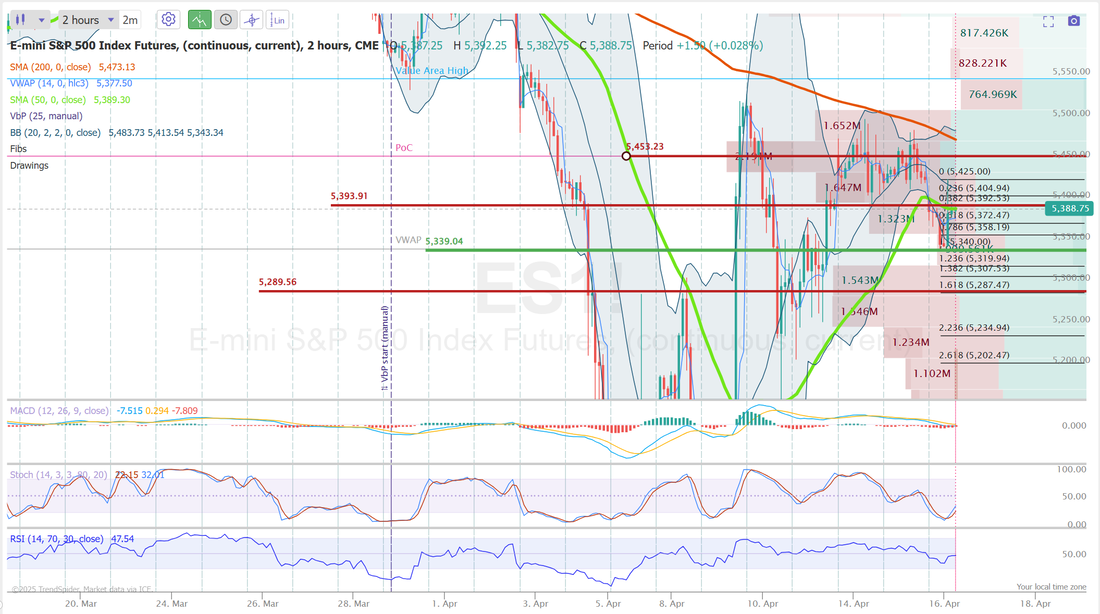

Trade 24/7Welcome back traders! We had a good day of trading yesterday that starts, just like every day at 4:00 A.M MDT for me. That's my time to write this blog. Do my research for the day. Get my technical analysis levels on my charts and target my setups and tickers. We then start our trading day many times with futures and our unique, 1HTE Bitcoin setups before the cash markets open up and then we'll build trades in the evening. Theta fairys, Scalps, 1DTE futures trades etc. Basically we trade all day long! It's always a bit shocking to me but we'll get some of our trading members complaining that "you trade too much!" Money never sleeps. You won't find a trading room run by anybody that's trading more than I. If you want to take advantage of market moving news you need to be ready to trade whenever. Why am I rambling on about this? Well...NVDA just gave us a beautiful, after-hours gift and futures are dropping like a rock! It's not only driving more profits into our short /MNQ futures contract that we've been carrying but it allowed us to put a nice cover on it and generate some overnight cash flow. Are you going to make $800 dollars overnight every day if you trade with us? Probably not, but you did last night. The market never sleeps. Your trading room shouldn't either. Here's a look at our day yesterday: It was a bit messy but we got our $1,000+ profit for the day. Let's take a look at the markets this morning. NVDA news started us off early last night, sending technicals into sell mode...again. Futures were up yesterday and I set a bias of bearish. I thought we'd get a retace and that ended up being right. Today futures are smashed down on the NVDA catalyst and I think there's a decent chance we rebound. Maybe we don't get green on the day but I think there's a good chance we can go higher from our present level with /ES off -40 points as I type. une Nasdaq 100 E-Mini futures (NQM25) are trending down -1.22% this morning as sentiment took a hit after the Trump administration imposed new restrictions on Nvidia’s chip exports to China. The Trump administration has barred Nvidia from selling its H20 chip in China, further escalating the trade war between the world’s two largest economies. The U.S. government notified Nvidia that the company must now obtain a license to export its H20 processors to China and several other countries, according to a Tuesday filing. The chipmaker cautioned it would incur up to $5.5 billion in related charges in its fiscal first-quarter results. As a result, shares of Nvidia (NVDA) slumped over -5% in pre-market trading. U.S. equity futures trimmed some of their losses after Bloomberg News reported that China wants the Trump administration to take several steps before agreeing to trade talks, including demonstrating more respect by curbing disparaging comments from cabinet members. Investors now await remarks from Federal Reserve Chair Jerome Powell as well as a raft of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s main stock indexes ended lower. Boeing (BA) fell over -2% and was the top percentage loser on the Dow after Bloomberg reported that China had ordered its airlines to stop taking deliveries of the company’s jets. Also, Albemarle (ALB) slumped more than -5% and was the top percentage loser on the S&P 500 after three brokerages lowered their price targets on the stock. In addition, Allegro Microsystems (ALGM) plunged over -9% after ON Semiconductor withdrew its $6.9 billion takeover offer. On the bullish side, Netflix (NFLX) climbed more than +4% after the Wall Street Journal reported that the streaming giant aims to achieve a $1 trillion market capitalization and double its revenue by 2030. Economic data released on Tuesday showed that the U.S. import price index unexpectedly fell -0.1% m/m in March, weaker than expectations of +0.1% m/m. Also, the U.S. March export price index was unchanged m/m, weaker than expectations of +0.1% m/m. In addition, the Empire State manufacturing index came in at -8.10 in April, stronger than expectations of -12.80. Meanwhile, Fed Chair Jerome Powell is set to deliver a speech on the economic outlook before the Economic Club of Chicago later today. Also, Kansas City Fed President Jeff Schmid and Cleveland Fed President Beth Hammack will speak today. U.S. rate futures have priced in a 79.9% probability of no rate change and a 20.1% chance of a 25 basis point rate cut at the next FOMC meeting in May. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that March Retail Sales will stand at +1.3% m/m, compared to the February figure of +0.2% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.3% m/m in February. Economists expect the March figure to be +0.4% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists forecast March Industrial Production at -0.2% m/m and Manufacturing Production at +0.3% m/m, compared to February’s figures of +0.7% m/m and +0.9% m/m, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists foresee this figure standing at 0.400M, compared to last week’s value of 2.553M. On the earnings front, notable companies like Abbott Laboratories (ABT), Prologis (PLD), U.S. Bancorp (USB), Kinder Morgan (KMI), Travelers (TRV), and CSX Corporation (CSX) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.312%, down -0.25%. The Gold to Silver ratio recently spiked by 15% in a week This is typically a risk-off signal as Traders are dumping silver (risk-on) for gold (risk-off) Such moves have coincided with some major market corrections How long will tariffs stay in place? That is the question. The heat could be very real and it's just getting started. While tariffs grab all the headlines, keep in mind, companies earnings revisions are tanking! The talk of recession is growing louder. Our trade docket for today is partially already up and running. We've got almost $500 dollars of cash flow setup today in our /MNQ short with the /NQ cover. We already have a 1HTE working on Bitcoin with a 12% ROI potential in just 38 min. duration. We will be working our SPX 0DTE again. I may look at using ASML today as the starting point for an equity 0DTE tomorrow. Let's take a look at the intra-day levels that interest me today. /ES: There are four levels that interest me today. 5391 to the upside is the 50 period M.A. on 2hr. chart. A break above would be a bullish indicator for me. 5493 is PoC. On the downside, 5339 is VWAP with 5289 below that. I will likely start today off builidng butterflies around PoC and VWAP. BTC: Bitcoin yielded us some good results yesterday, considering its lack of range. I think we have a decent shot at Bitcoin going higher today. 84,871 is first resistance and 86,139 is the next. 82,500 is support. I'll likely play the support zone to start our 1HTE's off today. I think we've got as good a shot as ever to get our $1,000+ profit today. Scalping is doing its part and our first 1HTE is trying as well. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |