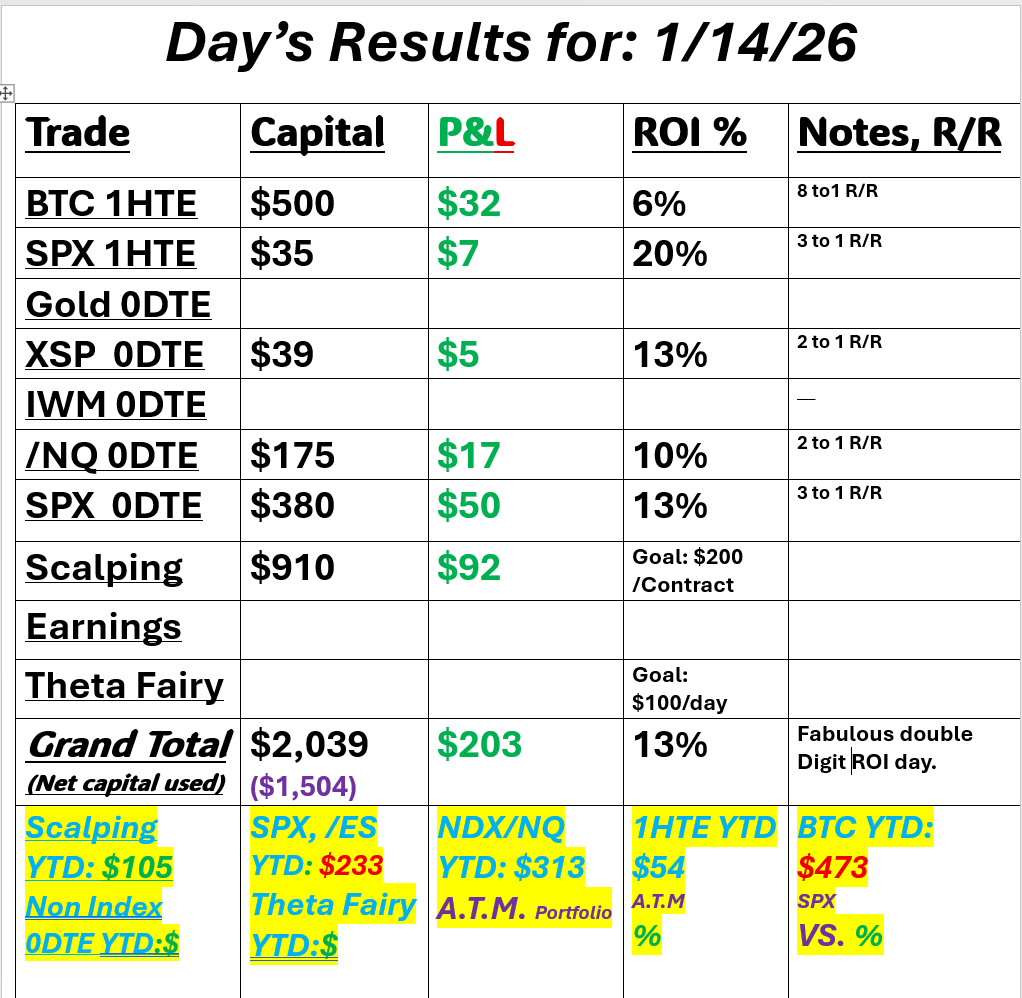

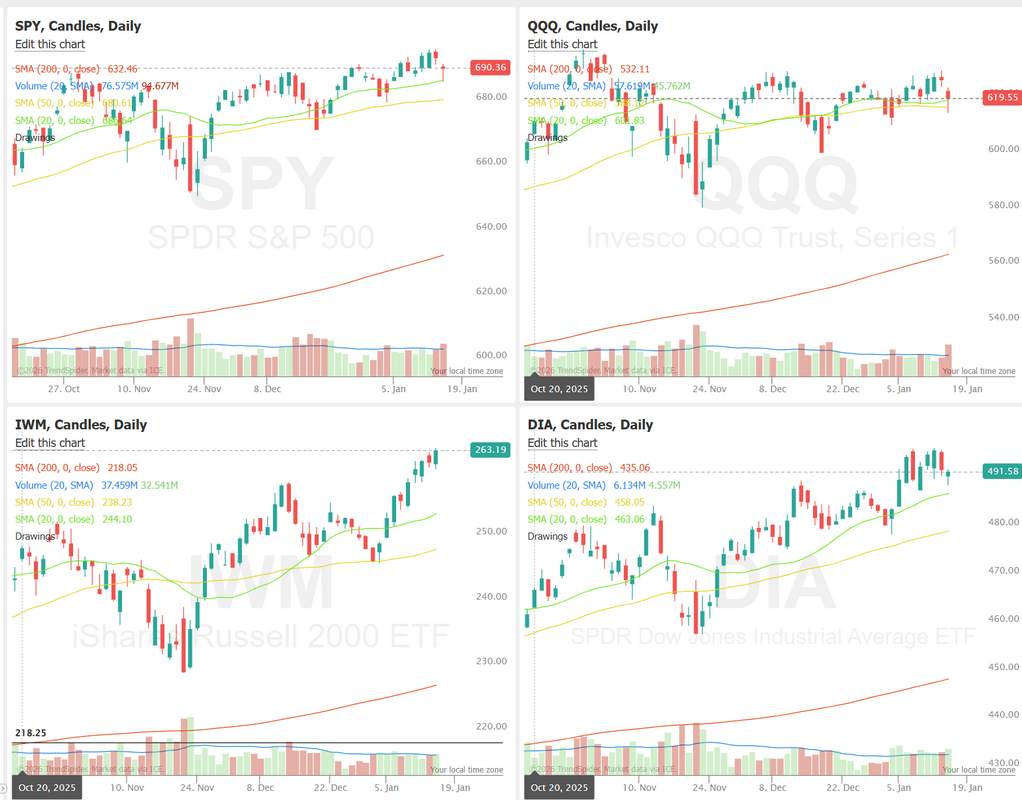

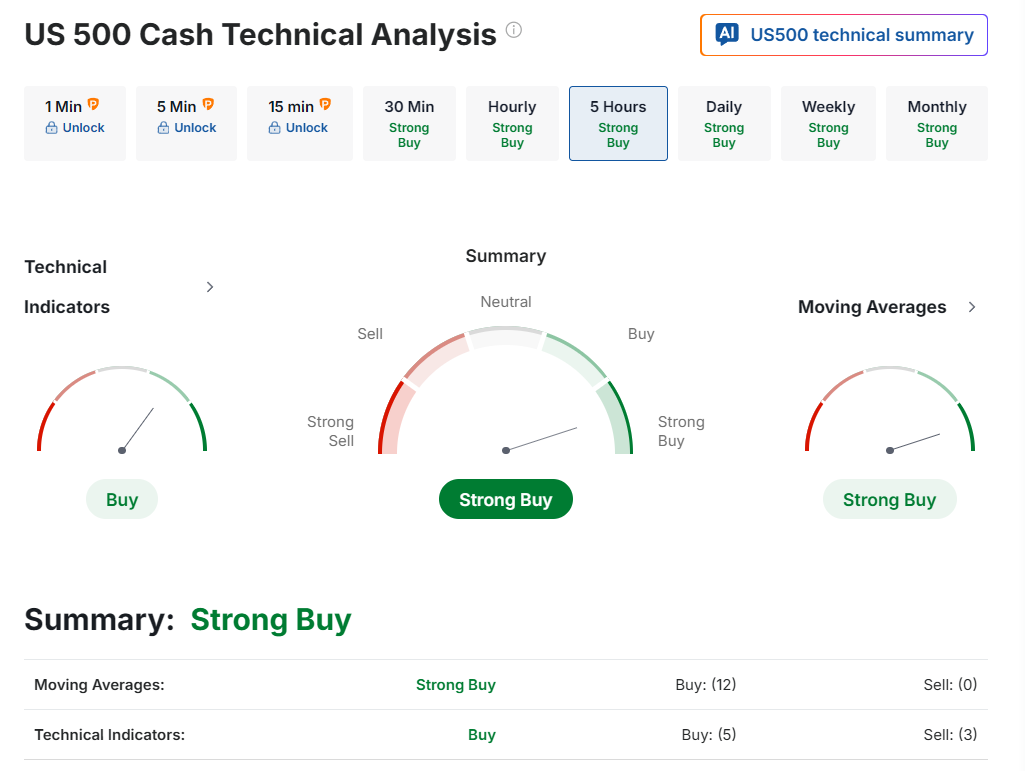

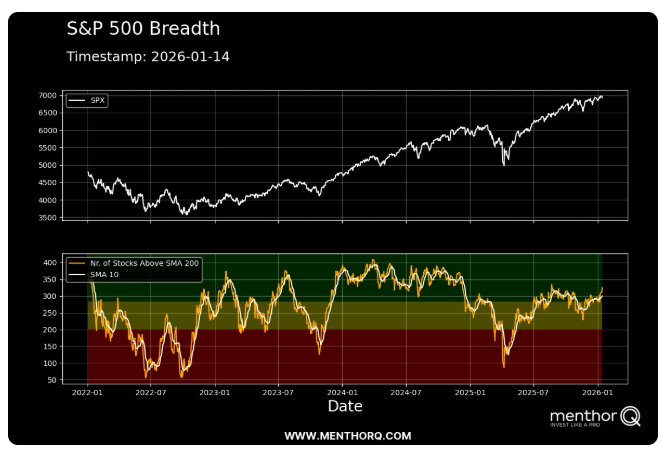

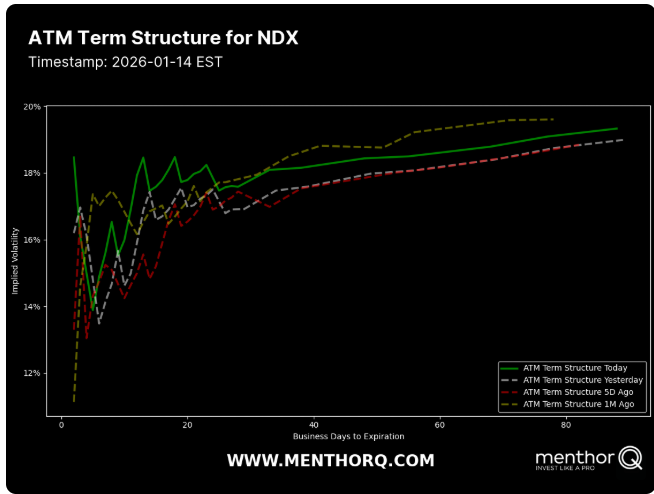

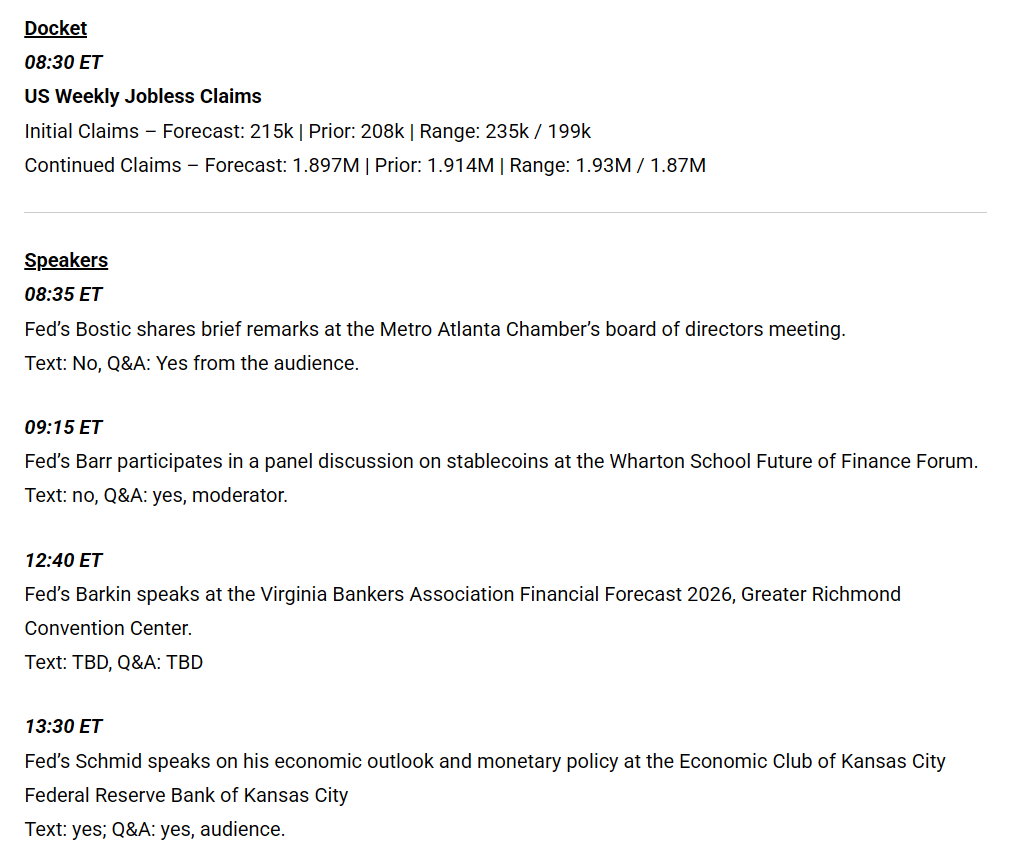

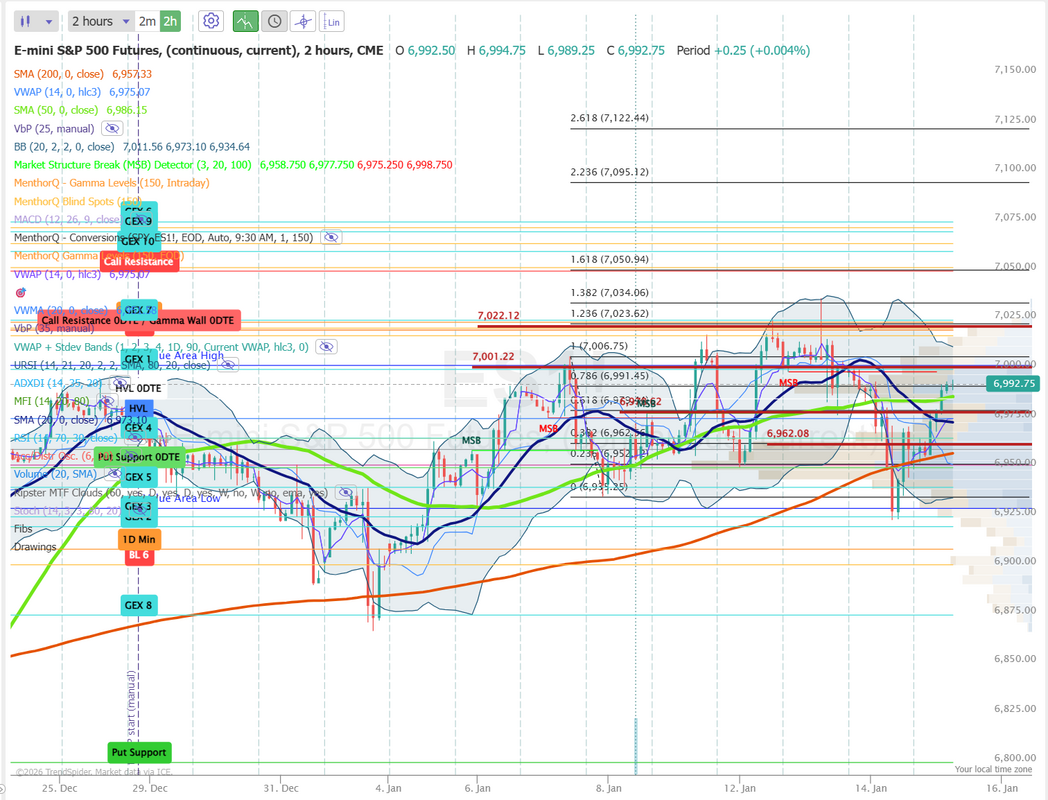

Who doesn't love a gap down day?We had a nice gap down start to the day yesterday and finished red even though we clawed a lot of the downside back by the close. We love down days. They give us #1. Price action. #2. Good premium. We had a solid day overall with everything working. We were able to risk $5 dollars on a 400% potential profit at the end of the day on a 1HTE SPX trade. If you're not using these you are leaving opportunity on the table. Here's a look at our day. Let's take a look at the markets after we've had the first back-to-back selling pressure of this year. Bullish bias to start off the day. Yesterday was red, but bulls fought back valiantly into the close. Technicals for the day have turned bullish to start the day. March S&P 500 E-Mini futures (ESH26) are up +0.37%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.74% this morning after Taiwan Semiconductor Manufacturing Co. renewed confidence in the sustainability of AI demand. U.S.-listed shares of Taiwan Semiconductor Manufacturing Co. (TSM) jumped over +5% in pre-market trading after the world’s biggest contract chipmaker posted a record Q4 profit and projected faster-than-expected 2026 revenue growth. The biggest surprise was TSMC’s annual capital expenditure forecast for this year, set at $52 billion to $56 billion, well above its $40.9 billion capex for 2025. TSMC’s chief executive, C.C. Wei, said at an earnings call that the decision to ramp up spending came after months of checks with major customers and reflects confirmed AI-driven demand. “When you’ve got a business like TSMC spending at this level, investors should be prepared for sustained AI demand rather than a short-lived boom,” said Zavier Wong, market analyst at eToro. AI-related U.S. heavyweights advanced in pre-market trading, with Broadcom (AVGO) rising over +2% and Nvidia (NVDA) gaining more than +1%. TSMC suppliers Applied Materials (AMAT) and Lam Research (LRCX) climbed more than +6% in pre-market trading. Investors now await a fresh batch of U.S. economic data, quarterly reports from more big banks, and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed lower. The Magnificent Seven stocks fell, with Amazon.com (AMZN) and Meta Platforms (META) dropping over -2%. Also, most chip stocks slid, with Broadcom (AVGO) falling more than -4% and Arm Holdings (ARM) dropping over -2%. In addition, Wells Fargo (WFC) sank more than -4% after the bank posted weaker-than-expected Q4 net interest income. On the bullish side, Mosaic (MOS) climbed over +5% and was among the top percentage gainers on the S&P 500 after Morgan Stanley raised its price target on the stock to $35 from $33. Economic data released on Wednesday showed that U.S. retail sales climbed +0.6% m/m in November, stronger than expectations of +0.5% m/m, and core retail sales, which exclude motor vehicles and parts, grew +0.5% m/m, stronger than expectations of +0.4% m/m. Also, the U.S. producer price index (PPI) for final demand rose +3.0% y/y in November, stronger than expectations of +2.7% y/y, and the core PPI rose +3.0% y/y, stronger than expectations of +2.7% y/y. In addition, U.S. December existing home sales rose +5.1% m/m to a 2-3/4-year high of 4.35 million, stronger than expectations of 4.21 million. “This data likely doesn’t change anything for the Federal Reserve, which ended up cutting rates back in December even without knowing this data,” said Clark Bellin at Bellwether Wealth. “We expect the Federal Reserve to remain on hold for the next six months and then cut rates by one or two times in the second half of 2026.” Minneapolis Fed President Neel Kashkari said on Wednesday that the U.S. economy is showing “resilience” and that he does not see the “impetus” for the Fed to cut interest rates this month. Also, Atlanta Fed President Raphael Bostic said interest rates should stay at a restrictive level that weighs on the economy, as policymakers still have more work to do on inflation. At the same time, Philadelphia Fed President Anna Paulson said, “I see inflation moderating, the labor market stabilizing, and growth coming in around 2% this year. If all of that happens, then some modest further adjustments to the funds rate would likely be appropriate later in the year.” In addition, Fed Governor Stephen Miran said the Trump administration’s deregulatory agenda gives the central bank another reason to keep lowering interest rates. The Fed said on Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity picked up at a “slight to modest pace” in most districts since mid-November. “This marks an improvement over the last three report cycles where a majority of districts reported little change,” according to the Beige Book. The report said employment levels were largely unchanged in eight of the Fed’s 12 regional districts, while wages grew at a “moderate” pace, with “multiple contacts reporting that wage growth had returned to ‘normal’ levels.” The report also noted that most districts saw prices grow at a “moderate” pace. Meanwhile, U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. In tariff news, U.S. President Donald Trump said on Wednesday that he has, for now, decided against imposing tariffs on rare earths, lithium, and other critical minerals, instead directing his administration to seek supplies from international trading partners. Fourth-quarter corporate earnings season is gathering pace, and investors look ahead to new reports from major U.S. banks such as Goldman Sachs (GS) and Morgan Stanley (MS), as well as notable companies like BlackRock (BLK) and J.B. Hunt Transport Services (JBHT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 215K, compared to last week’s number of 208K. The U.S. Philadelphia Fed Manufacturing Index will also be released today. Economists anticipate that the Philly Fed manufacturing index will stand at -1.6 in January, compared to last month’s value of -10.2. The New York Fed-compiled Empire State Manufacturing Index will come in today. Economists foresee the January figure coming in at 0.80, compared to -3.90 in December. The U.S. Import Price Index for November will be released today as well. The data was originally scheduled for release on December 16th, but was delayed due to the fallout from the longest-ever government shutdown. Economists expect the import price index to drop -0.1% m/m in November. In addition, market participants will parse comments today from Atlanta Fed President Raphael Bostic, Fed Governor Michael Barr, Richmond Fed President Tom Barkin, and Kansas City Fed President Jeff Schmid. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.141%, up +0.07%. Short term, the S&P 500 continues to trade near recent highs, but market breadth is giving a more nuanced signal. The number of stocks above their 200-day moving average has rebounded from recent lows and is curling higher, suggesting improving participation beneath the surface. However, breadth remains below prior cycle peaks, indicating leadership is still somewhat concentrated. In the near term, sustained follow-through above the recent breadth range could support further upside, while any stall or rollover in the breadth line especially if SPX holds highs would raise the risk of short-term consolidation or a pullback as internal momentum cools. The NDX ATM term structure shows elevated implied volatility across the entire curve, with front-end expiries particularly rich and remaining well above recent baseline levels. Near-dated options are pricing in heightened short-term uncertainty, while the back end of the curve also stays elevated, suggesting that the market is assigning a sustained risk premium rather than a purely event-driven spike. Compared with recent history, volatility remains firm rather than mean-reverting, indicating persistent demand for optionality and protection. Overall, the structure points to a high-volatility environment where uncertainty is being priced both immediately and over the medium term. We continue our series on 0DTE setups and rules today. Come join us in our live zoom session! News catalysts for today (planned). Let's take a look at the intraday /ES levels for our 0DTE trades today. There are two major support/resistance levels I'm focusing on today. 7001 and 7022 are the resistance levels with 6979 and 6962 working as support. We had a really solid day yesterday. Double digit ROI with good risk control. Let's work to keep that same risk control in place today and let the results fall where they may. See you all in the Live Trading Room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |