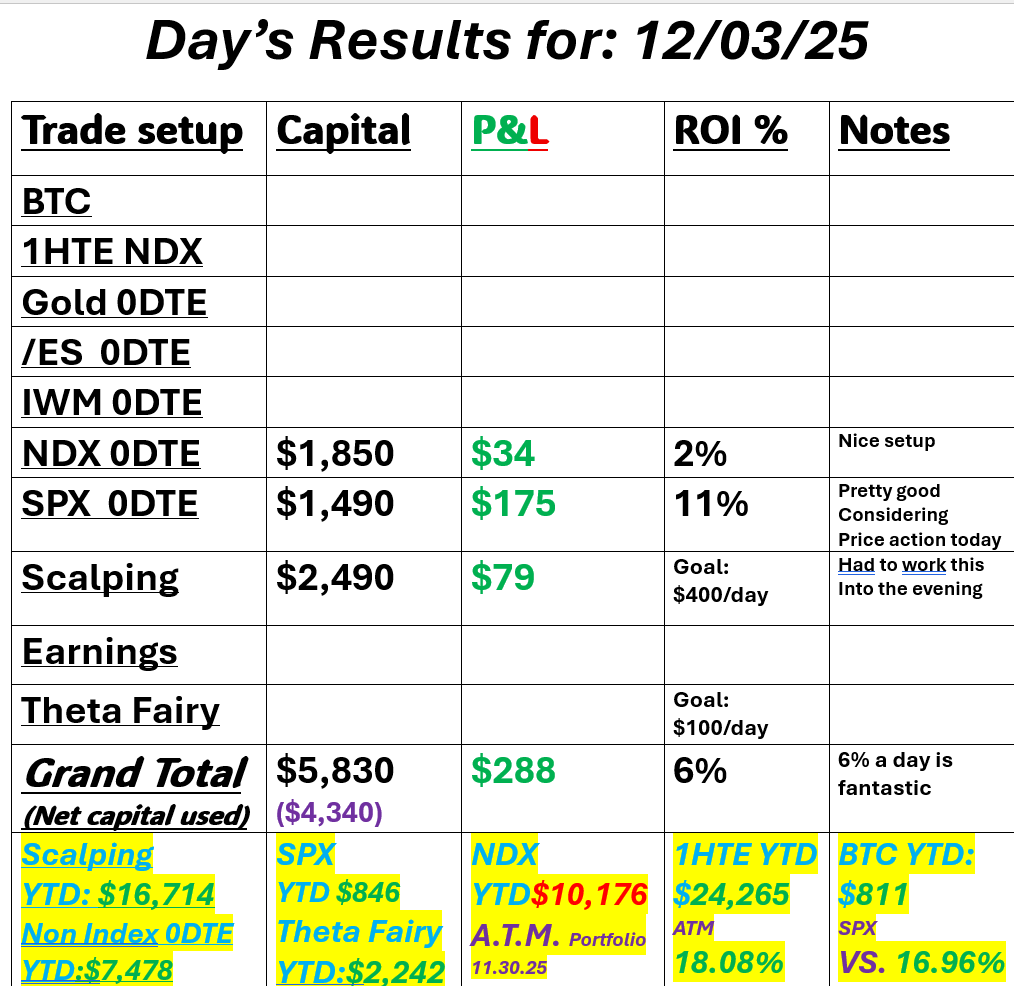

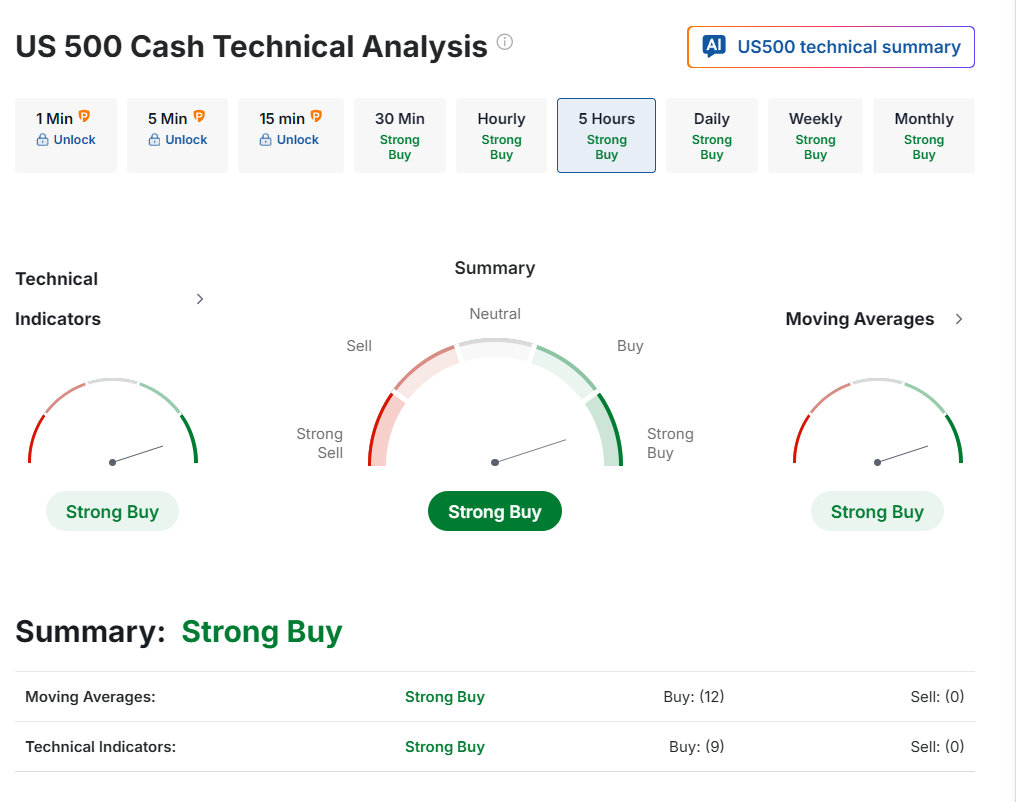

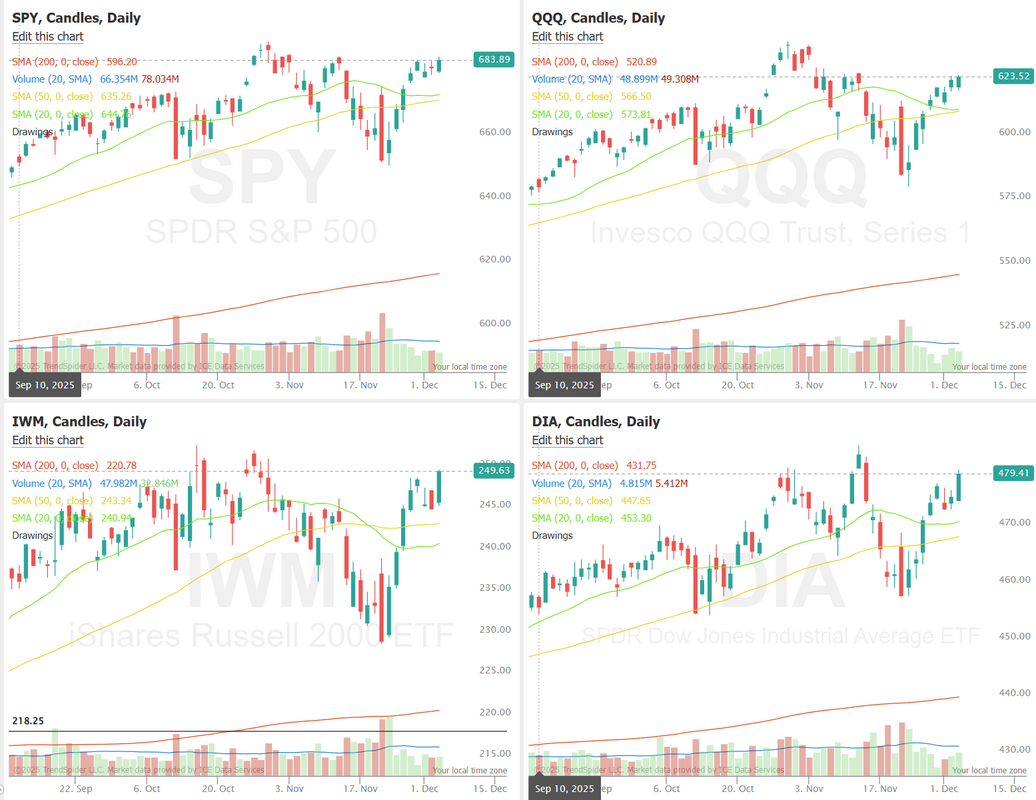

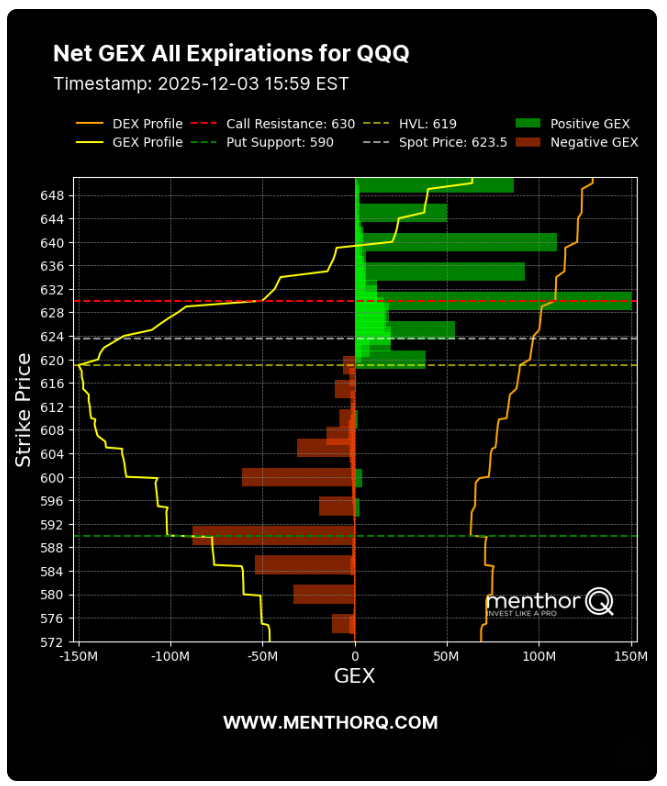

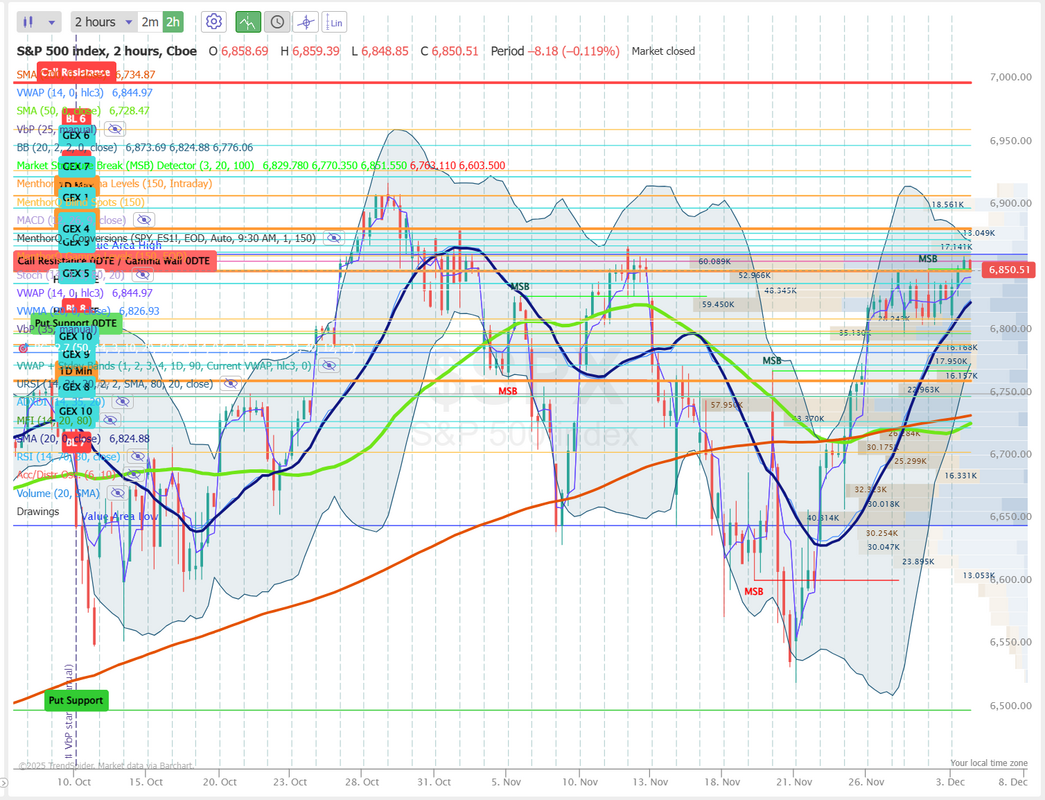

Has "normalization" returned?It's always important as day traders to remember how myopic we can get. The last three trading days have been slow, consistent, small moves. This is what we used to get last year. It was no biggie to throw on a credit Iron condor and let it ride. Risk/reward is always bad with a 70+ delta setup but it didn't matter. Moves were small and the trade was generally easy to manage. This year has been the opposite. Big moves and directional debit trades have been the go to. Are we returning to a "boring" market? It feels wrong to trade short Iron condors in this market but that's the trade the keeps coming to the top of the list. Today looks like another potentially slow day. We'll see. That's why we show up every day. We had an easy day yesterday but couldn't squeeze and "home runs" in. I had to take our short scalping position into the evening to finally grab a profit. Here's a look at the day we had: Let's take a look at the markets. We are clinging to a buy signal but it sure looks tired to me. IWM and DIA had strong bullish days yesterday but the SPY and QQQ are starting to look tired. Todays training will focus on Japanese Candlestick Charting Techniques by Steve Nison. Considered the "Grandfather of candlesticks". This is considered the bible of candlesticks. It should be another good one. Come join us in our live zoom feed and enrich your trading knowledge! The SPX is stabilizing near recent highs, and the option score has climbed back to its strongest reading in weeks, signaling improving short-term sentiment from the derivatives market. This upswing in the score suggests traders are positioning more confidently after a choppy period in mid-November, with fewer signs of hedging pressure and a tilt toward supportive flows. In the near term, the combination of firming price action and a high option score points to reduced downside momentum, making upcoming sessions important for confirming whether buyers can maintain control as SPX approaches overhead resistance. The QQQ Net GEX setup shows a supportive options landscape, with the spot price sitting near 623 and a notable pocket of positive GEX building above, helping dampen volatility on small pullbacks. The chart highlights put support around 590, meaning dealer positioning could act as a stabilizing buffer if price drifts lower. On the upside, call resistance near 630 marks a zone where dealer hedging flows may start to slow upward momentum, creating a tactical ceiling in the short term. With heavy negative GEX concentrated below and a growing positive cluster forming closer to spot, near-term flows lean toward a market that may trade in a contained range unless a clean break of these hedging levels forces dealers to adjust exposure. Let's look at the intraday levels on /ES for our 0DTE setups. 6857, 6864, 6875, 6884* (top of my range for today) are resistance levels. 6850* (big demarcation line), 6841, 6812* (big gap down zone), 6003 are support. Let's keep our winning streak going today! See you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |