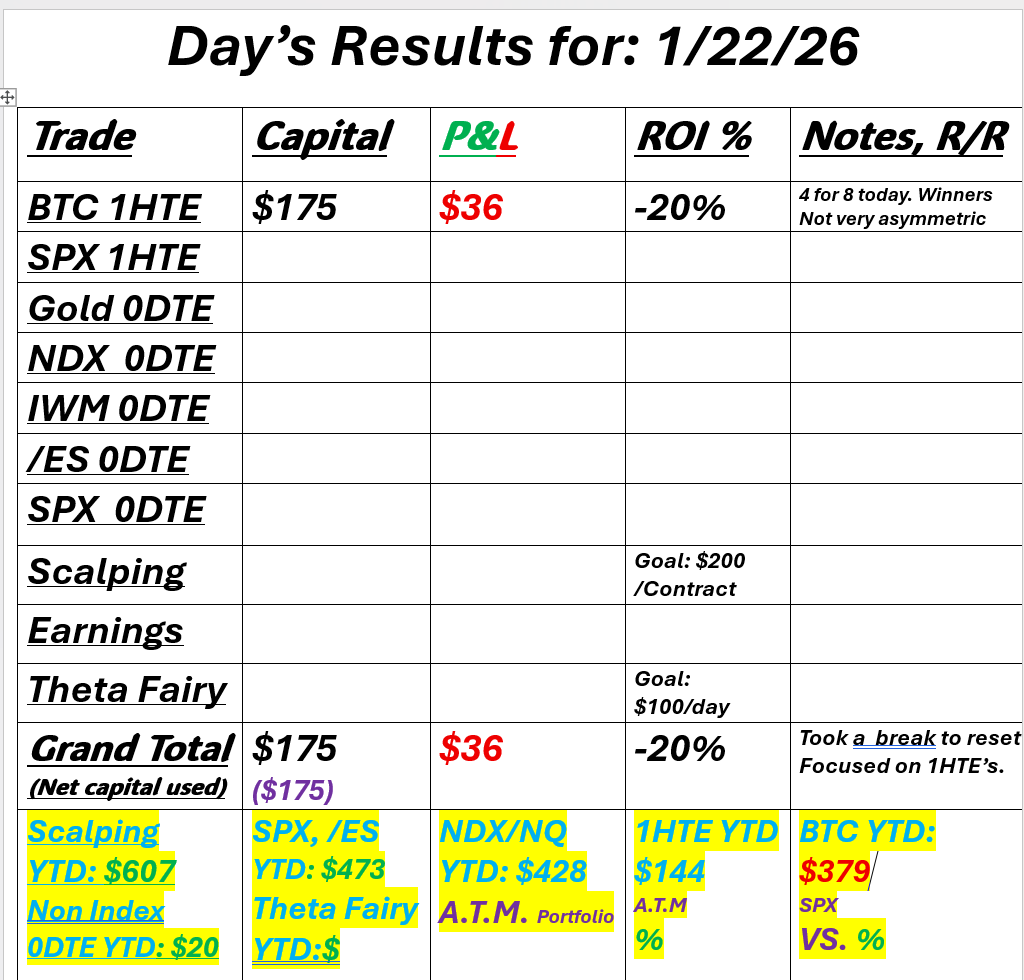

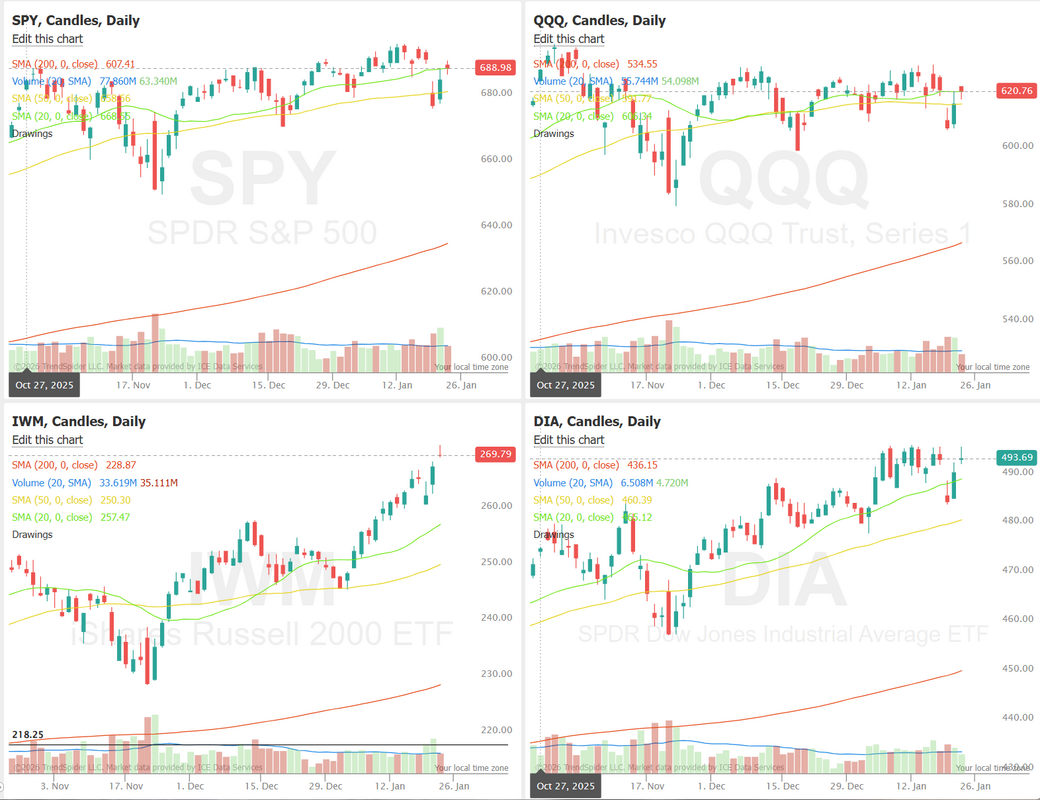

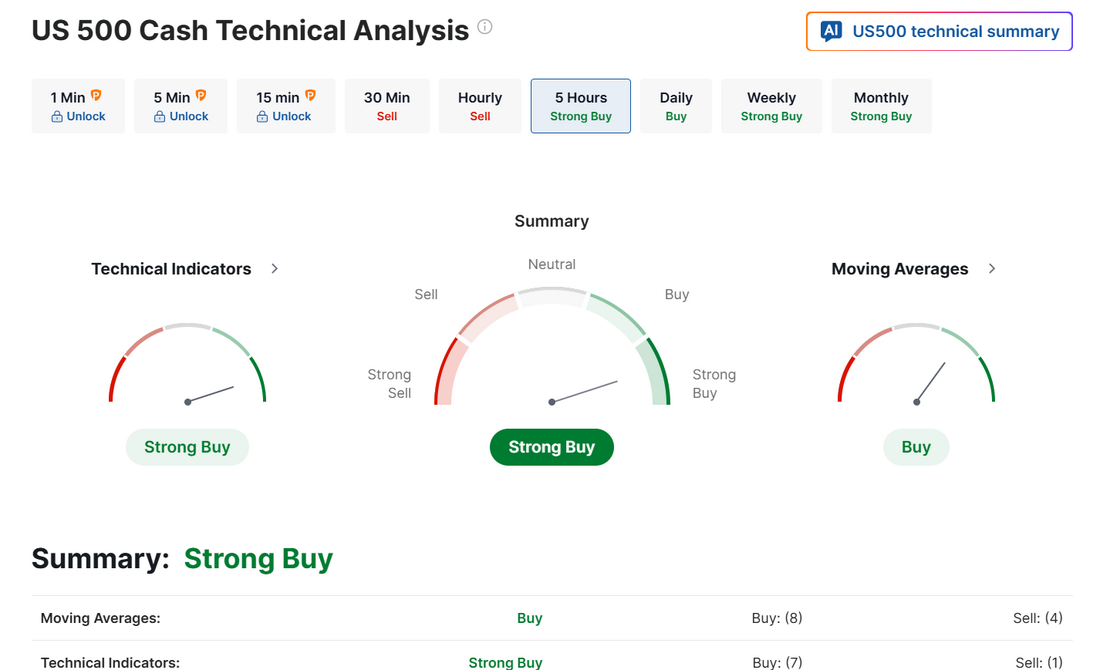

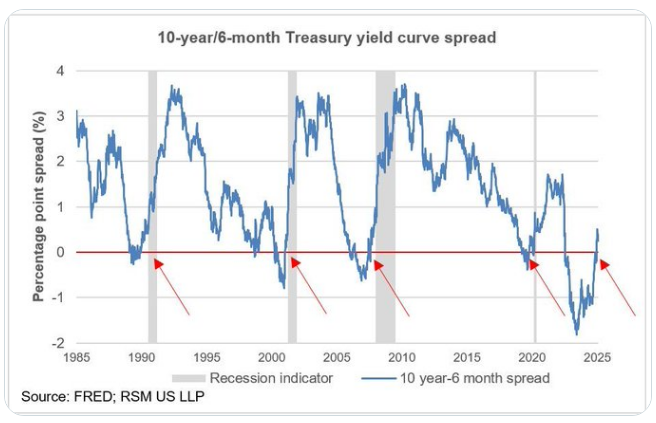

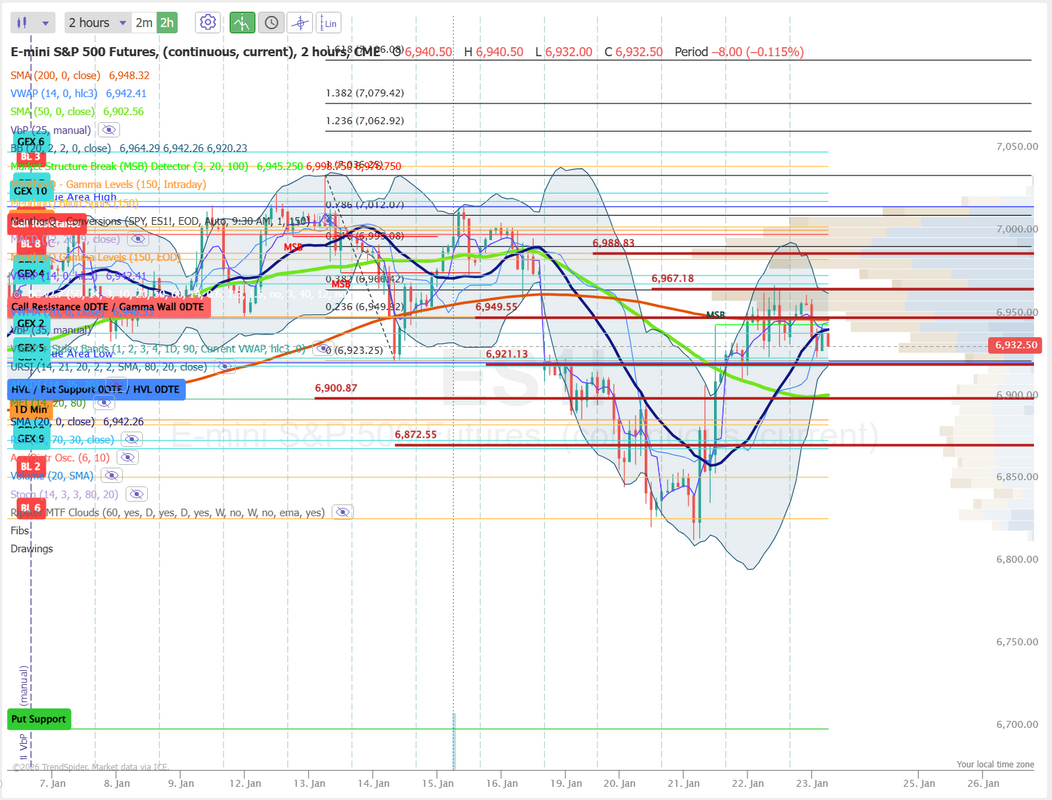

Intel finally disappoints.Futures are a bit weaker this morning as Intel finally looks to stop its rocket ride higher. I was very active yesterday, but not really. After Tasty's meltdown the previous day, I wanted to take it slow and make sure I was only focusing on prime setups. I didn't see anything to get excited about. I did spend the day doing eight 1HTE BTC setups. We hit four out of eight, which is pretty good, but the last winners weren't very asymmetric and couldn't get us into the green. We've already started this morning with our new batch. Here's a look at our first one. Here's a look at my day yesterday. As I said...not much action. Let's take a look at the markets this Friday morning. Both the SPY and QQQ are battling to get and stay above their 50DMA. In spite of the Intel hit to futures, the technicals are still slightly bullish to start the day. March Nasdaq 100 E-Mini futures (NQH26) are trending down -0.20% this morning as a lackluster forecast from semiconductor giant Intel weighed on sentiment. Intel (INTC) sank more than -13% in pre-market trading after the chipmaker issued disappointing Q1 guidance and Chief Executive Officer Lip-Bu Tan cautioned that the company continues to face manufacturing challenges. Investor focus now turns to U.S. business activity data, which will offer fresh insight into the health of the world’s largest economy. In yesterday’s trading session, Wall Street’s major indices ended in the green. The Magnificent Seven stocks advanced, with Meta Platforms (META) rising over +5% and Tesla (TSLA) gaining more than +4%. Also, most chip stocks climbed, with ARM Holdings (ARM) surging over +4% and Advanced Micro Devices (AMD) rising more than +1%. In addition, Datadog (DDOG) jumped over +6% and was the top percentage gainer on the Nasdaq 100 after Stifel upgraded the stock to Buy from Hold with a price target of $160. On the bearish side, Abbott Laboratories (ABT) slumped more than -10% and was the top percentage loser on the S&P 500 after the medical devices maker posted weaker-than-expected Q4 net sales. Data from the U.S. Department of Commerce released on Thursday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.2% m/m and +2.8% y/y in November, in line with expectations. Also, the U.S. Bureau of Economic Analysis said Q3 GDP growth was revised higher to +4.4% (q/q annualized) in its final estimate, stronger than expectations of no change at +4.3%. In addition, U.S. November personal spending rose +0.5% m/m, in line with expectations, while personal income grew +0.3% m/m, weaker than expectations of +0.4% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose by +1K to 200K, compared with the 209K expected. “[Thursday’s] data should reassure the Fed that the economy remains on a solid footing, despite a cooler labor market,” said James McCann, an economist at Edward Jones. “Indeed, there looks to be little urgency to cut rates at next week’s meeting, and the central bank could stay on hold for longer should growth remain robust into 2026 and inflation continue to run at above target rates.” Meanwhile, U.S. rate futures have priced in a 97.2% probability of no rate change and a 2.8% chance of a 25 basis point rate cut at next week’s monetary policy meeting. Today, investors will focus on preliminary U.S. purchasing managers’ surveys, set to be released in a couple of hours. Economists expect the January S&P Global Manufacturing PMI to be 51.9 and the S&P Global Services PMI to be 52.9, compared to the previous values of 51.8 and 52.5, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will also be released today. Economists anticipate that the final January figure will be unrevised at 54.0. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.239%, down -0.28%. The #1 metric that predicted every recession since 1970 just flashed red. The Yield Curve. Normal curve (10Y > 2Y) → Economy healthy, stay long Inverted 1-3 months → Early warning, watch closely Inverted 6+ months → Recession within 12-18 months The 2Y/10Y has been inverted since July 2022—longest inversion in history. Every recession since 1970 was preceded by an inverted curve. No false signals. Ever. Watch the curve. Ignore the talking heads. SPX remains in a short-term uptrend but momentum has become choppier, with the momentum score repeatedly cycling between strong (4–5) and corrective (2) regimes over recent sessions. This pattern suggests buyers are still defending dips, yet follow-through has been less consistent near recent highs. In the near term, sustained momentum back above the prior 5-score zone would signal renewed upside traction, while another rollover toward the lower momentum band would point to consolidation or a shallow pullback rather than trend failure. For the short horizon, price action looks more tactical than directional, with momentum acting as a key tell for whether strength can extend or if the market needs time to reset. Let's take a look at our intraday levels. They haven't shifted too much from yesterday. 6949, 6967, 6988 are resistance with 6921, 6900, 6872 working as support. I think we've got a better shot at some good setups today. I'll see you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |