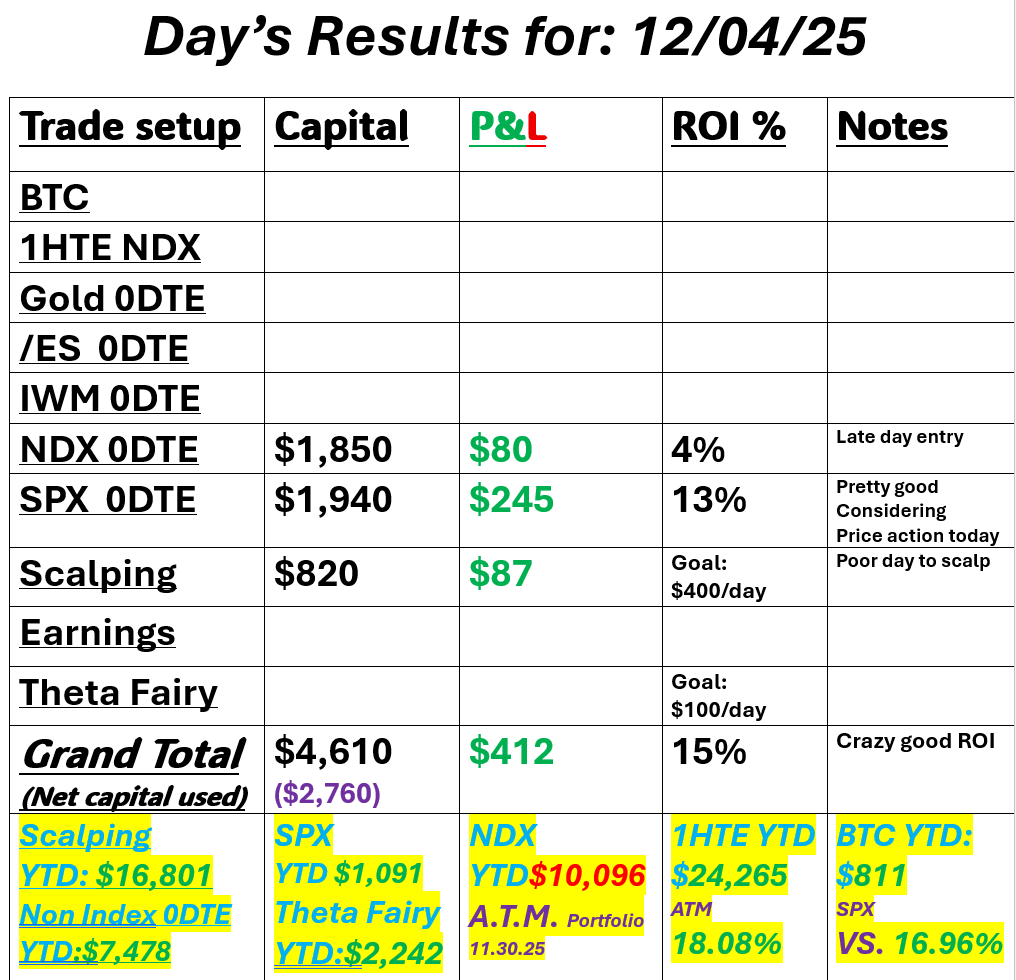

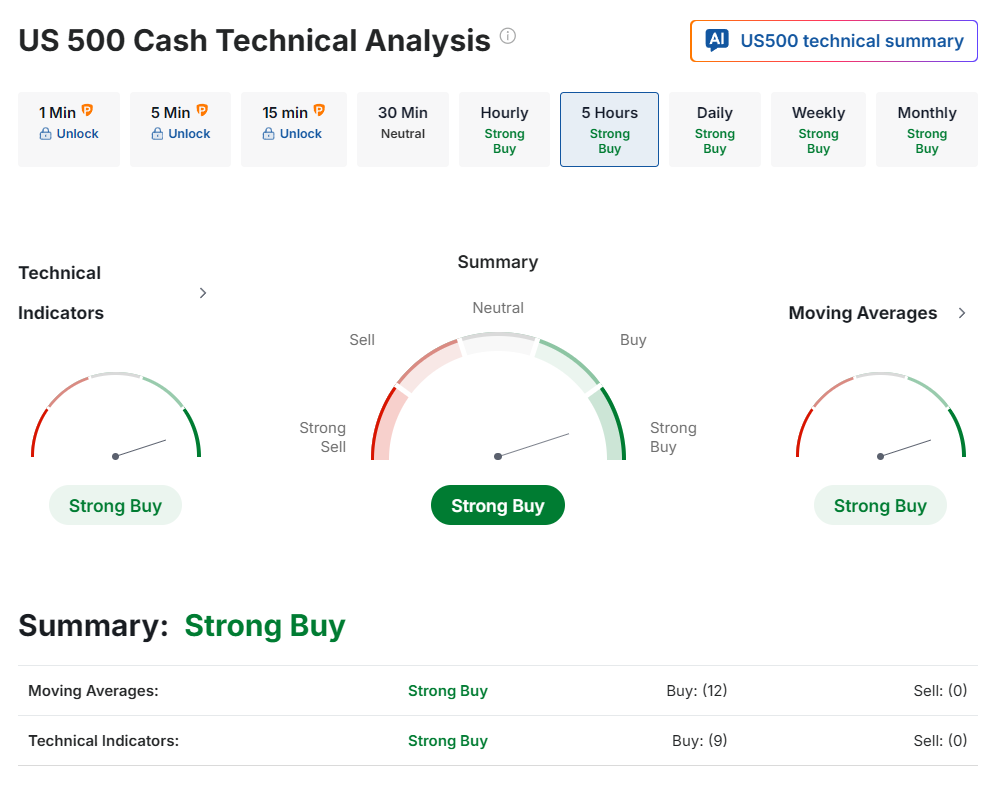

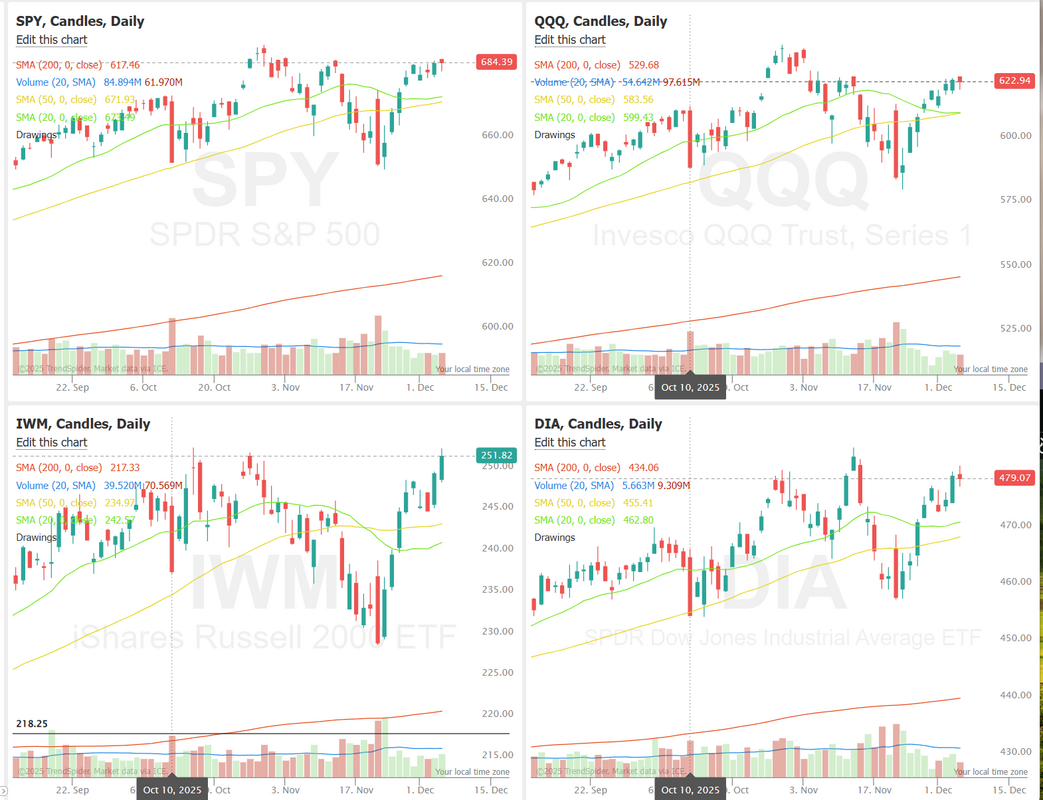

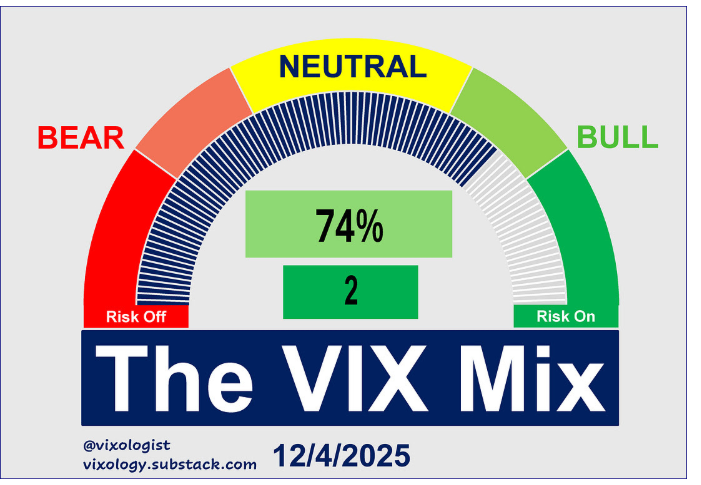

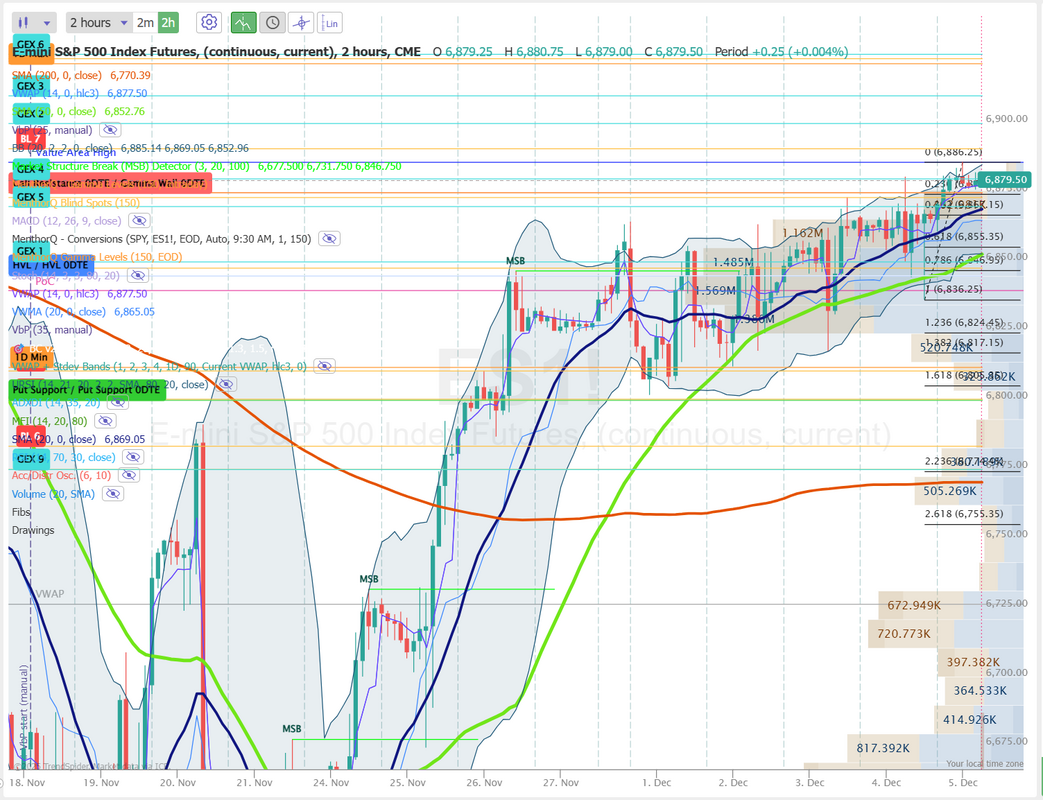

PCE dayWe are finally starting to get back to a normal flow of economic reports, after the Government shutdown ended. PCE report this morning could be the driver for the days price action. Yesterday was once again, a slow "normal" day in the markets. We got trades working early so that helped. Overall it was another solid day for us. This whole week had been very consistent as far as results go. Here's a look at our day: Let's take a look at the markets: Bullish bias continues into today. PCE report may change that but bulls look to still be in charge. The bulls are looking a bit tired here, with the exception of the interest rate sensitive IWM which powered to a new ATH. December S&P 500 E-Mini futures (ESZ25) are trending up +0.16% this morning, extending their advance toward a new all-time high, while investors look ahead to the release of the Federal Reserve’s first-line inflation gauge. In yesterday’s trading session, Wall Street’s major indices closed mixed. Chip stocks retreated, with Intel (INTC) sliding over -7% to lead losers in the S&P 500 and Nasdaq 100, and ON Semiconductor (ON) falling more than -4%. Also, Snowflake (SNOW) slumped over -11% as the cloud storage company’s Q4 product revenue guidance disappointed investors. In addition, Genesco (GCO) plummeted more than -30% after the company posted downbeat Q3 results and cut its full-year guidance. On the bullish side, Dollar General (DG) surged over +14% and was the top percentage gainer on the S&P 500 after the budget retailer posted better-than-expected Q3 results and raised its full-year guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -27K to a 3-year low of 191K, compared with the 219K expected. Separately, U.S. factory orders rose +0.2% m/m in September, weaker than expectations of +0.3% m/m. “Overall, the net takeaway from the [jobless claims] data served to confirm the crosscurrents evident in the labor landscape,” said Ian Lyngen at BMO Capital Markets. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. The core PCE price index for September was originally scheduled for release on October 31st, but was delayed due to the government shutdown. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in September, the same as in August. “[Recent] soft core CPI and PPI reports suggest that tariffs continue to have more bark than bite with regard to inflation, and this should also be reflected in [the] September core PCE deflator,” according to ING economist James Knightley. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists expect September Personal Spending to rise +0.3% m/m and Personal Income to grow +0.3% m/m, compared to the August figures of +0.6% m/m and +0.4% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists foresee the preliminary December figure coming in at 52.0, compared to 51.0 in November. The Fed’s Consumer Credit report will be released today as well. Economists expect the U.S. Consumer Credit to be $11.8 billion in October, compared to the previous figure of $13.1 billion. Meanwhile, the U.S. November jobs report, originally scheduled for release today, was pushed back to December 16th due to the shutdown. That release will also incorporate the October payroll figures. U.S. rate futures have priced in an 87.2% chance of a 25 basis point rate cut and a 12.8% chance of no rate change at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.110%, up +0.02%. The SPX momentum setup continues to stabilize, with the Momentum Score returning to the upper end of its range after a choppy period through mid-November. Price action has tightened near recent highs, and the index is now forming a short-term consolidation zone just below the 6900 level. With momentum back at 5, the market appears to be regaining directional strength, and the recent series of higher lows suggests buyers are defending dips more aggressively. In the near term, traders may watch whether SPX can push cleanly above last week’s highs to confirm renewed upside pressure, while a failure to hold the rising short-term troughs could signal another momentum fade. The VIX is implying a slight risk on environment. Let's take a look at our intraday /ES levels for 0DTE setups. 6886, 6892, 6900, 6909, 6921 are resistance levels. 6875, 6868, 6855, 6847, 6836 are support. Once again, PCE could be the driver today so lets see how it moves at the open. Let's finish off the week strong with another daily profit!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |