|

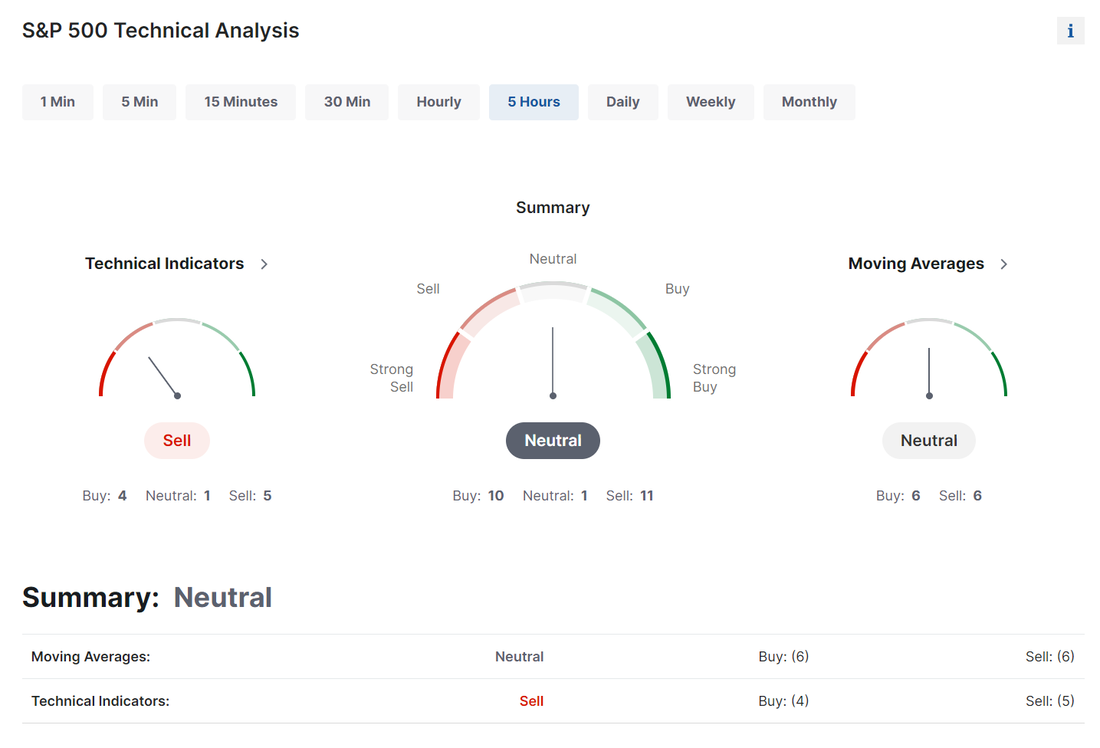

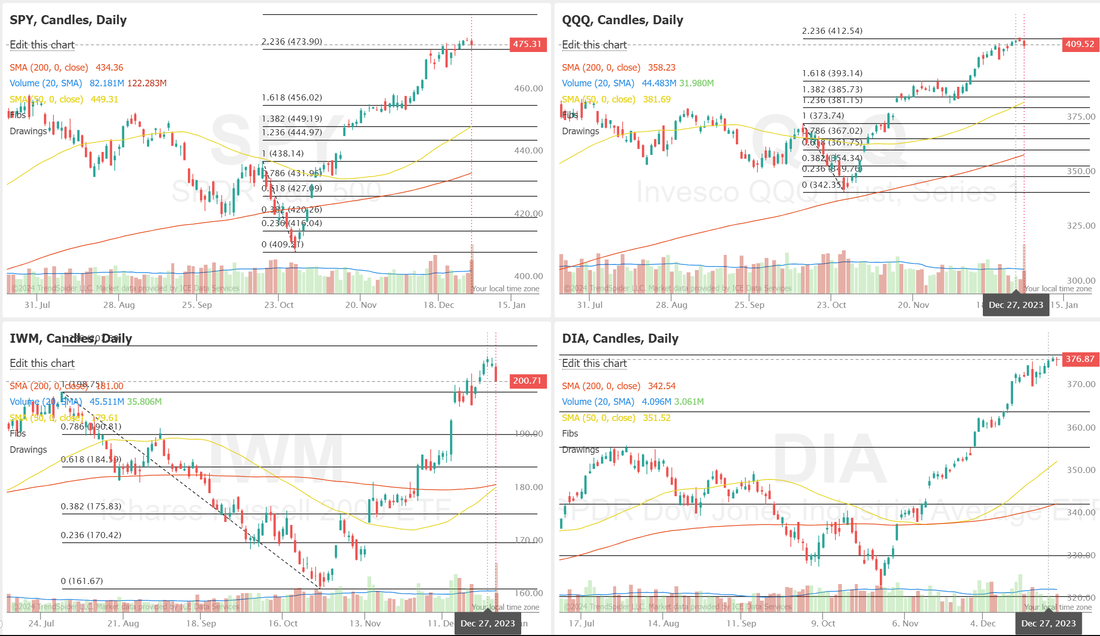

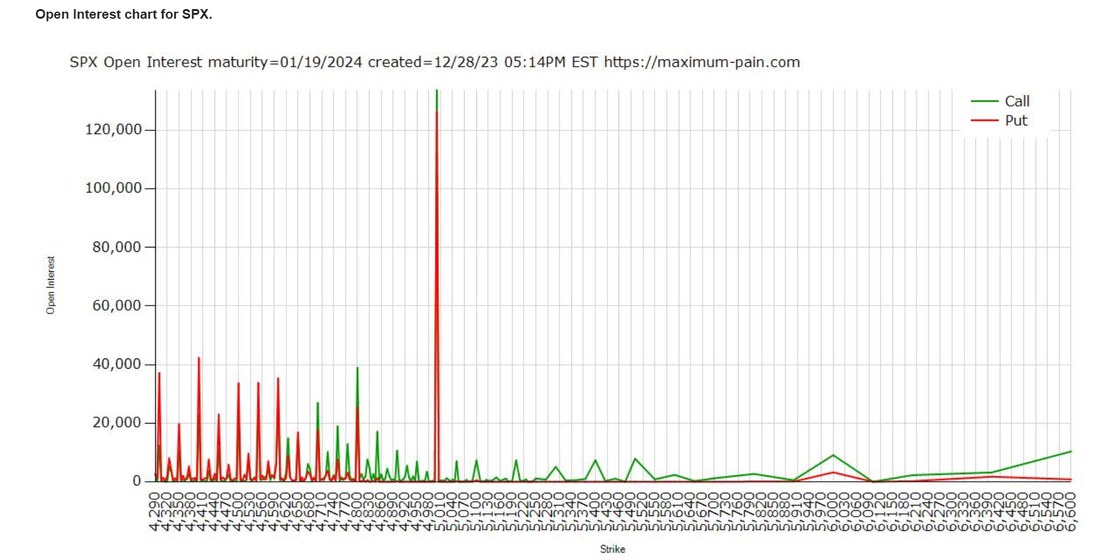

Welcome to 2024! Time for reflection. Time for laying out our plan of attack. Time to re-energize and up our game! 2023 was a very interesting year. 76% of analysts predicted a recession (count me in that group). That couldn't have been more wrong. The lesson? It usually pays to zig when the vast majority are zagging. Most bear markets are NOT predicted. 2000 Dot com bubble. 2008 Housing crisis. 2020 Pandemic. 2022 Inflation. 2023 Banking crisis. NONE of these were accurately forseen. There are still a lot of bearish forecasts for 2024. Will they be wrong again? We'll see. What's hot this year? Bitcoin. The halving and the potential for the SEC to finally approve multiple Crypto EFT's looks promising for the Crypto market. I'm long Etherium and BTC. The FED has 3 rate CUT's penciled in for this year. Rate cuts are generally bullish. As the saying goes...don't fight the FED. We have 8 FOMC Meetings scheduled for this year and those will be crucial. Perhaps the two biggest sector's for focus are A.I. and Real estate. This week we had JOLTS/FOMC/NFP all coming this shortened week. These news catalysts could be market movers for this shortened Holiday week. Our last week was fantastic. I finished off Friday with a $5,300 bump in my net liq. which gave me a $14,200 profit week. Traveling Paris and the Highlands in Scotland for Chirstmas and New Years had me worried with the time zone change and our busy schedule. We only traded the last hour of the day but it worked great! It just re-enforces that we don't need to be glued to our screens all day long to be profitable traders. We've been looking for a retrace for a while now and Friday delivered. Every, and I mean EVERY SINGLE ONE of our positions in the model portfolio participated in our past weeks profits. They all look great going into this week. All our indicators are still flashing buy, although they are weakening. Once again, if you look at the hourly you can see that as we went into the close the bears once again showed up and really tried to press. This time they held court all the way to the close. It's moved the 1 hr. indicators to the dreaded neutral rating. I absolutlely hate neutral rated days. They are tough to trade as the market abhors a vacum and seeks a directional bias. There are some interesting things happening on the daily charts for the four major indices we track and trade. Note they've all stalled out. QQQ and DIA got rebuffed at our resistance lines from last week. IWM and SPY continue to go now where and just hug our resistance lines from last week. The heat map from Friday had a very Christmas looking motif. Lots of Green but...also a color we haven't seen much of...red! Sure seems we are running out of steam here. With NFP, JOLTS, FOMC this week we are still sitting at a miserable 56 point expected move in the SPX. Even for a four day week, that's pretty pathetic. Its a tough enviroment for credit traders. Open interest continues to load that 5000 level heavy with call selling Technicals for the /ES headed into this shortened week are starting to show some wear signs. Selling volume increasing. Stochastics crossing into a sell signal. MACD almost there. RSI over bought and diverging. A/D line diverging and the CHOP index is depleted. Can the bears get some momentum this week? Intra day levels for me today: 4823/4831/4840/4850 to the upside. 4813/4807/4797/4788 to the downside.

1 Comment

Macho (Ron)

1/1/2024 11:31:29 am

Awesome week. Looking forward to next week.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |