|

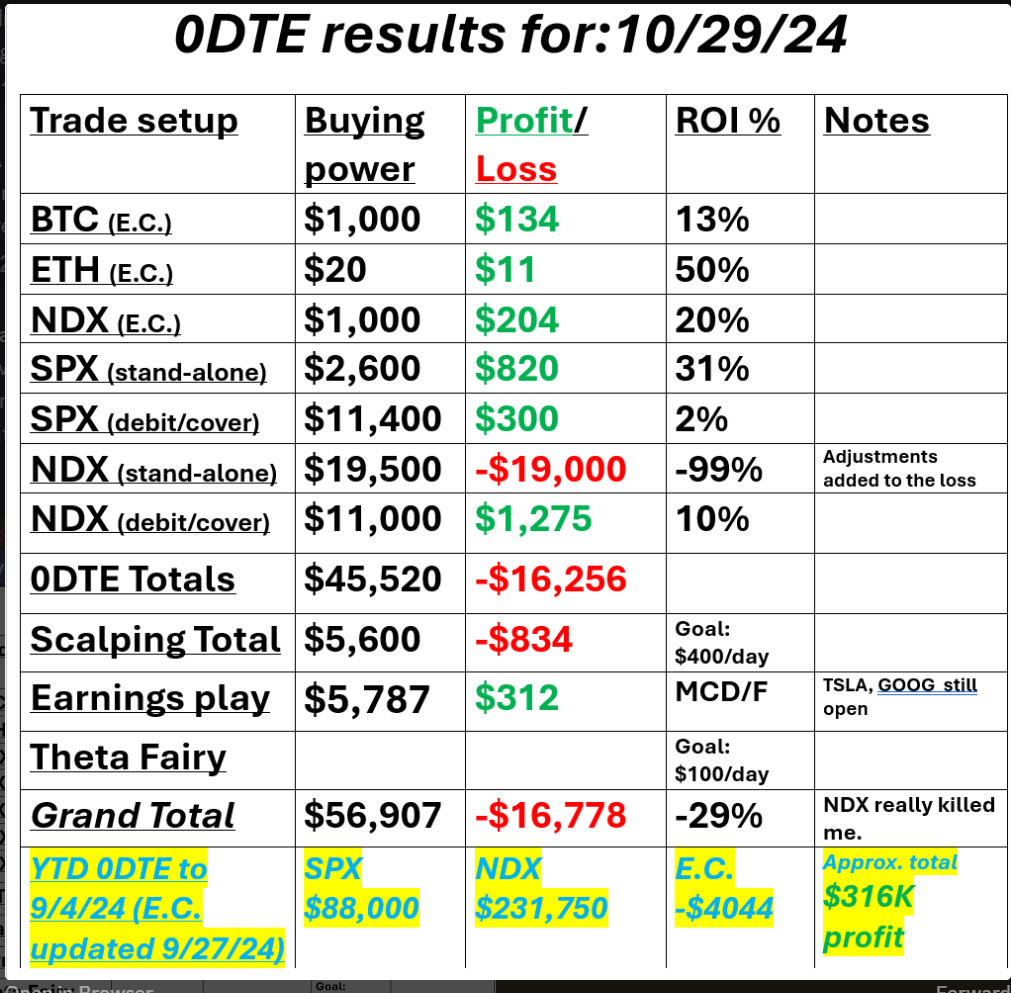

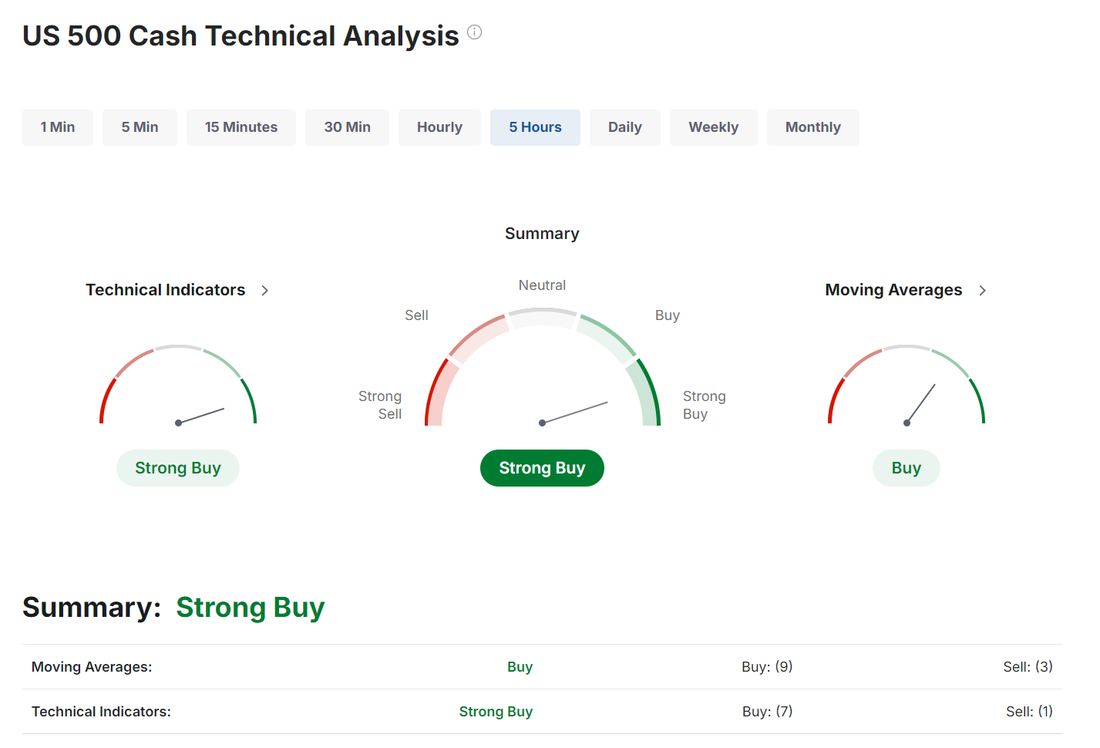

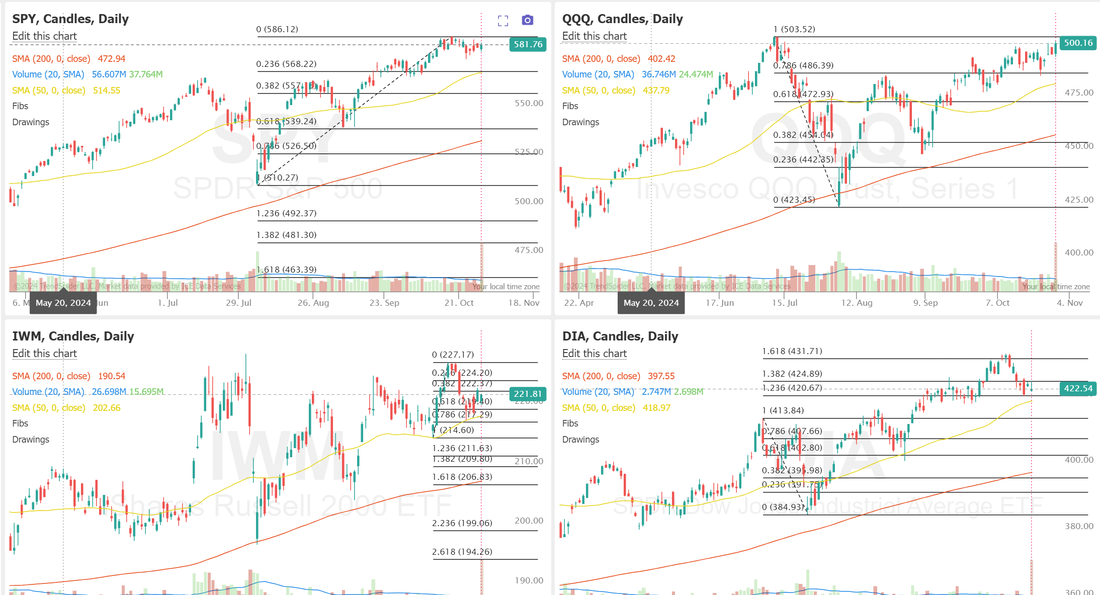

Welcome back! It's Weds. Yesterday was a bad one for me and it wasn't the markets fault. It was mine. I had a losing position on in the NDX and while it would have resulted in a loss it would have been managable however I adjusted it and the adjustment ALSO lost. It was a double whammy. I'll work to do better today. Here's our results below: One key thing I remind myself and our trading room after a bad day like this is to not revenge trade. It can just dig the hole deeper. Let's take a look at the markets; Buy mode is holding. It's interesting that even though the push up on the NDX yesterday caught me by surprise and killed my results, we are still just chopping around the same levels we have been for a while now. December Nasdaq 100 E-Mini futures (NQZ24) are trending up +0.28% this morning as strong quarterly results from Alphabet boosted sentiment, while investors also awaited a fresh batch of U.S. economic data and earnings reports from “Magnificent Seven” companies Microsoft and Meta. Alphabet (GOOGL) climbed over +5% in pre-market trading after the Google parent reported stronger-than-expected Q3 results. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Cadence Design Systems (CDNS) surged over +12% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q3 results and raised its full-year EPS guidance. Also, chip stocks gained ground, with Arm (ARM) and Broadcom (AVGO) climbing more than +4%. In addition, V.F. Corporation (VFC) soared over +27% after the company reported stronger-than-expected FQ2 results. On the bearish side, Ford (F) plunged more than -8% after the carmaker lowered its full-year adjusted EBIT guidance. Also, PayPal (PYPL) slid about -4% and was the top percentage loser on the Nasdaq 100 after the payment technology firm reported weaker-than-expected Q3 revenue and offered a soft Q4 revenue forecast. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to a 3-3/4 year low of 7.443M in September, weaker than expectations of 7.980M. Also, the U.S. Conference Board’s consumer confidence index jumped to a 9-month high of 108.7 in October, easily beating the 99.5 consensus. In addition, the U.S. August S&P/CS HPI Composite - 20 n.s.a. eased to +5.2% y/y from +5.9% y/y in July, stronger than expectations of +4.9% y/y. “The labor market no longer poses a threat to the price stability side of the Fed’s dual mandate,” Wells Fargo economists said. Meanwhile, U.S. rate futures have priced in a 99.7% chance of a 25 basis point rate cut at the November FOMC meeting. Third-quarter corporate earnings season rolls on, with investors looking forward to fresh reports today from major companies such as Microsoft (MSFT), Meta Platforms (META), Eli Lilly (LLY), AbbVie (ABBV), Caterpillar (CAT), Booking (BKNG), KLA Corp. (KLAC), and Doordash (DASH). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the first estimate of U.S. third-quarter gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +3.0% q/q, matching the second quarter’s figure. Also, investors will focus on the U.S. ADP Nonfarm Employment Change data, which came in at 143K in September. Economists foresee the October figure to be 110K. U.S. Pending Home Sales data will come in today. Economists expect the September figure to be +1.9% m/m, compared to the previous figure of +0.6% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be 1.500M, compared to last week’s value of 5.474M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.235%, down -0.94%. Today the flood gates open for earnings. Our trade docket will be filled with them. Trade docket:CVNA, ROKU, TWLO, HOOD, RIOT, DASH, MSFT, SBUX, META, COIN, AMD, CMG, FSLR, GOOG, SNAP, V, /MNQ scalping 0DTE's. Levels havent really changed much from yesterrday for intra-day trades. I'll alter them a bit in the zoom feed today. My bias or lean today is Neutral to slightly bearish. GOOG earnings have pushed the futures higher which keeps us pinned at some big resistance levels. Let's get ourselves back on track today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |