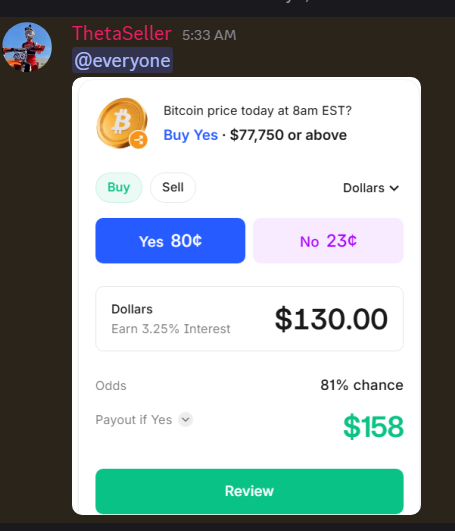

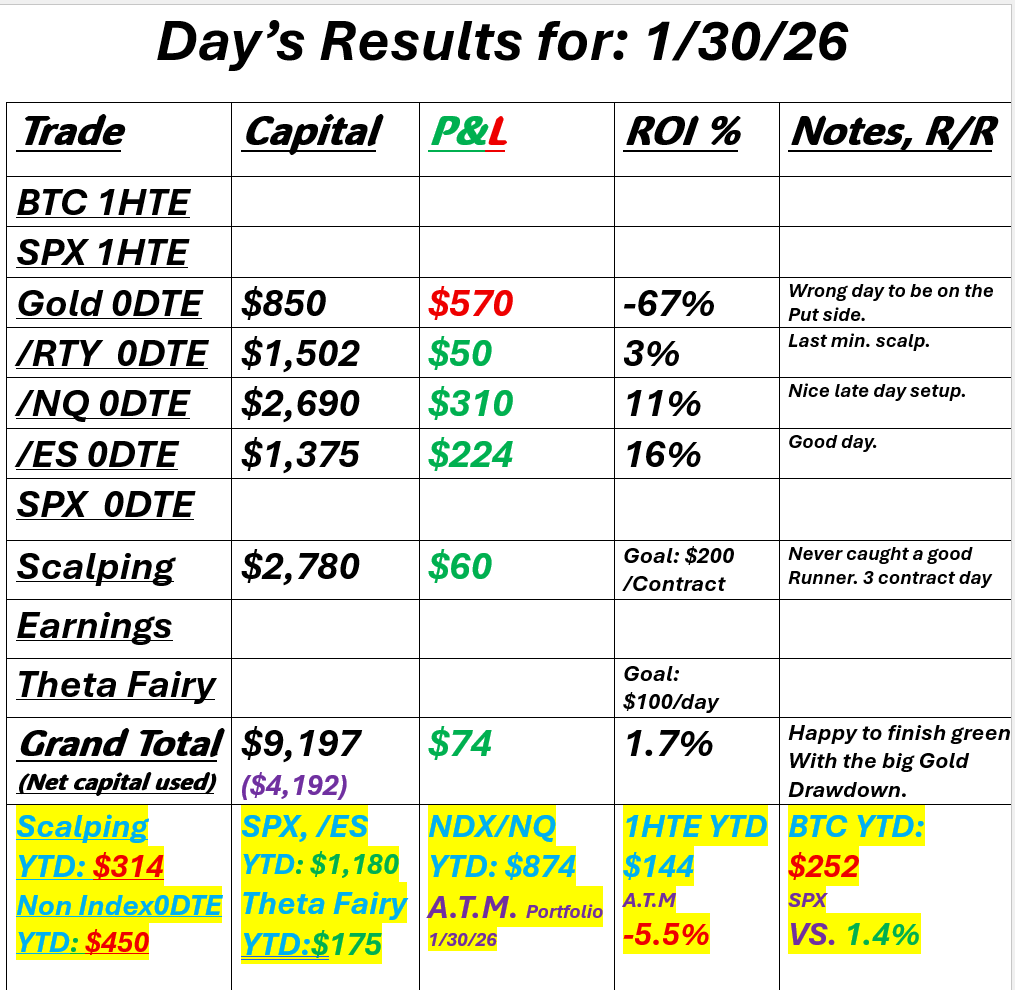

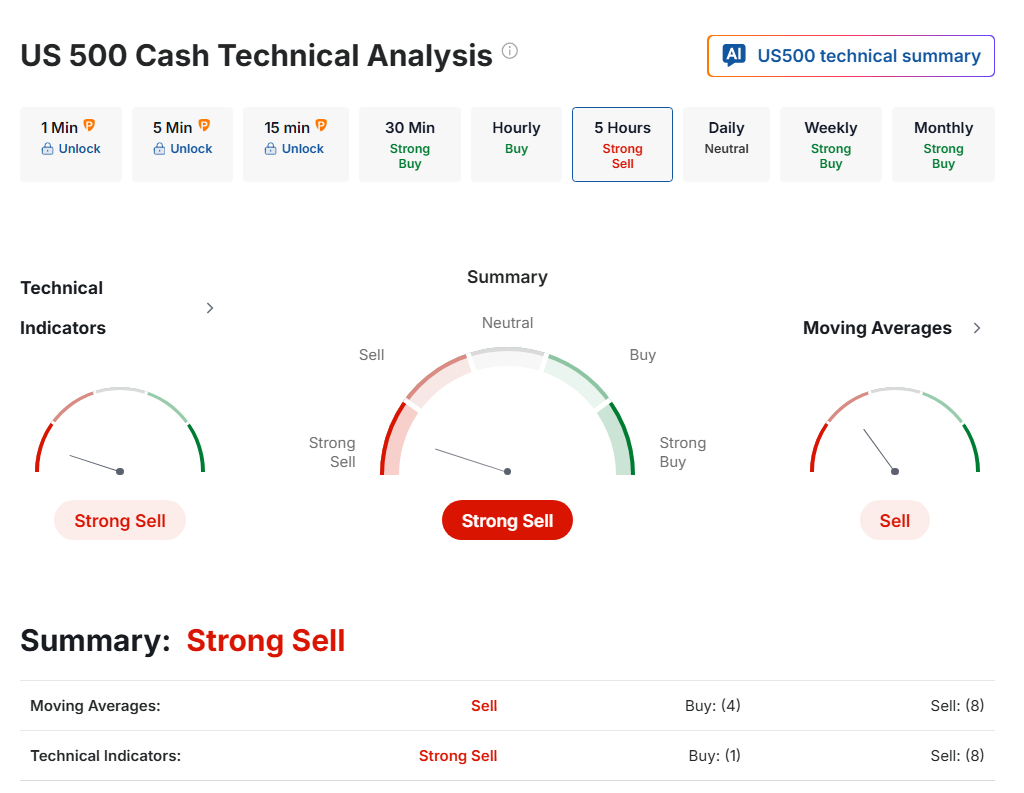

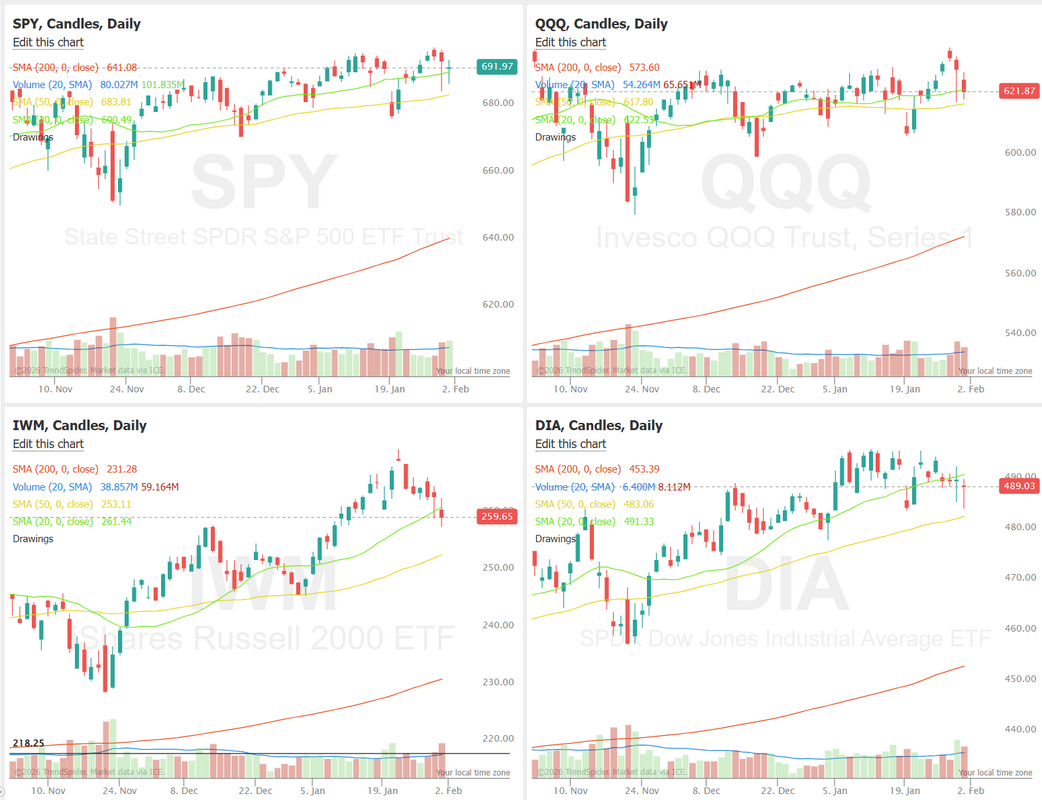

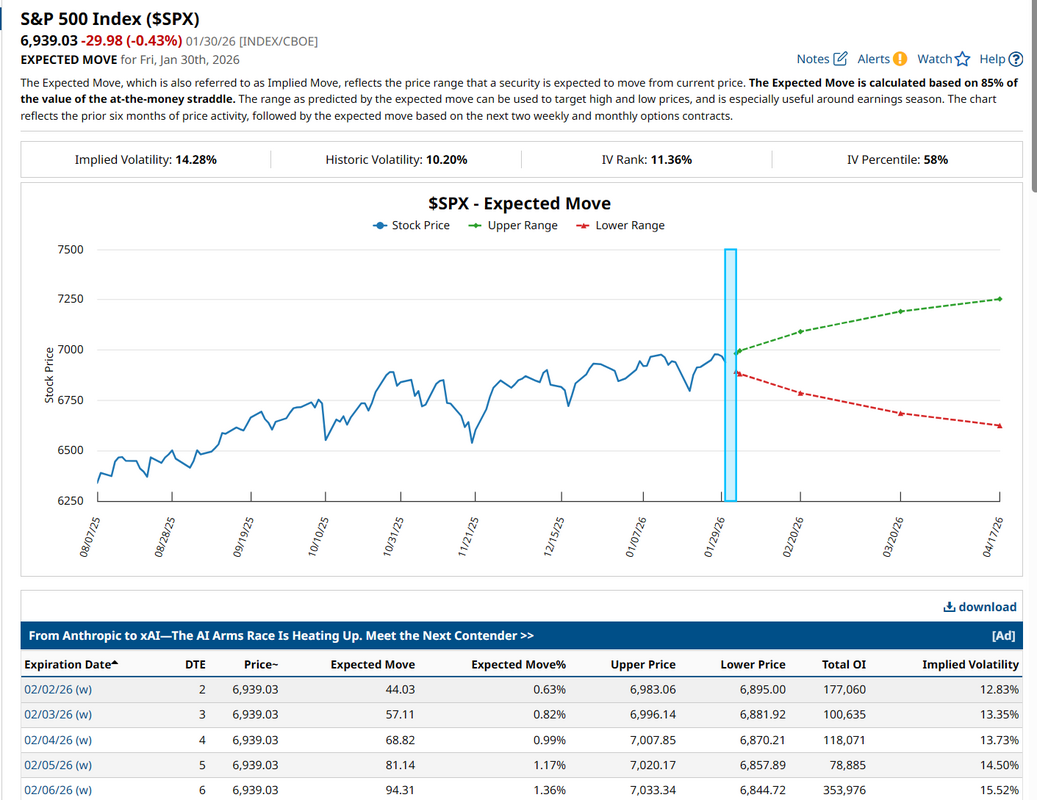

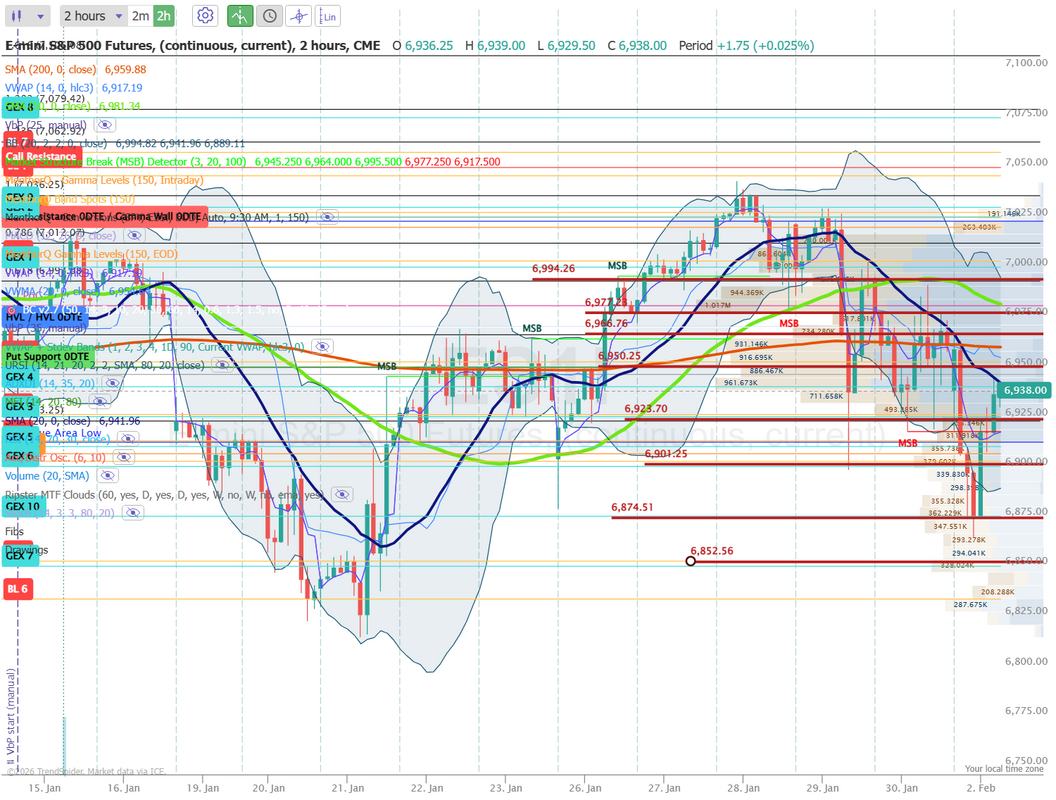

BTC crashes. Bank implodes in Illinois. CME raises margin requirements on gold & silver.Welcome back to a new week of trading! One thing is clear about day trading. There are certainly pros and cons but one big pro that always rises to the top is no overnight risk. Futures are weak again this morning, although they are fighting back as I type. Things are getting interesting in the market. The 1HTE BTC setups may offer some opportunities today. We just finished our first of the day with a $130 trade making $28 dollars (21%) in less than 30 min. Keep an eye on these today. We had a busy day on Friday and nailed four out of five trade setups. Unfortunately I added the put side to our Gold trade and of course, that was the day gold decided to collapse. All in all, I'm happy we were able to escape the day profitable. There were so many opportunities with scalping but I was always just a bit behind on catching the runners. Here's a full look at my day. Let's take a look at the markets. We've had a bit of a shake up lately. It's a tricky technical look to start the day. Futures are down and flashing a sell signal but they have also come roaring back from their overnight lows. Today could be decisive. Is this just another "buy the dip" opportunities or have bears finally showed up to take command? Friday certainly looked like the start of a break down with that pesky 20DMA acting as some key support. March S&P 500 E-Mini futures (ESH26) are down -0.57%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.92% this morning, pointing to a lower open on Wall Street as investors continue to sell risky assets amid a rout in precious metals. Gold and silver prices fell on Monday as increased CME margin requirements compounded selling pressure following last week’s selloff triggered by Kevin Warsh’s nomination as the next Fed chair. Gold and silver are down more than -3% after sliding as much as -10% and -16%, respectively, earlier on Monday. Also weighing on sentiment on Monday were renewed concerns around the AI trade. Oracle (ORCL) slid over -3% in pre-market trading after announcing plans to raise $45 billion to $50 billion this year to expand its cloud infrastructure, stoking investor concerns about its growing debt burden. Separately, Nvidia (NVDA) fell about -2% in pre-market trading after CEO Jensen Huang said the company’s proposed $100 billion investment in OpenAI was “never a commitment” and that it would consider any funding rounds “one at a time.” This week, investors look ahead to a new round of corporate earnings reports, remarks from Federal Reserve officials, and a slew of U.S. labor market data, assuming there is no prolonged government shutdown. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Chip stocks sank, with KLA Corp. (KLAC) plunging over -15% and Advanced Micro Devices (AMD) slumping more than -6%. Also, mining stocks cratered as gold and silver prices plummeted, with Coeur Mining (CDE) tumbling over -16% and Hecla Mining (HL) sliding more than -14%. In addition, PennyMac Financial Services (PFSI) plummeted over -33% after the company posted downbeat Q4 results. On the bullish side, Deckers Outdoor (DECK) jumped more than +19% and was the top percentage gainer on the S&P 500 after the owner of shoe brands Ugg and Hoka reported better-than-expected FQ3 results and raised its full-year guidance. Economic data released on Friday showed that the U.S. producer price index for final demand rose +0.5% m/m and +3.0% y/y in December, stronger than expectations of +0.2% m/m and +2.7% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.7% m/m and +3.3% y/y in December, stronger than expectations of +0.2% m/m and +2.9% y/y. In addition, the U.S. January Chicago PMI rose to 54.0, stronger than expectations of 43.5. “The unemployment rate has stabilized, and inflation remains sticky with uncertainty lingering around tariff policy,” said Eric Teal, chief investment officer at Comerica Wealth Management. “There is justification for the wait-and-see approach given the potential for a second wave of higher prices as the tariff pass-through rate increases.” St. Louis Fed President Alberto Musalem said on Friday that policymakers should refrain from cutting interest rates further for now to avoid reigniting inflationary pressures. “Aside from risking higher or more persistent inflation, easing could be counterproductive for the labor market by raising inflation expectations and long-term interest rates, thus slowing the economy and hurting employment,” Musalem said. Also, Atlanta Fed President Raphael Bostic said elevated inflation means officials should wait before cutting interest rates again. “We are still too high in inflation, so I think we need to be somewhat restrictive,” Bostic said. In addition, Fed Vice Chair for Supervision Michelle Bowman said there is merit in waiting to cut rates further, citing elevated inflation and uncertainty over possible distortions in economic data caused by last year’s record-long government shutdown. At the same time, Fed Governor Christopher Waller said, “Monetary policy is still restricting economic activity, and economic data make it clear to me further easing is needed.” U.S. rate futures have priced in an 87.2% chance of no rate change and a 12.8% chance of a 25 basis point rate cut at the March FOMC meeting. Meanwhile, the U.S. government partially shut down early Saturday, even though the Senate had passed a funding deal hours earlier. That’s because the House of Representatives must also vote to approve the final version of the deal. The shutdown is expected to be short, with the House returning from a week-long break on Monday and President Trump fully backing the spending package. House Speaker Mike Johnson said on Sunday that he believes he has enough votes to end the partial shutdown by Tuesday. Fourth-quarter corporate earnings season continues, and investors await new reports from prominent companies this week, including Alphabet (GOOGL), Amazon.com (AMZN), Advanced Micro Devices (AMD), Qualcomm (QCOM), Arm Holdings (ARM), Palantir Technologies (PLTR), Walt Disney (DIS), PepsiCo (PEP), Pfizer (PFE), Eli Lilly (LLY), AbbVie (ABBV), and Uber Technologies (UBER). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. Market watchers will also be awaiting the U.S. January Nonfarm Payrolls report this week for fresh insight into the health of the jobs market and the potential implications for monetary policy. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. It remains unclear whether the Bureau of Labor Statistics could delay the report’s release due to the shutdown, even if it is expected to be short. “The market remains wary of what is happening in the jobs market and was unmoved by the Fed’s positive spin, continuing to price two 25 basis-point rate cuts this year,” said James Knightley, economist at ING. Other noteworthy data releases include the JOLTs Job Openings, ADP Nonfarm Employment Change, the S&P Global Services PMI, the S&P Global Composite PMI, the ISM Non-Manufacturing PMI, Initial Jobless Claims, Average Hourly Earnings, the Unemployment Rate, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). In addition, several Fed officials will be making appearances throughout the week, including Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Lisa Cook, and Fed Vice Chair Philip Jefferson. Today, investors will focus on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. The survey will be closely watched for insights into the state of the economy and for clues on inflation and employment trends. Economists expect the January ISM manufacturing index to be 48.5, compared to the previous value of 47.9. The U.S. S&P Global Manufacturing PMI will also be released today. Economists forecast that the final January figure will be unrevised at 51.9. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.214%, down -0.71%. SPY closed the week slightly higher at $691.97 (+0.39%) as January comes to a close. On the monthly chart, price has reached a key 1.618 Fibonacci extension level, an area where trends often pause or reverse. Meanwhile, the monthly RSI remains in overbought territory, raising the stakes for bulls. Will momentum persist into February, or is a pullback imminent? With several major tech earnings last week, QQQ closed flat on the week at $621.87 (-0.14%). Price continues to face resistance near the 1.618 Fibonacci extension and has yet to print a new all-time high, unlike SPY. With more tech earnings set to report this week, traders may finally see a break from the recent consolidation range. Small-caps took some heat last week, with IWM closing at $259.65 (-1.95%). However, the monthly chart remains constructive, as the ETF sits at an all-time high and still well below its 1.618 Golden Fibonacci extension. The monthly RSI also remains below 70, giving momentum room to run. Even with rates left unchanged last week, small-caps continue to look bullish on a larger timeframe. Despite its reputation as digital gold, Bitcoin has recently diverged from the precious metals sector, sliding lower while shiny rocks staged a historic rally. A broken bear flag and drift toward $80,000 echo the 2021-2022 price action that preceded a 75% drawdown, while the Multi Length Alignment Oscillator reinforces bearish momentum as downside pressures mount. Let's take a look at the weekly expected move in SPX. A healthy 1.36% expected move for the week should provide a good base for credit premiums. We'll finish our part II training today on PPC (Performance process cycle) this is a good one to download. Come join us today on our zoom feed. Let's take a look at the intraday levels we'll work off today. 6950, 6966, 6977, 6994 are resistance. 6923, 6901, 6874, 6852 are support. Today could be another day of good opportunities. Let's see how the morning firms up. See you shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |