|

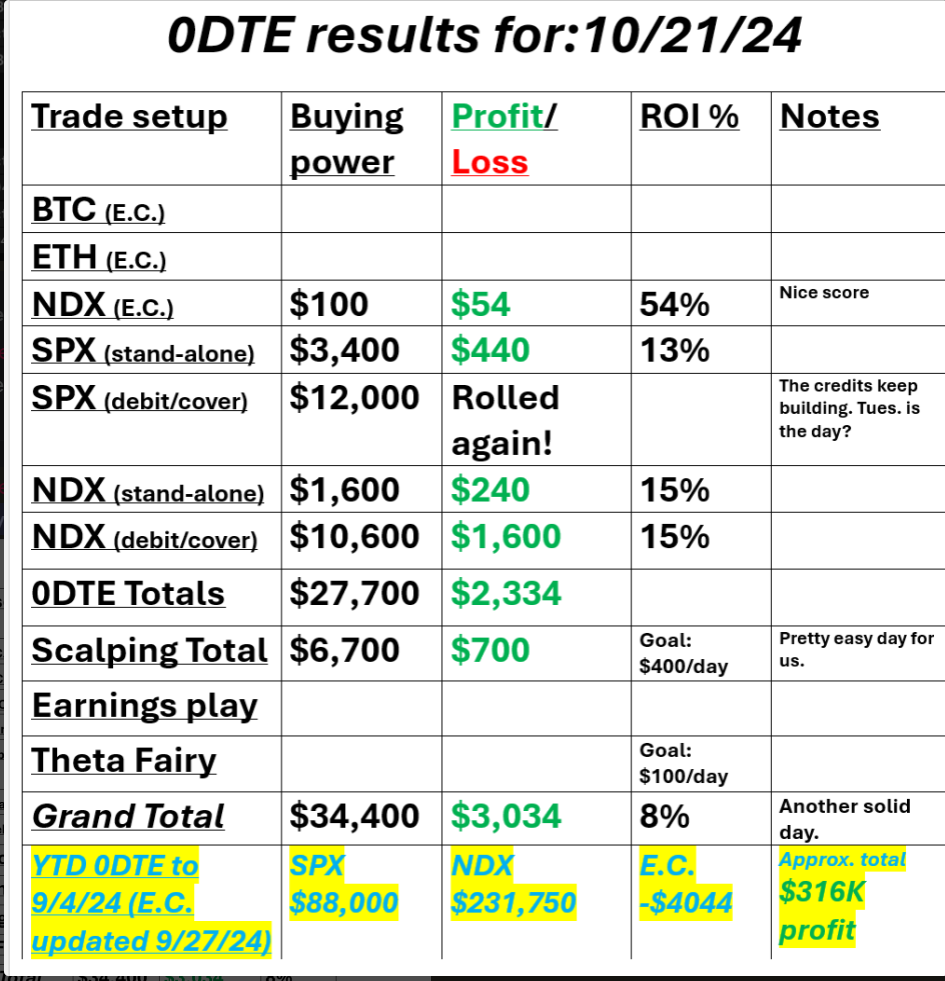

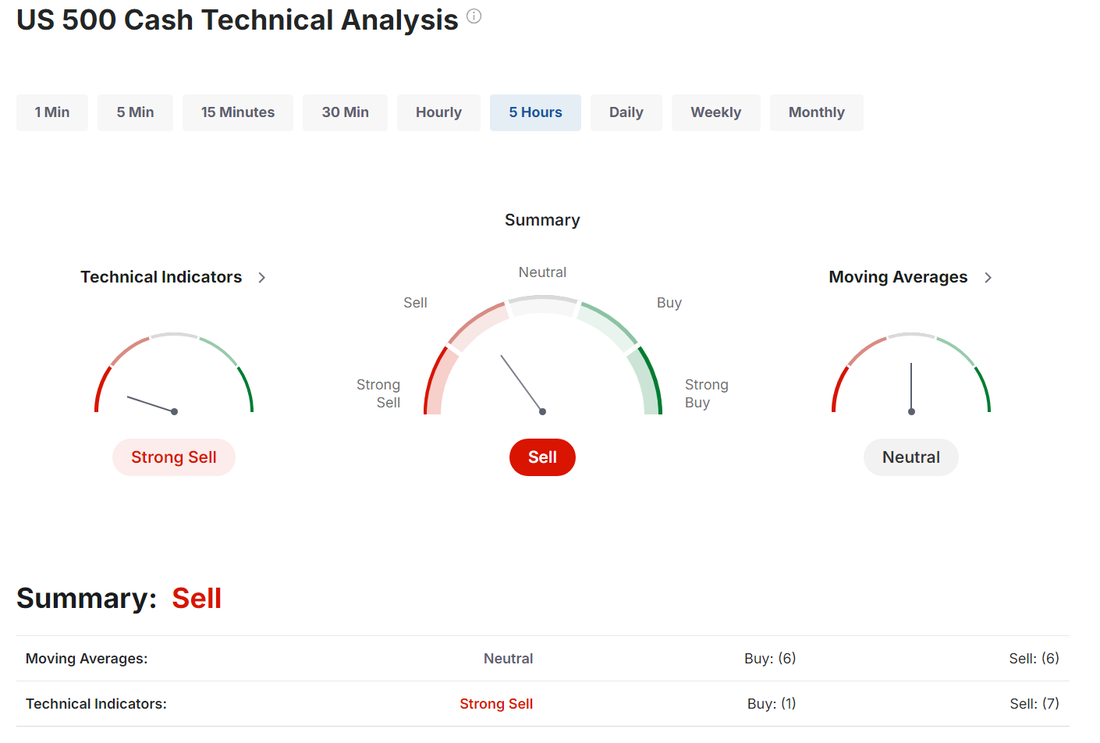

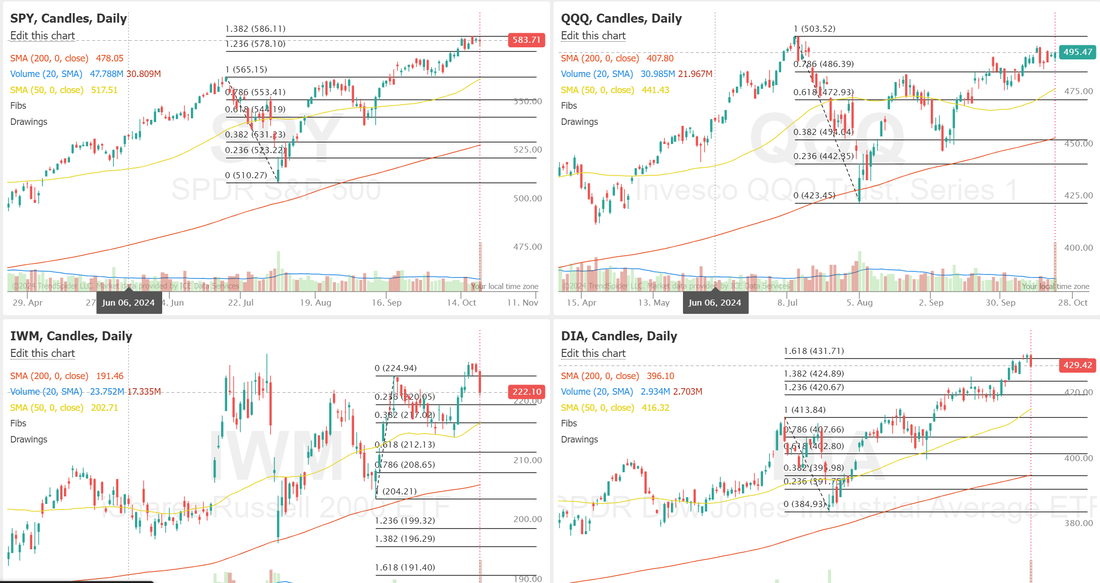

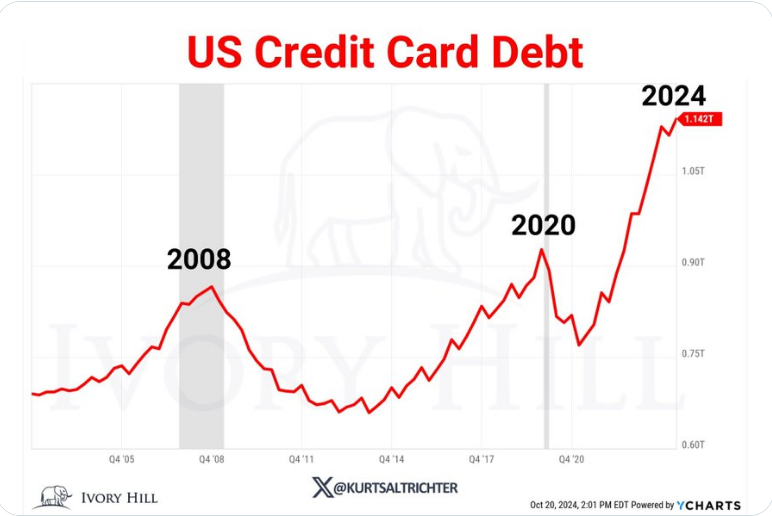

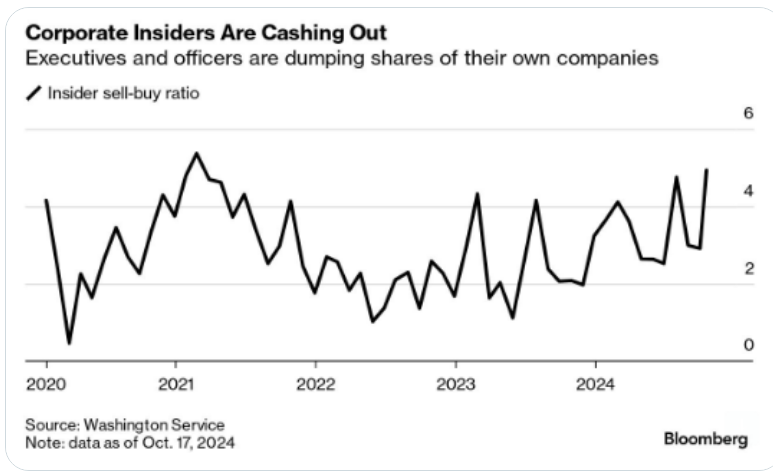

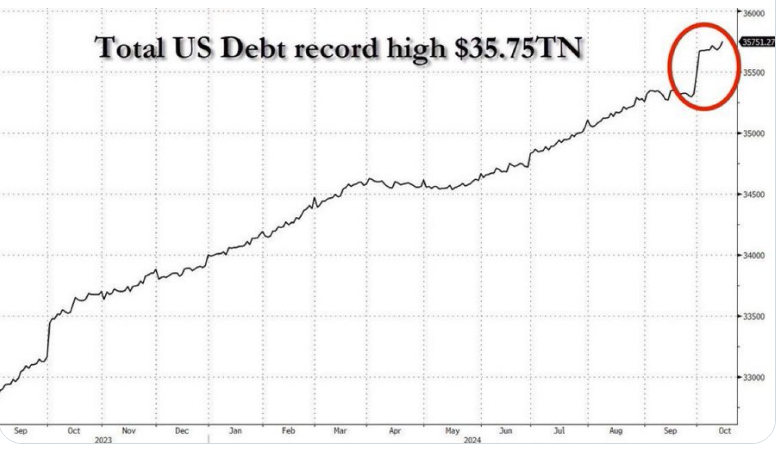

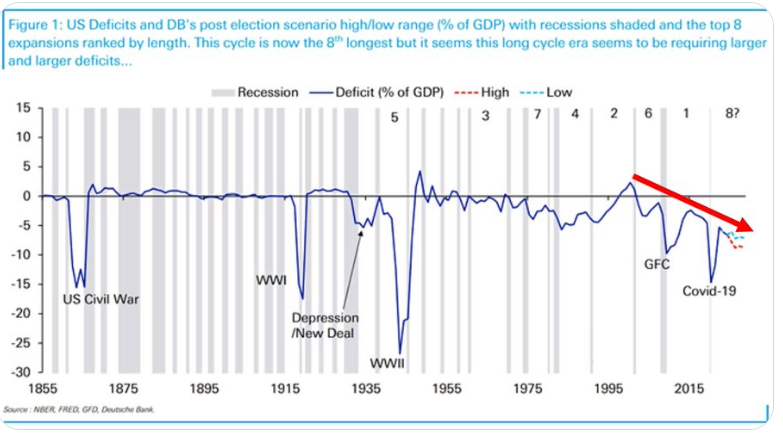

Welcome back traders! Today is Tuesday. We had a solid day yesterday. All our trades worked with the exception of the SPX debit. We rolled the cover on it again. This morning looks good with futures down a bit. Maybe today is our payoff day? The payoff continues to grow. This is what it looks like going into todays trading session. It could be almost a $15,000 dollar payday. Here's our results from yesterday. It was another "excellent" day. Our net liq was up and we made money on our day trades. Let's take a look at the markets: We've got an ever so slight sell signal forming this morning. We are due for a pullback and today may be that day. This is now six days in a row that the major indices can't break higher. A rollover looks more and more likely. My bias for the day: Bearish. It's time. We've been running out of gas for six days now. Buyers are getting tired. Without a major catalyst today I think we drift lower. Our SPX debit/cover trade would like that (and so would our bank accounts). December S&P 500 E-Mini futures (ESZ24) are down -0.46%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.62% this morning as Treasury yields extended their rise amid speculation on the trajectory of U.S. interest rates, while investors geared up for the next round of corporate earnings. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Cigna Group (CI) slumped over -4% after Bloomberg reported that the company was reviving efforts to merge with its smaller rival Humana. Also, homebuilder stocks lost ground after the benchmark 10-year Treasury yield rose to a 2-1/2 month high, with Builders FirstSource (BLDR) sliding more than -5% to lead losers in the S&P 500 and DR Horton (DHI) falling over -4%. In addition, United Parcel Service (UPS) dropped more than -3% after Barclays downgraded the stock to Underweight from Equal Weight with a price target of $120. On the bullish side, Kenvue (KVUE) advanced more than +5% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that activist investor Starboard Value had taken a sizeable stake in the company. Also, Boeing (BA) rose over +3% and was the top percentage gainer on the Dow after the company and the leaders of its striking machinists union reached a new tentative agreement that could end a strike lasting over a month. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in September, weaker than expectations of -0.3% m/m. Dallas Fed President Lorie Logan reiterated her stance on Monday that the U.S. central bank should lower interest rates at a careful pace given the uncertain economic environment. “If the economy evolves as I currently expect, a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve our goals,” Logan said. Also, Minneapolis Fed President Neel Kashkari reiterated that he supports reducing interest rates at a gradual pace in the coming quarters, though a sharp weakening of the labor market could prompt him to push for faster rate cuts. In addition, Kansas City Fed President Jeffrey Schmid stated he supports a slower pace of interest rate cuts due to uncertainty about the ultimate level to which the Fed should reduce rates. Meanwhile, U.S. rate futures have priced in an 88.9% probability of a 25 basis point rate cut and an 11.1% chance of no rate change at the next FOMC meeting in November. Third-quarter earnings season is gathering pace, with investors awaiting fresh reports from notable companies today, including General Electric (GE), Philip Morris (PM), Verizon (VZ), Texas Instruments (TXN), Lockheed Martin (LMT), General Motors (GM), and 3M (MMM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will likely focus on the U.S. Richmond Manufacturing Index, which is set to be released in a couple of hours. Economists estimate this figure to come in at -19 in October, compared to the previous value of -21. Market participants will also be anticipating a speech from Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.212%, up +0.60%. Here's a few things I'm thinking about. Gold hits new all time high despite surging dollar; the precious metal has now completely disconnected from the greenback amid relentless central bank buying Credit card debt is exploding way beyond 2008 and 2020 levels. If history’s taught us anything, it’s that this kind of spike usually screams incoming economic crash. Time will tell. Corporate Insiders are dumping shares at the fastest pace in more than 3 years Rates just keep moving higher! Either the bond market is wrong on this economy or the FED is. The Bond market is rarely wrong! Half a TRILLION dollars has been added to the National Debt in the in the past 3 weeks. Wasteful spending is out of control in this country. A Department of Government Efficiency is desperately needed. I don't get into politics here but a Trump presidency is important. Not for Trump (IMHO) rather to get Elon Musk in there to cut spending and Bobby Kennedy to clean up our horrible food sources. US public deficit hit $1.8 trillion in Fiscal Year 2024 or 6.4% of GDP, the largest since 2021. Over the last 200 years, it has been higher only during wars, the Great Financial Crisis, and the COVID Crisis. There will be a day of reckoning. I don't know when and I don't know how bad but it IS coming. Trade docket for today: T, STX, ENPH, KO, BA, GM, TXN, VZ, /MNQ,QQQ,/NQ scalping, 0DTE's. Let's go get em today folks! All eyes on the SPX debit trade!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |