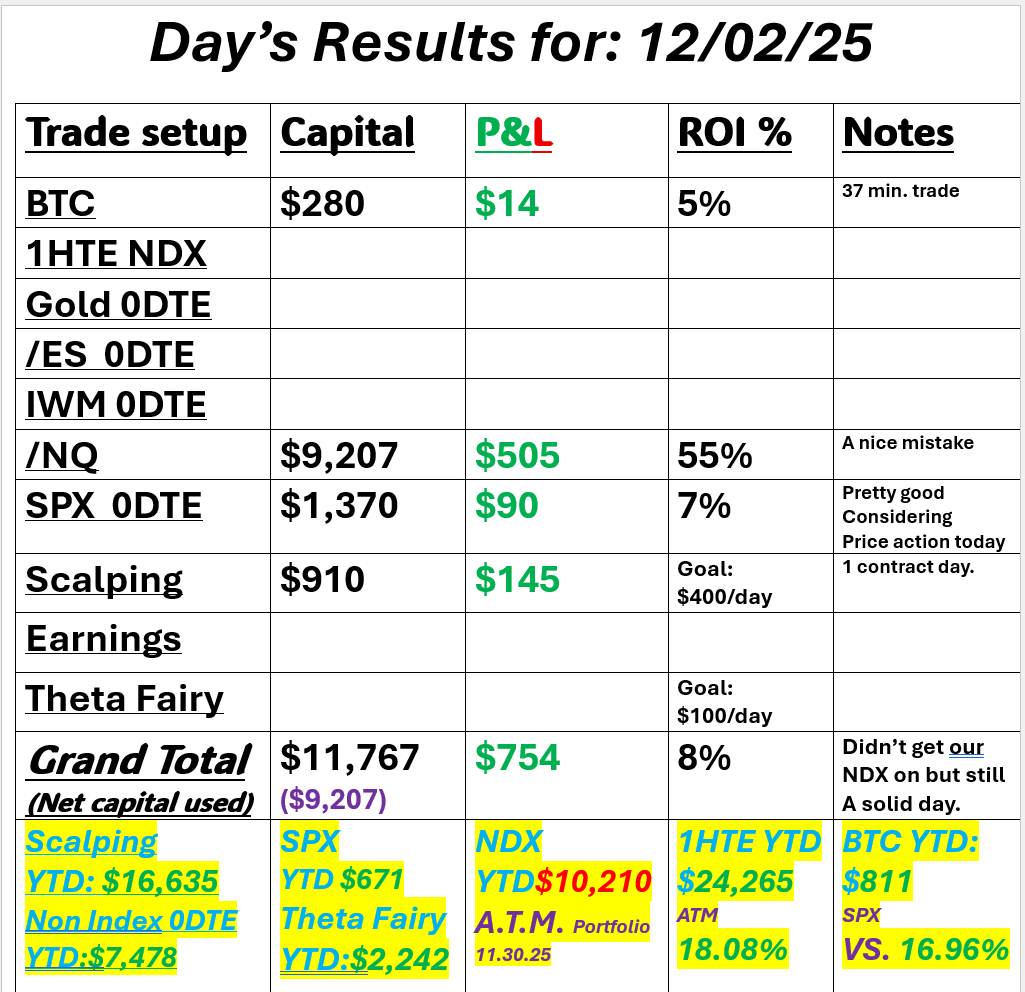

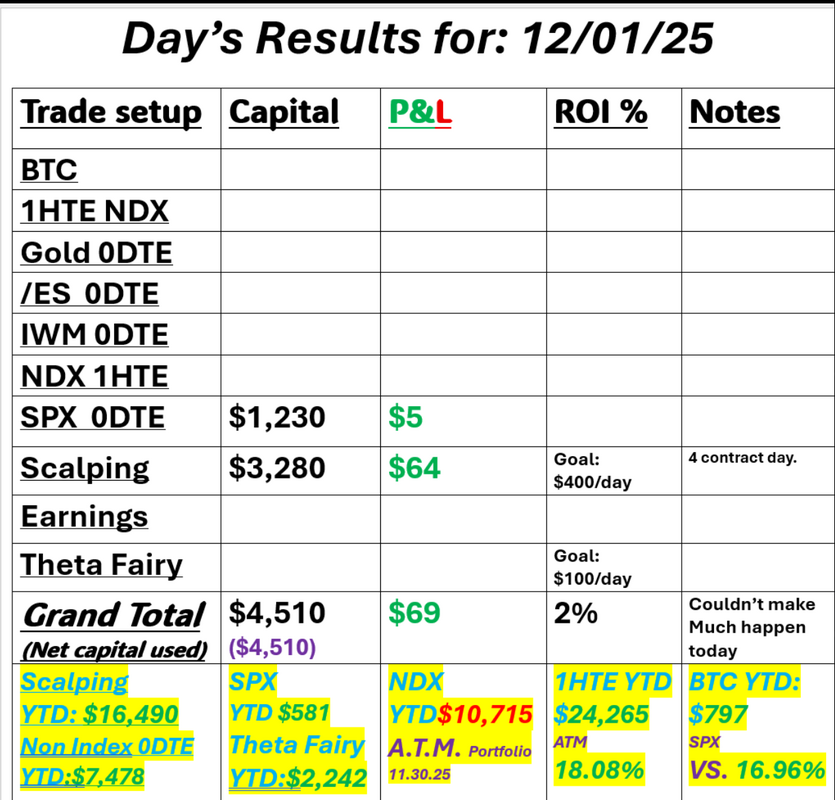

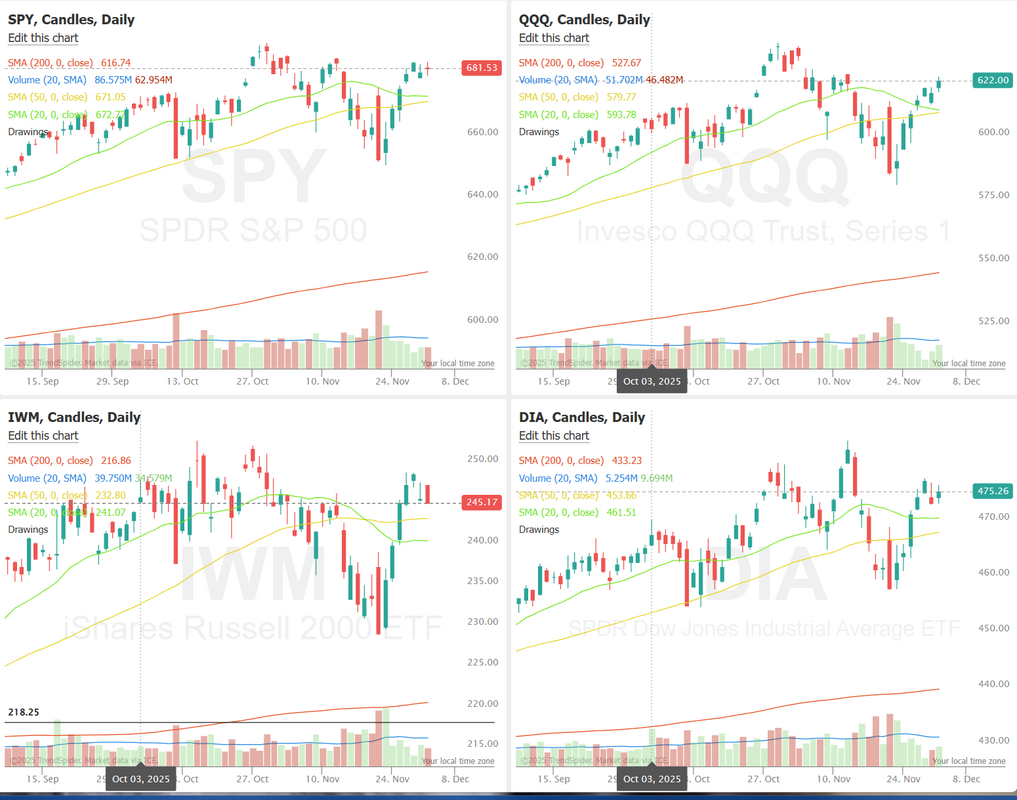

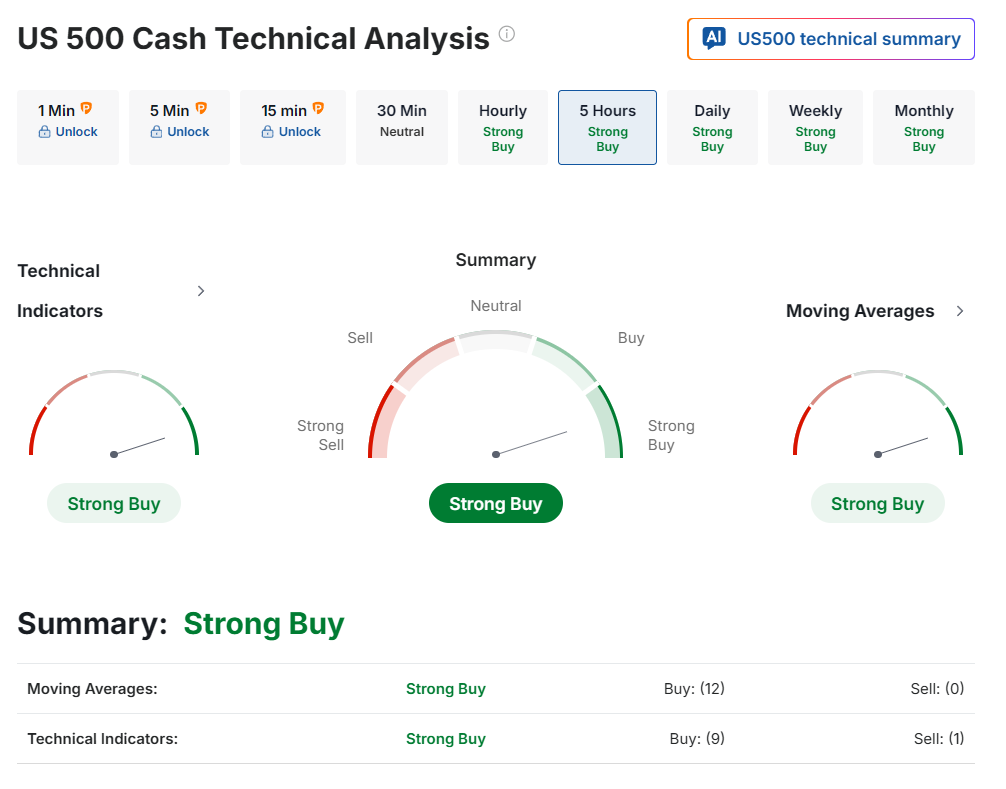

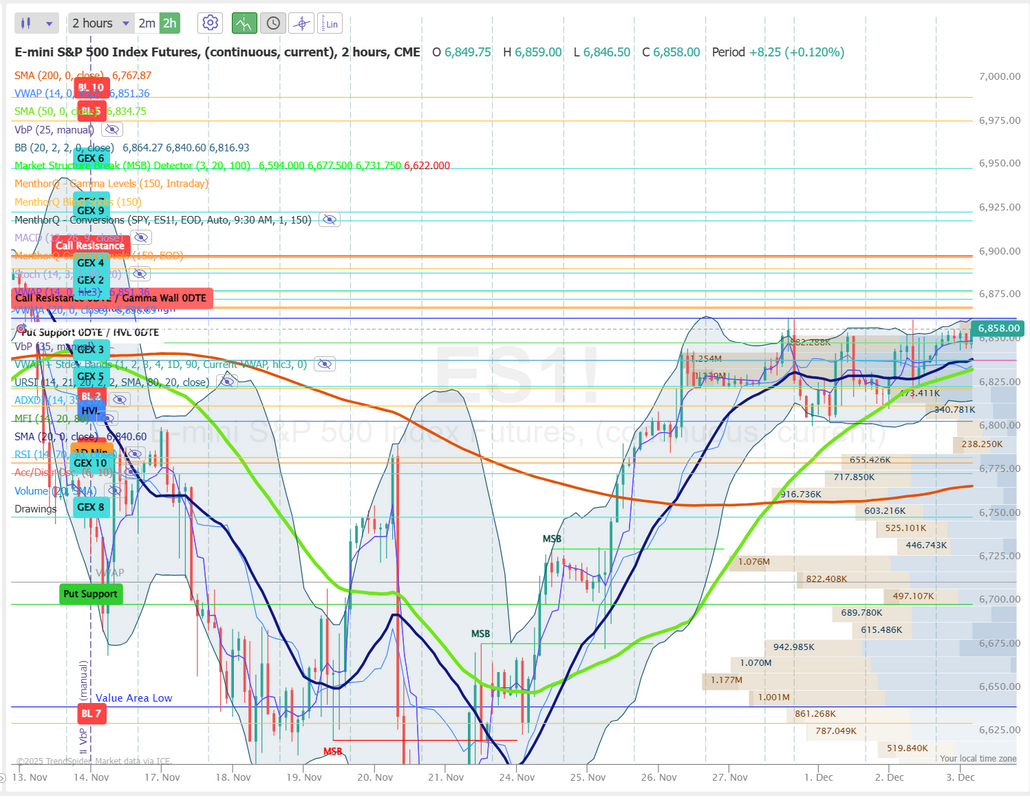

Nassim Taleb's randomnessMonday's training session focused on Nassim's book "Fooled by Randomness". It's a must-read for serious traders. One quote we focused on was •Mild success stems from skill, wild success from luck: Consistent, moderate achievements can often be credited to effort and ability, but extreme outliers are typically the result of variance and fortunate timing. Sometimes trades make money, and we feel like we are smart. That we know what we are doing. The reality is that not all winning trades are great trades. Sometimes the randomness of high-variance activities (trading qualifies) can make us look better than we are. Not all "winning" trades are winners. Sometimes it's just luck. It was just coincidental that we'd had that training on Monday, because I started yesterday with a $500 profit in a few minutes in our scalping room. I was surprised to see it up that much until I realized I'd scalped the /NQ vs. the /MNQ. That's 10X the size if you aren't familiar. Instead of a $900 trade, it was a $9,000 entry. To be fair to myself, it was a good entry and would have still been profitable if I'd hit the /MNQ entry, but to also be clear, there was a mistake. Regardless, we had a solid day yesterday. This price action continues to present a challenge to me on the SPX. It's a bit all over the place, but nonetheless, still a nice day. This type of price action isn't a great trading environment for me. Here's a look at our day yesterday. I didn't get a blog post up yesterday. We installed a new computer to run the scalping zoom and that took longer than expected. Our day was green but not by much. Still...green is green. Let's take a look at the markets this morning. Bulls have staged a nice comeback over the last week. Do they have enough juice to keep pushing? They seemed a bit tired yesterday. Technicals are all bullish this morning. December S&P 500 E-Mini futures (ESZ25) are trending up +0.16% this morning as traders bet that a new round of U.S. economic data will reinforce expectations for a Federal Reserve rate cut next week. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the S&P 500 and Nasdaq 100 notching 2-1/2-week highs. Chip stocks advanced, with Intel (INTC) climbing over +8% to lead gainers in the Nasdaq 100 and NXP Semiconductors N.V. (NXPI) rising more than +7%. Also, Boeing (BA) surged more than +10% and was the top percentage gainer on the S&P 500 and Dow after Chief Financial Officer Jay Malave said he expects the company to generate low-single-digit positive free cash flow next year. In addition, MongoDB (MDB) jumped over +22% after the database software company posted upbeat Q3 results and raised its full-year guidance. On the bearish side, Symbotic (SYM) tumbled more than -21% after Goldman Sachs downgraded the stock to Sell from Neutral with a price target of $47. “Although our breadth and trend indicators showed some improvement last week, more time and technical evidence are needed for a ‘buy’ signal to occur” in the stock market, according to Craig Johnson at Piper Sandler. U.S. President Donald Trump said on Tuesday he plans to announce his choice to lead the Federal Reserve in early 2026. “We’ll be announcing somebody, probably early next year, for the new chairman of the Fed,” Trump said during a Cabinet meeting at the White House. Bloomberg News reported last week that White House National Economic Council Director Kevin Hassett is viewed as the leading candidate to succeed Powell, a pick investors see as aligned with President Trump’s push for lower rates. Meanwhile, U.S. rate futures have priced in an 87.0% chance of a 25 basis point rate cut and a 13.0% chance of no rate change at the December FOMC meeting. Today, all eyes are on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. Economists, on average, forecast that the November ADP Nonfarm Employment Change will stand at 5K, compared to the October figure of 42K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the November ISM services index to be 52.0 and the S&P Global services PMI to be 55.0, compared to the previous values of 52.4 and 54.8, respectively. U.S. Industrial Production and Manufacturing Production data for September will be released today. The reports were originally scheduled for release on October 17th, but were delayed due to the government shutdown. Economists expect Industrial Production to rise +0.1% m/m and Manufacturing Production to rise +0.1% m/m in September, compared to the August figures of +0.1% m/m and +0.2% m/m, respectively. U.S. Export and Import Price Indexes for September will come in today. The figures were originally scheduled for release on October 17th, but were delayed due to the shutdown. Economists anticipate the export price index to rise +0.1% m/m and the import price index to rise +0.1% m/m in September, compared to the previous figures of +0.3% m/m and +0.3% m/m, respectively. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.9 million barrels, compared to last week’s value of 2.8 million barrels. On the earnings front, notable companies like Salesforce (CRM), Snowflake (SNOW), and Dollar Tree (DLTR) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.083%, down -0.12%. The SPX momentum score has pushed back to 5, reflecting a short-term improvement in trend strength after the recent pullback. Price action has also stabilized, with the index reclaiming the bulk of last week’s losses and holding above the mid-range of the recent consolidation zone. In the near term, the key focus is whether SPX can maintain this renewed momentum and push through the late-November swing highs; if the momentum score slips again, it would signal weakening follow-through and a market that’s reverting back into choppy range-bound behavior. Overall, the metric suggests short-term strength, but continuation will depend on how price behaves around nearby resistance. Today's training is on the book: The Disciplined Trader by Mark Douglas. This is a book we talk about a lot in our trading room so it should be a great review. Join us in our live zoom feed today. My lean or bias today: I'm leaning bullish. It seems like the bulls gas tank is running a bit on the empty side but technicals, futures and overall market structure are all leaning bullish to start the day. Let's take a look at the intraday /ES levels for our 0DTE trading. 6865* (key resistance level), 6871, 6879, 6891, 6900 are all resistance levels. 6850, 6839* (key support. 20/50PMA on 2hr. chart convergence zone), 6826, 6814, 6805 are support levels. Let's work on continuing our win streak! See you all shortly in the live trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |