|

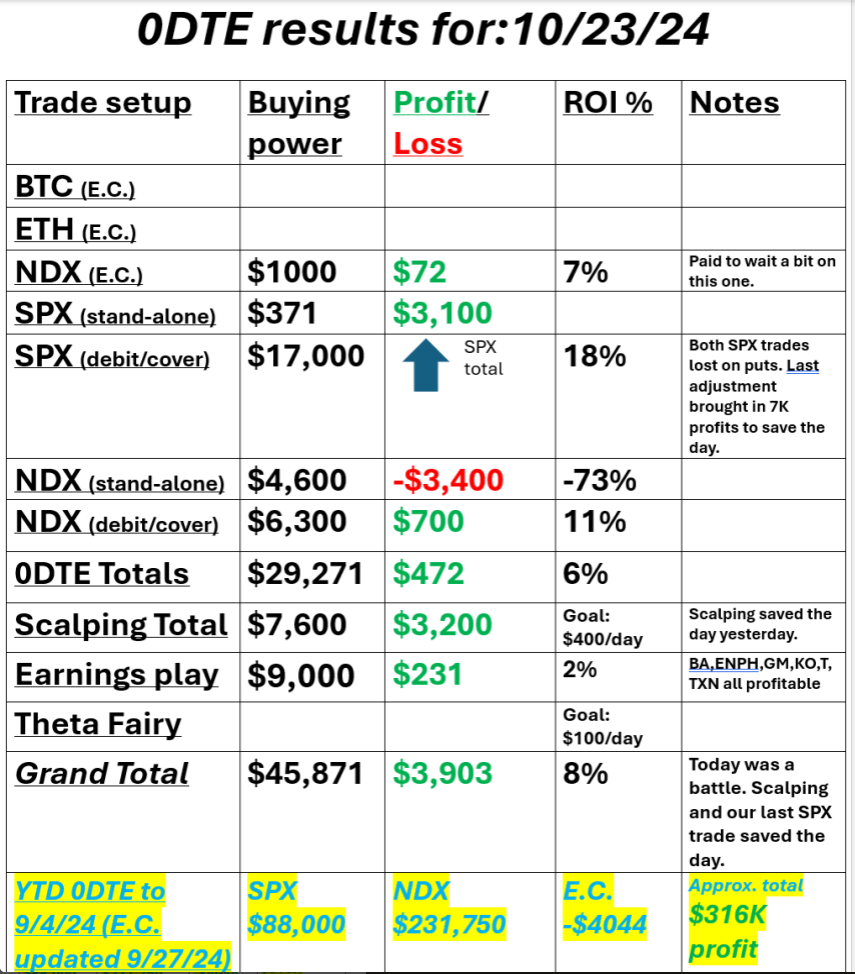

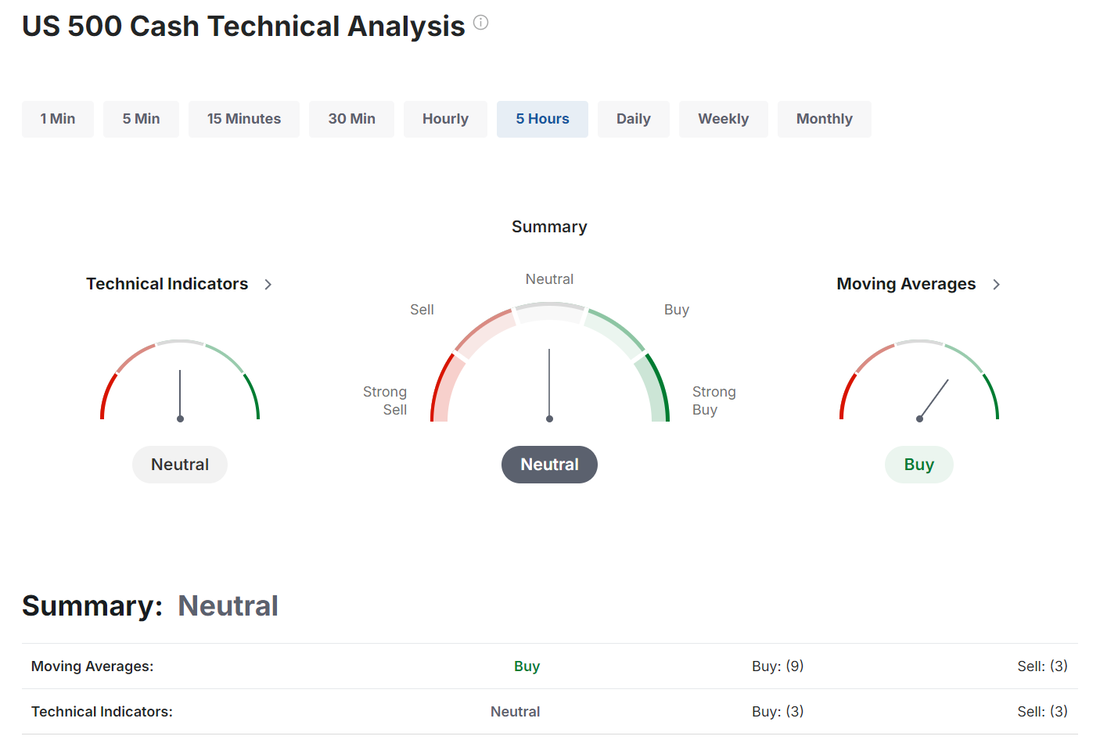

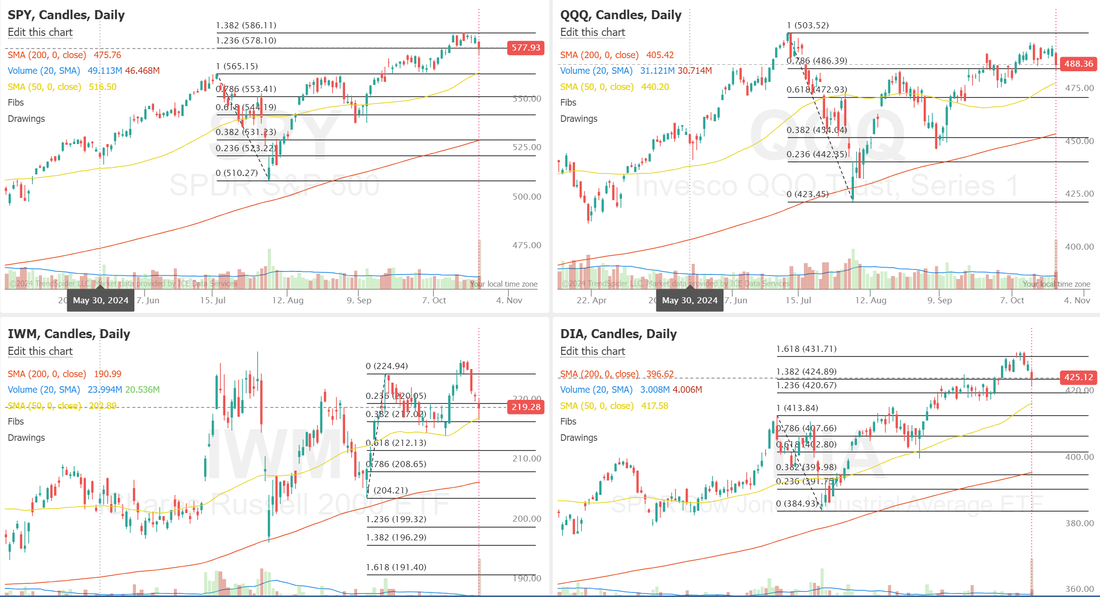

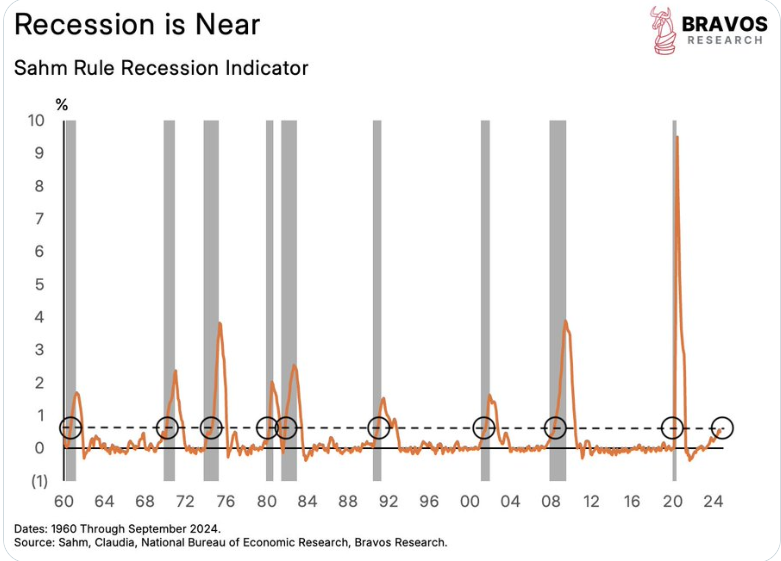

Welcome back traders! Well...I'm super conflicted about our trading day yesterday. We squeaked out a small green result on our 0DTE's. Scalping and our earnings trades absolutely killed it and last but certainly not least, my net liq was us $2,300 dollars. That all meets our critera for an "excellent" day but oh what could have been! We've been builidng our SPX debit trade for several weeks now looking for a 20K payoff. I messed that up yesterday and should have just sat on my hands all day. I'm super grateful and relieved that we got the result we did. At one point my net liq was down $5,500 so being able to swing to green was a relief. Our last SPX adjustment brought in $7,100 profit and made all the difference. Check out our results below. I talked about how important our scalping was Tues.. Little did I know we'd need it yesterday! A large part of our trades are credit trades. What hurts a credit trade? Big moves. What's the best enviroment for scalping? Big move days! It's critical if you're serious about trading to have as many tools as possible to give you an edge and be able to hedge your positions. Scalping has been invaluable to us. Let's take a look at the markets: We are back to a neutral rating this morning with futures rebounding from yesterdays sell day. Was the bull market damaged yesterday? Well, the slide didn't help but all the major indices we track and trade are still well above their respective 50DMA. Unless those break you're uptrend is still in play. My lean or bias today is bullish. Futures are rebounding strong and Tesla earnings are helping lift other underlyings. December S&P 500 E-Mini futures (ESZ24) are up +0.46%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.72% this morning as risk sentiment got a boost after Tesla posted its biggest quarterly profit in over a year, while investors geared up for U.S. business activity data and the next round of corporate earnings reports. Tesla (TSLA) surged over +10% in pre-market trading after the electric vehicle maker reported stronger-than-expected Q3 adjusted EPS and said it expects “slight growth” in vehicle deliveries this year and a big jump in 2025. In yesterday’s trading session, Wall Street’s major indices closed in the red. Enphase Energy (ENPH) plunged about -15% and was the top percentage loser on the S&P 500 after the solar equipment maker posted downbeat Q3 results and provided below-consensus Q4 revenue guidance. Also, Arm (ARM) slumped more than -6% and was the top percentage loser on the Nasdaq 100 following a Bloomberg report that the company canceled a license that allowed Qualcomm to use its intellectual property to design chips. In addition, McDonald’s (MCD) slid over -5% and was the top percentage loser on the Dow after the U.S. Centers for Disease Control and Prevention said that a severe E. coli outbreak linked to the company’s Quarter Pounders sickened dozens of people in the U.S. On the bullish side, Northern Trust (NTRS) climbed more than +7% and was the top percentage gainer on the S&P 500 after posting upbeat Q3 results. Also, Texas Instruments (TXN) advanced over +4% and was the top percentage gainer on the Nasdaq 100 after the semiconductor company reported better-than-expected Q3 results. “This is about price exhaustion, this is about election exhaustion, it’s about campaign exhaustion, it’s about Fed exhaustion, it’s about policy exhaustion, it’s about geopolitical exhaustion,” said Kenny Polcari at SlateStone Wealth. “It’s about how stocks are stretched and it’s about the need for stocks to retreat, test lower, shake the branches, see who falls out, and then move on.” Economic data released on Wednesday showed that U.S. existing home sales unexpectedly fell -1.0% m/m to an almost 14-year low of 3.84M in September, weaker than expectations of 3.88M. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity was little changed in most parts of the U.S. since early September. Over half of the Fed’s 12 districts reported “slight or modest” growth in employment, while most districts said that prices increased at a “slight or modest pace.” Multiple districts also reported a slowdown in wage growth. “Reports on consumer spending were mixed, with some districts noting shifts in the composition of purchases, mostly toward less expensive alternatives,” according to the Beige Book. U.S. rate futures have priced in a 92.9% chance of a 25 basis point rate cut and a 7.1% chance of no rate change at the November FOMC meeting. On the earnings front, notable companies like United Parcel Service (UPS), Honeywell International (HON), Union Pacific (UNP), Keurig Dr Pepper (KDP), L3Harris Technologies (LHX), Tractor Supply (TSCO), Southwest Airlines (LUV), and American Airlines (AAL) are scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the October Manufacturing PMI will come in at 47.5, compared to last month’s value of 47.3. Also, investors will focus on the U.S. S&P Global Services PMI, which arrived at 55.2 in September. Economists foresee the preliminary October figure to be 55.0. U.S. New Home Sales data will come in today. Economists foresee this figure to stand at 719K in September, compared to 716K in August. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 243K, compared to last week’s number of 241K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.197%, down -1.11%. Trade docket for today: /MNQ,/NQ scalping. DXCM, MCD, LRN, TSLA, UAL, /BTC, /SI, /ZN, 0DTE's Some things I'm thinking about today: 10-year Treasury yield has just spiked to 4.25% The last 3 times yields spiked, markets corrected: - Sept 2022 - Oct 2023 - April 2024. Those were NOT good times! The Sahm Rule has been triggered It's predicted the last 9 recessions With 0 false signals since 1960. If you aren't familar with this rule you can brush up here: Let's look at our intra-day 0DTE levels: /ES; As you can see, the futures have already repaired most of the damage from yesterdays sell off. Two key levels for me today. 5884 is key resistance its close to both PoC and the 50 period M.A. on the 2hr. chart. 5836 is key support and corresponds to the 200 period M.A. /NQ: Nasdaq futures, with the help of Tesla are popping this morning and have negated any downside momentum the bears wished to establish yesterday. I'm looking at a tight support/resistance range today. 20441 is key resistance for me. It's closely coorelated to both the PoC and 50 period M.A. A break above this zone is back to full bull mode. 20329 is key support. It corresponds to the 200 period M.A. /BTC: Bitcoin got hammered yesteday. We pulled our trade at a profit but just barely. I'm looking for a bullish setup today with 65,744 as support. I'll be out of the office for most of the day today with eye surgery and then next Thurs. for the other eye. Trade to trade well folks. I'll see you in our zoom feed tomorrow.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |