|

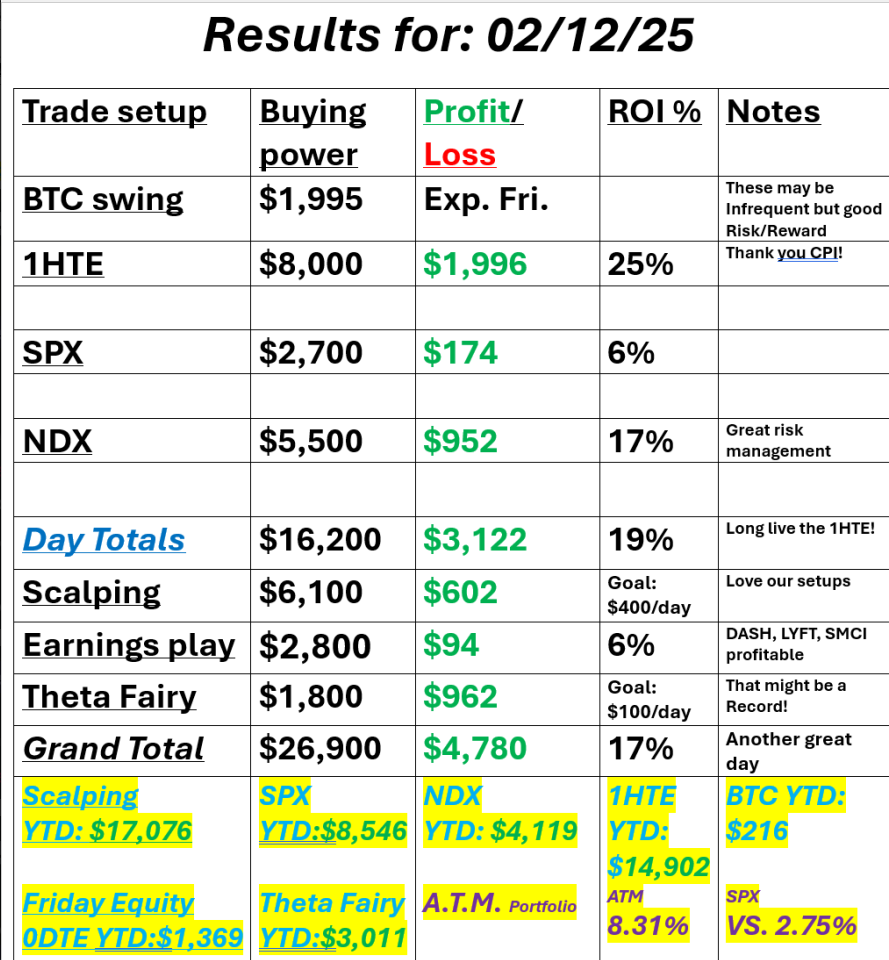

Welcome back traders. CPI was good for us. It offered up great scalping opportunities. We had to work our NDX most of the day. It caused me to miss some good earnings setups but that's o.k. I'm proud of our risk management again with our NDX. One of the most powerful quotes in trading is: "All large losses start as small losses". Be willing to take lots of small losses in order to avoid that big one. CPI offered us an amazing opportunity in the 1HTE bitcoin trade. It contributed a bunch to our excellent overall results. Here's a look at our results. PPI incoming today so no bias or levels. March S&P 500 E-Mini futures (ESH25) are down -0.02%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.06% this morning as market participants awaited crucial producer inflation data and a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Westinghouse Air Brake Technologies (WAB) slumped over -9% and was the top percentage loser on the S&P 500 after the company posted downbeat Q4 results and provided soft FY25 guidance. Also, Biogen (BIIB) fell more than -4% and was the top percentage loser on the Nasdaq 100 after the drug developer issued weaker-than-expected FY25 adjusted EPS guidance. In addition, Lyft (LYFT) slid over -7% after the ride-hailing company gave disappointing guidance for Q1 gross bookings. On the bullish side, CVS Health (CVS) surged nearly +15% and was the top percentage gainer on the S&P 500 after the healthcare conglomerate reported better-than-expected Q4 results. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices jumped +0.5% m/m in January, stronger than expectations of +0.3% m/m. On an annual basis, headline inflation unexpectedly accelerated to +3.0% in January from +2.9% in December, stronger than expectations of no change at +2.9% and the fastest pace of increase in 7 months. Also, the January core CPI, which excludes volatile food and fuel prices, unexpectedly accelerated to +3.3% y/y from +3.2% y/y in December, stronger than expectations of +3.1% y/y. “Higher-for-longer may have just gotten a little longer,” said Ellen Zentner at Morgan Stanley Wealth Management. “The Fed has been waiting for clear signs that inflation is trending lower again, and [yesterday] they got the opposite. Until that changes, the markets are going to have to remain patient about additional rate cuts.” Federal Reserve Chair Jerome Powell stated on Wednesday that the latest CPI report indicates that although the central bank has made substantial progress toward taming inflation, there is still more work to do. “I would say we’re close, but not there on inflation. Last year, inflation was 2.6% - so great progress - but we’re not quite there yet,” Powell told House lawmakers in response to a question on the second day of his semi-annual testimony to Congress. The Fed chief added that policymakers “want to keep policy restrictive for now,” suggesting that interest rates will stay elevated for the foreseeable future. Also, Atlanta Fed President Raphael Bostic said that the timing of the next interest rate cut remains uncertain due to the unclear trajectory of inflation and potential policy changes, including tariffs, from the Trump administration. “It’s going to take a while to just figure out what is going on,” Bostic noted. Meanwhile, U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the March meeting. On the earnings front, notable companies like Applied Materials (AMAT), Deere & Company (DE), Palo Alto Networks (PANW), Duke Energy (DUK), Airbnb (ABNB), and Datadog (DDOG) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. January PPI will come in at +0.3% m/m and +3.2% y/y, compared to the previous figures of +0.2% m/m and +3.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect January figures to be +0.3% m/m and +3.3% y/y, compared to December’s numbers of 0.0% m/m and +3.5% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 217K, compared to 219K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.601%, down -0.71%. AMT, PANW, ABNB, TWLO, WYNN, COIN, DDOG, /ES, /NG, UPST, 0DTE's. See you in our live zoom shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |