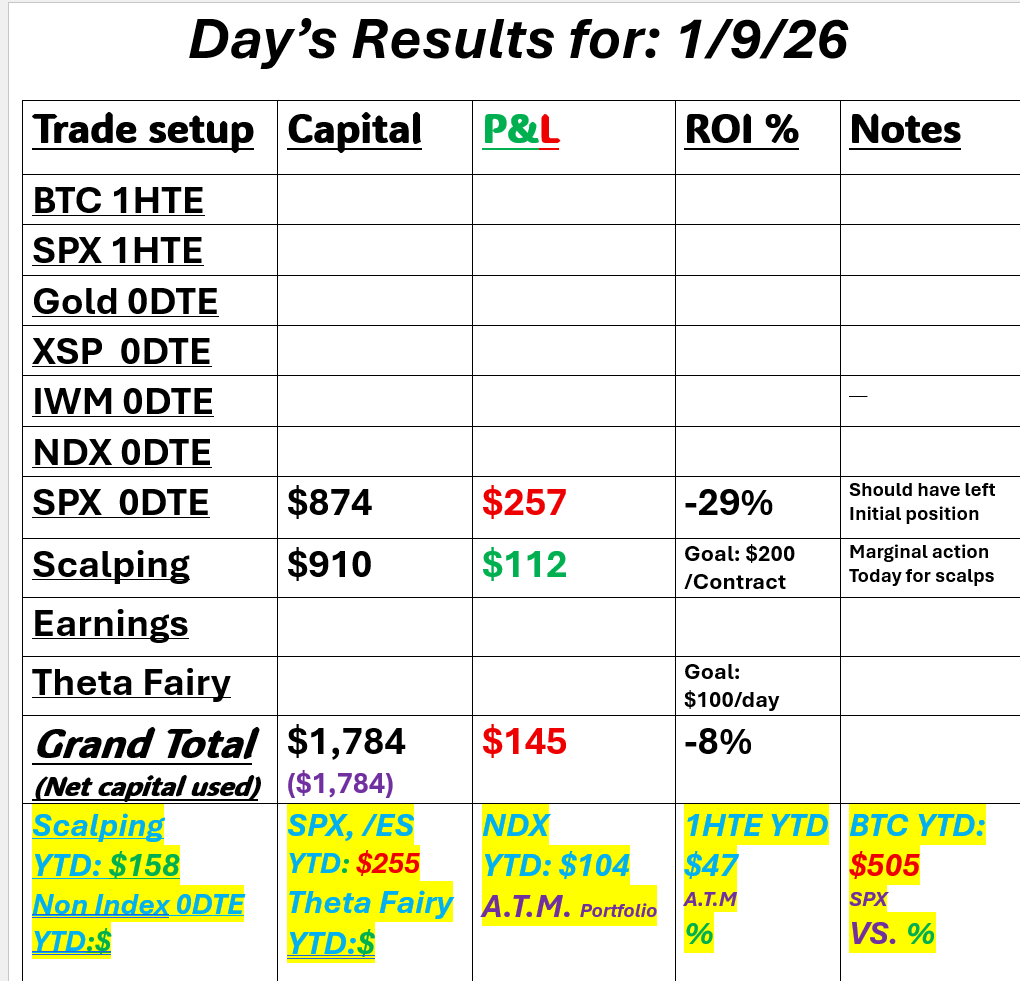

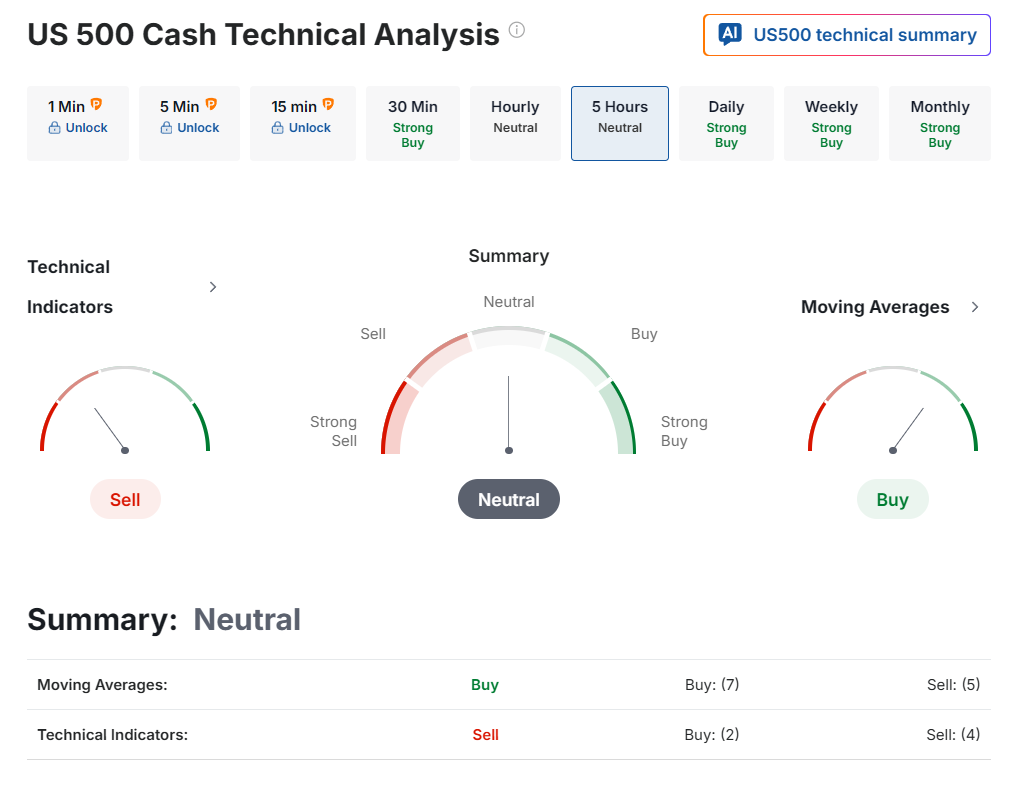

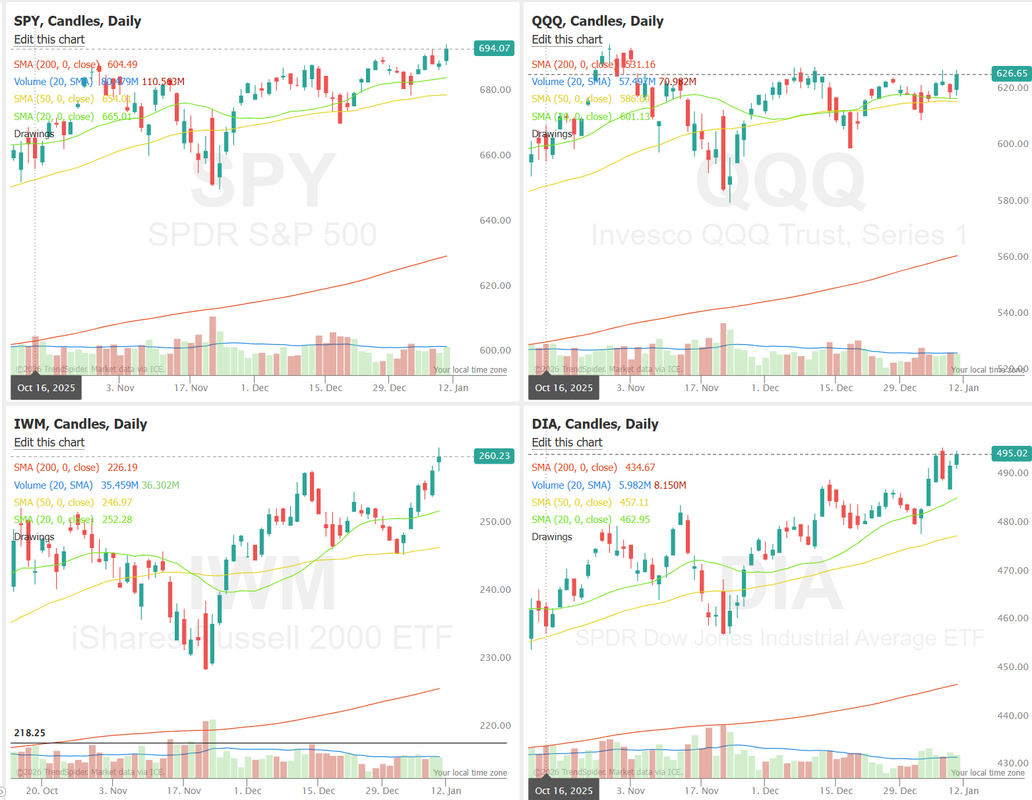

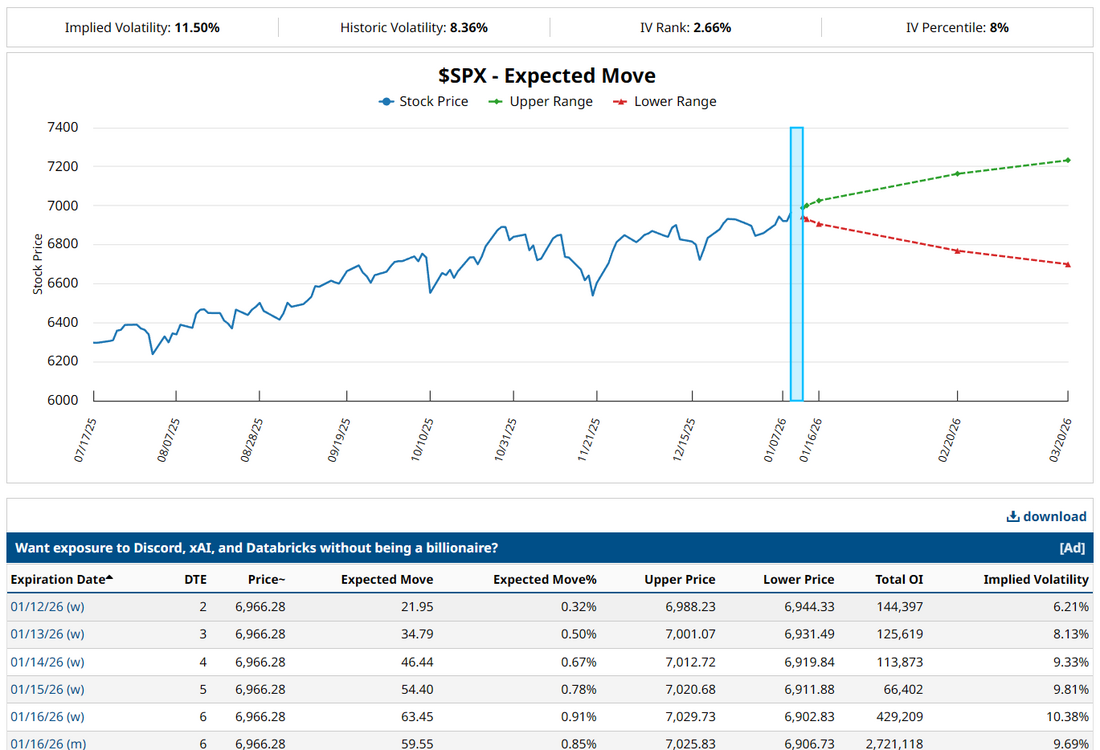

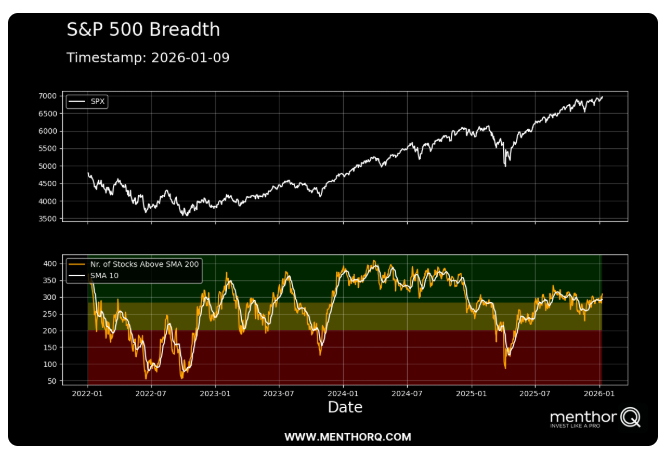

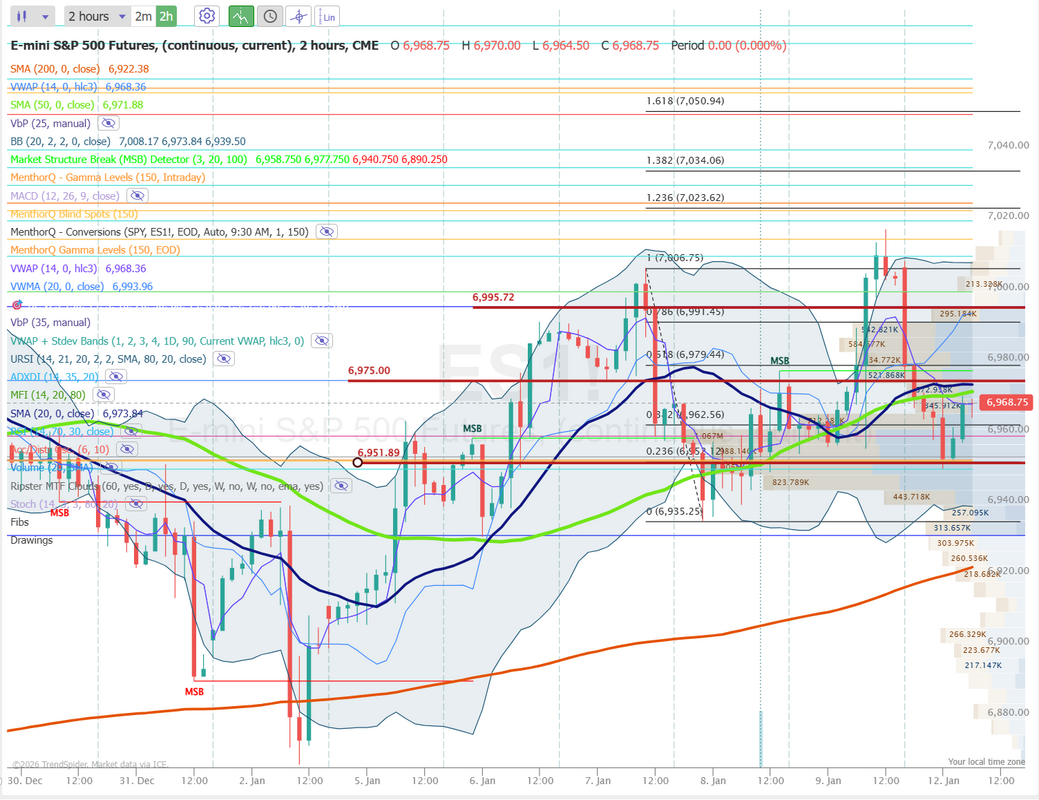

Another crazy day in the marketsVenezuela, Greenland, Colombia, Cuba, Iran and now the FED chair. Don't say the markets are boring. There's always something to key off of. The question is, how meaningful are any of these in the long run? Tariffs are still up in the air. Perhaps we get some clarity there this coming Friday? Our day last Friday was blah. I had a great bullish setup going into the day looking for a pop off of NFP numbers. We got just that and I should have just left our initial setup alone. We got something out of scalps but it wasn't a great day either. Here's a look at the results. Let's take a look at the markets. Technicals aren't giving us much to read into this morning. With the strong finish to Fridays session, we are mostly back to new ATH's on most of the indices, with the QQQ's lagging just a bit. March S&P 500 E-Mini futures (ESH26) are down -0.64%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.82% this morning as sentiment took a hit amid escalating tensions between the Trump administration and the Federal Reserve. The Fed disclosed it had received grand jury subpoenas on Friday, threatening a criminal indictment related to Chair Jerome Powell’s Senate testimony last June. The testimony partly addressed a multiyear renovation project at the Fed’s headquarters in Washington, D.C., which U.S. President Donald Trump has criticized. “This unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure,” Mr. Powell said in a statement on Sunday. He added that “the threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.” The U.S. government’s move raised concerns over central bank independence. “The Powell investigation is certainly not a great look for the Fed, the US government, and US markets as a whole,” said Nick Twidale, chief market analyst at AT Global Markets. “Powell’s comments are very strong, and it looks like he is happy to go head-to-head with the president.” This week, investors look ahead to the release of key U.S. inflation data, comments from Fed officials, and the start of the fourth-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages ended in the green, with the S&P 500 notching a new record high. Shares of data storage companies rallied, with Sandisk (SNDK) surging over +12% to lead gainers in the S&P 500 and Seagate Technology Holdings (STX) rising more than +6%. Also, most chip stocks advanced, led by a more than +10% jump in Intel (INTC) after President Trump said the U.S. government was “proud to be a Shareholder of Intel” in a Truth Social post following a meeting with CEO Lip Bu-Tan. In addition, Vistra (VST) soared over +10% and Oklo (OKLO) climbed more than +7% after the nuclear energy companies announced separate agreements to supply power to Meta Platforms for its data centers. On the bearish side, Qualcomm (QCOM) fell over -2% after Mizuho downgraded the stock to Neutral from Outperform with a price target of $175. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 50K in December, weaker than expectations of 66K. At the same time, the U.S. unemployment rate ticked down to 4.4% in December, stronger than expectations of 4.5%. In addition, U.S. December average hourly earnings rose +0.3% m/m and +3.8% y/y, compared to expectations of +0.3% m/m and +3.6% y/y. Finally, the University of Michigan’s preliminary U.S. consumer sentiment index rose to 54.0 in January, stronger than expectations of 53.5. Richmond Fed President Tom Barkin said on Friday that the latest employment data points to modest job growth and a continued low-hiring environment. “This fine balance between a modest job growth environment with a modest labor-supply growth environment seems to be continuing, and that was encouraging,” Barkin said. Still, he noted that policymakers must remain alert to the risks of both higher unemployment and persistent inflation. Also, San Francisco Fed President Mary Daly said in an interview that she sees the central bank as being in a phase of “fine-tuning.” “We’re not in a place where we’re making large policy moves. We’re in a place where we’re fine-tuning as the economy evolves,” Daly said. In addition, Atlanta Fed President Raphael Bostic said, “Inflation is too high, and we have to make sure that we don’t lose sight of the fact that even labor markets have gotten cooler and more people are expressing concerns, that we still have this big concern around inflation.” Meanwhile, U.S. rate futures have priced in a 94.3% probability of no rate change and a 5.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. The U.S. consumer inflation report for December will be the main highlight this week, as investors continue to gauge the likely timing and extent of additional rate cuts by the Fed. ING economists said the report is unlikely to change expectations that the Fed will lower interest rates at least twice this year. “We believe falling energy prices, slowing housing rents, and weakening wage growth will allow the annual inflation rate to head back towards 2% around the turn of the year,” the economists said in a note. U.S. retail sales data for November will also attract attention, offering insight into the 2025 holiday shopping season. Other noteworthy data releases include the U.S. PPI, the Core PPI, New Home Sales, Existing Home Sales, the Export Price Index, the Import Price Index, Initial Jobless Claims, the Philly Fed Manufacturing Index, the Empire State Manufacturing Index, and Industrial Production. Market participants will also hear perspectives from a slew of Fed officials, including Bostic, Barkin, Williams, Musalem, Paulson, Miran, Kashkari, Barr, Bowman, and Jefferson, throughout the week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Fourth-quarter corporate earnings season kicks off this week. JPMorgan Chase (JPM), the largest bank in the U.S., will report earnings on Tuesday, followed by Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) the next day. Morgan Stanley (MS) and Goldman Sachs (GS) are set to report results on Thursday. Delta Air Lines (DAL), Bank of New York (BK), BlackRock (BLK), and PNC Financial (PNC) are among other major names scheduled to deliver quarterly updates during the week. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.202%, up +0.72%. Let's take a look at the expected move this week. With a .85% expected move I'd expect premium to be well below average today. SPY ended the week near its all-time high at $694.07 (+1.60%), as price broke out of an ascending triangle on the daily timeframe. Momentum confirmed the move, with a bullish MACD cross and sustained green CHATS candle colors, signaling absolute strength holding above 70 for most of the week. QQQ finished the week at $626.65 (+2.21%), but continued to lag the broader market in momentum. Underperformance from the Mag 7 kept CHATS candles neutral, reflecting limited bullish participation. Still, a breakout from a symmetrical triangle and a bullish MACD cross suggest the uptrend remains intact. IWM took charge last week, closing at $260.23 (+4.60%), as a double bottom pattern continued to play out. Price broke above the pattern’s neckline, with green CHATS candle colors and a bullish MACD cross confirming momentum. The breakout pushed the small-cap ETF to fresh all-time highs ahead of this week’s key inflation reports. Short term, the S&P 500 continues to hold an upward price trend, but breadth is sending a more cautious message. The number of stocks above their 200-day moving average has stabilized in the mid-range rather than pushing back into the strong participation zone, suggesting the recent advance is being carried by fewer names. With breadth hovering near the neutral band and the 10-day average flattening, upside momentum looks constructive but fragile. A sustained push higher in breadth would reinforce trend continuation, while a rollover back toward the lower zone would flag rising risk of consolidation or a pullback despite index-level strength. No training session for us today! I don't want to do our weekly zoom trainings just to do them. They need to be compelling and I didn't find anything exciting to share over the weekend. Let me know today if you have any topics you'd like to focus on this week. Let's take a look at the intraday levels this morning. We don't have any major economic releases scheduled for today. Futures are weak on the FED news. The main question today is can the bulls come rescue the market once again? With the retrace this morning it puts us back into almost the exact same zones as we started last Friday with. 6975 is the first resistance level with 6995 next. 7000 is still a big phycological overhang. 6959 is a support level with 6951 up next. Below that we are all the way down at 6335. I look forward to trading with you all today in the live trading room. We should have some opportunity today with the futures action indicating some movement today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |