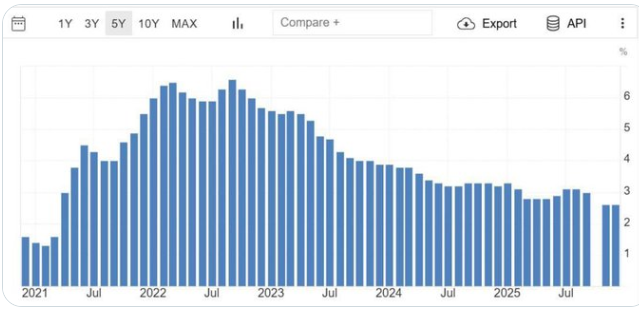

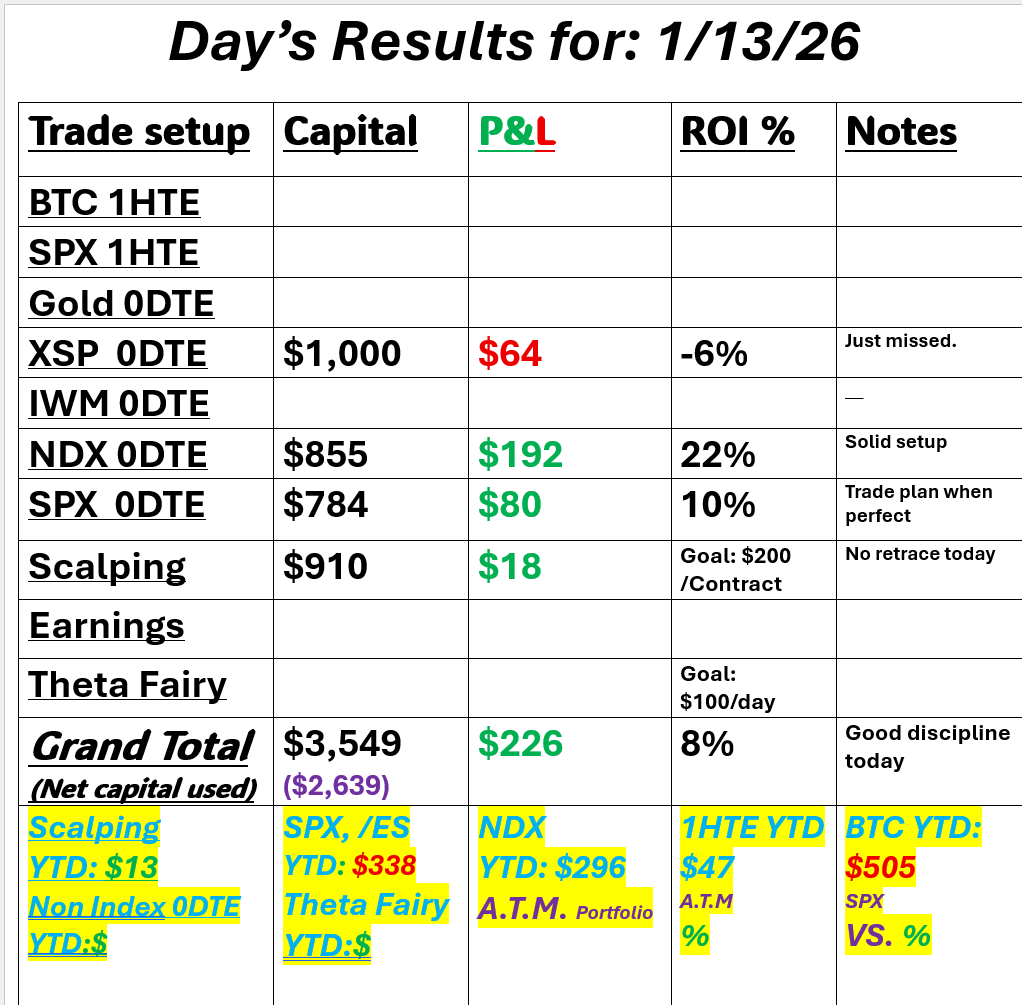

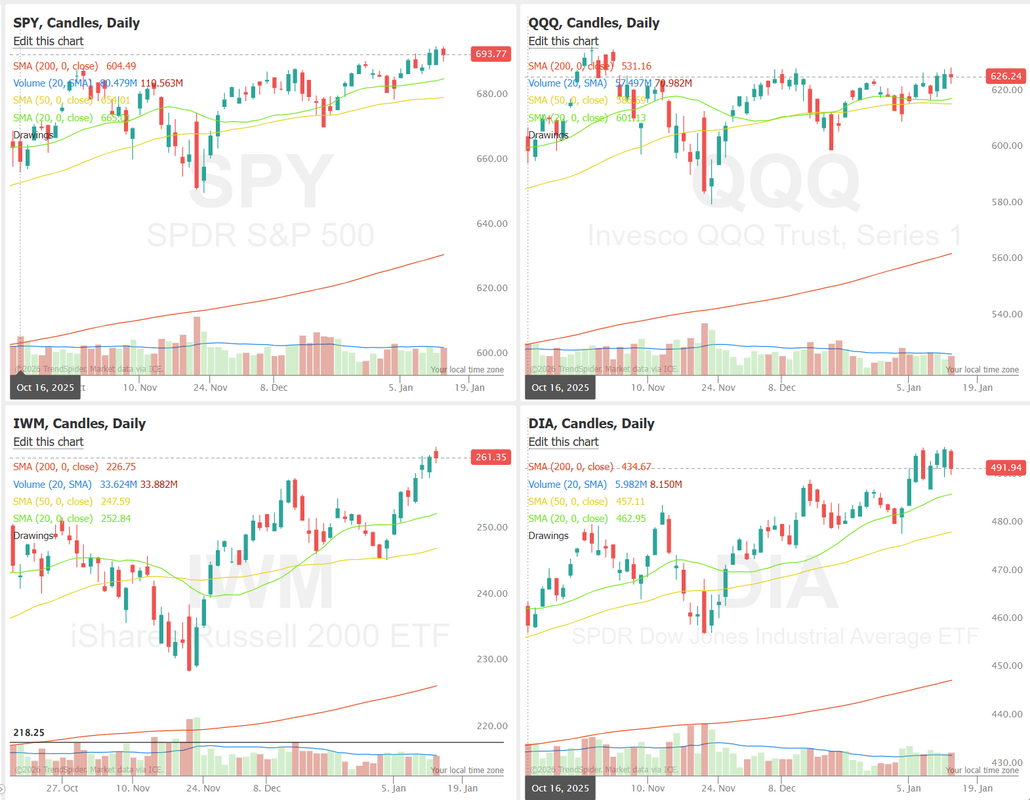

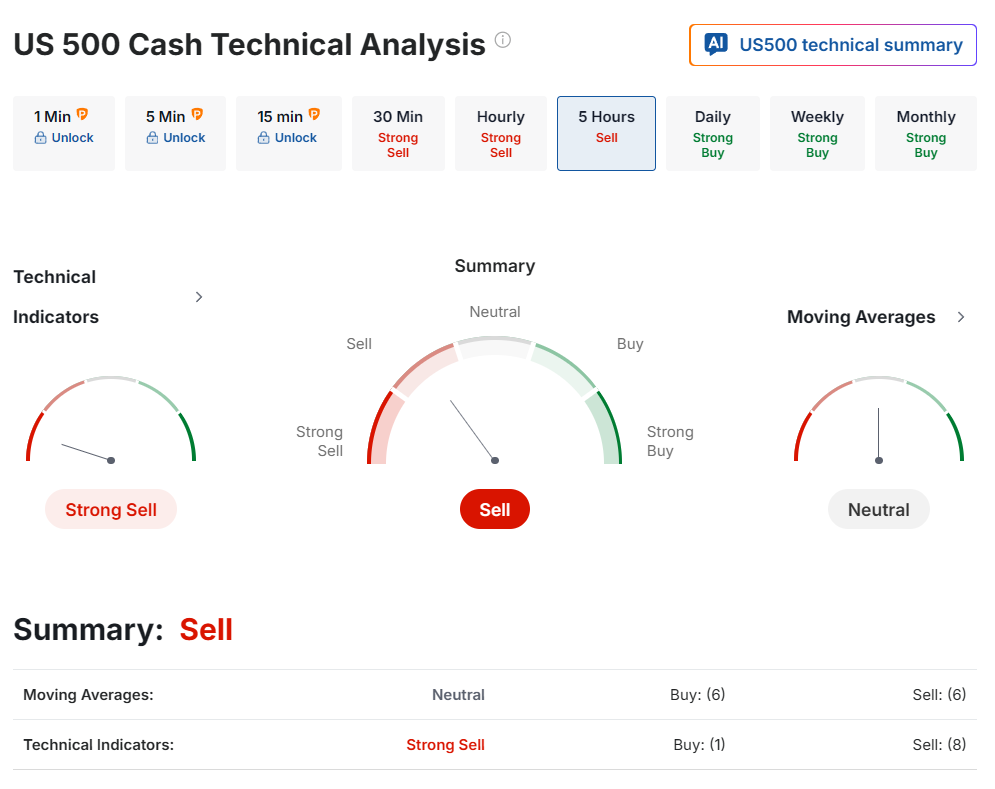

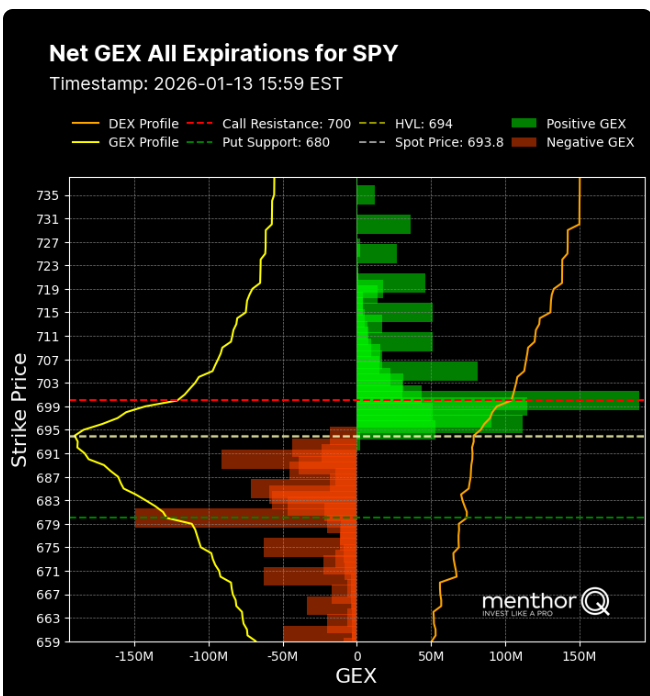

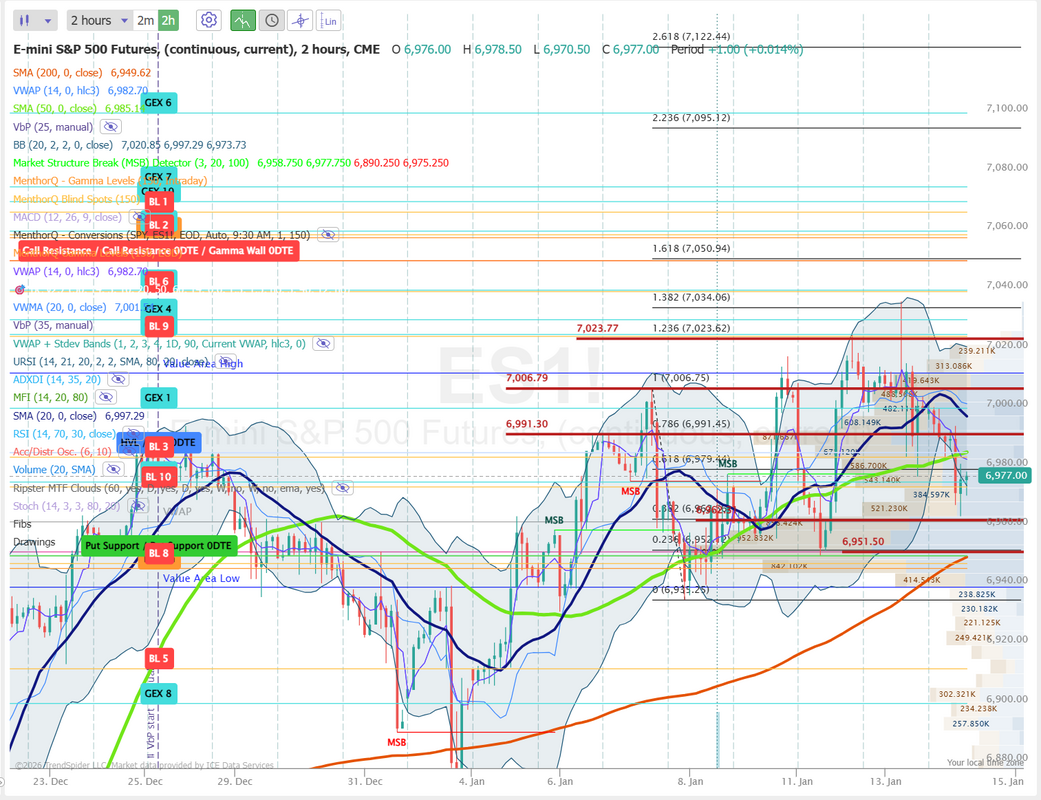

PPI dayWelcome back folks. CPI looked strong (or weak, as the case may be). It seems that inflation is definitely moving in the right direction. We've got PPI today We had a really good technically tight trading day. I missed on a late day XSP but our plan worked out perfectly for all our other setups. Scalping didn't yield much but that's how that goes some days. Here's a look at our day. Let's take a look at the markets today. We continue to hang around the ATH's. Buyers seem a bit tentative. Technicals are pointing bearish this morning but PPI could change all that. March S&P 500 E-Mini futures (ESH26) are down -0.44%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.66% this morning as investors trim risk ahead of a slew of U.S. economic data, including the retail sales report and producer inflation figures, comments from Federal Reserve officials, and earnings reports from some of the biggest U.S. banks. Market participants also brace for a potential Supreme Court ruling on President Trump’s sweeping tariffs. In addition, geopolitical risks dampened sentiment as the U.S. continued to threaten direct intervention in Iran. The U.S.-based Human Rights Activists News Agency reported 2,571 deaths linked to Iranian protests as of Wednesday, up from roughly 500 at the start of the week. Reuters reported that some personnel had been advised to leave a U.S. air base in Qatar. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Software stocks sank after Anthropic released a preview of a new tool designed for a wider range of work-related tasks beyond coding, with Salesforce (CRM) slumping over -7% to lead losers in the S&P 500 and Dow, and Adobe (ADBE) falling more than -5%. Also, shares of credit card companies extended their declines after President Trump called for a one-year cap on credit card interest rates at 10%, with Visa (V) falling over -4% and Mastercard (MA) dropping more than -3%. In addition, Super Micro Computer (SMCI) slid over -5% after Goldman Sachs assumed coverage of the stock with a Sell rating and a price target of $26. On the bullish side, Moderna (MRNA) jumped over +17% and was the top percentage gainer on the S&P 500 after CEO Stephane Bancel said the company expects to launch its combined flu and COVID-19 vaccine over the next two years. The U.S. Bureau of Labor Statistics report released on Tuesday showed that consumer prices rose +0.3% m/m in December, in line with expectations. On an annual basis, headline inflation rose +2.7% in December, the same as the previous month and in line with expectations. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +2.6% y/y in December, weaker than expectations of +0.3% m/m and +2.7% y/y. In addition, U.S. new home sales fell -0.1% m/m to 737K in October, stronger than expectations of 716K. “[Tuesday’s] softer-than-expected core CPI print is unlikely to alter the Fed’s calculus for the January meeting,” said Seema Shah at Principal Asset Management. “With unemployment still low, growth running above trend, fiscal stimulus providing an offset, and inflation remaining above target, the Fed can comfortably keep rates on hold this month and likely over the next few meetings.” St. Louis Fed President Alberto Musalem said on Tuesday that inflation risks are easing and that he expects prices to start moving toward the central bank’s target later this year. “I think policy is really well positioned right now, balancing both the expected path of the economy and the risks on both sides,” Musalem said. Also, Richmond Fed President Tom Barkin described December’s inflation data as “encouraging.” “It is, I think, a delicate balance right now,” Barkin said, noting that inflation remains above target but does not appear to be accelerating, while unemployment is not spiraling out of control. Meanwhile, U.S. rate futures have priced in a 97.2% probability of no rate change and a 2.8% chance of a 25 basis point rate cut at January’s monetary policy meeting. Fourth-quarter corporate earnings season picks up steam, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are on the U.S. Retail Sales report for November, which is set to be released in a couple of hours. The report was originally scheduled for release on December 17th, but was delayed due to the fallout from the longest-ever government shutdown. Economists, on average, forecast that Retail Sales will show a +0.5% m/m increase in November. Investors will also focus on U.S. Core Retail Sales, which rose +0.4% m/m in October. Economists expect the November figure to rise +0.4% m/m. The U.S. Producer Price Index for November will be closely monitored today. The PPI was originally scheduled for release on December 11th, but was delayed due to the fallout from the shutdown. Economists forecast that the U.S. November PPI will stand at +2.7% y/y. The U.S. Core PPI will also be released today. Economists expect the November figure to be +2.7% y/y. U.S. Existing Home Sales data will be reported today. Economists foresee this figure coming in at 4.21 million in December, compared to 4.13 million in November. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.7 million barrels, compared to last week’s value of -3.8 million barrels. In addition, market participants will be looking toward speeches from Philadelphia Fed President Anna Paulson, Fed Governor Stephen Miran, Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, and New York Fed President John Williams. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.150%, down -0.50%. Tensions between the U.S. and Europe are set to intensify as senior Greenlandic and Danish officials head to the White House for high-stakes talks amid President Trump’s renewed push to bring Greenland under U.S. control. Greenland and Denmark are presenting a united front, firmly rejecting takeover rhetoric and warning that any coercive move would carry serious consequences for NATO cohesion and trans-Atlantic relations. While the meeting could open the door to negotiations around Arctic defense cooperation and U.S. access to Greenland’s strategic resources, expectations for a breakthrough are low, with analysts warning the talks may instead underscore a deeper geopolitical rift. The outcome will be closely watched as a signal of how far the Trump administration is willing to press its ambitions and how Europe responds to mounting pressure in the Arctic. Today's training will focus on the rules for different 0DTE setups. It should be another good one. Come join us! SPX remains near recent highs, but the volatility risk premium (VRP) has pushed into elevated territory, with implied volatility priced well above realized levels and sitting in a high 3-month percentile range. In the short term, this suggests the market is paying up for protection despite relatively stable price action, which often coincides with slower upside momentum or brief consolidations rather than sharp trend extensions. With price holding firm while VRP stays stretched, near-term action may favor tighter ranges and mean reversion in volatility, making upside follow-through less impulsive unless a fresh catalyst emerges. SPY is currently trading near the center of a dense positive gamma zone, with spot around 694 sitting between clearly defined put support near 680 and call resistance clustered around 700. The Net GEX profile shows strong positive gamma above spot, suggesting dealer positioning may dampen volatility and encourage mean-reverting price behavior as long as SPY remains within this range. A sustained push toward the 700 level could meet mechanical resistance from call gamma, while moves lower toward the high-680s may find stabilizing flows from put-related gamma. Overall, the options structure points to controlled, range-bound price action unless price decisively escapes these gamma boundaries. Let's take a look at the intraday /ES levels for 0DTE trading today. 6991, 7007, 7023 are resistance levels and 6962, 6951, 6939 are support levels. PPI just hit. A tad hot. Futures a bit weak. We could get some good movement today. See you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |