|

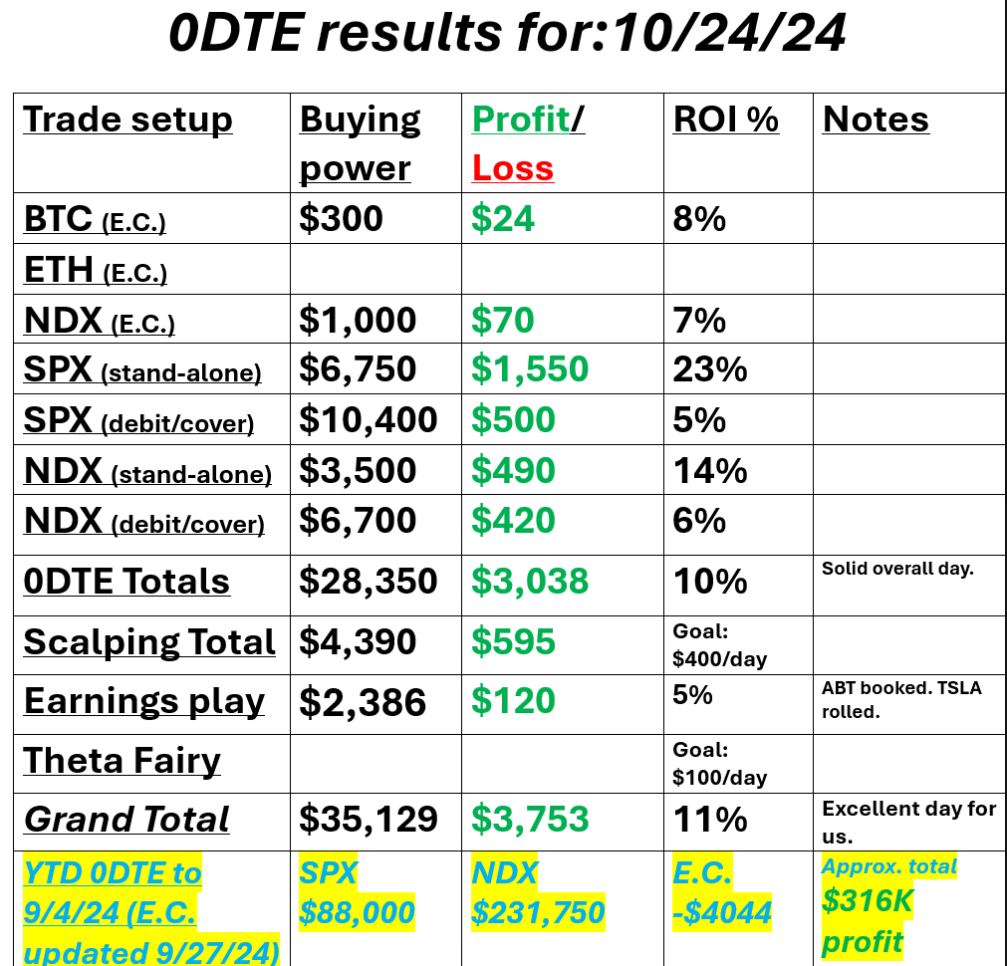

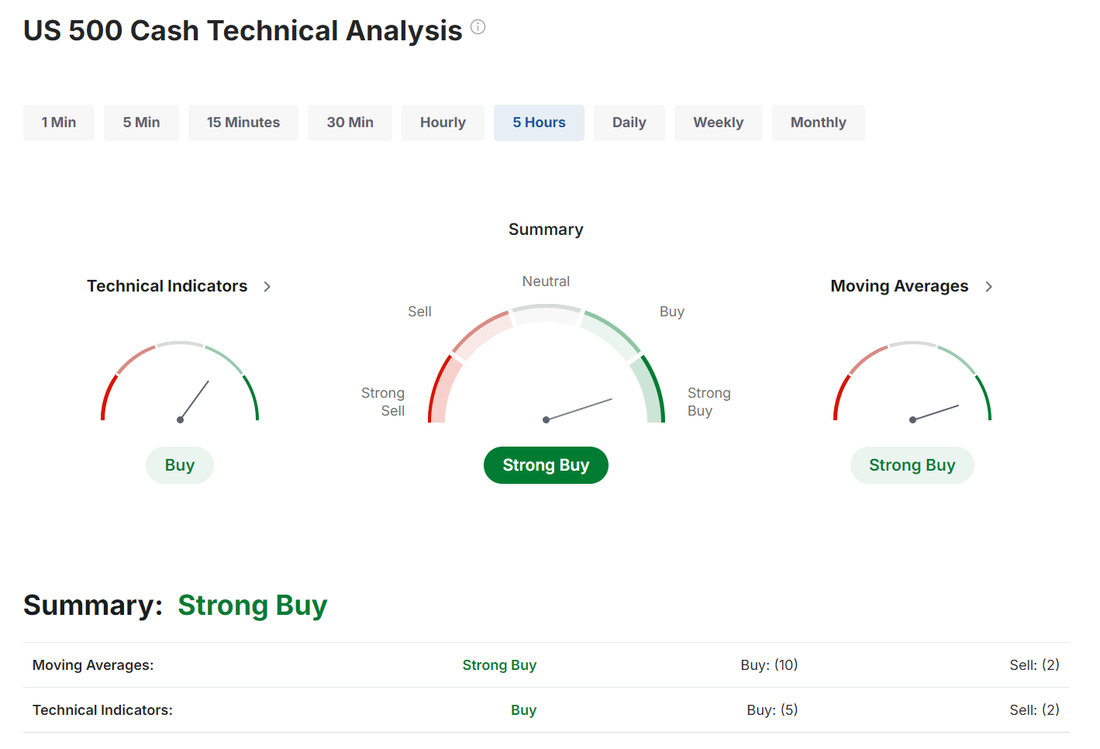

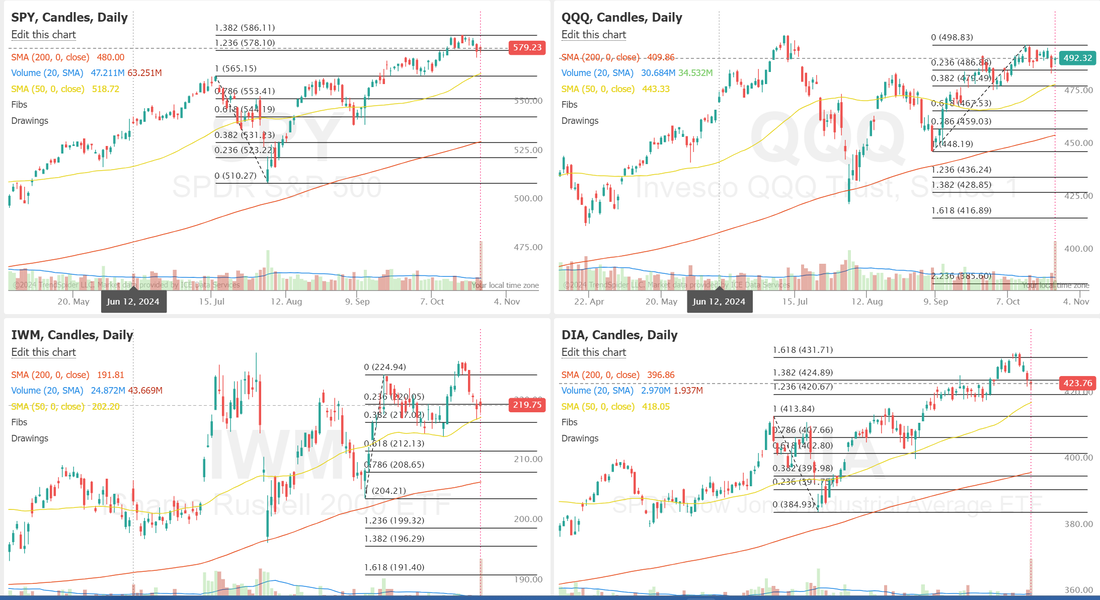

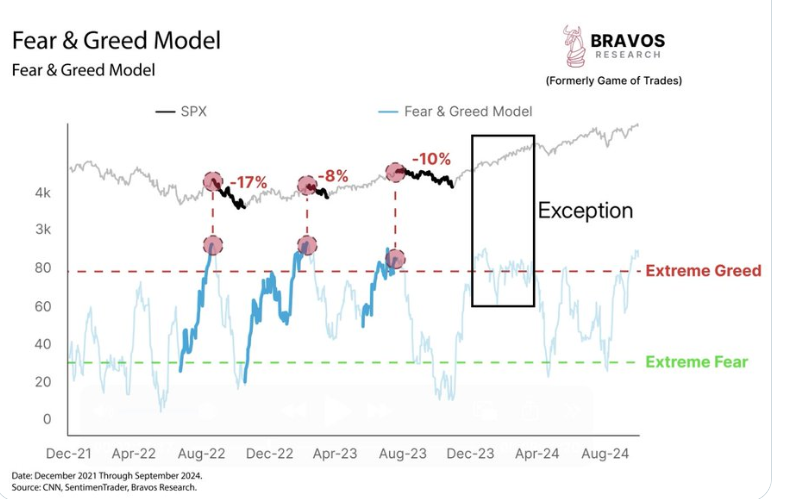

Welcome back to Friday traders! This week went by fast for me. I was out of pocket for half the day yesterday with eye surgery and monitoring our positions with one eye on a phone with a cracked screen! It went well and we had an excellent day. Check out our results below: It was a perfect day for us. Much smoother than Weds. We had another late day enhancement to the SPX stand alone trade that really boosted the ROI there and scalping just continues to pull more than its fair share of weight. Let's take a look at the markets: With yesterdays push and the futures being up this morning we are back to a bullish bias. While the IWM and DIAhave a bit more retrace going on, the SPY and QQQ continue to just channel. No real discernable trend as of yet. December S&P 500 E-Mini futures (ESZ24) are up +0.21%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.22% this morning as Treasury yields fell for a second day, with investors looking ahead to a new batch of U.S. economic data and comments from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Tesla (TSLA) soared nearly +22% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the electric vehicle maker reported stronger-than-expected Q3 adjusted EPS and said it expects “slight growth” in vehicle deliveries this year and a big jump in 2025. Also, United Parcel Service (UPS) gained more than +5% after the parcel delivery giant and economic bellwether posted upbeat Q3 results. In addition, Molina Healthcare (MOH) surged over +17% after reporting better-than-expected Q3 results. On the bearish side, Newmont (NEM) tumbled more than -14% and was the top percentage loser on the S&P 500 after the company reported downbeat Q3 results. Also, International Business Machines (IBM) slid over -6% and was the top percentage loser on the Dow after reporting weaker-than-expected Q3 revenue. Economic data released on Thursday showed that the U.S. S&P Global manufacturing PMI edged up to 47.8 in October, stronger than expectations of 47.5. Also, the U.S. October S&P Global services PMI unexpectedly rose to 55.3, better than expectations of 55.0. In addition, U.S. new home sales rose +4.1% m/m to a 16-month high of 738K in September, stronger than expectations of 719K. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -15K to 227K, compared with the 243K expected. “Goldilocks data that’s in-line with expectations (so not too good or too bad) is the best outcome for a continued rebound in stocks and bonds,” said Tom Essaye at The Sevens Report. Meanwhile, U.S. rate futures have priced in a 95.0% chance of a 25 basis point rate cut and a 5.0% chance of no rate change at November’s monetary policy meeting. On the earnings front, notable companies like Colgate-Palmolive (CL) and HCA Healthcare (HCA) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on U.S. Durable Goods Orders data, which is set to be released in a couple of hours. Economists, on average, forecast that September durable goods orders will come in at -1.1% m/m, compared to 0.0% m/m in August. Also, investors will focus on U.S. Core Durable Goods Orders data, which stood at +0.5% m/m in August. Economists foresee the September figure to be -0.1% m/m. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 68.9 in October, compared to 70.1 in September. In addition, market participants will be anticipating a speech from Boston Fed President Susan Collins. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.195%, down -0.14%. My lean or bias today is bullish. We have durable goods and consumer sentment coming out this morning that could change that but I believe that's a low likelyhood. A couple things I'm thinking about today: Number of times when both gold and the S&P 500 are up 25% in the same year? Zero. SPY up 24% or so this year with gold up 33%. Hum. Something seems fishy here to me. Fear and Greed model has just flashed a WARNING sign It has entered the "Extreme Greed" zone This typically occurs near local stock market tops Fasten your seatbelts Trade docket today: ABT, /MNQ scalping, DXCM, FDX, LRN, MCD, SPY/QQQ, UAL, TSLA, /SI, 0DTE's. Let's take a look at the intra-day levels for our 0DTE's today: /ES: Today should be an interesting one. The price action this morning looks bullish but we are below both the 50 period M.A. and the Poc on the 2 hr. chart. That could pose some overhang for the bulls today. 5970 is first resistance. It's the 50 period M.A. 5980 is next with 5990 being key. It's PoC. On the downside, 5860, 5852, 5843 are the support levels with 5843 being key. It's the 200 period M.A. /NQ is not as nuanced. 20536 is resistance. 20344 is support with 20455 is the PoC and most likely magnet for today. BTC has stabilized a bit. 68601 is resistance with 66471 support. Let's have a storng finish to the week!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |