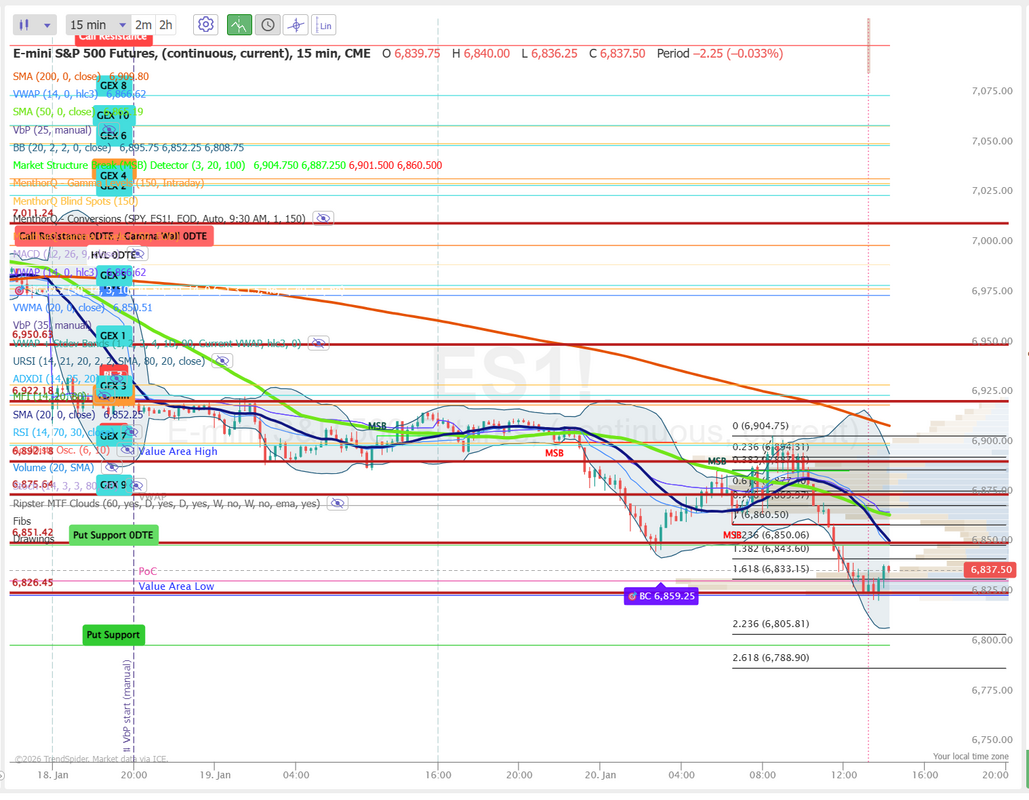

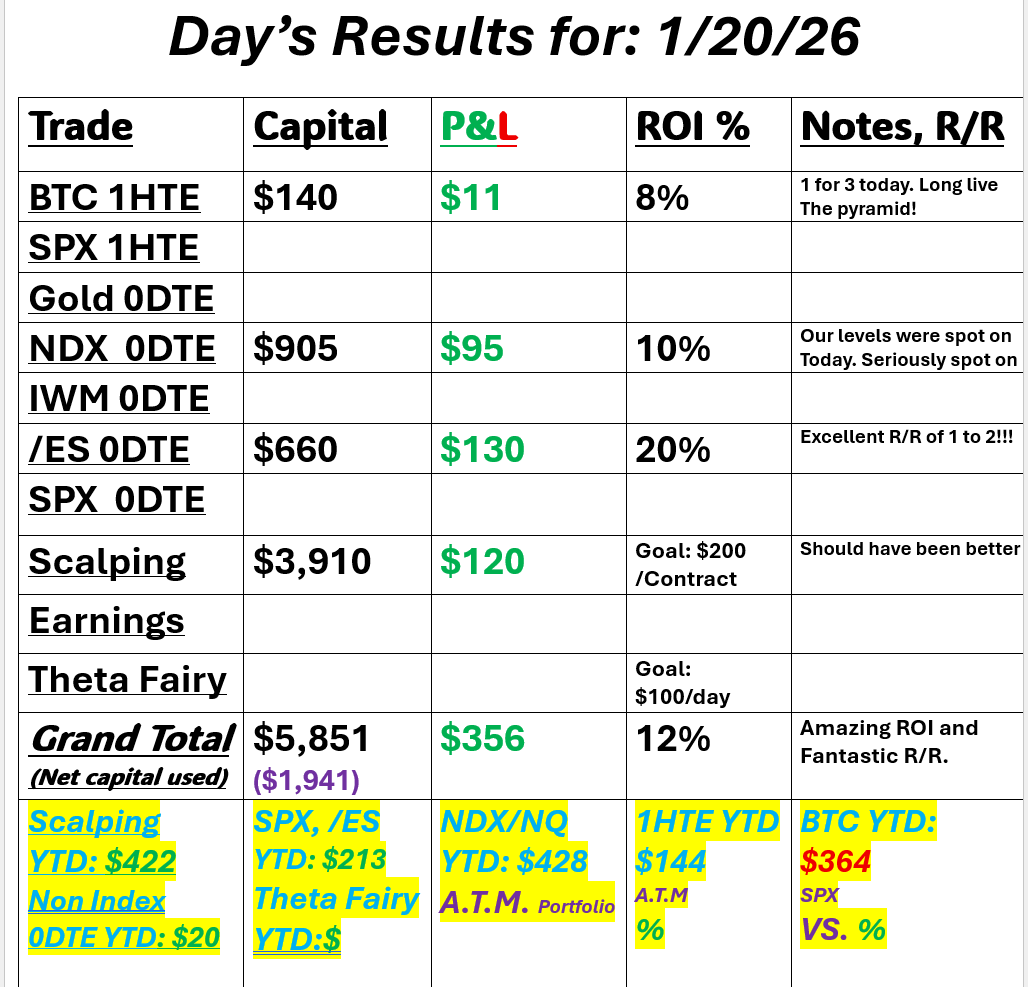

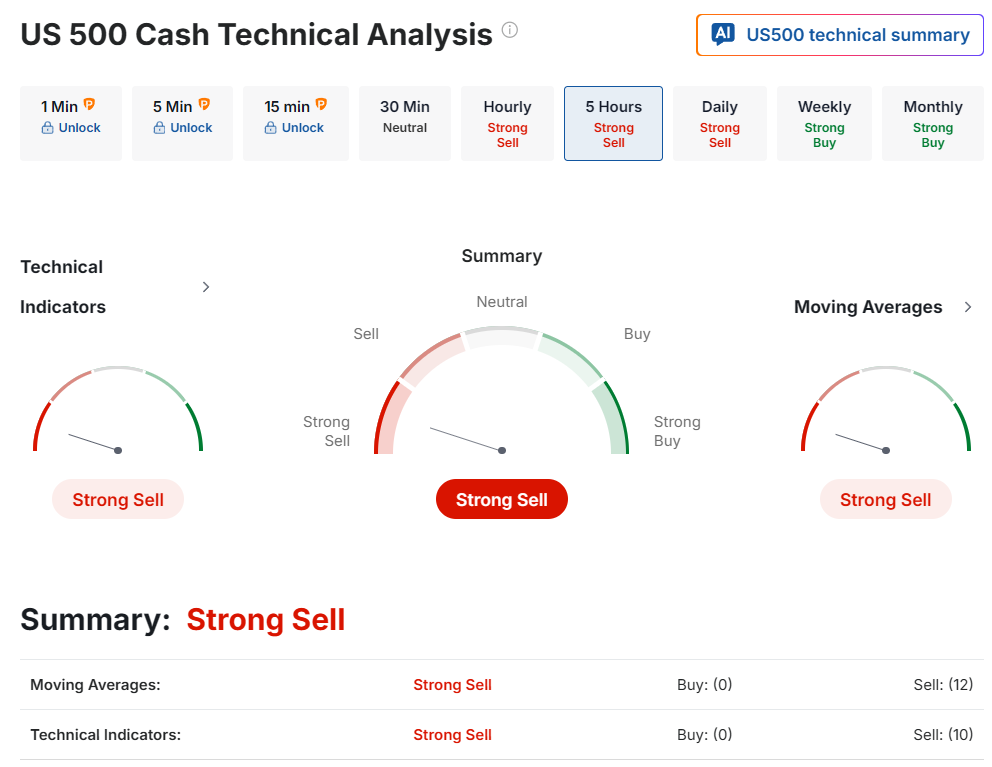

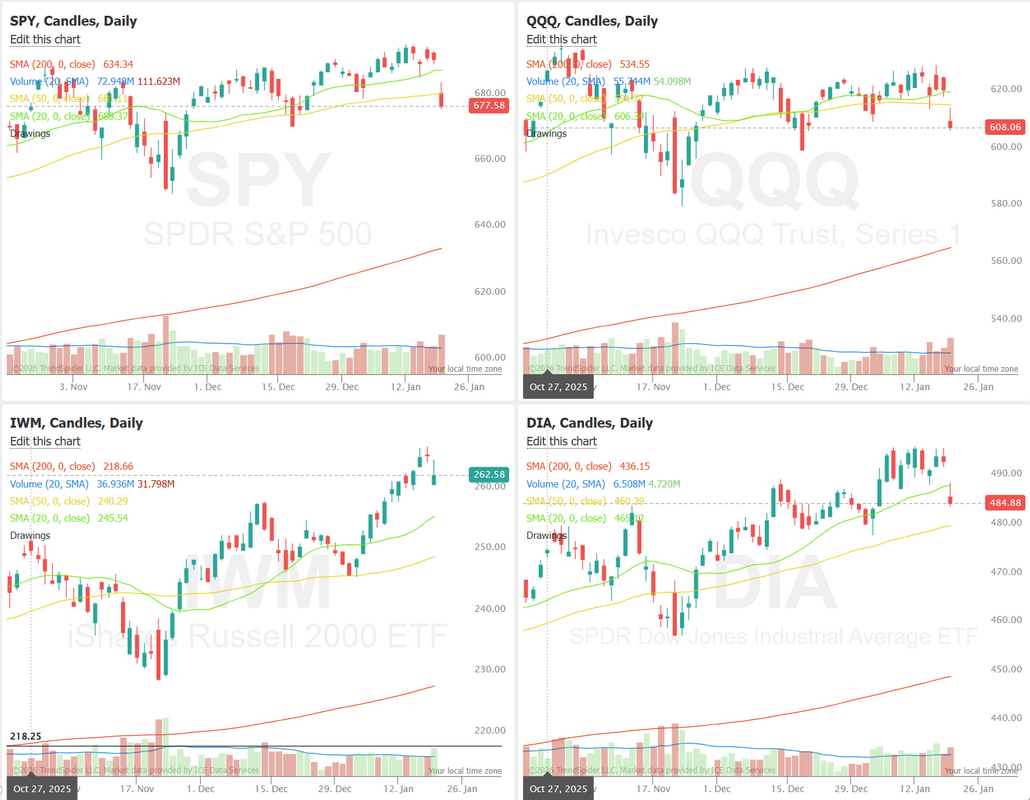

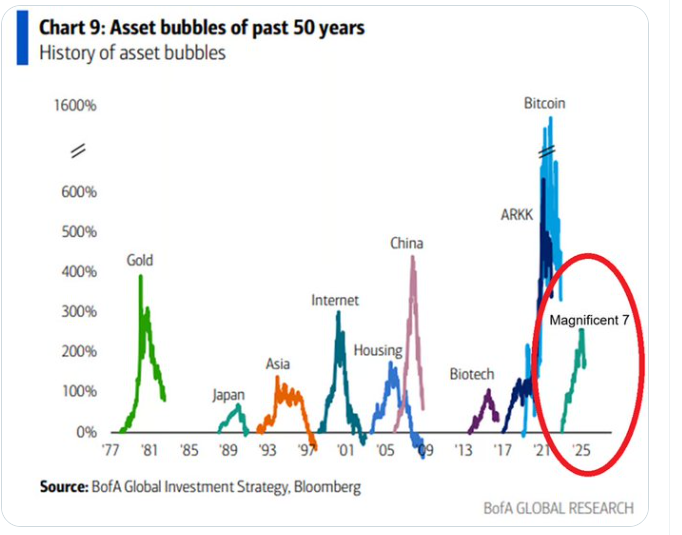

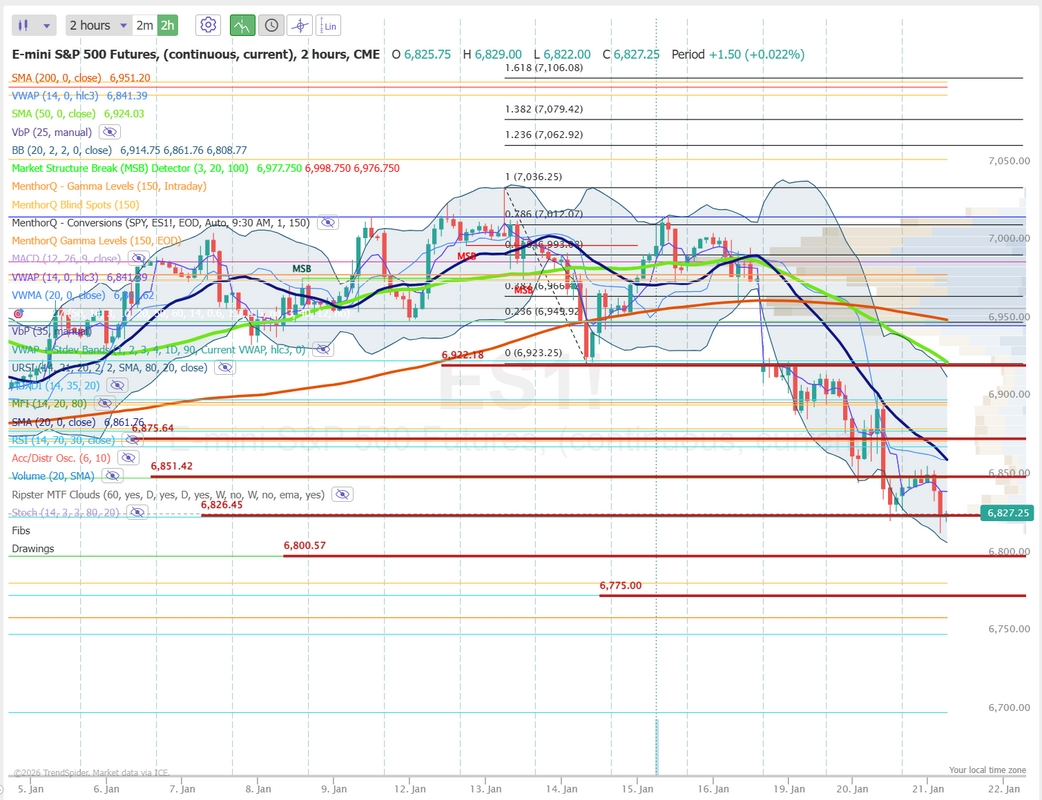

Market red (usually) = Portfolio Green for us.What an awesome day for us traders yesterday. Our ATM portfolio made money (it loves down markets) and our trading levels were spot on. I mean, spot on! We nailed every move yesterday. It was scary good. Look at a trader you need an edge or it's just not going to work out for you. I don't care what your edge is but get one! We use levels and they serve us very well. Here's a look at our day. We are continuing to have great success with our pyramiding approach to low prop/high asymmetry 1HTE setups. This irony of this approach is that the more losers we have before getting to a winner, the bigger the payout. Yesterday we got to our winner a bit too early! Todays setups look great. We've already got the first one working for you early risers. Let's take a look at the markets. Technicals are bearish after yesterdays selloff. That was a beautiful gap down day yesterday. Futures are weak this morning. Can we get some more selling? We can only hope! March S&P 500 E-Mini futures (ESH26) are trending down -0.17% this morning as investors cautiously await U.S. President Donald Trump’s address at the World Economic Forum in Davos, as well as a new round of economic data and corporate earnings reports. Lower bond yields today are helping limit losses in S&P 500 futures. The 10-year T-note yield fell 1 basis point to 4.29% after long-dated Japanese bonds rebounded sharply from yesterday’s selloff. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. The Magnificent Seven stocks slid, with Nvidia (NVDA) and Tesla (TSLA) falling over -4%. Also, cryptocurrency-exposed stocks sank after Bitcoin fell more than -3%, with MARA Holdings (MARA) slumping over -8% and Strategy (MSTR) dropping over -7% to lead losers in the Nasdaq 100. In addition, 3M Co. (MMM) slid over -6% and was the top percentage loser on the Dow after the industrial company issued soft FY26 adjusted EPS guidance. On the bullish side, SanDisk (SNDK) surged over +9% and was the top percentage gainer on the S&P 500 after Citi raised its price target on the stock to $490 from $280. “Headlines out of Washington partially overshadowed the start of earnings season, and this week is looking like it could be a similar story,” said Chris Larkin at E*Trade from Morgan Stanley. Market participants are looking ahead to U.S. President Donald Trump’s address at the World Economic Forum in Davos, Switzerland, later in the day. President Trump was scheduled to speak in Davos at 2:30 p.m. local time, but his appearance will be delayed after his aircraft experienced technical issues. Investors are waiting to see whether he will dial back days of heightened tensions with Europe over Greenland. Fourth-quarter corporate earnings season is gathering pace, with investors awaiting reports from notable companies today, including Johnson & Johnson (JNJ), Charles Schwab (SCHW), Truist Financial (TFC), Kinder Morgan (KMI), and The Travelers Companies (TRV). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the National Association of Realtors’ pending home sales data, set to be released in a couple of hours. Economists expect the December figure to drop -0.3% m/m following a +3.3% m/m climb in November. The U.S. Construction Spending report for October will also be released today. The report was originally scheduled for release on December 1st, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the September figure. Economists expect construction spending to rise +0.1% m/m in October. U.S. rate futures have priced in a 95.0% probability of no rate change and a 5.0% chance of a 25 basis point rate cut at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.286%, down -0.21%. Are we in a bubble? If we are, is this the start of the correction? Take a look at past bubbles. Todays training will focus on our 0DTE setups. This is one you'll want to bookmark and keep for future reference. Let's look at our intraday levels. From a macro standpoint the sell signal seems pretty solid, looking at the daily on the VTI. The 50DMA will be the test today. On the /ES 6851, 6875, 6922 are resistance. 6826, 6800, 6776 are support. We pushed down through the BB's yesterday and look a tad bit overstretched to the downside. I wouldn't be surprised to see a bounce today. See you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |