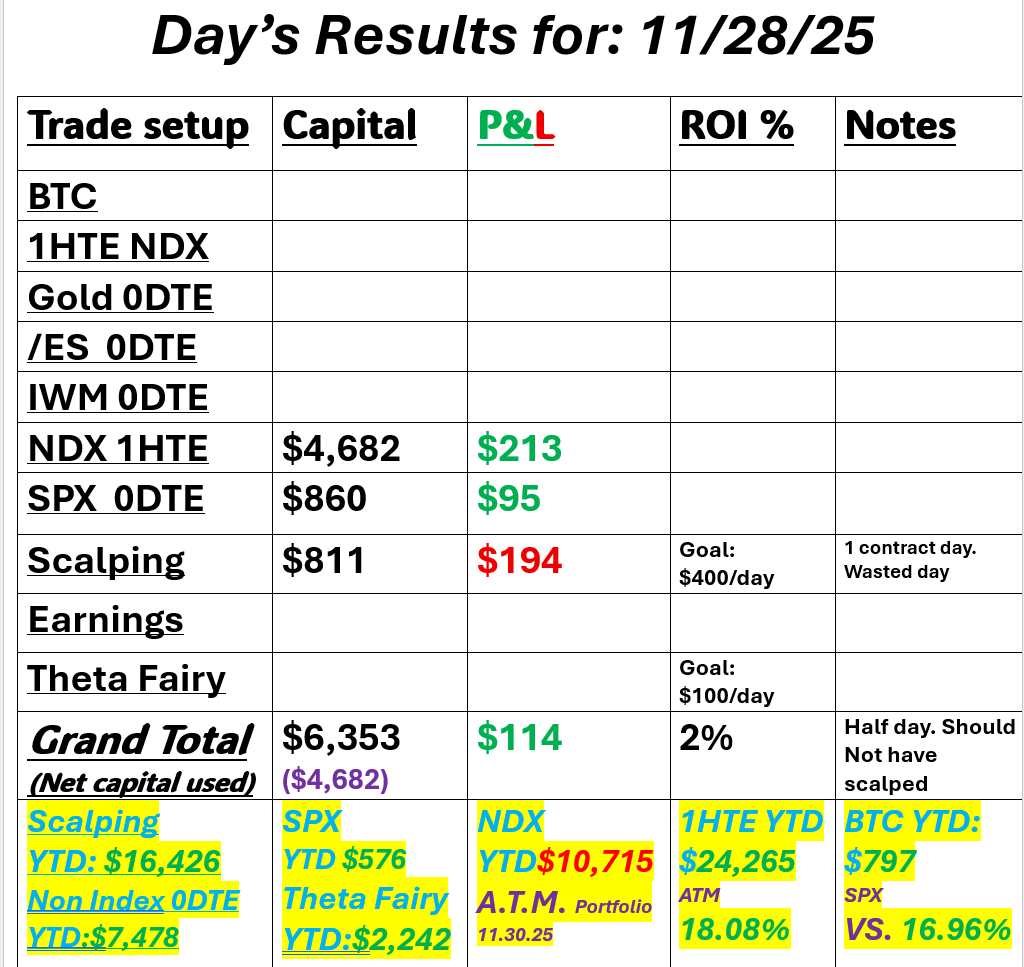

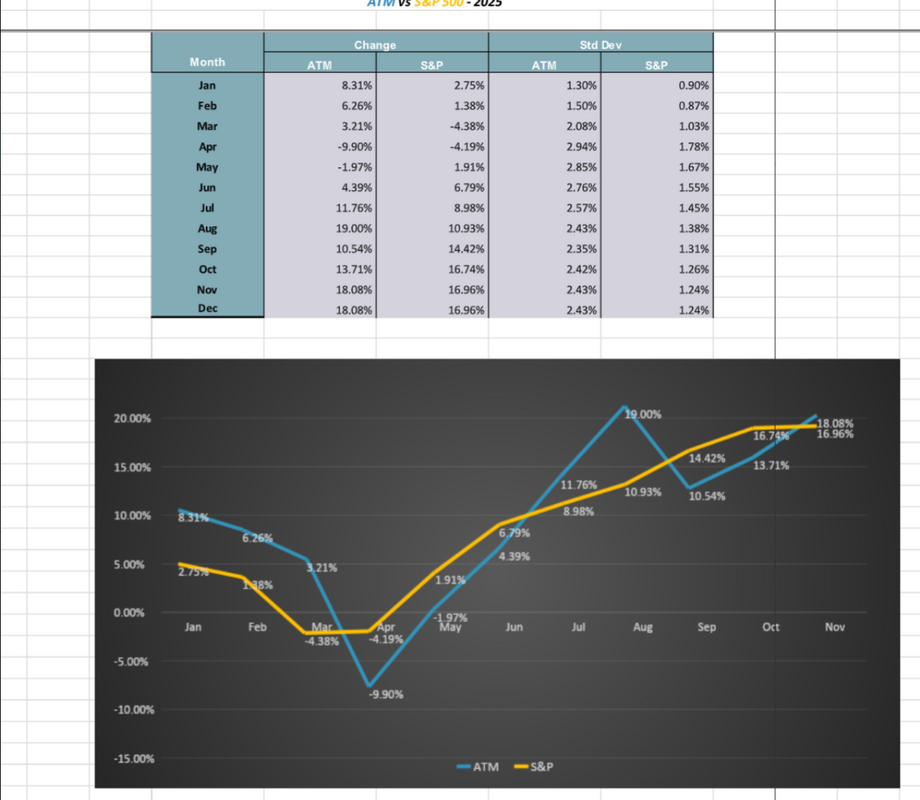

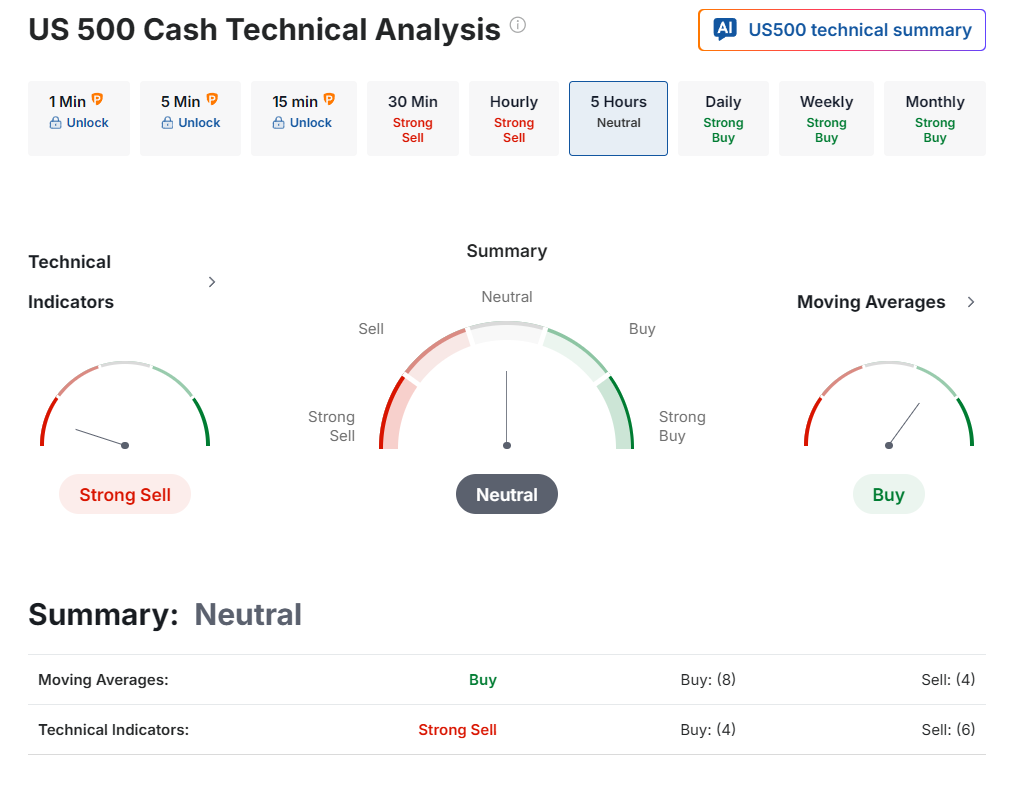

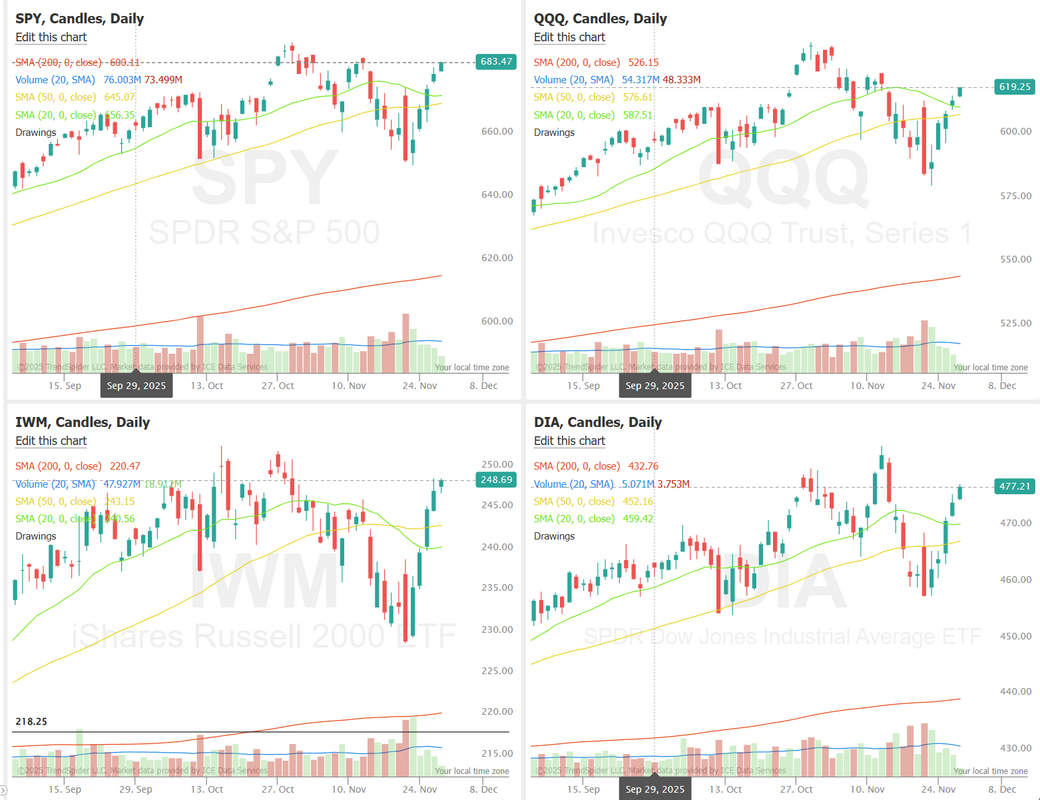

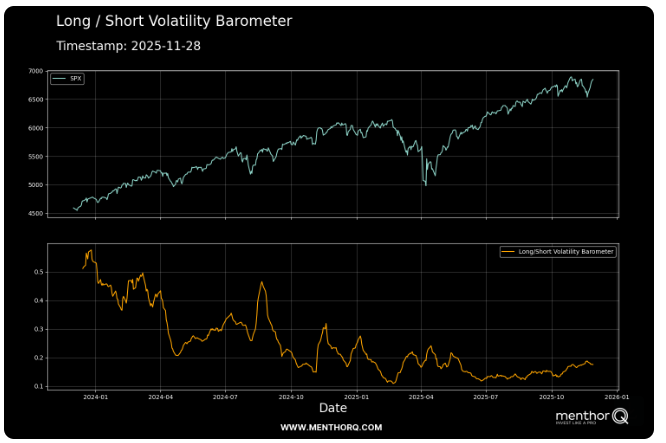

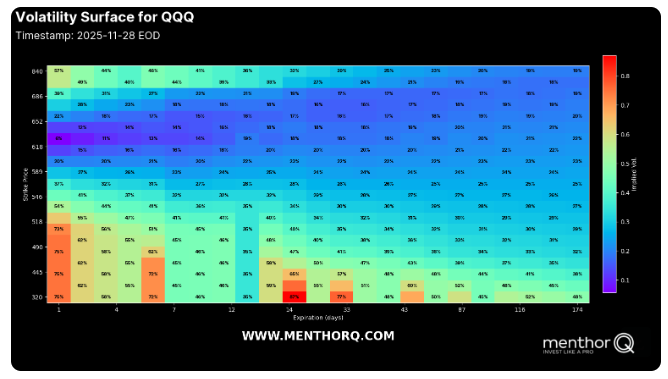

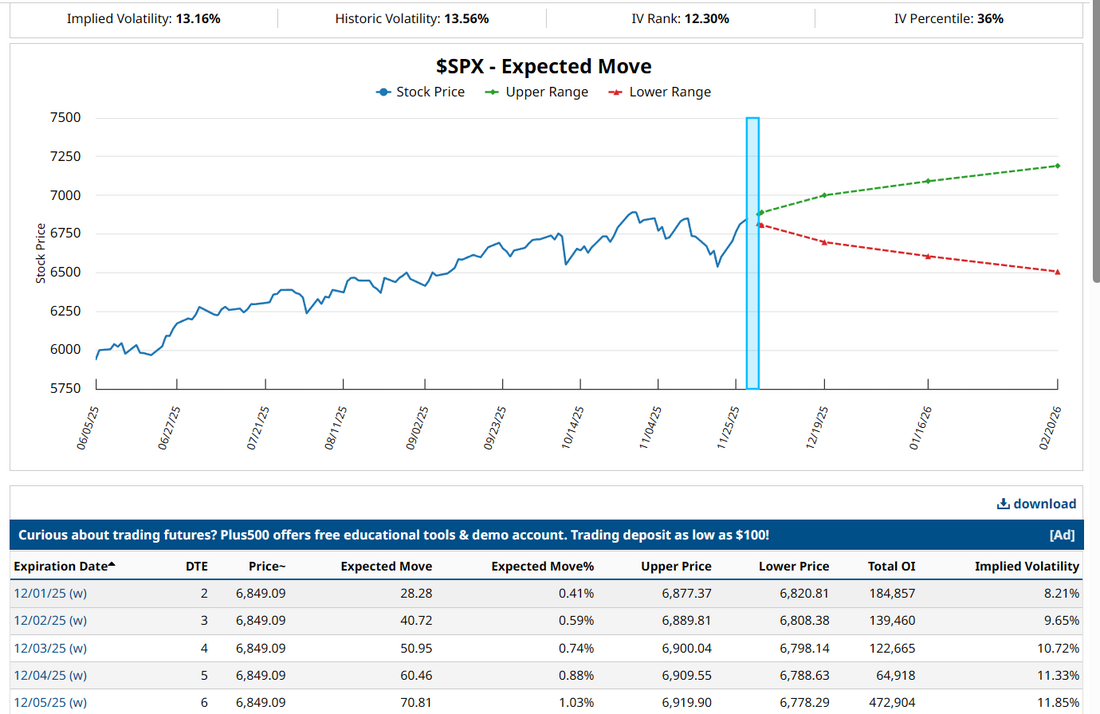

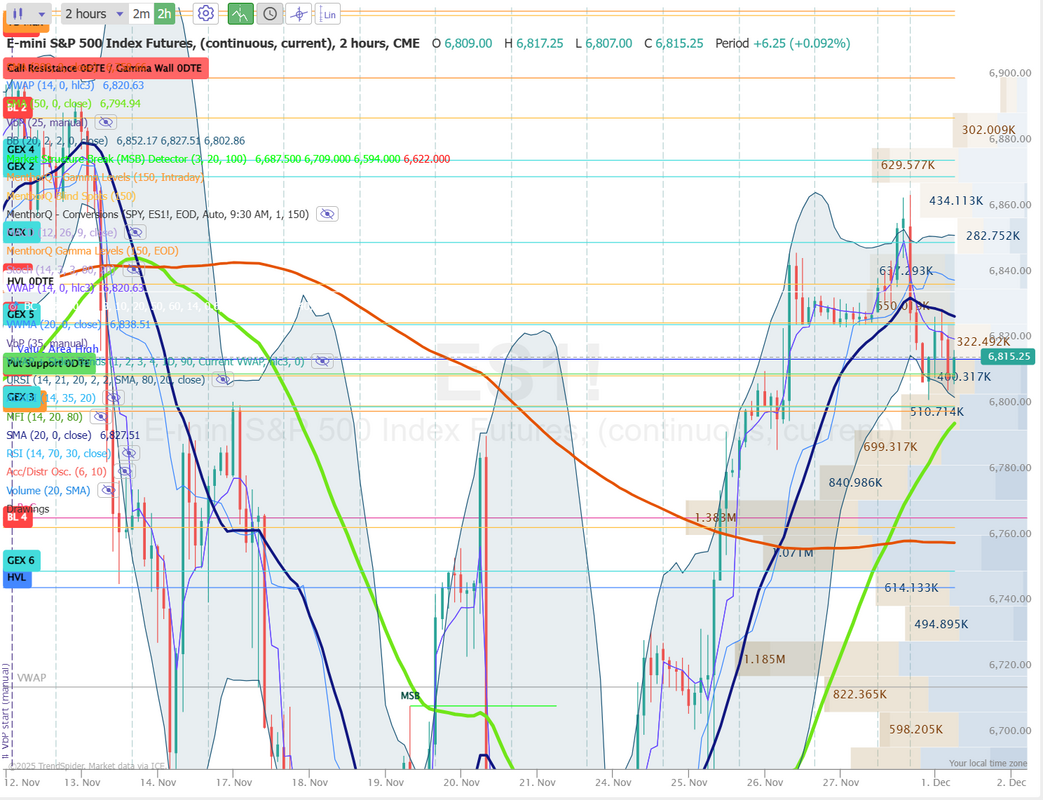

What a great time of year.Welcome to December! Where has the year gone? I hope you all had a great, somewhat extended weekend. I love this time of year. So much gratitude during Thanksgiving and now into the celebration of Christ. We don't have many family traditions but one big one is to go out to our land in central Utah and cut down a Christmas tree the weekend after Thanksgiving. It's so much work but I love it. I hope your celebrations are wonderful as well. We had an easy day on Friday. Half days usually treat us fairly well. The quick theta erosion means a credit trade is usually the way I go. It is tricky because you don't usually have time to adjust or alter your initial setup. It either works or it doesn't. I marred my day by trying to scalp. That was a waste of time on a day like that. Here's a look at our results. Quarterly results are also updated for our ATM portfolio. We continue to outpace the market, if only by the slimmest of margins. Our big news for the ATM portfolio is that auto trading is coming! You'll never need to even open your laptop of hit an enter key to follow our asset allocation model. A model which has averaged 26% a year since inception and outpaced the market by 148%. If you want to see how you can position your portfolio to consistently beat the market with less potential risk and protect your downside in the process you can feel free to schedule a one-on-one zoom call with me here: Let's take a look at the market: We start off the new month with a neutral rating. Not much help there. Markets seem to be trying to work their way back to ATH'S. SPY closed the week higher at $683.05 (+3.65%), pushing the index back to within 1% of its all-time high. Price tested the lower LinkLine, a volatility-aware Heikin-Ashi channel created by James Chellis, for the first time since early 2025 and bounced decisively. With SPY now reclaiming the year-to-date volume point of control, the path toward a new all-time high is becoming increasingly favorable. QQQ rebounded sharply last week, closing at $619.20 (+4.92%). A bullish MACD cross just confirmed as the ETF charged back above its YTD volume point of control, even as its top holding, NVDA, ended the week in the red. Given that it can hold above its LinkLine support, the bullish momentum will likely stay intact. Small-caps led the bullish charge last week, with IWM closing near its all-time highs at $248.63 (+5.48%). A bullish MACD crossover confirmed early last week, and momentum strengthened steadily throughout the week, though overall volume remained muted during the holiday period. With PCE on deck, the rate-sensitive small-cap space is likely to see heightened volatility. The Long/Short Volatility Barometer for SPX continues to stabilize near the lower end of its two-year range, suggesting a muted appetite for long-volatility positioning even as the index pushes into fresh recovery highs. In the short term, this low-volatility posture often aligns with tighter trading ranges and a market more responsive to incremental catalysts rather than broad directional swings. If the barometer remains compressed while SPX grinds higher, it may indicate that volatility sellers are still in control, keeping near-term moves contained. However, any sudden uptick in the barometer, especially from these depressed levels would signal a shift in volatility demand that could precede sharper price swings. The QQQ volatility surface shows a clear pocket of elevated implied volatility concentrated in the near-term, especially around shorter expirations and lower strike prices, where IV readings cluster in the 60–80% range. This indicates that the market is assigning more uncertainty to short-dated downside scenarios, while volatility tapers sharply as expirations extend, reflecting a calmer outlook further out on the curve. Mid-range strikes hold more moderate IV levels, suggesting a more balanced risk profile around the current spot. In the short term, this skewed surface points to a market that is pricing in event-driven fluctuations or hedging demand concentrated in the immediate horizon, making near-dated options more sensitive to shifts in sentiment or catalysts. Our training today will focus on Fooled by Randomness by Nassim Nicholas Taleb. Please join our live zoom feed. These sessions are always valuable. My lean or bias today: With a neutral rating and PCE (finally) coming out this morning it's anybody's guess but don't get too twisted by the futures being down. (/ES -44 and /NQ -223 as I type). If the NDX opens down -200 points but climbs back 100+ and you put on a bullish play, the market will still post a -100 point "loss" but your day was bullish. Start from the open and work from there. In other words, Depending on how PCE is received, we could have a bullish reaction. December S&P 500 E-Mini futures (ESZ25) are down -0.57%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.68% this morning, pointing to a lower open on Wall Street as Treasury yields climbed following hawkish comments from Bank of Japan Governor Kazuo Ueda. Treasury yields tracked Japanese government bond yields higher after BOJ Governor Kazuo Ueda offered his strongest signal yet of a rate hike this month. Ueda said on Monday that the central bank “will consider the pros and cons of raising the policy interest rate and make decisions as appropriate” by assessing the economy, inflation, and financial markets both domestically and overseas. Ueda’s remarks prompted investors to shift away from risky assets. Investor focus this week is on a fresh batch of U.S. economic data, with particular attention on the long-delayed U.S. PCE inflation reading, as well as earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500, Dow, and Nasdaq 100 notching 2-week highs. Chip stocks climbed, with Intel (INTC) jumping over +10% to lead gainers in the S&P 500 and Nasdaq 100, and Analog Devices (ADI) rising more than +2%. Also, energy stocks gained ground after the price of WTI crude rose over +1%, with Diamondback Energy (FANG) advancing over +2% and Devon Energy (DVN) rising more than +1%. In addition, cryptocurrency-exposed stocks rose after Bitcoin rebounded past the $90,000 level, with Riot Platforms (RIOT) surging over +7% and MARA Holdings (MARA) climbing more than +6%. On the bearish side, Tilray (TLRY) tumbled over -21% after the cannabis company announced it would implement a one-for-ten reverse stock split, effective Monday. This week, the September reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. The Bureau of Economic Analysis will release the long-delayed PCE price data, along with personal income and spending figures, on Friday. “[Recent] soft core CPI and PPI reports suggest that tariffs continue to have more bark than bite with regard to inflation, and this should also be reflected in this week’s September core PCE deflator,” according to ING economist James Knightley. Other noteworthy data releases include ADP private employment figures, the Export Price Index, the Import Price Index, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Initial Jobless Claims, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). The Fed is also set to publish industrial production data for September. Any indications of labor-market weakness or slowing economic activity would further bolster expectations for a Fed rate cut this month. U.S. rate futures have priced in an 87.6% chance of a 25 basis point rate cut and a 12.4% chance of no rate change at the conclusion of the Fed’s December meeting. Meanwhile, U.S. President Donald Trump said on Sunday he has made his choice for the next Fed chair after signaling clearly that he expects his nominee to deliver interest rate cuts. “I know who I am going to pick, yeah,” Trump told reporters on Air Force One, without giving a name. “We’ll be announcing it.” Investors will also turn their attention to earnings releases from several high-profile names. Prominent companies such as Salesforce (CRM), CrowdStrike Holdings (CRWD), Marvell Technology (MRVL), Snowflake (SNOW), Hewlett Packard Enterprise (HPE), and MongoDB (MDB) are scheduled to report their quarterly results this week. U.S. central bankers are in a media blackout period before the December 9-10 policy meeting, so they are prohibited from making public comments on the economic outlook or policy this week. Fed policy limits the extent to which FOMC participants and staff can speak publicly or grant interviews during Fed blackout periods. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI data, set to be released in a couple of hours. Economists expect the November ISM manufacturing index to be 49.0 and the S&P Global manufacturing PMI to be 51.9, compared to the previous values of 48.7 and 52.5, respectively. Also, Fed Chair Jerome Powell is scheduled to deliver brief remarks and join a panel discussion with Michael Boskin and Condoleezza Rice on George Shultz and his economic policy contributions later today at the Hoover Institution’s George P. Shultz Memorial Lecture Series in Stanford, California. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.041%, up +0.52%. Nothing special with the implied vol this week. Let's take a look at intraday /ES levels for our 0DTE setups. 6825, 6838, 6851, 6864 are resistance levels. It looks like futures will be starting in a hole this morning. 6814, 6809, 6799, 6787 are support levels. Let's make it a great day! See you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |