|

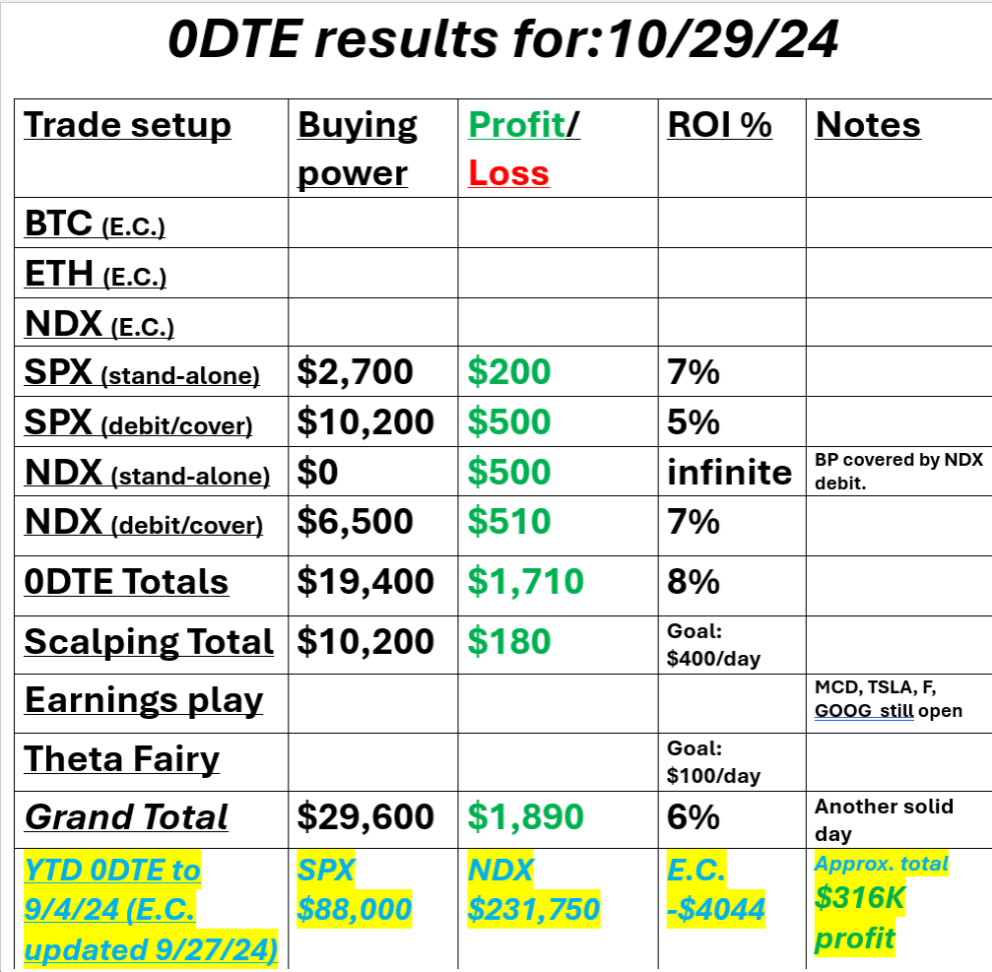

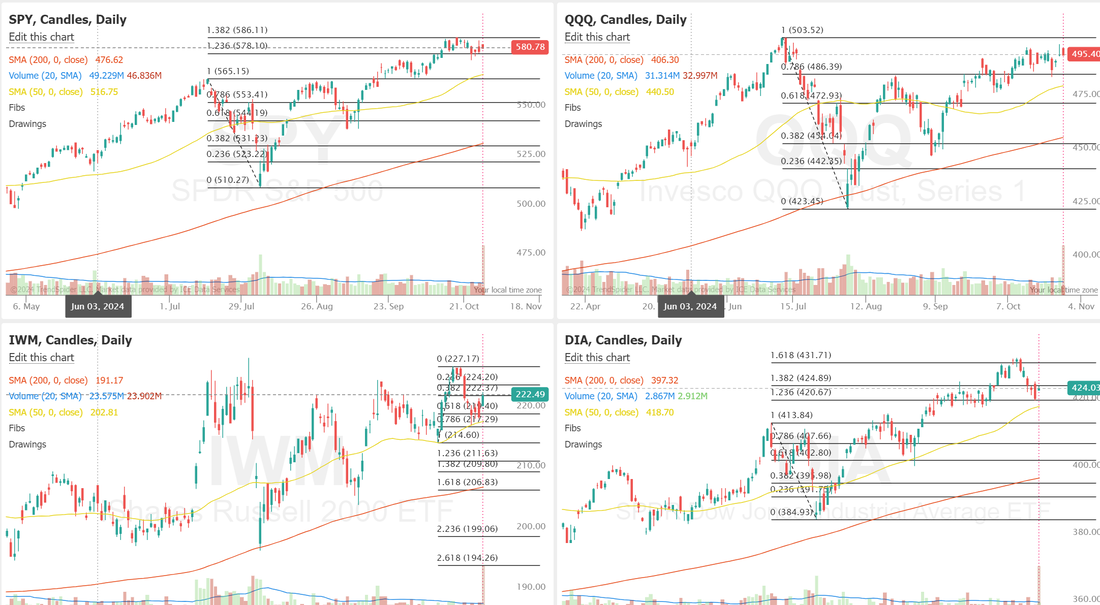

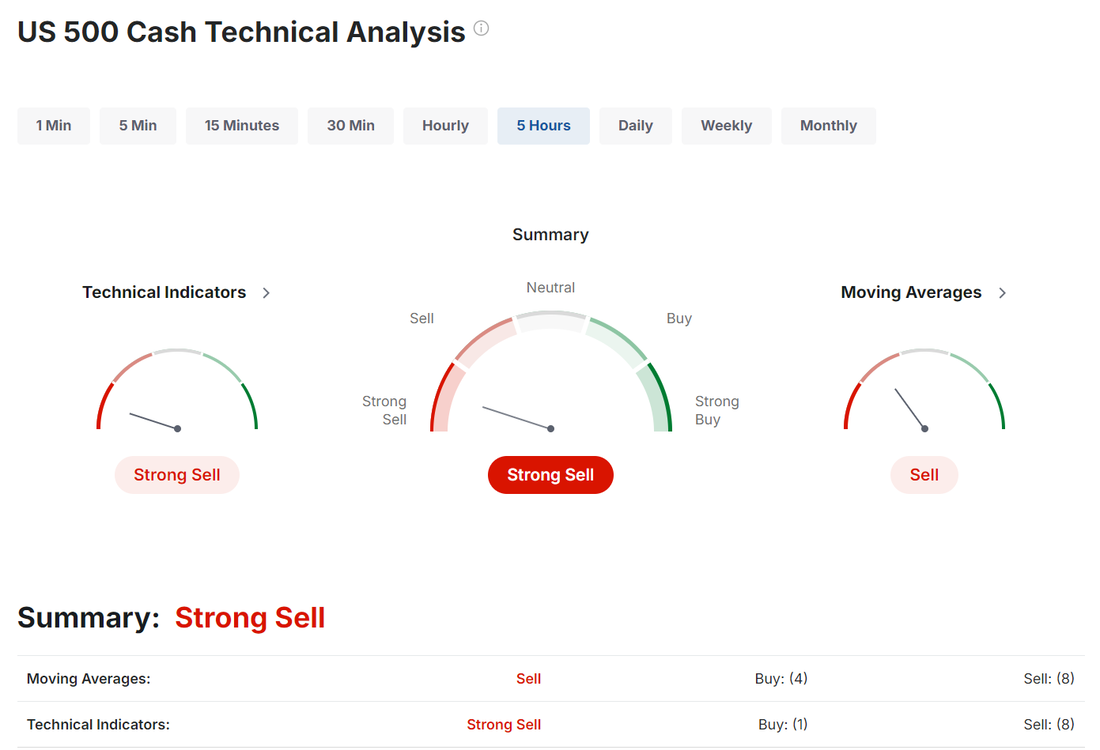

Welcome back traders! We had a clean and "excellent" day yesterday. Everything worked for us but scalping was a battle. See our results below. December S&P 500 E-Mini futures (ESZ24) are up +0.06%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.08% this morning as market participants geared up for the latest reading on U.S. job openings while also awaiting a deluge of corporate earnings reports from heavyweight names. In yesterday’s trading session, Wall Street’s major indexes ended in the green. 3M Company (MMM) climbed over +4% and was the top percentage gainer on the Dow after JPMorgan raised its price target on the stock to $165 from $160. Also, airline and transportation stocks rallied as oil prices plunged, with Carnival (CCL) rising more than +4% and American Airlines Group (AAL) advancing over +3%. In addition, ON Semiconductor (ON) gained more than +1% after reporting better-than-expected Q3 results. On the bearish side, Boeing (BA) fell over -2% and was the top percentage loser on the Dow after the planemaker launched a $19 billion share sale. Meanwhile, markets are bracing for the possibility of Donald Trump returning to the White House, with most major polls indicating he is in a close race with Vice President Kamala Harris. A win for Trump could be more advantageous for stocks and Bitcoin compared to his Democratic opponent, whereas a Harris presidency might provide slightly more relief in housing costs, according to a Bloomberg Markets Live Pulse survey. Third-quarter corporate earnings season is in full swing, with investors awaiting new reports today from prominent companies such as Alphabet (GOOGL), Visa (V), Advanced Micro Devices (AMD), McDonald’s (MCD), Pfizer (PFE), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. “Near-term focus is shifting to megacap earnings that kick off today with Google. There is still an expectation that AI spending will be maintained and that could continue to be a significant driver of broader equity momentum,” said Charu Chanana, chief investment strategist at Saxo Markets. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the September JOLTs Job Openings will stand at 7.980M, compared to the August figure of 8.040M. Also, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which arrived at 98.7 in September. Economists foresee the October figure to be 99.5. The U.S. S&P/CS HPI Composite - 20 n.s.a. will come in today. Economists expect August’s figure to be +4.9% y/y, compared to the previous number of +5.9% y/y. U.S. Wholesale Inventories preliminary data will be reported today as well. Economists estimate this figure to arrive at +0.2% m/m in September, compared to +0.1% m/m in August. U.S. rate futures have priced in a 96.4% chance of a 25 basis point rate cut and a 3.6% chance of no rate change at the conclusion of the Fed’s November meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.314%, up +0.75%. Let's take a look at the markets: The best way to describe the market is "stalled". It's just hanging out, waiting for a directional bias to kick in. Technicals today start with a slight sell bias. Trade docket today: SNAP, AMD, CMG, /NG, V, /MNQ,QQQ scalping, /ZC, /ZN, F, FSLR, GOOG, LRN, MCD?, PYPL?, 0DTE's Let's take a look at intra-day levels: /ES; Still consolidating. 5865 then 5880 resistance with 5838 and 5818 support. /NQ; Two key levels for me today. 20624 resistance and 20422 support. Between is the chop zone. Bitcoin: BTC is picking up steam! Getting very close to new highs! Can it continue to push today? I'm looking for a retace to enter a bearish setup today. Let's have great day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |