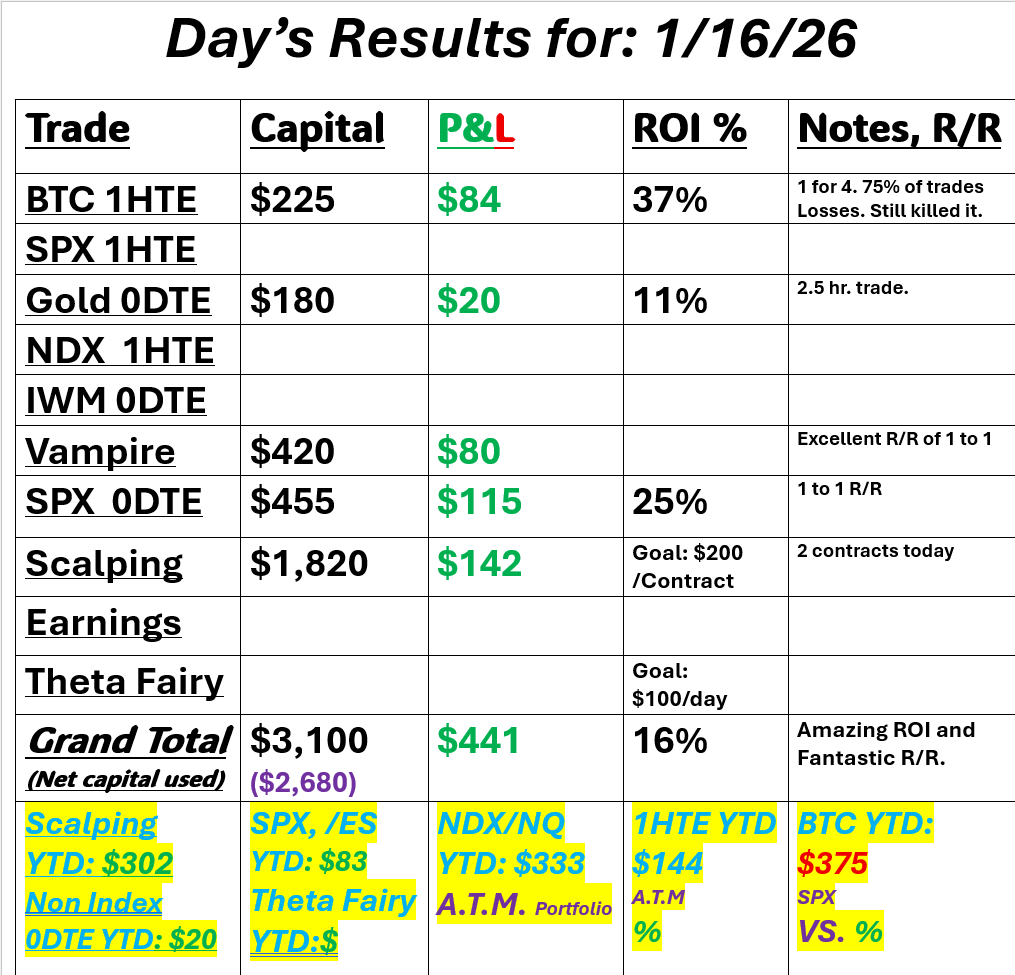

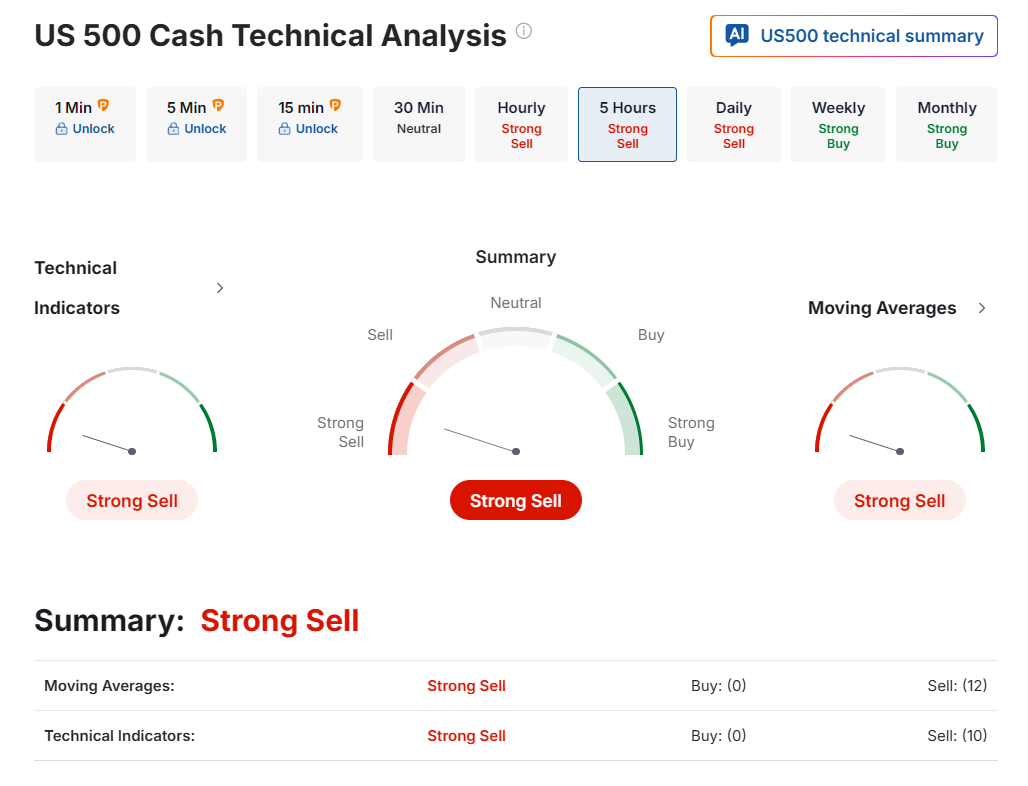

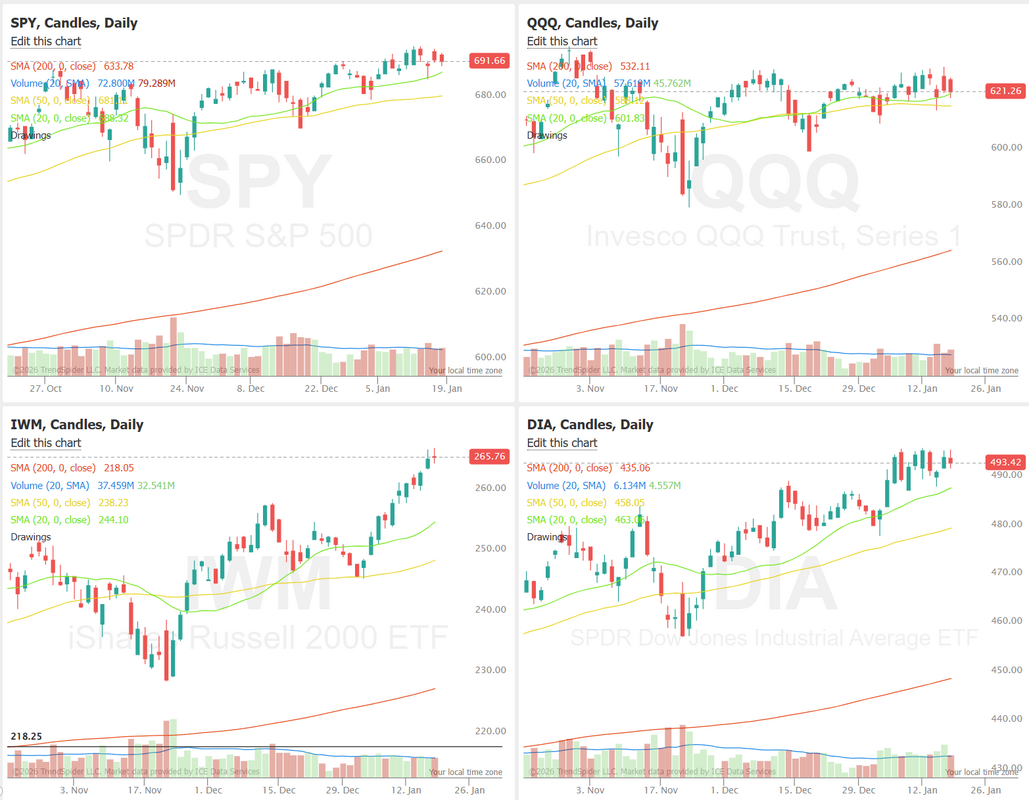

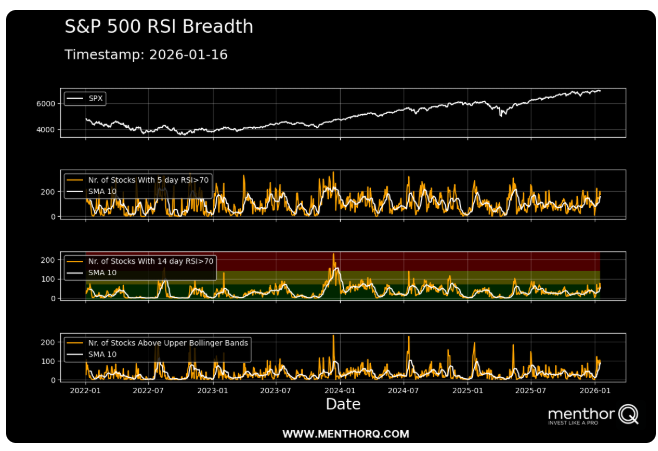

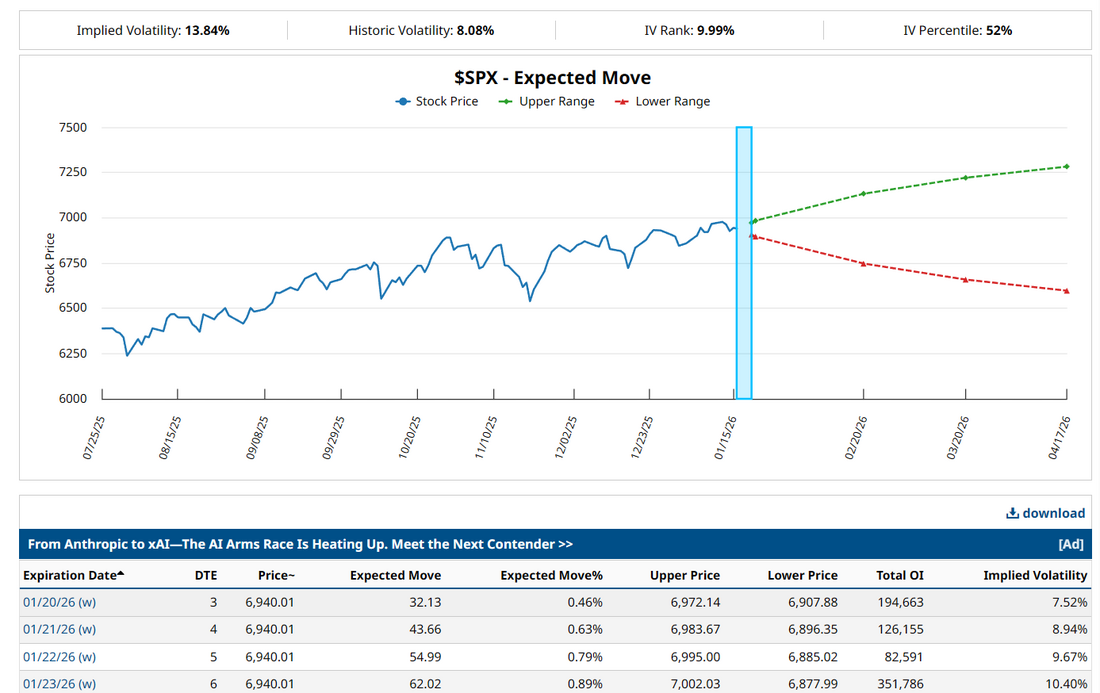

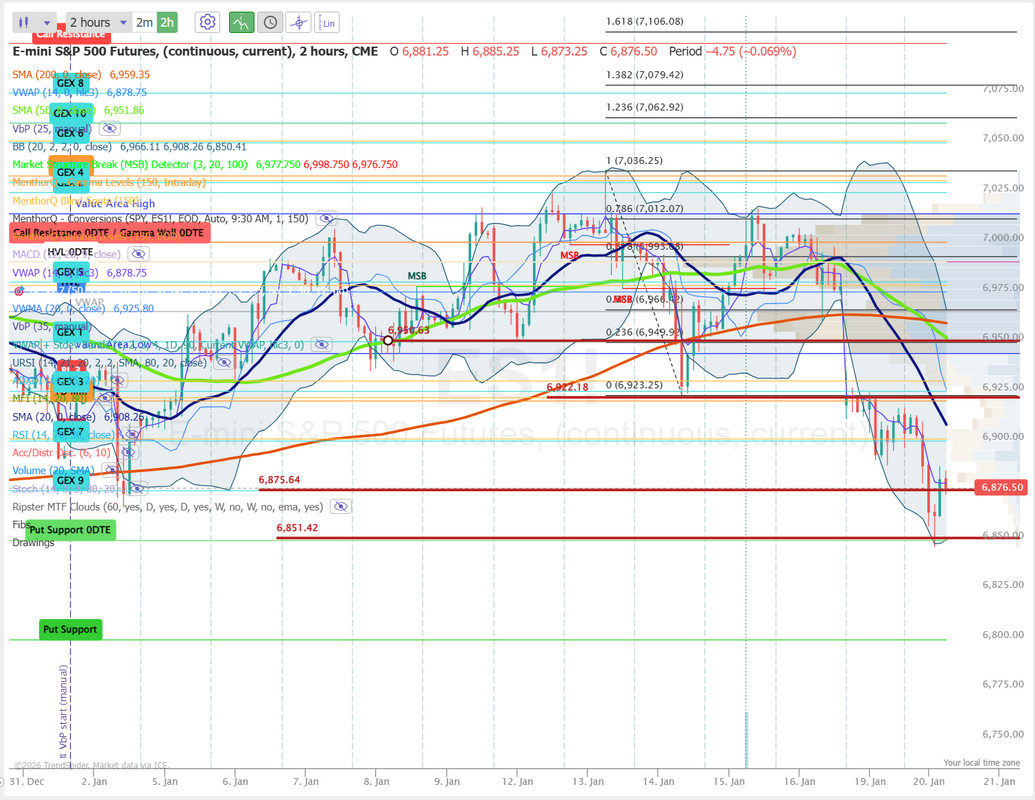

Judgement day?Welcome back traders! I hope the extended weekend treated you all well! We've got another shot this morning at SCOTUS giving a Tariff ruling. It could come about 30 min. into the cash open. Futures are down this morning, wiping out the years gains. It should be a great opportunity for us today with scalping and 0DTE's. We had an absolutely stellar day Friday. Here's a look at our results. Everything we touched worked on Friday. Well...that's not true. we went 1 for 4 on our 1HTE's. That was planned our low prob/high profit potential setups allow us to go 7-9 losers in a row and still have great risk management. To think you can get a 37% ROI on trade setups that fail 75% of the time is impressive. If you aren't trading the 1HTE setups with us you're missing out. You can get started for free and trade as little as $5 dollars! Get signed up here. Let's take a look at the markets to start off the holiday shortened week. Technicals are giving us a beautiful sell rating to start the day. We build some nice weakness into the indices last week. Only the IWM was able to hold it's buying streak. Today looks like we'll start down as well. This could all change with a potential SCOTUS ruling on the horizon. March S&P 500 E-Mini futures (ESH26) are down -1.58%, and March Nasdaq 100 E-Mini futures (NQH26) are down -1.95% this morning, pointing to a sharply lower open on Wall Street as sentiment took a hit after U.S. President Donald Trump threatened to impose new tariffs on a handful of European countries amid a dispute over Greenland. President Trump announced in a Truth Social post on Saturday that exports from eight European countries—Germany, France, the U.K., the Netherlands, Sweden, Denmark, Finland, and Norway—will face 10% tariffs starting February 1st. Those are the countries opposing his bid to control Greenland. Trump said the levies would rise to 25% in June and remain in place until a deal is reached “for the complete and total purchase of Greenland.” In response, European officials are considering a range of countermeasures, including potential retaliatory tariffs on $108 billion of U.S. exports. President Trump said on Tuesday he agreed to hold a meeting at the World Economic Forum in Davos over Greenland following a “very good” call with NATO Secretary-General Mark Rutte. “I had a very good telephone call with Mark Rutte, the Secretary General of NATO, concerning Greenland,” Trump said. As Trump heads to Davos, he reiterated his rhetoric on Greenland, writing in a Truth Social post that the territory is “imperative for National and World Security.” Stock index futures losses deepened after a selloff in Japanese long-term bonds sparked a sharp rise in global bond yields. The 10-year T-note yield climbed 6 basis points to 4.29% on negative carryover from a surge in long-term Japanese bond yields to record highs as investors pushed back against Prime Minister Sanae Takaichi’s election pitch to cut taxes on food. Investor focus this week is also on a fresh batch of U.S. economic data, with particular attention on the delayed U.S. PCE inflation reading, as well as a slew of corporate earnings reports. In Friday’s trading session, Wall Street’s major equity averages closed slightly lower. Shares of power suppliers sank on President Trump’s move to push for an emergency wholesale electricity auction and make tech giants pay for rising power costs, with Talen Energy (TLN) plunging over -11% and Constellation Energy (CEG) sliding more than -9% to lead losers in the S&P 500 and Nasdaq 100. Also, Mosaic (MOS) slid over -4% after the chemical company posted weak preliminary Q4 results. In addition, J.B. Hunt Transport Services (JBHT) fell more than -1% after the transportation and logistics company reported weaker-than-expected Q4 revenue. On the bullish side, Micron Technology (MU) climbed over +7% and was the top percentage gainer on the Nasdaq 100 after the company disclosed in a regulatory filing that director Teyin Liu bought about $7.8 million worth of shares. Economic data released on Friday showed that U.S. industrial production rose +0.4% m/m in December, stronger than expectations of +0.1% m/m, and manufacturing production unexpectedly rose +0.2% m/m, stronger than expectations of -0.2% m/m. Fed Vice Chair Philip Jefferson said on Friday that interest rates are close to a level that neither restrains nor stimulates the economy. “In my view, the current policy stance leaves us well positioned to determine the extent and timing of additional adjustments to our policy rate based on the incoming data, the evolving outlook, and the balance of risks,” Jefferson said. At the same time, Fed Vice Chair for Supervision Michelle Bowman said monetary policy remains moderately restrictive and that policymakers should be ready to cut interest rates further unless the employment picture improves. “We should also avoid signaling that we will pause without identifying that conditions have changed. Doing so will indicate that we are not attentive or responsive to the recent and expected path of the labor market,” Bowman said. U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. In this holiday-shortened week, the November reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as investors continue to gauge the likely timing and extent of additional rate cuts by the Fed. The core PCE price index for November was originally scheduled for release on December 19th, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the October figures. To fill in for data gaps in the October figures caused by the shutdown, the Bureau of Economic Analysis said it will use the average of September and November consumer price index data. The final estimate of third-quarter U.S. gross domestic product will also attract attention. Other noteworthy data releases include U.S. Pending Home Sales, Construction Spending, Initial Jobless Claims, Personal Spending, Personal Income, the S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), and the University of Michigan’s Consumer Sentiment Index. Fourth-quarter corporate earnings season heats up this week, with investors looking forward to fresh reports from major companies such as Netflix (NFLX), Intel (INTC), Johnson & Johnson (JNJ), GE Aerospace (GE), The Procter & Gamble Company (PG), Abbott Laboratories (ABT), Intuitive Surgical (ISRG), and 3M (MMM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. U.S. central bankers are in a media blackout period before the January 27-28 policy meeting, so they are prohibited from making public comments on the economic outlook or policy this week. Fed policy limits the extent to which FOMC participants and staff can speak publicly or grant interviews during Fed blackout periods. The U.S. Supreme Court will hear oral arguments this week in Fed Governor Lisa Cook’s challenge to President Trump’s efforts to fire her. Meanwhile, the annual World Economic Forum in Davos, Switzerland, takes place this week, with a number of major world leaders and central bankers, including U.S. President Donald Trump, scheduled to speak. Trump’s address to Davos on Wednesday is expected to be the most closely watched event on the agenda. The U.S. economic data slate is empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.291%, up +1.37%. SPY ended the week nearly unchanged at $691.66 (-0.35%), and closed just below the lower boundary of a rising wedge identified by TrendSpider’s auto chart pattern recognition. Meanwhile, contracting bars on the Momentum Filter signal a weakening trend, leaving traders wondering if price will hold above support. Even with a strong push in the semiconductor sector, the tech-heavy QQQ ETF finished the week lower, closing at $621.26 (-0.86%). While the Momentum Filter has remained green over the past two weeks, the bars have contracted meaningfully as QQQ continues to chop just a few percent below its all-time high. With earnings season ramping up, the Nasdaq may finally be forced to pick a direction. IWM extended its rally last week and closed higher at $265.76 (+2.12%) as it pushed further into a breakout above its rising wedge pattern and printed another all-time high. Along with its breakout, the Momentum Filter bars surged, confirming that the small-cap rally has real legs early in 2026. In the short term, SPX remains in an uptrend, but RSI-based breadth is flashing early signs of stretch. The number of stocks with 5-day RSI above 70 has lifted, showing strong near-term momentum, while the 14-day RSI breadth is elevated but not yet at extreme historical peaks. This suggests upside participation is broad, though increasingly selective rather than indiscriminate. With more names pushing above their upper Bollinger Bands, the market may be entering a zone where forward progress becomes more incremental and pullbacks are more likely to be shallow and rotational. Near-term price action is likely to be driven by whether RSI breadth can stay elevated without expanding further continued consolidation at these levels would favor trend digestion, while a sharp drop in short-term RSI breadth would signal a tactical cooling phase rather than a trend break. Let's look at the expected move for this holiday shortened week. With a .89% expected move we are about the same place we were last week with I.V. Today should be good though with the initial selloff in futures. Let's take a look at todays 0DTE levels via the /ES. We have two big levels on either side of the fence today. 6900 is the first barrier on the upside with 6922, 6950 being the big ones. 6875, 6851, 6826 are support levels. It looks like we could be some selling pressure today. Should be awesome for our ATM portfolio! I look forward to seeing you all in the live trading room shortly. Today should offer ample opportunity for us!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |