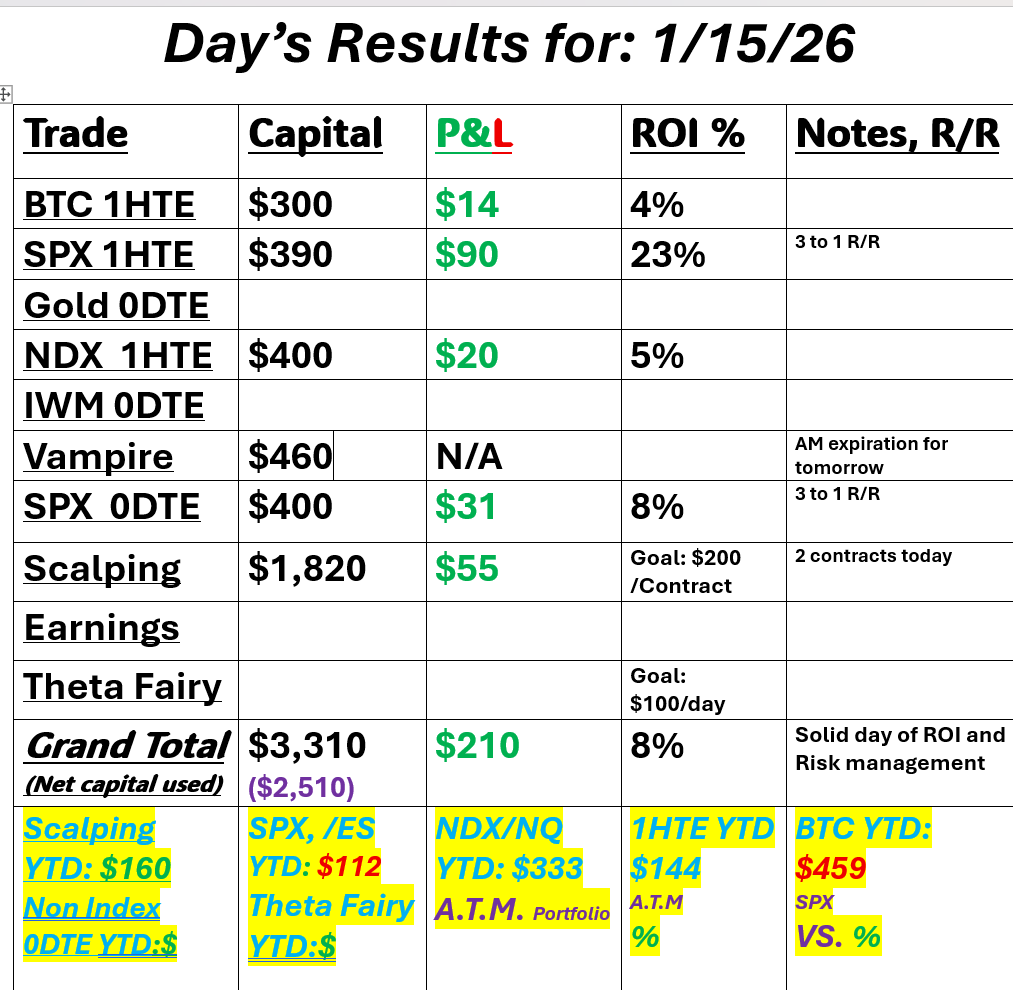

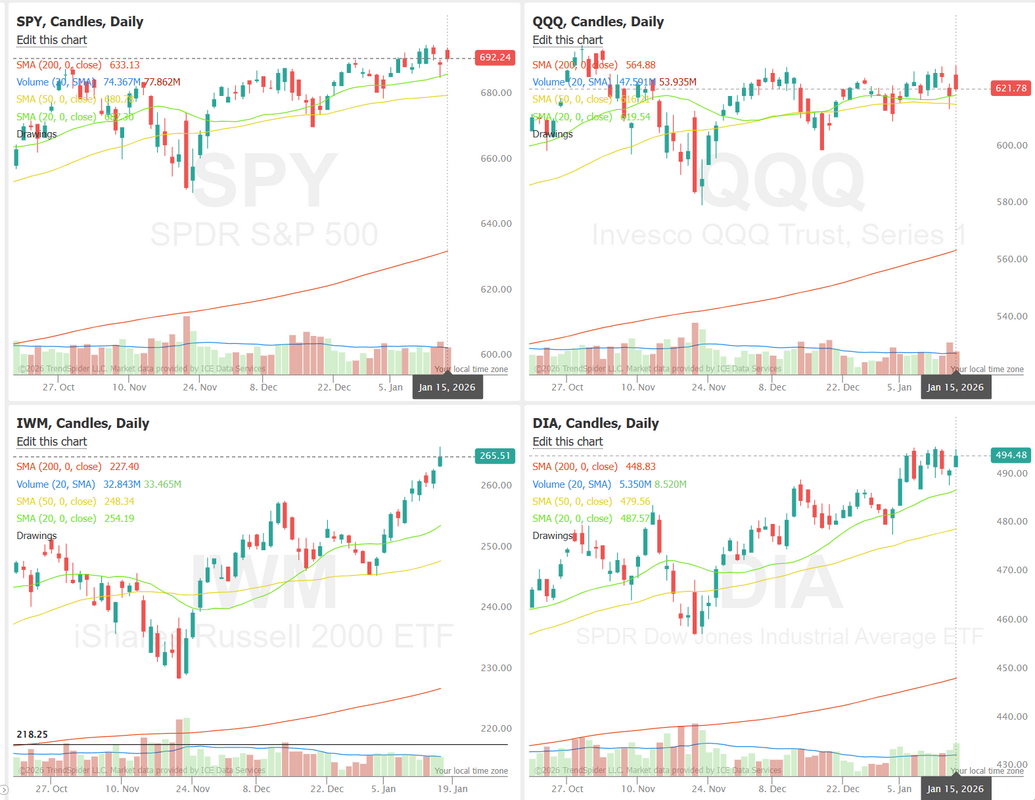

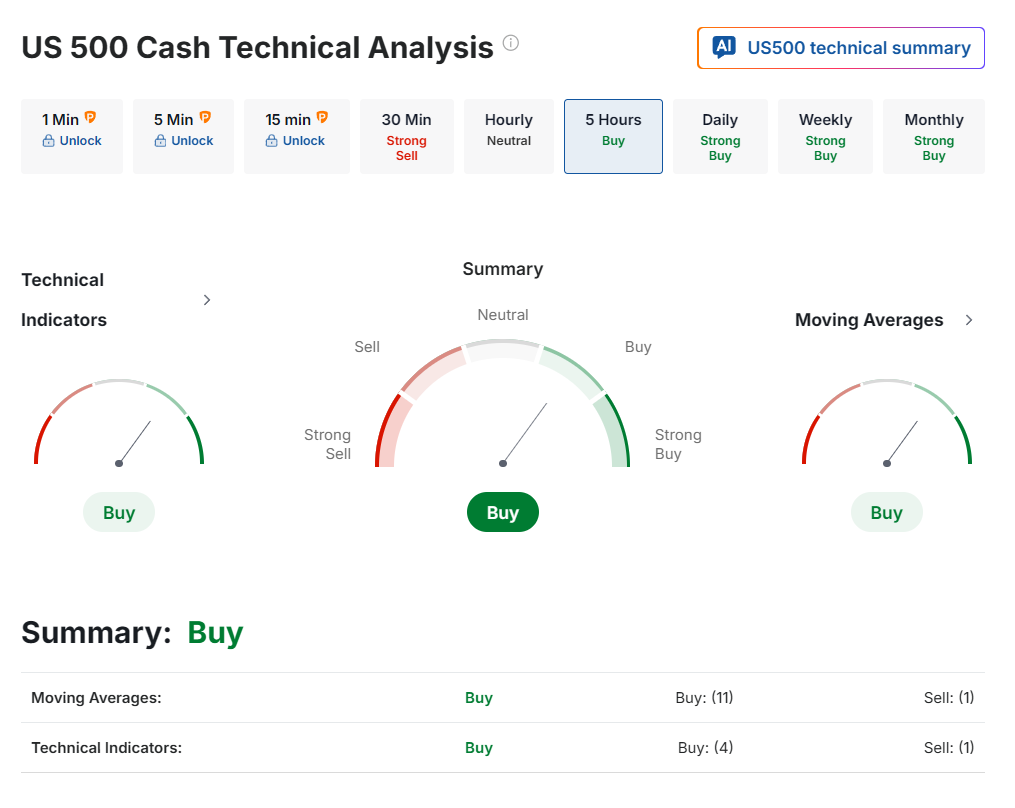

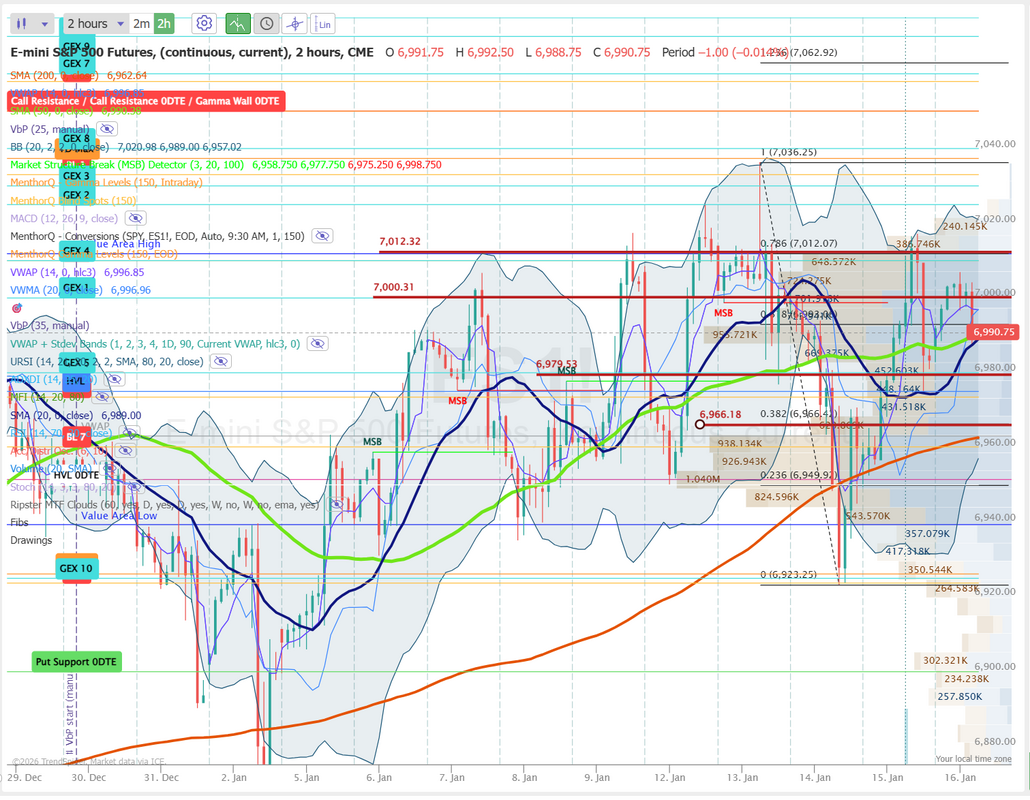

Overnight Vampire trade incomingIt's been a few expiration cycles since we've gotten an overnight Vampire trade working. We got one on yesterday so that should be a nice little profit to start off our day when the cash markets open up. Our day yesterday was another excellent one of risk management and great ROI. My risk went a bit higher on our SPX trade than I like but it was still workable. Here's a look at our day. Everything hit for a profit. Our mantra for yesterday was, "No green to red" so we were diligent on locking the gains in. Let's take a look at the markets. Monday of this week we looked at the expected weekly move and laughed. It looked ridiculously low. Well guess what? We didn't go anywhere! It was right. Lots of churning sideways. Technicals don't really give us much to go off. Leaning slightly bullish. March Nasdaq 100 E-Mini futures (NQH26) are trending up +0.59% this morning, signaling that a tech rally fueled by strong earnings from Taiwan Semiconductor Manufacturing Co., which revived optimism around AI, looks set to continue. Also aiding sentiment, shares of memory chipmakers rallied in pre-market trading, led by a more than +6% gain in Micron Technology (MU) after the company disclosed in a regulatory filing that director Teyin Liu bought about $7.8 million worth of shares this week. SanDisk (SNDK) climbed over +5% and Western Digital (WDC) rose more than +4%. In yesterday’s trading session, Wall Street’s major indices ended in the green. U.S.-listed shares of Taiwan Semiconductor Manufacturing Co. (TSM) climbed over +4% after the world’s biggest contract chipmaker posted a record Q4 profit, projected faster-than-expected 2026 revenue growth, and provided blockbuster capital expenditure guidance for this year. Also, chip stocks rallied following TSMC’s results and guidance, with KLA Corp. (KLAC) jumping more than +7% to lead gainers in the S&P 500 and Nasdaq 100, and Applied Materials (AMAT) rising over +5%. In addition, BlackRock (BLK) advanced more than +5% after the world’s largest asset manager reported stronger-than-expected Q4 results. On the bearish side, Coinbase Global (COIN) slumped over -6% after the Senate Banking Committee delayed a hearing on a key cryptocurrency bill on Wednesday following Coinbase’s withdrawal of support. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -9K to a 6-week low of 198K, compared with the 215K expected. Also, the U.S. Philly Fed manufacturing index rose to a 4-month high of 12.6 in January, stronger than expectations of -1.6. In addition, the U.S. January Empire State manufacturing index rose to 7.70, stronger than expectations of 0.80. Finally, the U.S. import price index unexpectedly rose +0.4% m/m in November, stronger than expectations of -0.1% m/m. “If earnings continue to beat expectations and economic data remains supportive, the likely path remains advance, backfill, then advance again,” said Kenny Polcari at SlateStone Wealth. Chicago Fed President Austan Goolsbee said on Thursday that the central bank’s primary focus should be curbing inflation, as the labor market shows signs of stabilizing. “We’ve been five years fighting to get inflation on a path back to 2% and we made some progress, but we need that, and if we get that, I think rates can come down,” Goolsbee said. Also, Atlanta Fed President Raphael Bostic said, “We need to make sure that we stay in a restrictive stance, because inflation is still too high, and those high prices are weighing on so many Americans.” In addition, Kansas City Fed President Jeff Schmid said interest rates should remain at levels that continue to exert some pressure on the economy, allowing inflation to cool further. Finally, San Francisco Fed President Mary Daly said she believes monetary policy is “in a good place” as risks to both sides of the central bank’s dual mandate remain. Meanwhile, U.S. rate futures have priced in a 95.0% probability of no rate change and a 5.0% chance of a 25 basis point rate cut at the January FOMC meeting. On the trade front, the U.S. and Taiwan reached a long-sought trade deal on Thursday that would cut tariffs on goods from the island to 15% and see Taiwanese semiconductor firms boost investment in U.S. operations by $500 billion. Today, investors will focus on U.S. Industrial Production and Manufacturing Production data, set to be released in a couple of hours. Economists expect Industrial Production to rise +0.1% m/m and Manufacturing Production to drop -0.2% m/m in December, compared to the November figures of +0.2% m/m and unchanged m/m, respectively. Market participants will also be anticipating speeches from Boston Fed President Susan Collins, Fed Vice Chair for Supervision Michelle Bowman, and Fed Vice Chair Philip Jefferson. On the earnings front, notable companies like PNC Financial (PNC), State Street (STT), and M&T Bank (MTB) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.18%, down -0.07%. Today will be a short one. Not much economic news today. We've got a bunch of expirations in our ATM portfolio today, which should bring in some income. Our Vampire trade looks like a full profit. Let's take a look at the intraday levels for our new 0DTE today. 7000 continues to be a big resistance level. 7012 comes in above that. 6979 is support with 6966, which is just down below that. Let's get after it folks. It's nice to know we are opening up with a nice profit already in the pocket.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |