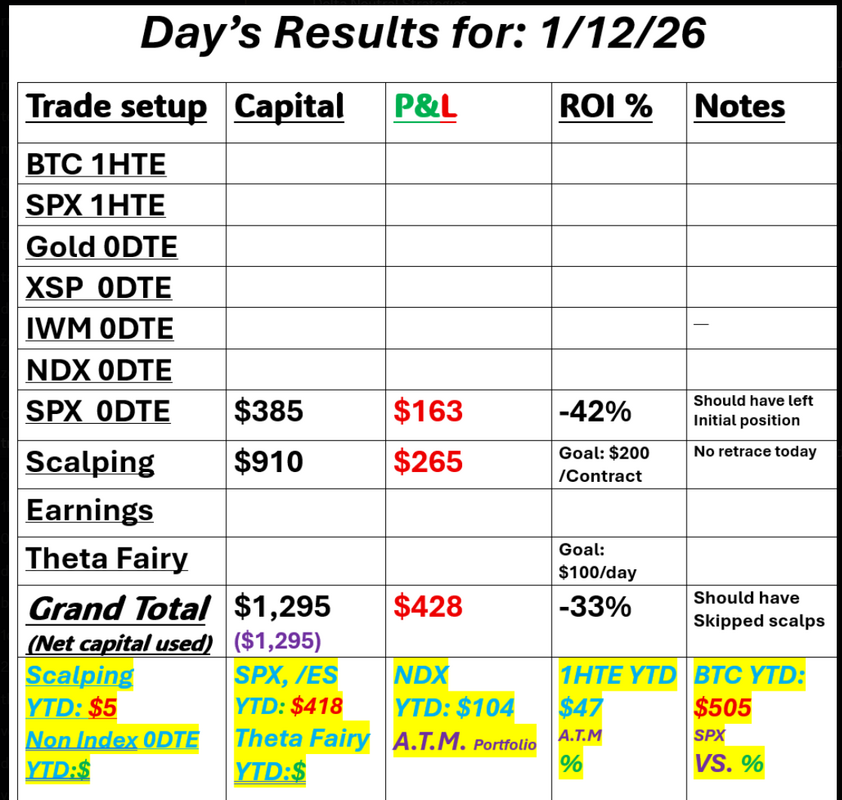

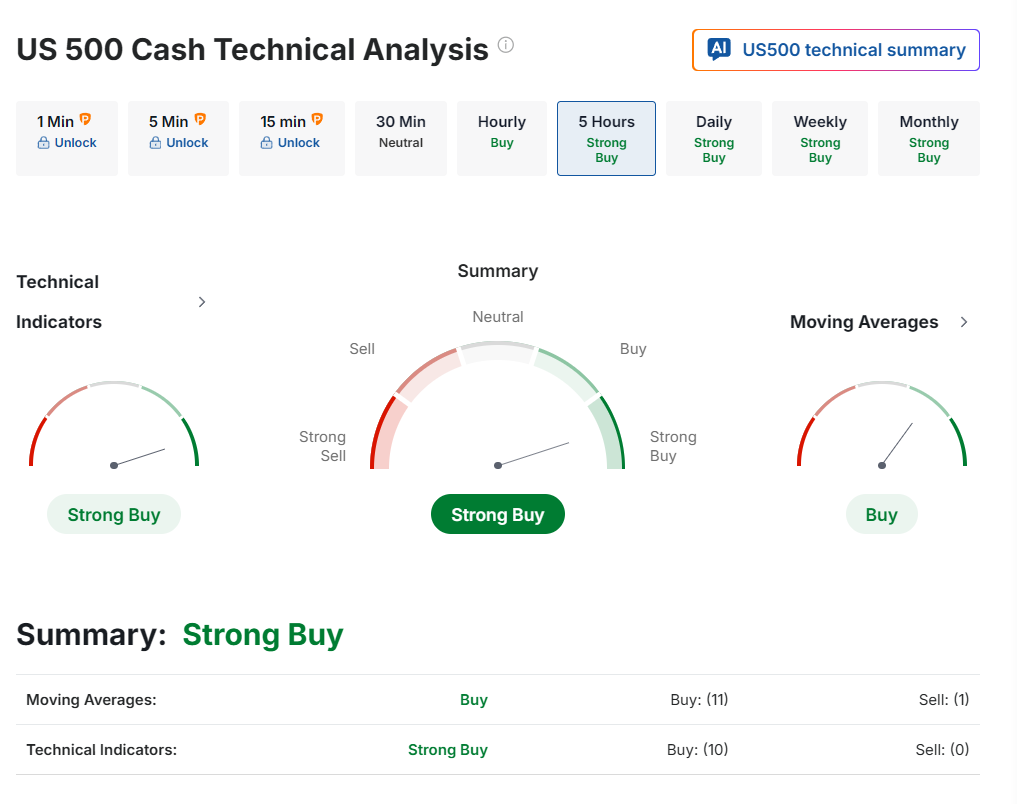

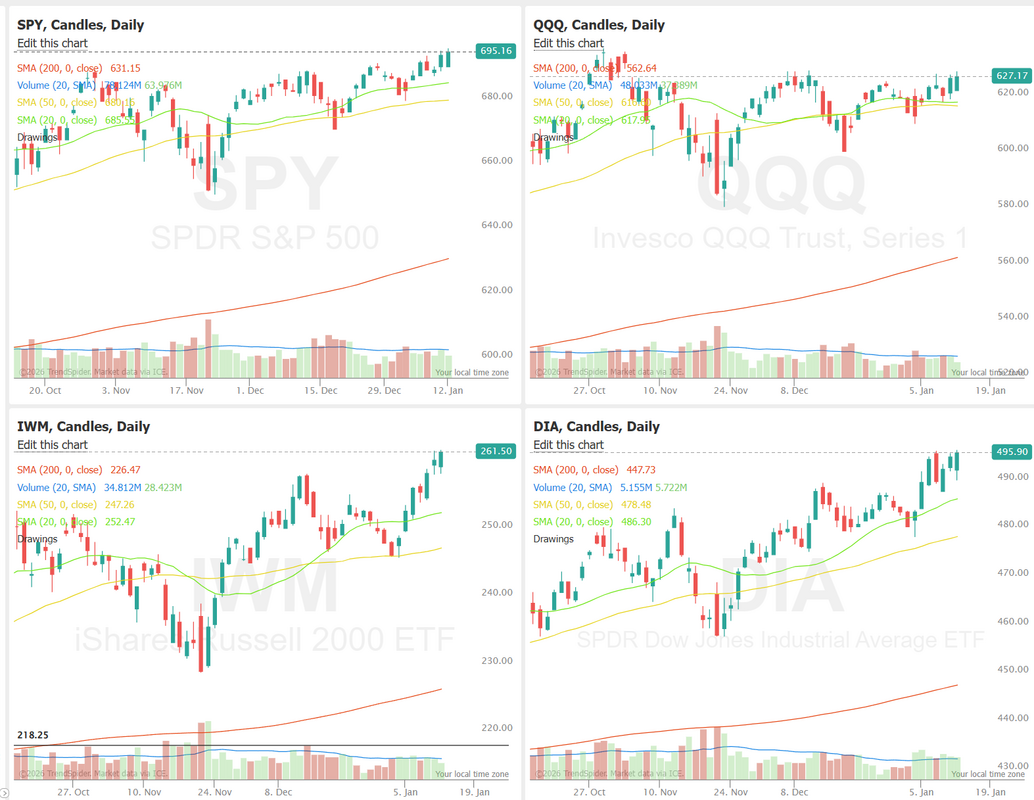

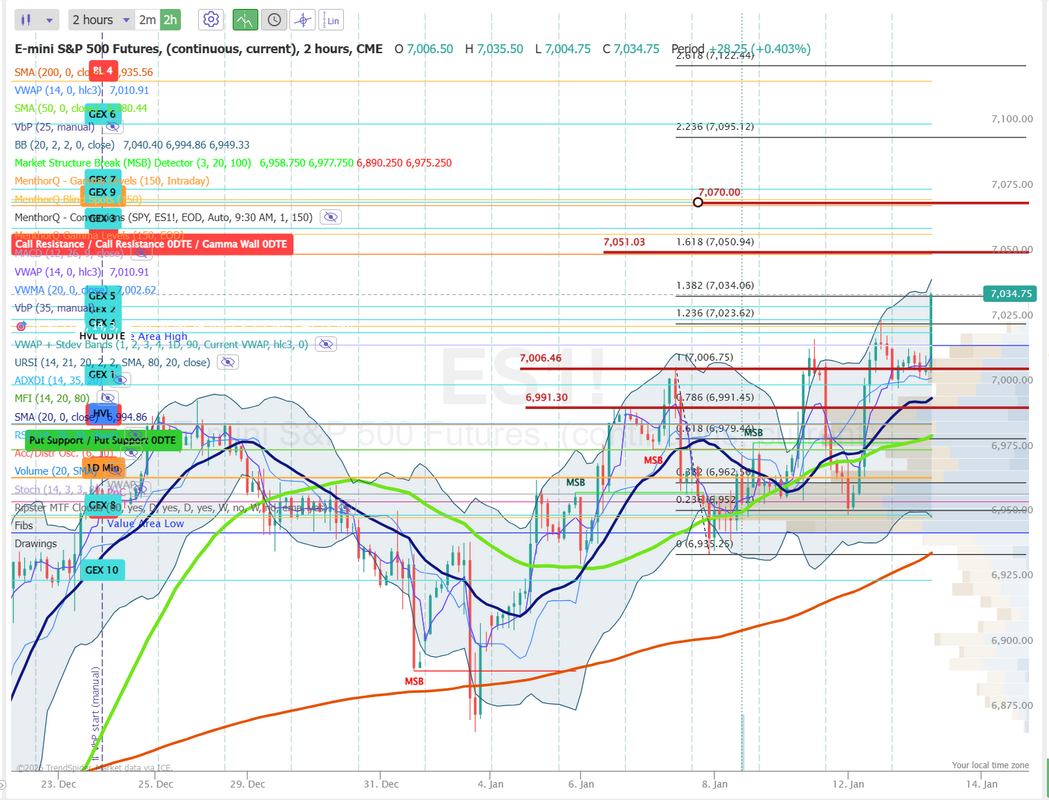

CPI incoming.CPI inflation data incoming this morning. Low I.V. and small expected move today may give us a good entry for a B.E.I.C. (break even Iron condor) initial setup. Yesterday was a loser for me. SPX risk was good all day but frustrating because my initial bullish call was right and I should have just left the original position on all day. Scalping also failed me with no retrace (I was short). Let's check the markets. Buy mode from a technical standpoint to start the day. Mostly new ATH's across the board. March S&P 500 E-Mini futures (ESH26) are trending down -0.08% this morning as investors digest an earnings report from JPMorgan Chase, the nation’s largest bank by assets, with the focus now turning to key U.S. inflation data. JPMorgan Chase (JPM) rose about +0.5% in pre-market trading after reporting better-than-expected Q4 results and providing a solid 2026 net interest income outlook. In yesterday’s trading session, Wall Street’s main stock indexes closed higher, with the S&P 500 notching a new record high. Shares of data storage companies advanced, with Western Digital (WDC) rising more than +5% to lead gainers in the S&P 500 and Nasdaq 100, and Seagate Technology Holdings (STX) gaining over +5%. Also, Walmart (WMT) rose +3% and was the top percentage gainer on the Dow after Nasdaq Global Indexes announced that the stock would join the Nasdaq 100 Index on January 20th, replacing AstraZeneca. In addition, DexCom (DXCM) climbed more than +5% after the maker of glucose monitors reported better-than-expected preliminary Q4 revenue. On the bearish side, credit card companies and bank stocks sank after President Trump called for a one-year cap on credit card interest rates at 10%, with Synchrony Financial (SYF) slumping over -8% to lead losers in the S&P 500 and Capital One Financial (COF) sliding more than -6%. “The bull market still has legs, and it’s entirely possible that we see further gains irrespective of what happens with internal and external policy,” said Giuseppe Sette at Reflexivity. New York Fed President John Williams said on Monday that interest rates are “well-positioned” to stabilize the labor market and return inflation to the central bank’s 2% target. Speaking to reporters after his speech, Williams stressed that the Fed’s independence from political interference had delivered “huge dividends in terms of helping keep inflation in check.” U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at the January FOMC meeting. On the trade front, President Trump said on Monday that any country doing business with Iran would face a 25% tariff on trade with the U.S. Meanwhile, a group of central banks released a statement on Tuesday in support of Fed Chair Jerome Powell. The statement was issued by the heads of the European Central Bank and their counterparts in the U.K., Sweden, Denmark, Switzerland, Australia, Canada, South Korea, and Brazil. “We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell. The independence of central banks is a cornerstone of price, financial, and economic stability in the interest of the citizens that we serve,” the statement said. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. December CPI will come in at +2.7% y/y, unchanged from November. Also, the U.S. core CPI is expected to be +2.7% y/y in December. That is slightly higher than the 2.6% annual increase in November, which was the smallest since early 2021. On a monthly basis, economists forecast 0.3% increases in both headline and core consumer prices. “While this is the final CPI print ahead of the late-January FOMC meeting, it is unlikely to alter Fed policy,” according to ADSS’ Neal Keane. “Today’s CPI may, however, influence expectations for the remainder of the year, with markets currently pricing two further cuts in 2026.” A survey conducted by 22V Research revealed that 33% of investors expect a “risk-on” market reaction to the CPI report, 45% see it as “mixed/negligible,” and just 21% anticipate a “risk-off” response. U.S. New Home Sales data for October will also be released today. The report was originally scheduled for release on November 26th, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the September figures. Economists expect October’s new home sales to be 716K. In addition, market participants will parse comments today from St. Louis Fed President Alberto Musalem and Richmond Fed President Tom Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.197%, up +0.26%. CPI looks right in line and futures are liking it. Let's take a look at our intraday ranges for 0DTE based on /ES levels. Nice pop off of the CPI release. That gives me two big support/resistance levels to que off of today. 7051 and 7070 on the upside with 7006, 6991 on the downside. We've got a good training coming up Weds. We'll go over our rules for strangle entries and all the different rules for our 0DTE setups. Even with the pop in futures off CPI data I think a B.E.I.C. could still be a good start to the day. I'll see you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |