|

Good morning traders! I hope everyone had a nice holiday and were able to decompress a bit. It's been nice to have some days off to focus on matters outside the trading world. We've had a spectacular start to the year and most of our model portfolio looks like it will continue to produce results for us. Friday was a $4,000 day for me and that puts us up over 22% YTD so far. Let's take a look at this holiday shortened week: Futures are down again this morning but we continue to cling to the technical buy rating. The talk continues to focus on rate cuts and how many we'll get this year. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut later this month and a 67.2% chance at the March meeting. Earnings season continues. We had great results last week trading the Banks and UNH. We'll be looking to initiate a new one today on SLB. Expected move on /ES this week is 54. Even for a shortened holiday week, that's just too low for a proper risk/reward on the Thetafairy setup. The market continues to be relatively flat this month with the RUT the most beat up. Bitcoin continues to be a "buy the rumor, sell the news" story. 11 new ETF's are now trading spot prices. The big question for the market continues to be, are we basing here for another push higher or are we rolling over? No clear answer on that yet, although a triple top pattern seems to be forming. Intra day levels for me: Pretty tight ranges for today. 4803/4811/4816/4823 to the upside. 4791/4784/4777/4772 to the downside. We may start our SPX 0DTE today with a chicken IC or a credit straddle with debit strangle.

0 Comments

Wow....that's all I can say about yesterday and the whole start of the year, for that matter. This is the best start to any year we've had. $13,000 bump in my net liq yesterday. We are up over 20% now on our model portfolio just 12 days into the holiday shortened month. Both our NDX and SPX 0DTE's hit for outsized profits and we had a massive day scalping with over a $2,000 dollar profit there is just under an hour. The RUT adding 5K in profits to the day and we were able to get a very favorable reset on our strikes with it. CRM was our only hot spot, pushing higher. We'll work that today. Most of our earnings trades (KBH, WFC, UHN, DAL) look good before the open. On to the market: Two big news items yesterday. CPI came in hot, as we expected and talked about in the trading room. The market is starting to get it. We ain't gettin no 7 rate cuts this year folks! The other big news item was the issuance of 11 spot bitcoin ETF's. There will be winners and losers here. Let the fallout happen before picking a winner. The leader of the pack right now is Blackrocks IBIT. It hauled in an amazing $4.7 billion in funds in the first day. We have PPI coming in this morning, which should be the news catalyst for today. Monday is a holiday so we'll have another shortened week. We may get a jump on a few of our weekly trades and start them today. Bullish bias continues to cling. Even though decliners out paced advancers. We've been talking in the trading room about a triple top for the market. It's looking more and more like it may come to fruition. You can see that even with bullish indicators still flashing buy, We havent been able to go anywhere for almost a month. Mostly just banging our heads on resistance. We are at the same level we were Dec. 18th. Here's the PPI data set. Intra day levels for me: 4813/4824/4838* (key level. high of the day yesterday)/4853 to the upside. 4797/4787/4772* (Key level. Low of the day yesterday)/ 4756 to the downside. Markets are closed Monday. We'll See you all Tuesday! Have a great, extended weekend!

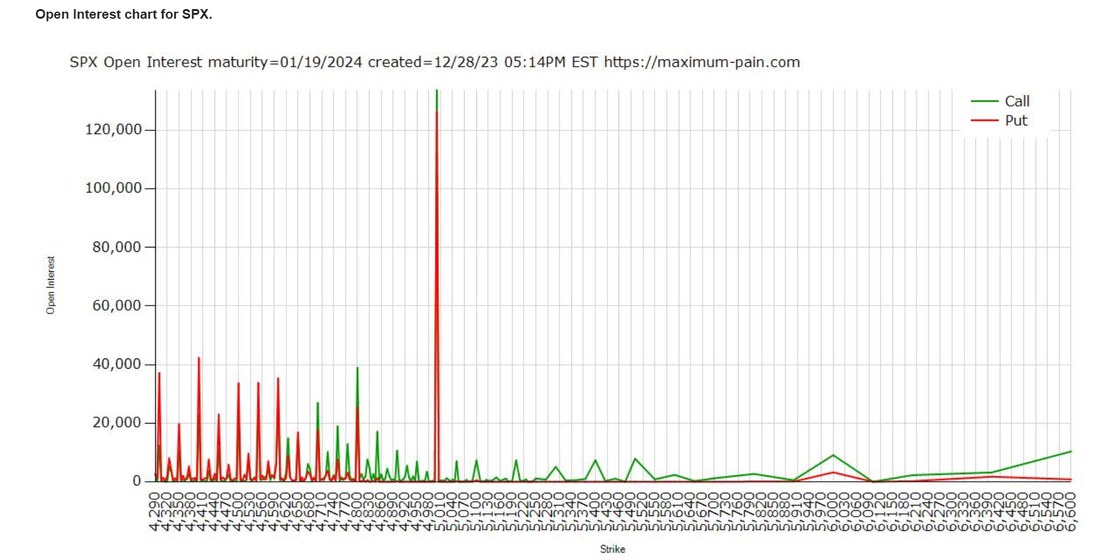

We had an "O.K." day yesterday. We hit a home run with our NDX 0DTE and some partial success with SPX puts but needed to roll the calls out to today. RUT saved our net liq once again putting me up about $1,100 for the day. Lets look at the market. I said yesterday that if 4802 on /ES was breached it would look bullish. That happened and now we just wait for CPI numbers to hit before the cash open. If we get a bounce from those numbers I'd say the bulls have full control again. It was largely bullish and green across the market yesterday, save for energy and healthcare. Bitcoin hit $47,000 on the euphoria of the SEC ETP approvals. Lots of premium in the crypto space today. MARA and BITO are my choices for today. With all the bullish action, we still have a massive wall of Option selling going on just above 5000 on the SPX We are now back to the high we reached on Dec. 19th. That high triggered a sell day. With CPI this morning it could certainly be the catalyst that clears that hurdle or sends us right back down. Intra day levels for me today: 4831/4838/4842 (above this is a new ATH) to the upside. 4821/4810/4801/4794 (key level for bears to acert control and move us back down) to the downside.

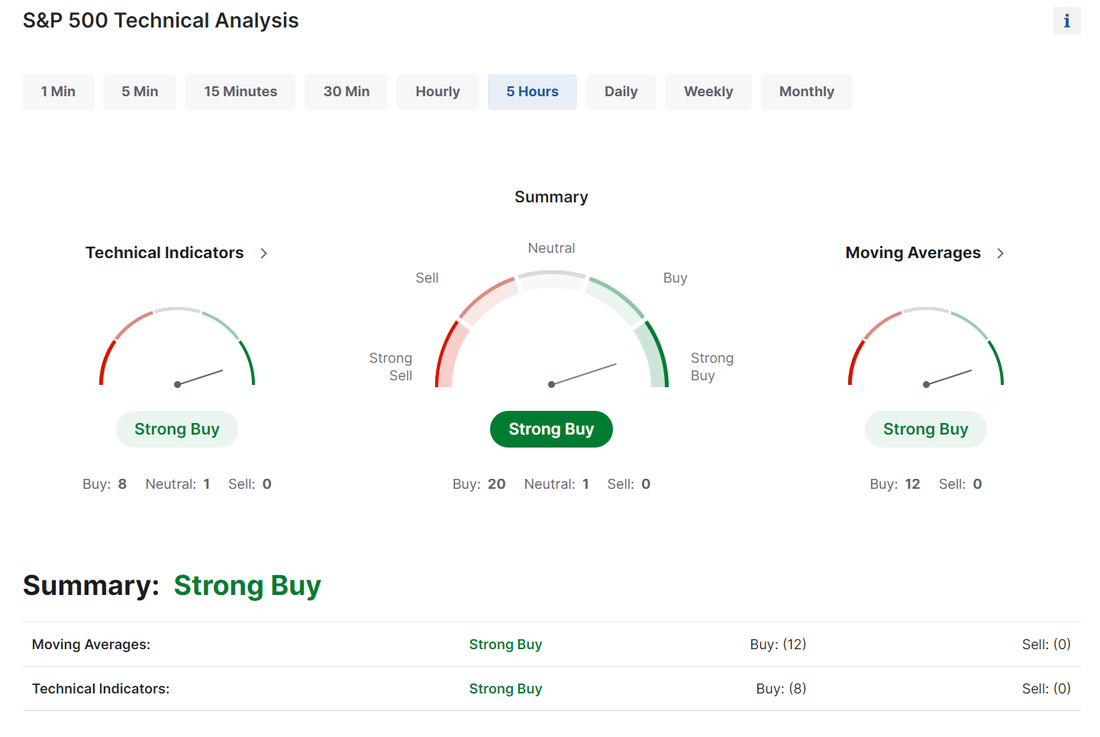

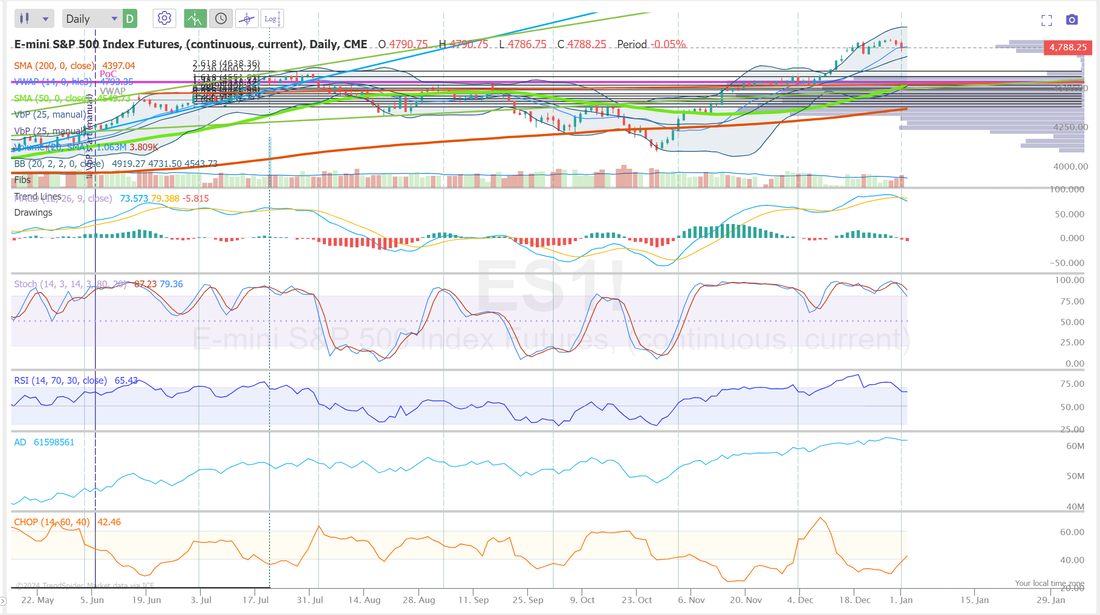

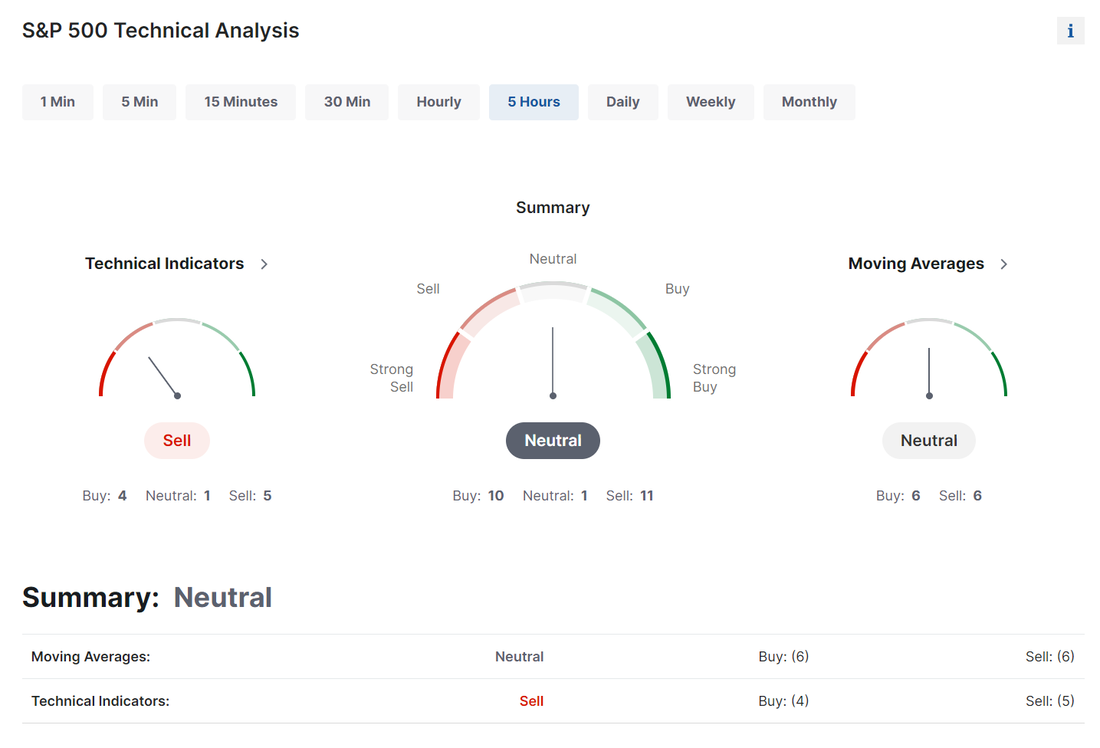

We had another blockbuster day yesterday with most every trade in the model portfolio (save NVDA) working for us. The RUT trade continues to do most of the heavy lifting and looks poised to do so again today. $15,000 bump in my net liq from yesterday and it puts us nicely green on the year overall. It's been a great start to the year. Let's take a look at the market. Technicals didn't change from yesterday. Still looking at bullish bias. It was a mixed day with not a lot of directional bias developing While the A/D line wasn't impressive yesterday, the number of underlyings above the 50/200 DMA continues to look healthly Traders seem reticent to take any large positions prior to the two incoming inflation reports and the start of earnings on Friday. Banks kick off earnings on Friday and we'll be putting positions on Thursday before the close The overall picture here still looks more neutral than bullish to me. Stoch have given us a clean buy signal but most other indicators are closer to flat. This marks almost a full month that we've been banging around this resistance level. At some point we'll get a break and a substantive move will take place. Intra day levels for me: The first two key areas on /ES for me are 4802 to the upside and 4782 to the downside. Any movement contained inside this range is just noise to me and not meaningful. 4802/4812/4825/4834 to the upside. 4782/4769/47/52/4748 to the downside.

We had a blockbuster day yesterday with RUT finally pulling its weight. Our event contracts 0DTE was fully profitable and we booked partial profits on our SPX/NDX 0DTE's with the call sides rolled and looking great to start the day. NVDA was our main pain point yesterday. Futures are down this morning after yesterdays rebound. It was enough to swing technicals back to bullish. Treasury yields sapped the demand for risk assets and investors are bracing for key U.S. inflation data later this week and then we'll get back to earnings season on Friday. We've had a lot of luck with our earnings trades so I'm excited to get back on those. Fed's Bostic spoke and we are on track for 2% inflation but US futures are only looking for a 4.7% chance of a Fed cut at the next central bank meeting in Jan. a 55.4% chance in March. SPX and NDX turned positive for the year yesterday: Everything was bullish, save energy. I would call our current position "neutral". Carry through today by bulls would tip up back bullish.Intra day levels for me: 4803 (critical for bulls)/4814/4826/4836 to the upside. 4770/4755/4748/4734 to the downside. Trades on our docket today: 0DTE on SPX/NDX, Event contract 0DTE, NVDA?, ORCL, PFE, QQQ/SPY combo, RUT, SHOP, Pairs trade, Insider trade, BA dragon fly.

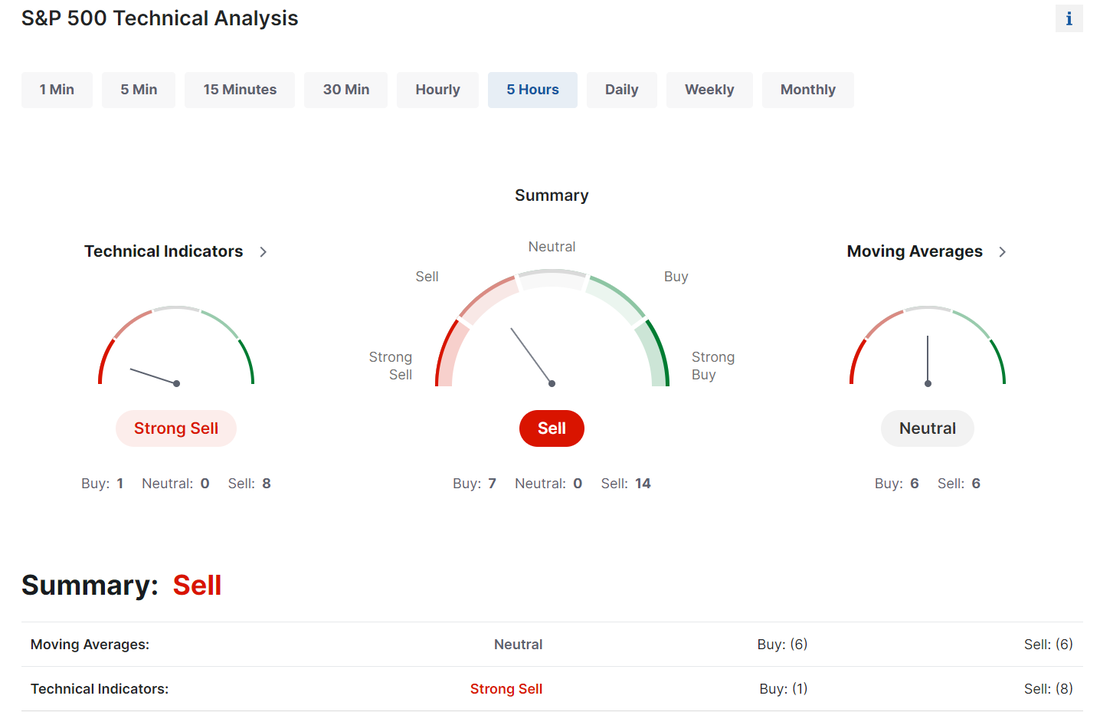

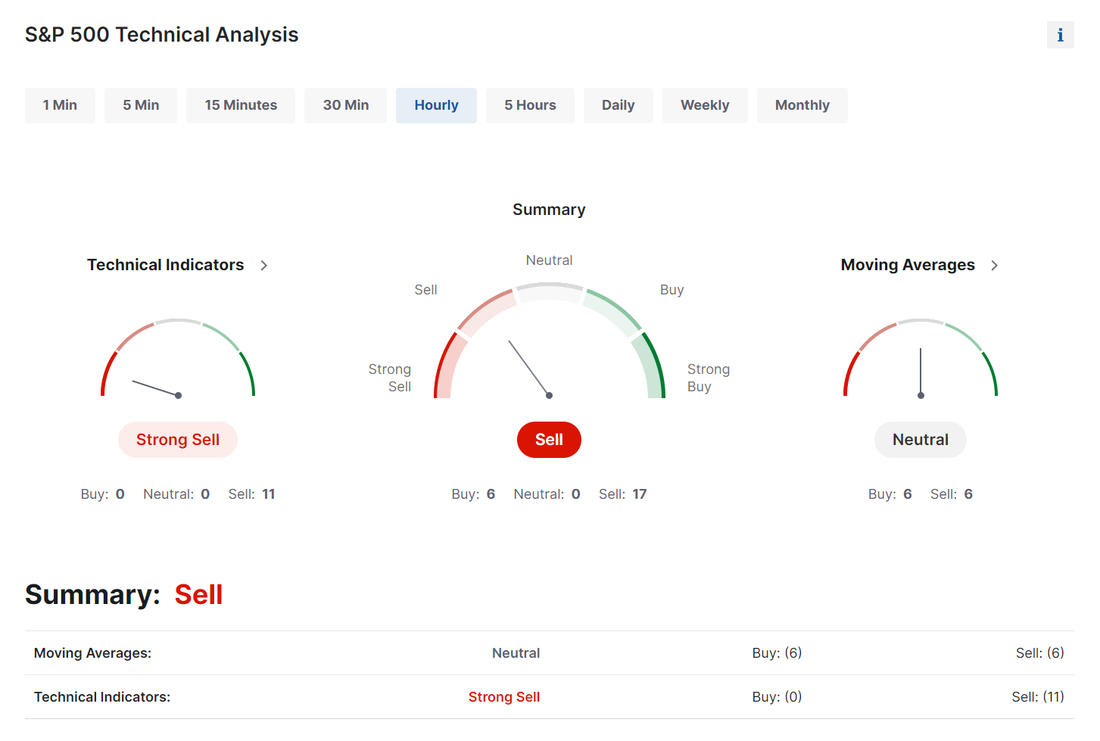

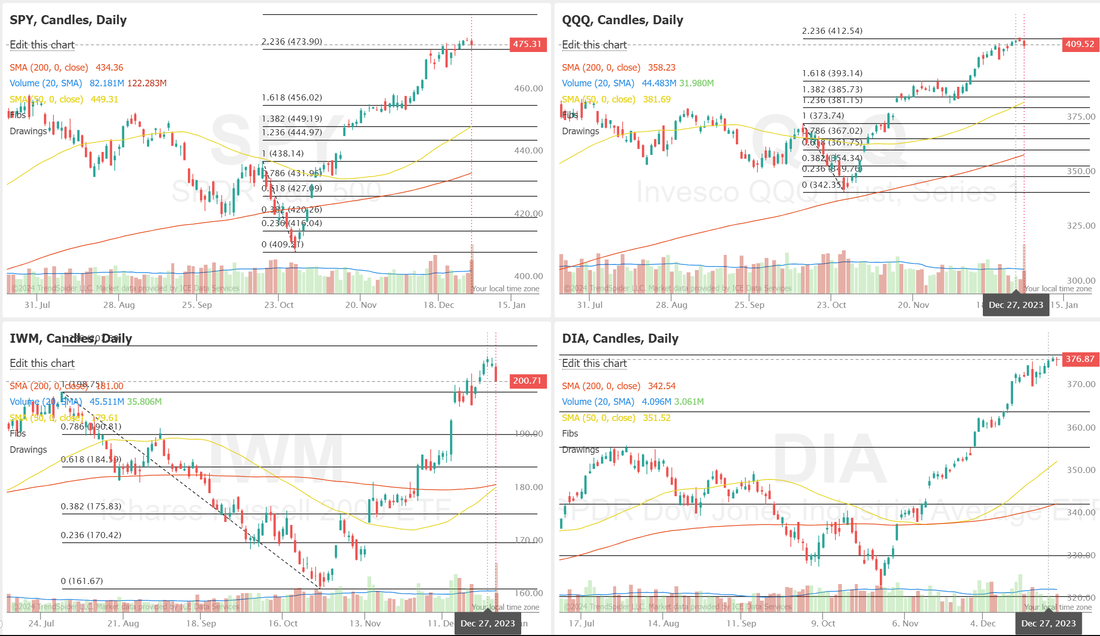

Welcome back to a new week of trading. Last week finished strong for us with multiple ladders and strangles expiring fully profitiable. We'll put some of that buying power back to work today. We had FOUR 0DTE's make profit on Friday as well (including the event contract). The RUT position is our main pain point and we'll keep working that today. Sell mode is starting to take hold with all of our major indices rolling over and our technicals flashing sell. The RUT continues to be the most oversold 60.67 is the SPX expected move. Our VTI swing trade looks good and I'm hopeful this will become on of our most popular trades. The RUT is forming an interesting pattern called Wyckoff. After a selloff and consolitation it looks poised to go higher with accumulation here. Intra day levels for me: 4738/4746/47560/4772 to the upside. 4714/4701/4689/4679 to the downside.

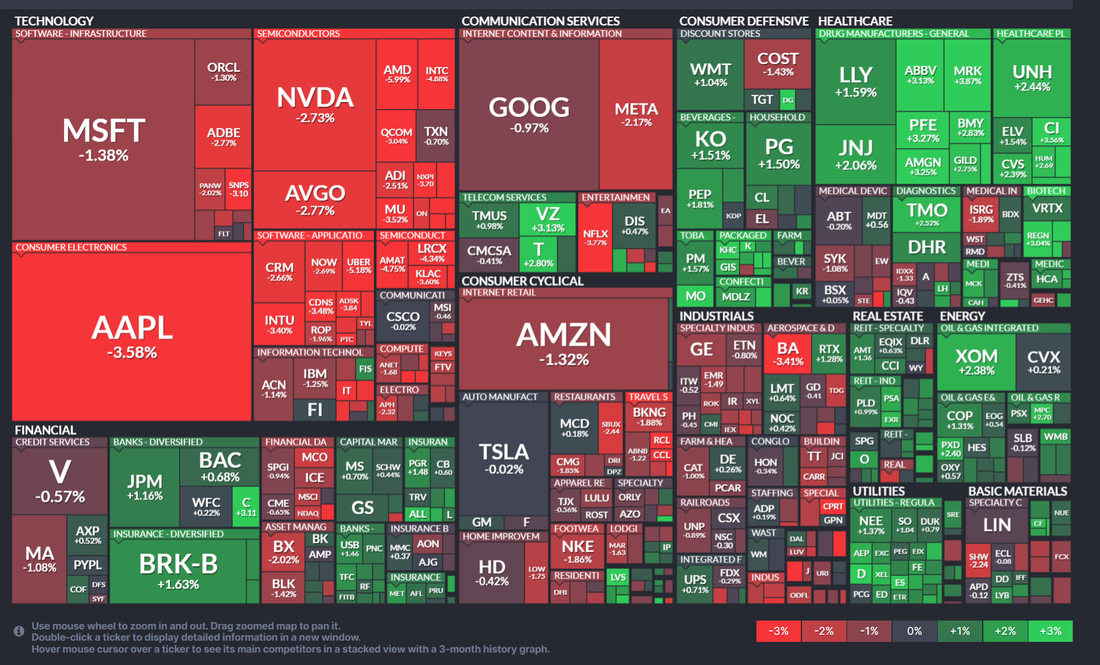

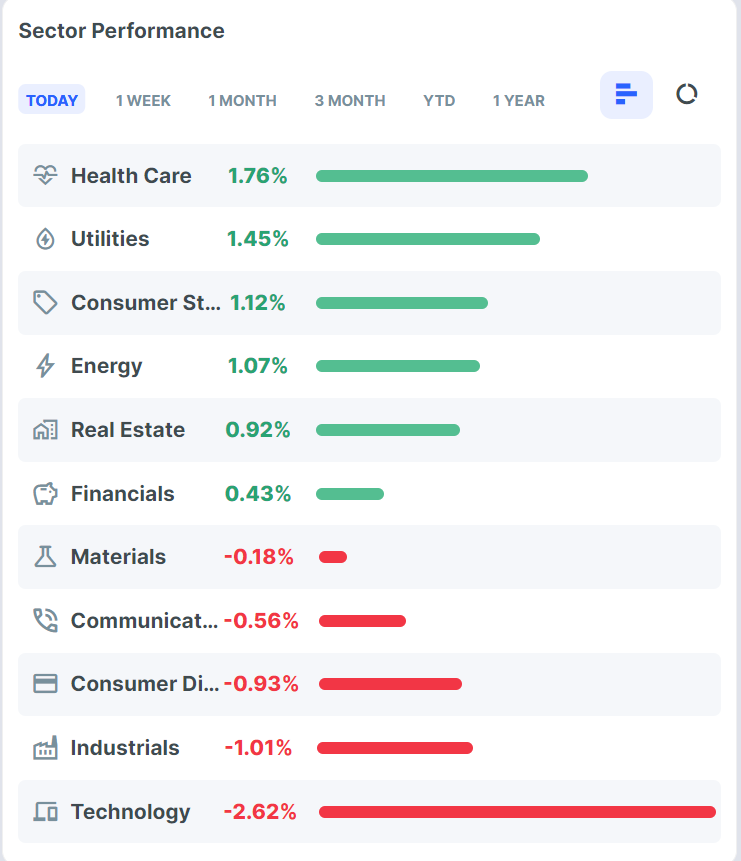

We had another pretty solid day yesterday with our NDX 0DTE hitting for a full profit and I got an exit on my SPX 0DTE for 45% capture. All our other trades are working nicely. NVDA keeps giving us nice green numbers each day. The RUT is still pressuring us and we'll need to work that some more today. On to the market. Sell mode is now firmly in place Our short VTI setup looks great whereas only a week ago I thought I was on the wrong side of that trade.  The 2 hr. candle chart tells the tale. The bears have finally gained some traction. Healthcare and surprisingly, financials showed some continued strength but the mighty techs that have led this market up are all weak. The chart of the great Apple Inc. looks horrible. Year to date the markets not off to a great start with the RUT getting the worst of it. Futures are down again this morning at the key U.S. Jobs report looms. The FED talking about keeping rates where they are is not helping the markets either Technicals look absolutely primed for a push down toward PoC on /ES which is approx. 4570 Intra day levels for me: 4741/4762/4773/4792 to the upside on /ES. 4711/4703/4693/4659 to the downside.

Fairly solid day for us yesterday. Both our SPX and NDX 0DTE's hit for a full profit. We are on a 10 day run of full captures. The RUT still needs some management but all our ladders (DIA, GLD, /MCL) look great. We are back to a slight sell signal now in the market. Three days in a row of selling. Futures are flat to start the day. Bears are finally gaining some momentum.

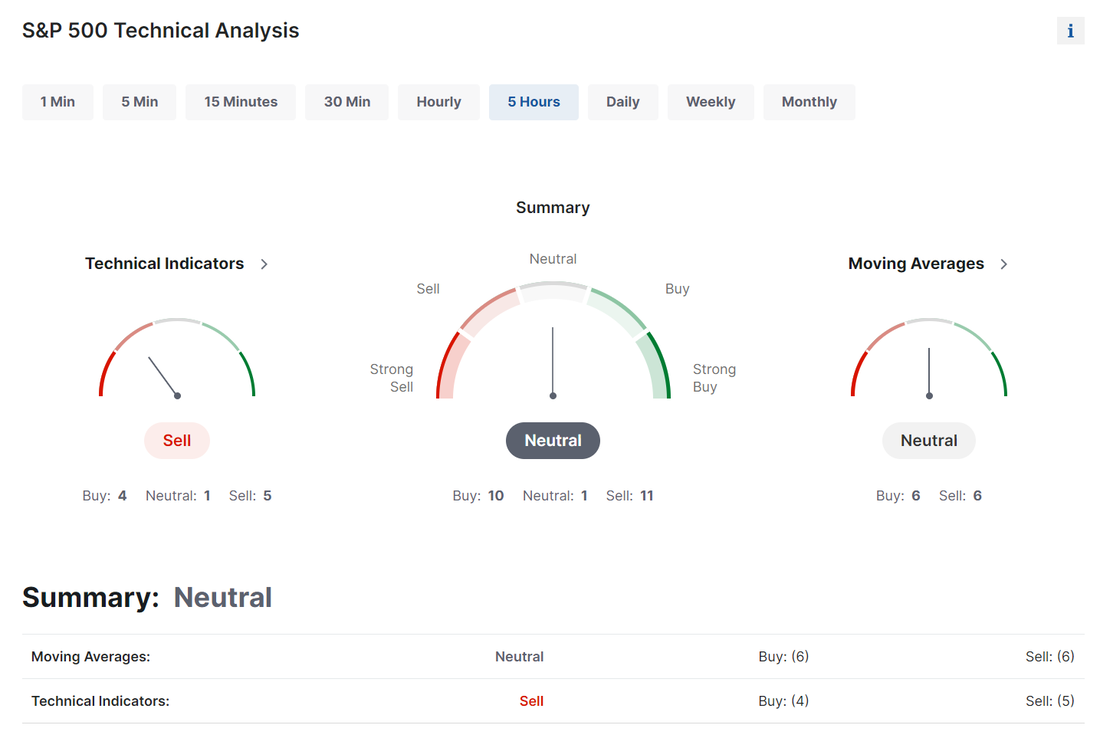

Intra day levels for me today: 4761/4774/4794/4808 to the upside. 4741/4732/4716/4694 to the downside. 2024 started off with a bang for us. We didn't cash flow a bunch but our RUT trade is looking better and better...building extrinsic and finally moving in the right direction. We scored another full profit capture on our NDX 0DTE. Our Gold, Oil and DIA ladders all look good. Our new weekly credit strangles look solid as well. With todays drawdown following Fridays weakness we haven't acomplished much in terms of directional change. We did get a technical move to the "dreaded neutral" rating. These days can be tough ones to get a bead on any substantive directional bias. Once again (just like Friday) The sellers were able to hold going into the close. The hourly looks much more bearish. Price action was mixed with Techs getting hit and health care strong. Lots of economic news catalysts out today. Could be a key day for market direction Markets starting to look much more vunerable now with ADX, RSI, STOC and MACD all rolling over with sell signals. Intra day levels for me today: The key demarcation line for me is 4790 on /ES. Above could start a bullish move. Below, a bearish one. 4805/4815/4828/4843 to the upside. 4779/4765/4756/4744 to the downside.

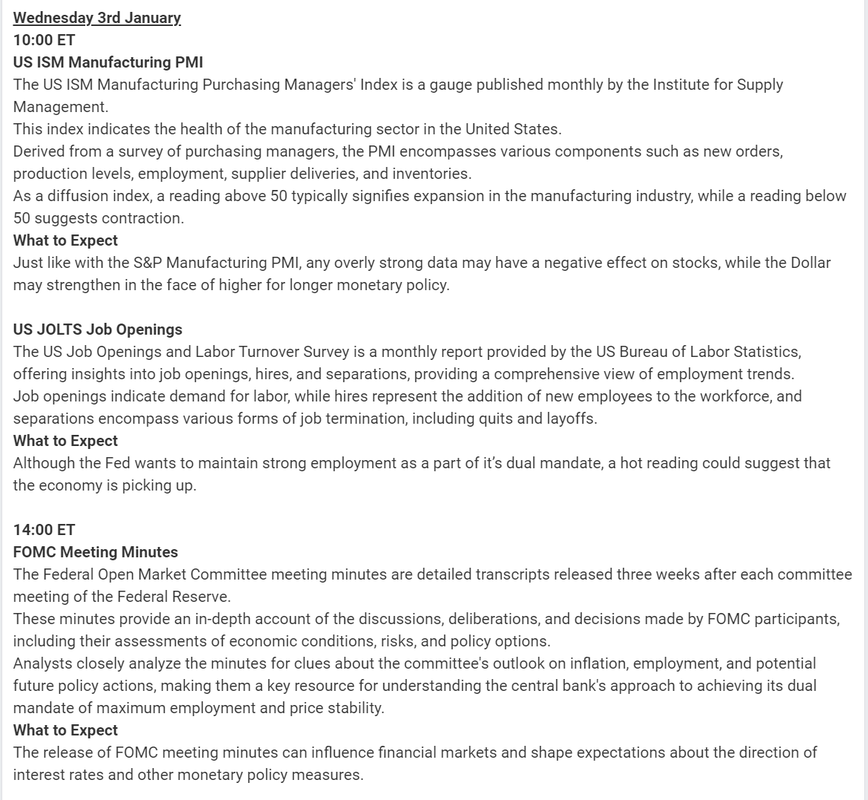

Welcome to 2024! Time for reflection. Time for laying out our plan of attack. Time to re-energize and up our game! 2023 was a very interesting year. 76% of analysts predicted a recession (count me in that group). That couldn't have been more wrong. The lesson? It usually pays to zig when the vast majority are zagging. Most bear markets are NOT predicted. 2000 Dot com bubble. 2008 Housing crisis. 2020 Pandemic. 2022 Inflation. 2023 Banking crisis. NONE of these were accurately forseen. There are still a lot of bearish forecasts for 2024. Will they be wrong again? We'll see. What's hot this year? Bitcoin. The halving and the potential for the SEC to finally approve multiple Crypto EFT's looks promising for the Crypto market. I'm long Etherium and BTC. The FED has 3 rate CUT's penciled in for this year. Rate cuts are generally bullish. As the saying goes...don't fight the FED. We have 8 FOMC Meetings scheduled for this year and those will be crucial. Perhaps the two biggest sector's for focus are A.I. and Real estate. This week we had JOLTS/FOMC/NFP all coming this shortened week. These news catalysts could be market movers for this shortened Holiday week. Our last week was fantastic. I finished off Friday with a $5,300 bump in my net liq. which gave me a $14,200 profit week. Traveling Paris and the Highlands in Scotland for Chirstmas and New Years had me worried with the time zone change and our busy schedule. We only traded the last hour of the day but it worked great! It just re-enforces that we don't need to be glued to our screens all day long to be profitable traders. We've been looking for a retrace for a while now and Friday delivered. Every, and I mean EVERY SINGLE ONE of our positions in the model portfolio participated in our past weeks profits. They all look great going into this week. All our indicators are still flashing buy, although they are weakening. Once again, if you look at the hourly you can see that as we went into the close the bears once again showed up and really tried to press. This time they held court all the way to the close. It's moved the 1 hr. indicators to the dreaded neutral rating. I absolutlely hate neutral rated days. They are tough to trade as the market abhors a vacum and seeks a directional bias. There are some interesting things happening on the daily charts for the four major indices we track and trade. Note they've all stalled out. QQQ and DIA got rebuffed at our resistance lines from last week. IWM and SPY continue to go now where and just hug our resistance lines from last week. The heat map from Friday had a very Christmas looking motif. Lots of Green but...also a color we haven't seen much of...red! Sure seems we are running out of steam here. With NFP, JOLTS, FOMC this week we are still sitting at a miserable 56 point expected move in the SPX. Even for a four day week, that's pretty pathetic. Its a tough enviroment for credit traders. Open interest continues to load that 5000 level heavy with call selling Technicals for the /ES headed into this shortened week are starting to show some wear signs. Selling volume increasing. Stochastics crossing into a sell signal. MACD almost there. RSI over bought and diverging. A/D line diverging and the CHOP index is depleted. Can the bears get some momentum this week? Intra day levels for me today: 4823/4831/4840/4850 to the upside. 4813/4807/4797/4788 to the downside.

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |