|

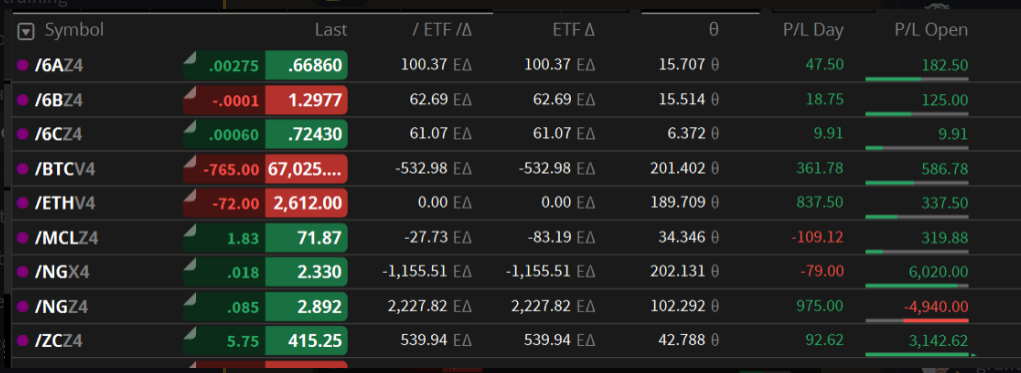

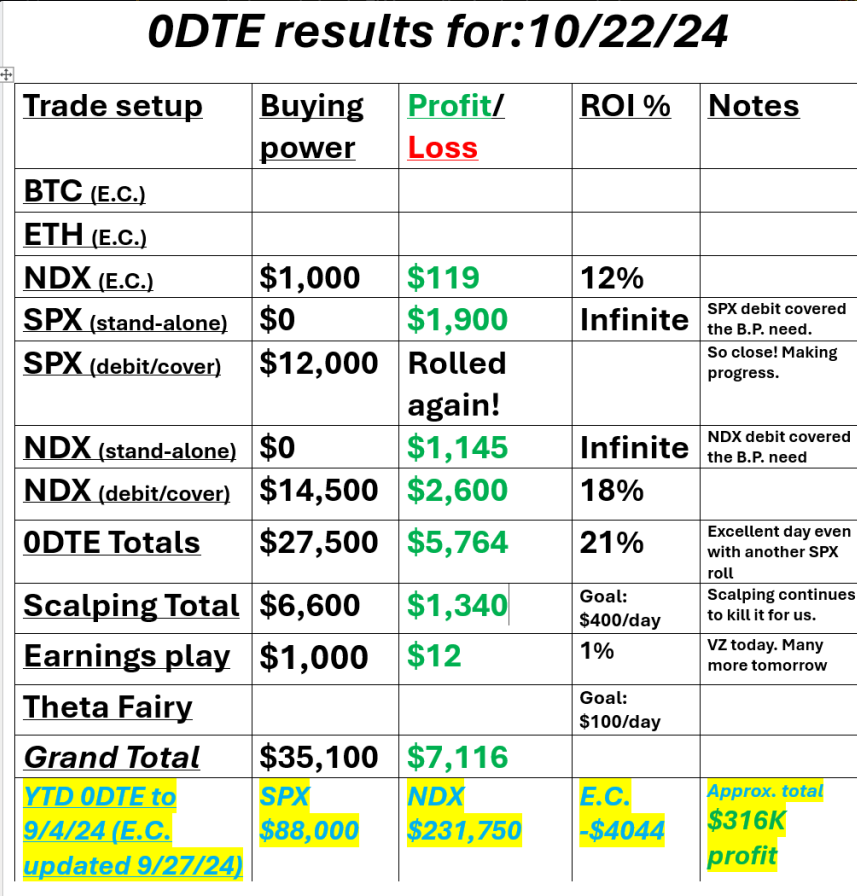

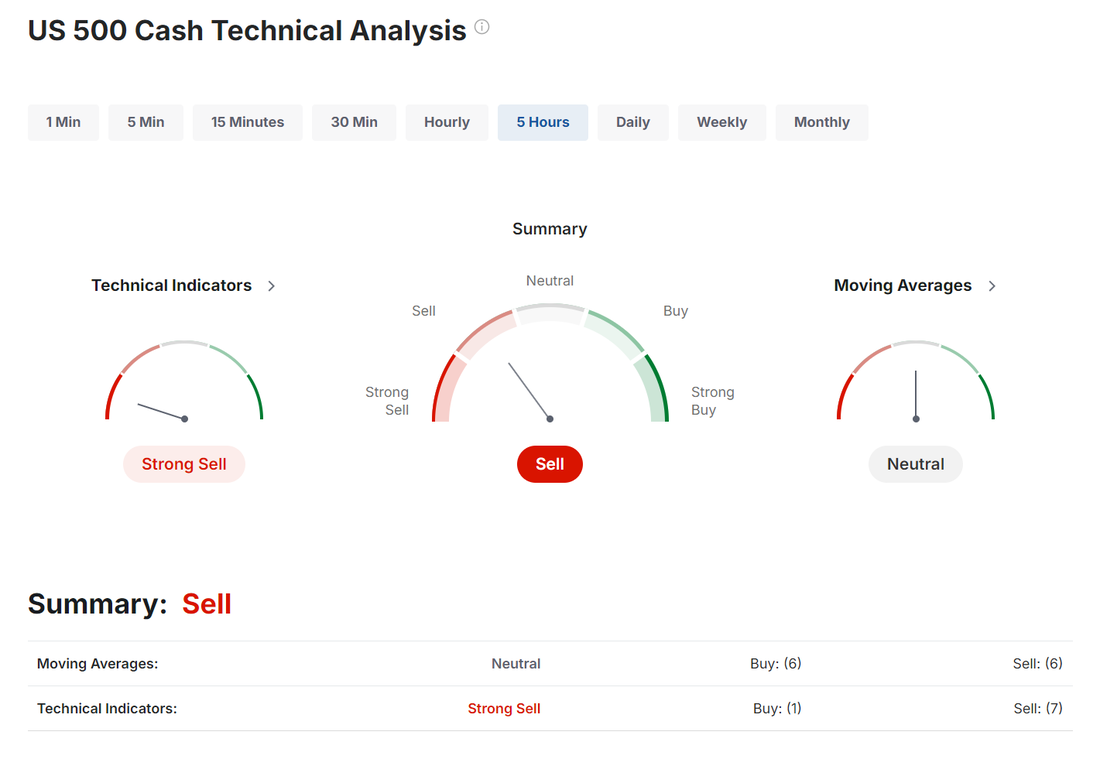

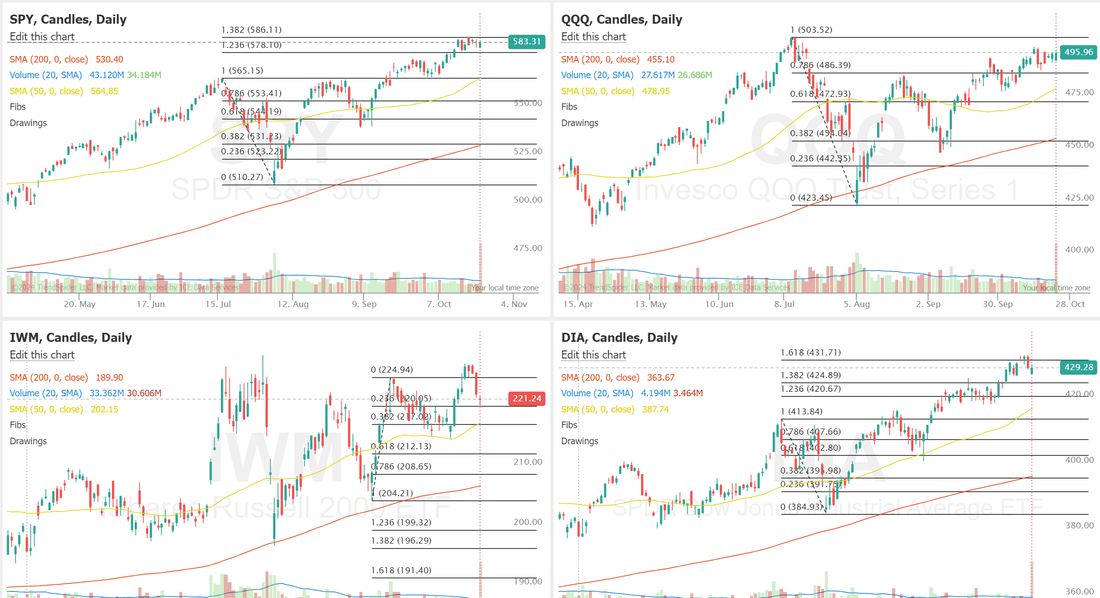

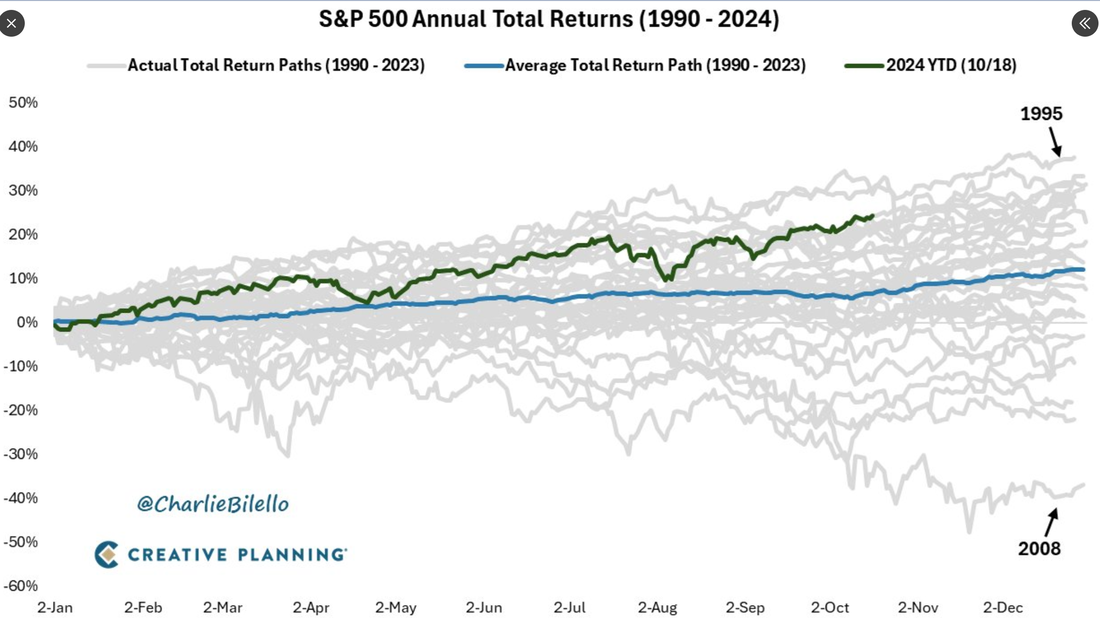

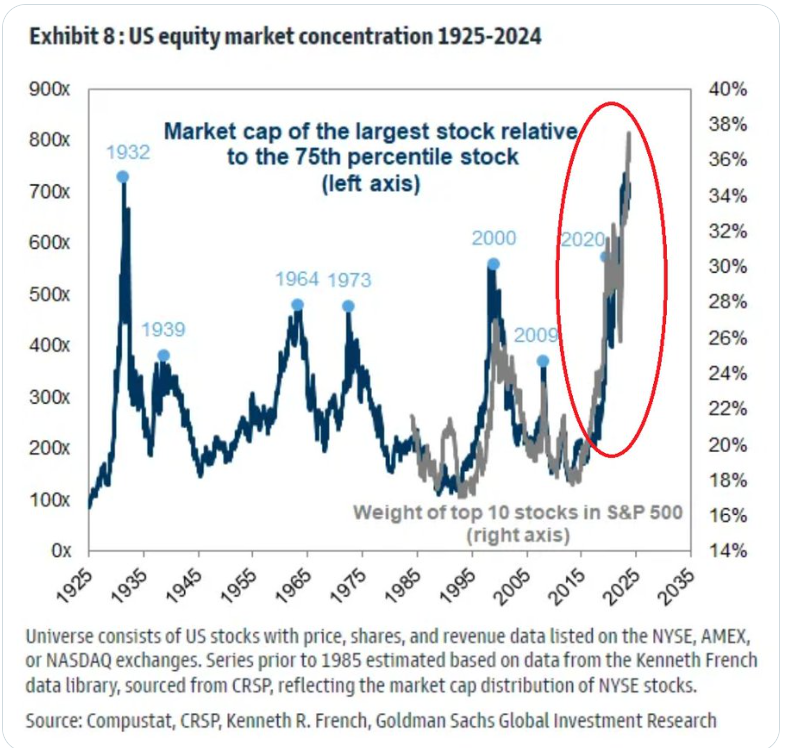

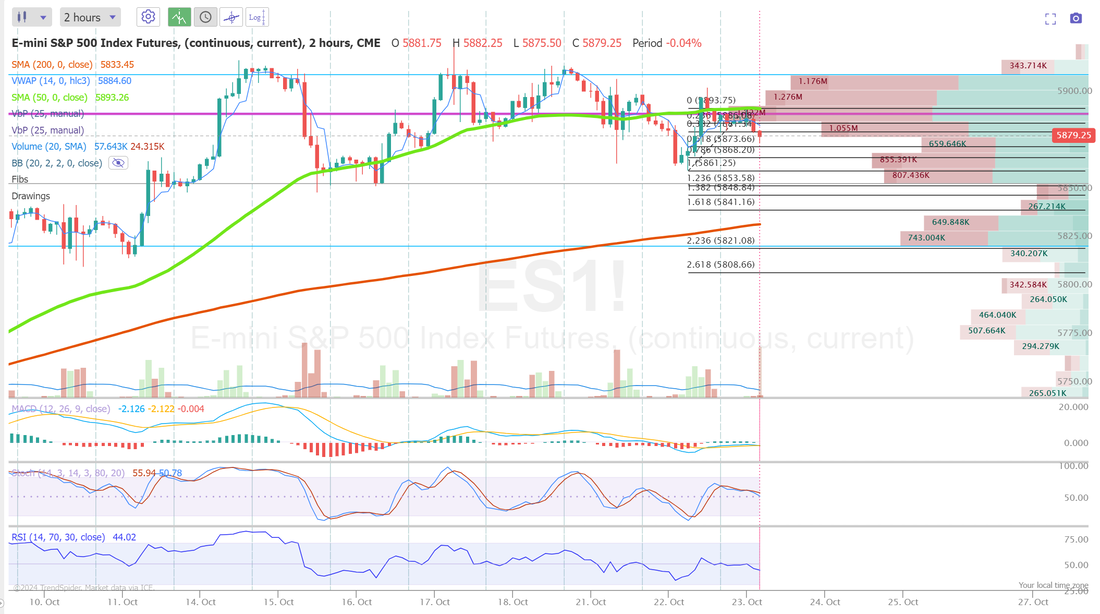

Welcome back traders. It's the mid-week point. We had an "excellent" day yesterday, meaning our net liq was up and our day trades made money. This quote from the wise James Clear really rang home for me yesterday. We aren't neccessarily amazing traders but...we have a system. We have a process and that process is working. Let's take a look at our day yesterday. It was another "excellent" day. My net liq was only up about 4K because our SPX debit still hasn't hit but man, everything else was super strong. I want to talk about a couple of our programs that don't get highlighted much here on the blog. Our day trades get all the attention but we've got plenty more out there working. Our scalping effort is one. We set a big goal this year to bring in $100,000 in profits and I'm proud to say we are well ahead of our goal! We continuously crush our $400 dollar a day target. Who doesn't need an extra $100,000 a year? If you are already trading 0DTE's then you are cutting your potential way down if you're not scalping at the same time. It our easiest, most straight forward program we offer. Check it out: The other is our model portfolio. Not everyone has the time or inclination to day-trade. No worries. We've got plenty of trades that span weeks or months that require little supervision or monitoring. This month we had over 25 of these. With $31,000 of capital we generated over $9,000 in profit! You don't need to day trade to create good potential. An additional benefit is that a lot of these are non-equity correlated and offer nice diversification. If you're interested in seeing how we generated these returns you're welcome to join us for free for a week to check us out. As I said, we had another "excellent" day. My net liq was up 4K and our day trades just killed it. Let's take a look at the market. We start the day with a slight sell signal. Seven trading days...seven! That's how long we've been hanging out near the ATH's. I've been saying and seeing that we've been "toppy" for a while now. Can the bears really gain any momentum? We are only going to stay in this tight zone for so long before some movement shows up. Our biggest position, profit potential wise is our SPX call debit trade that's covered with a credit call spread. It's got a whopping $23,000 of potential profit sitting in it today if we can slide down below 5840 on the SPX. If we don't, I've got a simple little tweak today that will at least guarantee us $5,000 in profit. Yes, that's right. We WILL be banking some profit today on it. No matter what the market does. Want to see how we do it? Come join us in our live trading room. December Nasdaq 100 E-Mini futures (NQZ24) are trending down -0.23% this morning as Treasury yields continued to rise on the prospect of less aggressive Federal Reserve interest rate cuts, while investors awaited a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” member Tesla. In yesterday’s trading session, Wall Street’s main stock indexes ended little changed. Philip Morris International (PM) surged over +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q3 results and lifted its full-year EPS forecast. Also, General Motors (GM) climbed more than +9% after the legacy carmaker reported stronger-than-expected Q3 results and raised the lower end of its full-year adjusted EPS guidance. In addition, Zions Bancorporation (ZION) advanced over +6% after reporting better-than-expected Q3 adjusted net interest income. On the bearish side, Genuine Parts Co. (GPC) tumbled about -21% and was the top percentage loser on the S&P 500 after cutting its full-year adjusted EPS guidance. Also, Verizon Communications (VZ) slid over -5% and was the top percentage loser on the Dow after the telecom giant reported weaker-than-expected Q3 revenue. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing survey rose to a 4-month high of -14 in October, stronger than expectations of -19. Meanwhile, the International Monetary Fund noted that the U.S. election is creating “high uncertainty” for markets and policymakers due to the starkly different trade priorities of the candidates. Investors continue to worry that, no matter who wins the presidential election, there will probably be a rise in both the government’s fiscal deficit and the issuance of bonds, some analysts say. Third-quarter corporate earnings season rolls on, with investors awaiting new reports from prominent companies today, including Tesla (TSLA), Coca-Cola (KO), T-Mobile US (TMUS), Thermo Fisher Scientific (TMO), International Business Machines (IBM), ServiceNow (NOW), AT&T (T), and Boeing (BA). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will focus on U.S. Existing Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that September existing home sales will stand at 3.88M, compared to 3.86M in August. U.S. Crude Oil Inventories data will also be reported today. Economists estimate this figure to be 0.800M, compared to last week’s value of -2.191M. In addition, market participants will be looking toward speeches from Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. U.S. rate futures have priced in an 88.9% chance of a 25 basis point rate cut and an 11.1% chance of no rate change at the next central bank meeting in November. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.239%, up +0.74%. Just some things to note: 1. Bonds are falling like the Fed is raising rates again 2. Gold is rising like the Fed is aggressively cutting rates 3. Oil prices are falling like we are entering a recession 4. Stocks are rising like the bull market just started 5. Home prices are rising like inflation is rebounding 6. Mortgage rates are rising like the economy is strong If you can make sense of all that you're a better man than I Gunga Din. Returns in the market the last couple of years have been well above avg. Reversion to the mean is a real thing. $2.3 trillion of US excess savings have been spent over the last 3 years. As a result, cumulative excess savings are now NEGATIVE $216 billion, according to the Fed data. Meanwhile, US credit card debt is a record $1.1 trillion. Folks, something has to give here. Top 10 largest stocks of the S&P 500 account now for 36% of the index market value, near the most on record. At the same time, the biggest stock (Apple) is 750 TIMES LARGER than the 125th one. Truly unprecedented. My bias or lean today is slightly bearish. No big news catalysts planned. Earnings season marches on. Trade docket for today: TSLA, IBM, UPN, UPS, DXCM, ENPH, BA, GM, KO, LRN, STX, T, TXN, 0DTE's. Let's take a look at our intra-day levels for 0DTE's: /ES; 5890 is the first key resistance. It's PoC on the 2hr. chart 5911 is the big one. The markets had a 100% failure rate, so far, in trying to hold above this level. 5864 is the first support line then 5854. If the bears can push below that we may have some downside potential. /NQ: The Nasdaq continues to lag the SP500 in terms of strenght to the upside. 20543, 20586, 20658 are the closest resistance levels. 20448 and 20361 are support. Below 20361 we could see some substantive downside. BTC: We've got a couple large crypto trades on right now with BTC and ETH. This slight retrace has been very helpful to our positions. 69,172 is resistance and 65173 is support. Let's keep this winning streak going folks. Let's make some money today! See you in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |