|

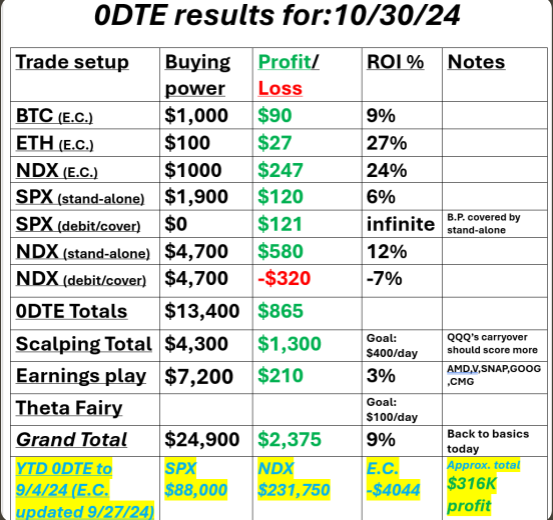

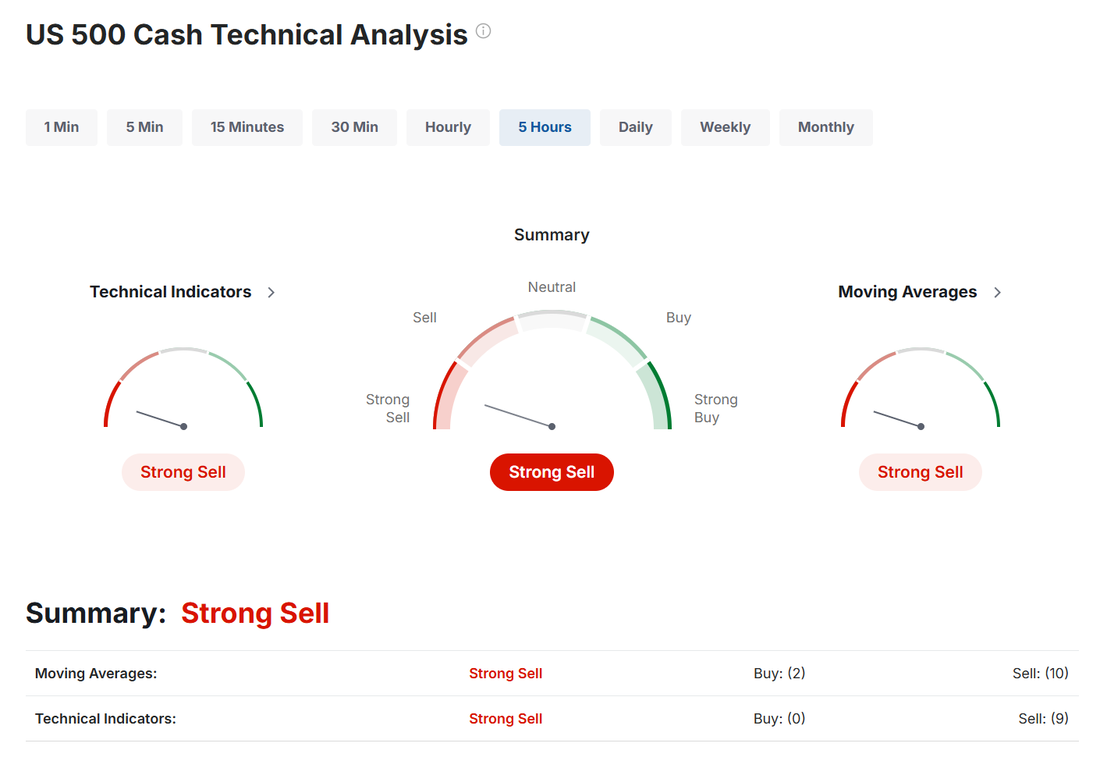

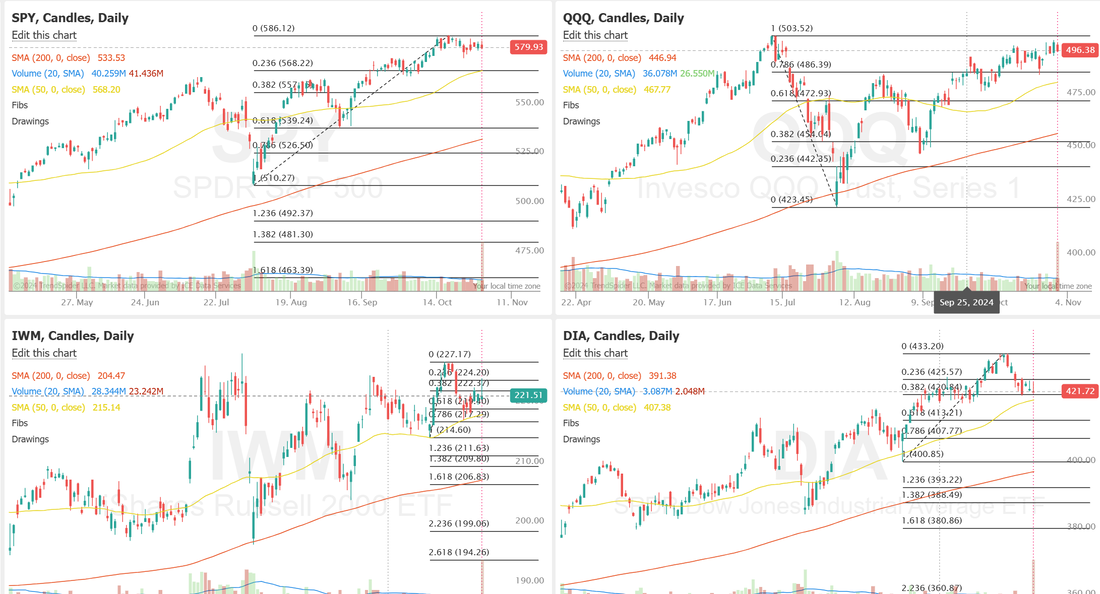

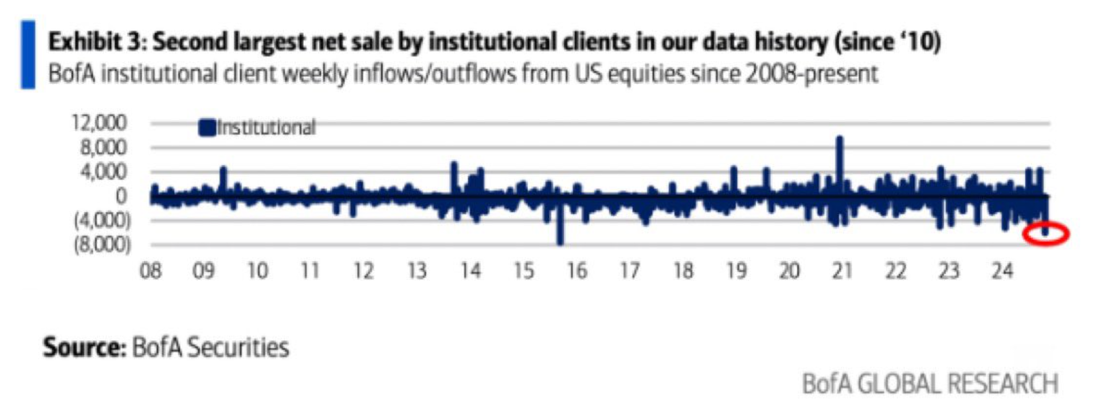

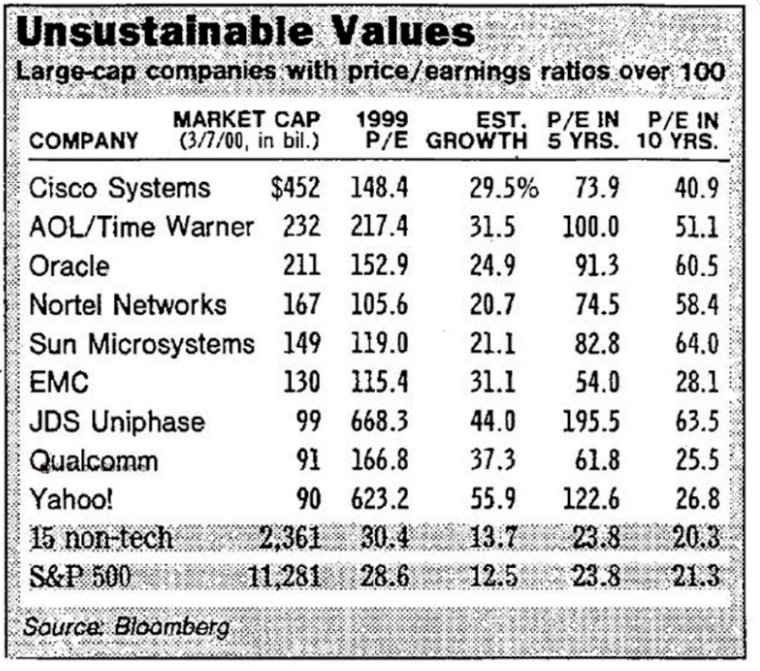

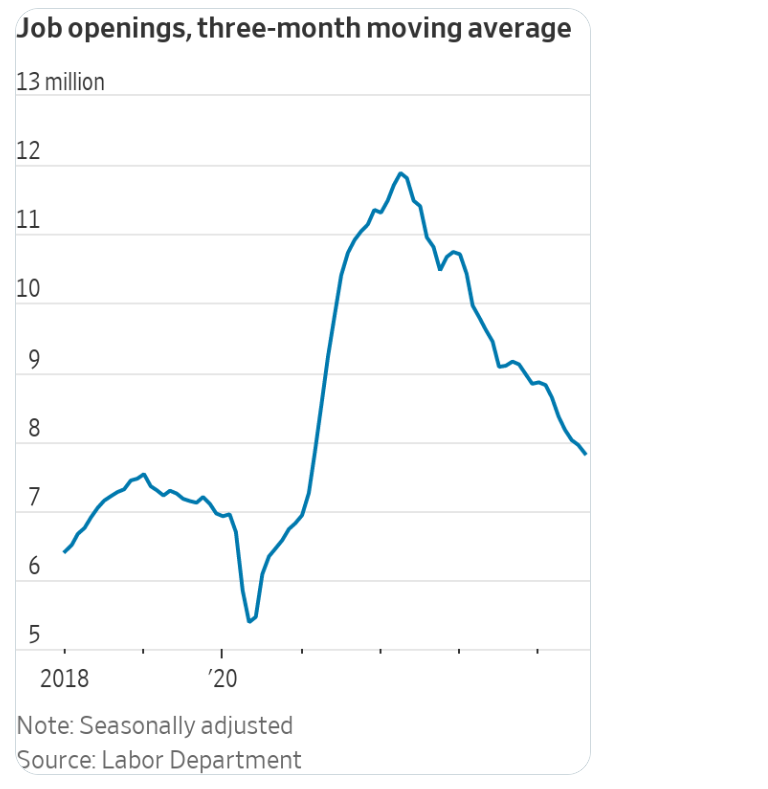

Good morning traders! After a nasty Tues. we went back to basics and scaled down. It's the best way to reduce stress. It ended up well for us and our QQQ puts we held from scalping yesterday should cash flow some additional profit for us at the open. I'll be getting my left eye worked on today so no zoom. Will move it to Friday. After this week we'll be on the Mon. Weds. Thurs. rotation. Also..happy Halloween! My wifes favorite holiday. Our results are below: Let's take a look at the markets this morning: Technicals have swung back to a sell rating after some earnings shortfalls. Once again, we get "some" movement but nothing that moves us out of the current chop zones or gives us any directional bias. December S&P 500 E-Mini futures (ESZ24) are down -0.77%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -1.09% this morning as investors digested quarterly earnings reports from Microsoft and Meta as well as robust U.S. economic data that muddied the outlook for Federal Reserve rate cuts. Investors now look forward to the release of the Fed’s preferred inflation gauge and a new round of corporate earnings reports, with particular focus on results from “Magnificent Seven” companies Apple and Amazon. Microsoft (MSFT) slid over -3% in pre-market trading after the tech giant provided a disappointing FQ2 cloud revenue growth forecast. Also, Meta Platforms (META) fell more than -3% in pre-market trading after CEO Mark Zuckerberg cautioned investors that the company will keep investing heavily in AI and other futuristic technologies. In yesterday’s trading session, Wall Street’s major indices ended in the red. Super Micro Computer (SMCI) plummeted over -32% and was the top percentage loser on the S&P 500 and Nasdaq 100 after accounting firm Ernst & Young LLP resigned as the company’s auditor. Also, Advanced Micro Devices (AMD) plunged more than -10% after the semiconductor giant provided a weak Q4 revenue forecast. In addition, Eli Lilly (LLY) slumped over -6% after the drugmaker posted downbeat Q3 results and cut its full-year adjusted EPS forecast. On the bullish side, Garmin Ltd. (GRMN) soared more than +23% and was the top percentage gainer on the S&P 500 after posting upbeat Q3 results and raising its full-year guidance. Also, Alphabet (GOOGL) gained over +2% after the Google parent reported stronger-than-expected Q3 results. The U.S. Bureau of Economic Analysis in its first estimate of Q3 GDP growth said on Wednesday that the economy grew at a +2.8% annualized rate, slightly weaker than expectations of +3.0%. Also, the U.S. October ADP employment change jumped +233K, higher than the +110K consensus and the biggest increase in 15 months. In addition, U.S. pending home sales climbed +7.4% m/m in September, stronger than expectations of +1.9% m/m and the largest increase in 4-1/4 years. “Solid but not blistering growth fits nicely within the current economic backdrop,” said Bret Kenwell at eToro. “Too hot of a print and investors would likely question the Fed’s decision to cut rates by 50 basis points in September, while a weak print could reignite worries about a deteriorating economy.” Meanwhile, U.S. rate futures have priced in a 96.1% chance of a 25 basis point rate cut and a 3.9% chance of no rate change at the November meeting. Third-quarter corporate earnings season continues in full flow, with market participants awaiting new reports today from notable companies such as Apple (AAPL), Amazon (AMZN), Mastercard (MA), Intel (INTC), Merck & Co. (MRK), Altria (MO), and Uber Technologies (UBER). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.6% y/y in September, compared to the previous figures of +0.1% m/m and +2.7% y/y. Also, investors will focus on the U.S. Chicago PMI, which arrived at 46.6 in September. Economists foresee the October figure to be 46.9. U.S. Personal Spending and Personal Income data will be closely monitored today. Economists forecast September Personal Spending to be +0.4% m/m and Personal Income to come in at +0.3% m/m, compared to the August numbers of +0.2% m/m and +0.2% m/m, respectively. The U.S. Employment Cost Index will come in today. Economists expect this figure to arrive at +0.9% q/q in the third quarter, matching the second quarter’s figure. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 229K, compared to last week’s number of 227K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.292%, up +0.59%. Lots of potential catalysts this morning. PCE, Jobless claims, Consumer spending data all hitting the wires 1hr. before the cash open. My bias today is back to Neutral. Look at the VTI for guidance as to what the total market picture looks like. We're just hanging around. At some point we'll get some directional bias but for now,..we wait. Some things I'm thinking about today: NSTITUTIONAL TRADERS JUST SOLD THE MOST AMOUNT OF STOCKS LAST WEEK IN MORE THAN 9 YEARS IN EVERY BUBBLE LIKE 1929, 1987, 2001, & 2008 THE LAST STAGES WERE WHEN INSTITUTIONS STARTED DUMPING ON THE BAG HOLDING RETAIL WHICH BUY IT UP At some point folks...we going to get a correction. It's just how it works. While the internet would go on to become ubiquitous and a source of tremendous wealth and innovation -- at the height of the dot com bubble it was pure Hype at that stage... certainly relative to the valuations prevailing at that time. The bond market continues screaming "policy error" Despite oil prices crashing below $70 and the latest employment data showing the weakest job openings in over 3 years, interest rates are spiking The 10-year US Treasury yield is breaking through 4.3% and now up 70 bps since the Fed's 50 bps rate cut This is the bond market making its best effort to take away Mr. Powell's printing press Meanwhile, gold prices are defying the typical gravitational pull imposed by higher rates and rallying to new all-time highs with each passing day Investors are dumping the former "safe haven" known as US government bonds in favor of real money Weak economy + sticky inflation + spiking bond yields and sky-rocketing gold prices = stagflation My bias for today is more neutral. Until we break the market out, one direction or the other we just continue to consolidate. Trade docket for today is pretty full. Mostly earnings plays. /MNQ,QQQ scalping, AMZN, JNPR, AAPL, INTC, X, TEAM, COIN, CVNA, DASH, HOOD, META?, MSFT, RIOT, ROKU, SBUX, TSLA? TWLO, 0DTE's Let's execute today and stick to our knitting and we should have another solid result.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |