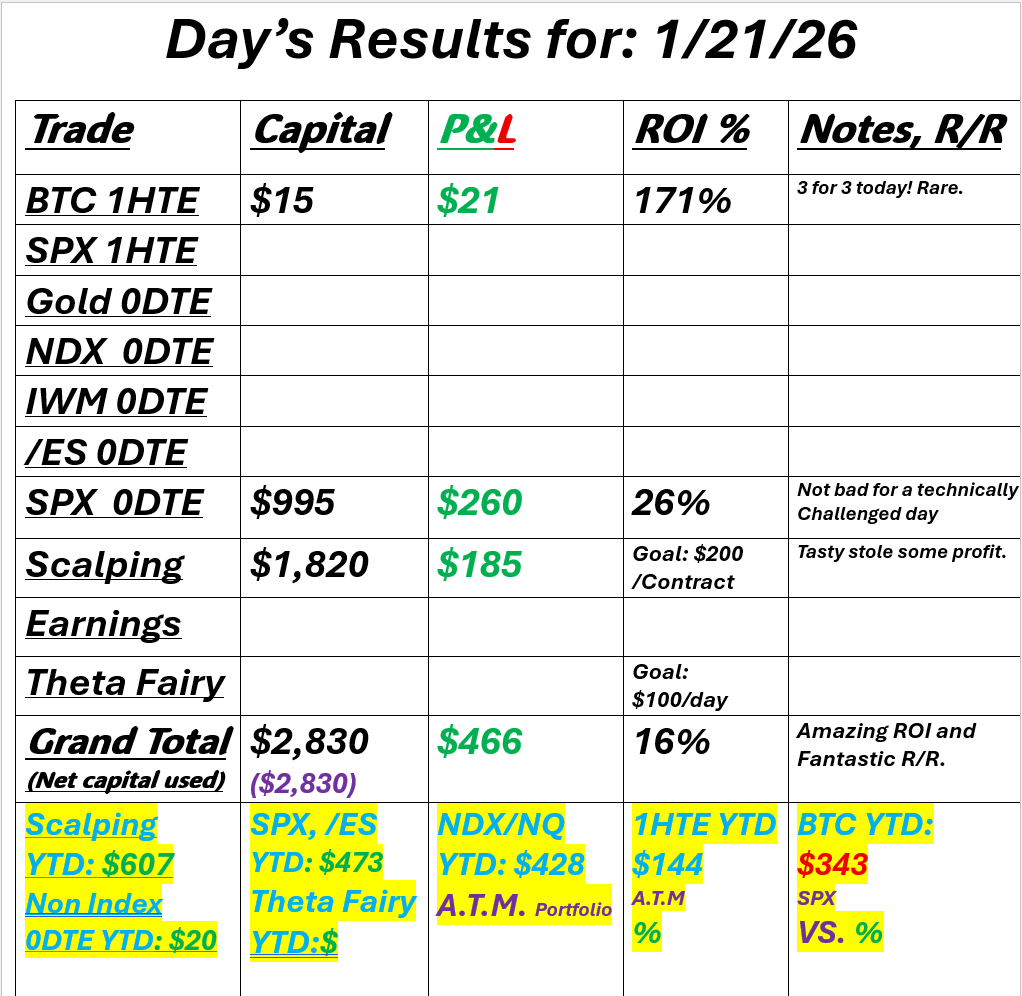

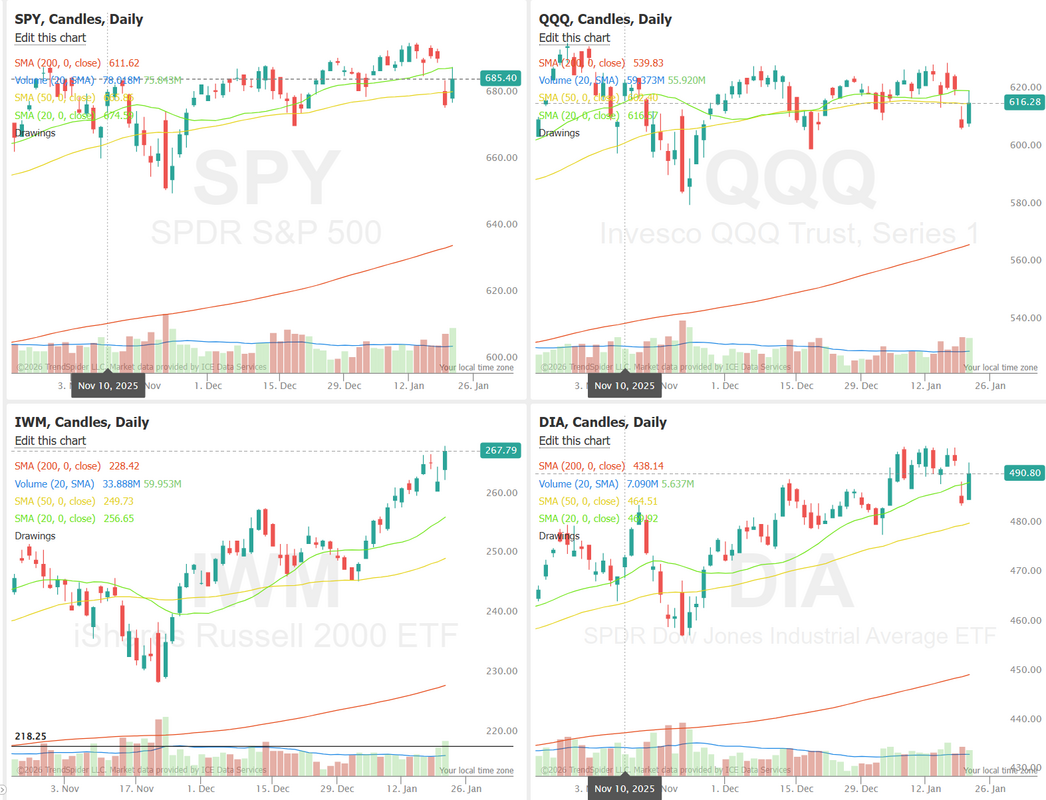

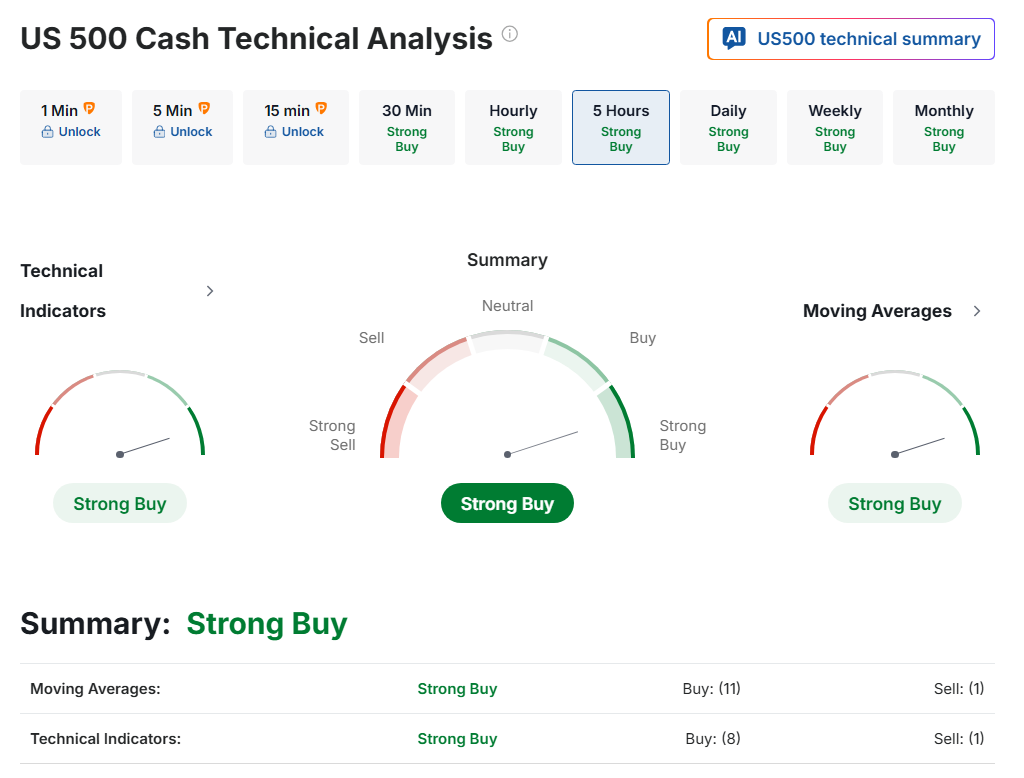

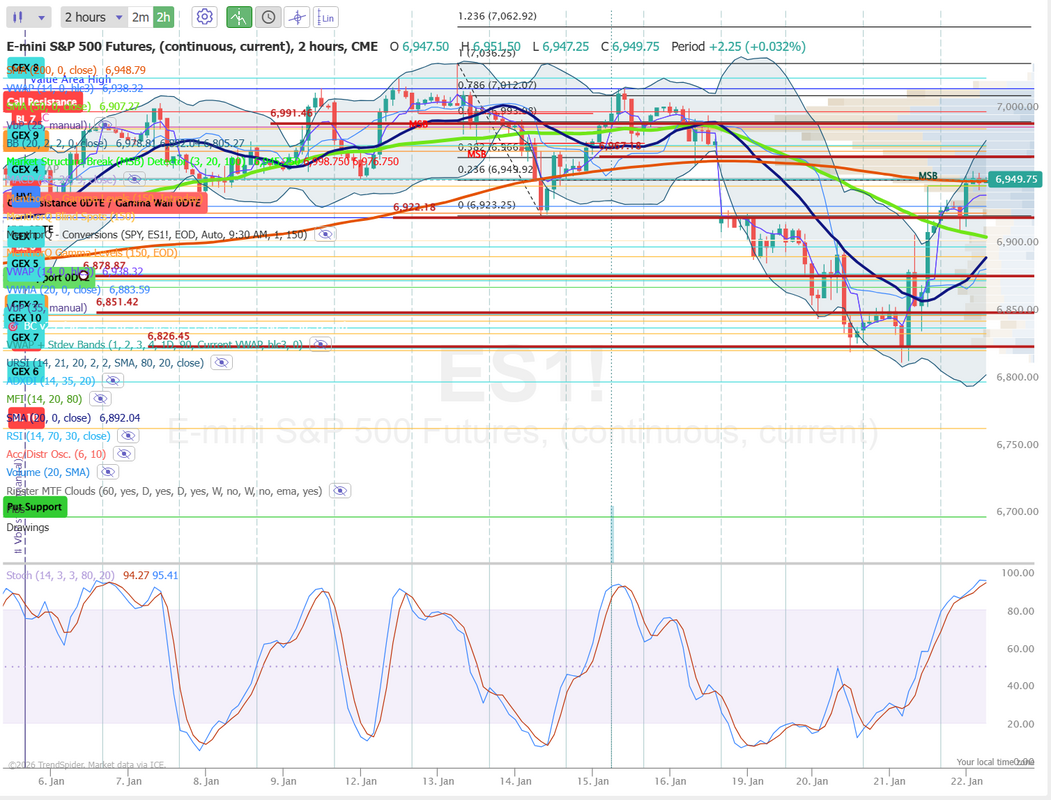

Technology is awesome...when it works.Good golly Miss Molly! Yesterday was a massive exercise in frustration. The day started off badly with our trades going the wrong way. No biggie. We can adjust them. We went to adjust and, boom! Nothing. Tastytrade was either down or doing weird things. We were super, super lucky that our trades all came into the profit zone, and I was able to get an execution via the online version. It's such a bummer because I feel like we could have gotten much more out of the day, but I am very grateful we didn't get too messed up. I gave back $140 profit on our scalp because the entry didn't process, but overall, we need to count our blessings on the shortened day. Here's a look at what we got done before I gave up. BTW, I also placed a long /NQ put position that lost money in the wrong account and now the ATM portfolio balance is messed up! Let's take a look at these crazy markets. Markets roared back yesterday but stopped short of recapturing their 50DMA's. The IWM hit a new ATH. Technicals are back to solid buy mode. March S&P 500 E-Mini futures (ESH26) are up +0.66%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.89% this morning, pointing to further gains on Wall Street after U.S. President Donald Trump walked back his threats to impose tariffs on a group of European countries over Greenland. President Trump said on Wednesday that he would not impose tariffs on eight European countries, citing a framework for a deal on Greenland and the Arctic. “Based upon a very productive meeting that I have had with the Secretary General of NATO, Mark Rutte, we have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region,” Trump said in a post on Truth Social. “Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.” NATO’s chief said on Thursday that the compromise did not involve discussions about the territory’s sovereignty. “The framework of the Greenland deal takes down the temperature a lot, given the happenings over the weekend,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “Less tariffs are unequivocally a positive for markets.” Futures on the Nasdaq 100 outperformed as AI-related stocks climbed in pre-market trading amid a wave of activity across the AI space. OpenAI Chief Executive Officer Sam Altman was holding meetings with Middle East investors for a funding round that could value the ChatGPT developer at up to $830 billion. Also, Nvidia CEO Jensen Huang said at Davos that the global AI buildout will require trillions of dollars in spending on computing infrastructure. In addition, Bloomberg reported that Alibaba Group was preparing to list its chipmaking unit. Investors now await a raft of U.S. economic data, with particular attention on the Fed’s favorite inflation gauge and the final estimate of third-quarter GDP, as well as a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher. Chip stocks rallied, with Intel (INTC) surging over +11% to lead gainers in the Nasdaq 100 and Advanced Micro Devices (AMD) climbing more than +7%. Also, shares of data storage companies advanced, with Sandisk (SNDK) rising over +10% and Western Digital (WDC) gaining more than +8%. In addition, Moderna (MRNA) jumped over +15% and was the top percentage gainer on the S&P 500 after the company, together with Merck, announced positive results from a five-year follow-up study of their skin cancer vaccine. On the bearish side, Kraft Heinz (KHC) slid more than -5% after the company disclosed in a regulatory filing that its largest shareholder, Berkshire Hathaway, could sell nearly all of its shares. Economic data released on Wednesday showed that U.S. pending home sales slumped -9.3% m/m in December, weaker than expectations of -0.3% m/m. At the same time, U.S. October construction spending rose +0.5% m/m, stronger than expectations of +0.1% m/m. Fourth-quarter corporate earnings season picks up pace, and investors await new reports from prominent companies today, including Intel (INTC), Procter & Gamble (PG), GE Aerospace (GE), Abbott Laboratories (ABT), Intuitive Surgical (ISRG), and CSX Corporation (CSX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. The core PCE price index for November was originally scheduled for release on December 19th, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the October figures. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.8% y/y in November. The U.S. Commerce Department’s final estimate of third-quarter gross domestic product will also be closely monitored today. Economists expect the U.S. economy to expand at an annual rate of 4.3% in the third quarter. U.S. Personal Spending and Personal Income data will be released today. Economists expect November Personal Spending to rise +0.5% m/m and Personal Income to grow +0.4% m/m. U.S. Initial Jobless Claims data will be reported today. Economists estimate this figure will come in at 209K, compared to last week’s number of 198K. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1 million barrels, compared to last week’s value of 3.4 million barrels. U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.240%, down -0.26%. I don't have a lot more to say this morning. I'm still super frustrated with yesterday. I should have just taken the day off when I saw the technical issues Tasty was having. Let's see if we can make it a happier day today. We've got our extended training on 0DTE setup rules today. That will take some time. Please come join us. Let's look at the intraday levels on /ES for todays setups. 6967 and 6992 are the major resistance zones. There are a few pivot points between them. We'll map those out in our zoom session. 6922, 6878, 6851 are support. Big ranges today after yesterdays big move. I'll see you all shortly! Let's make it a great day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |