|

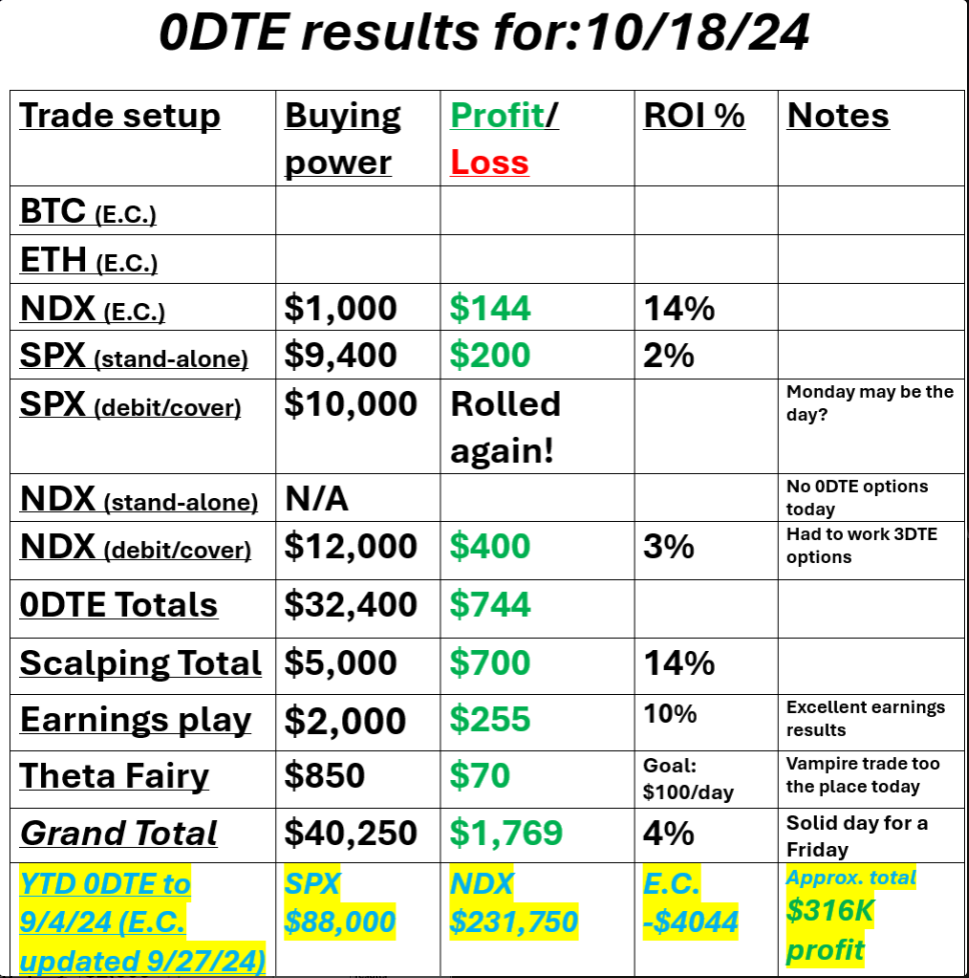

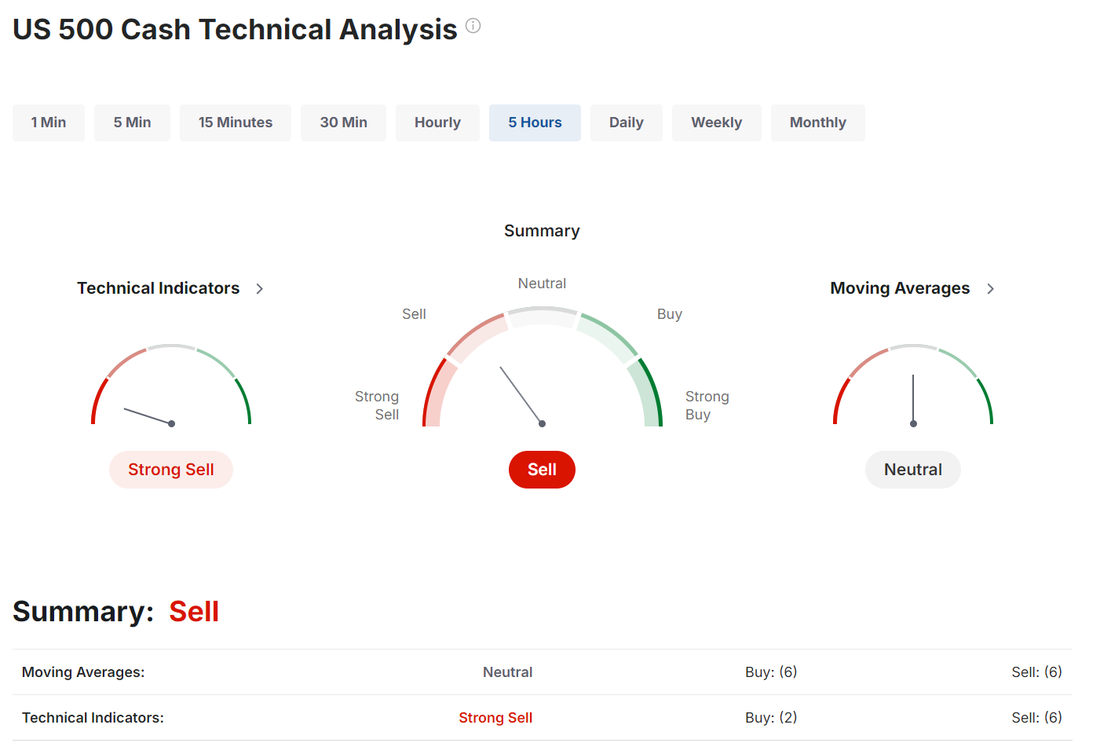

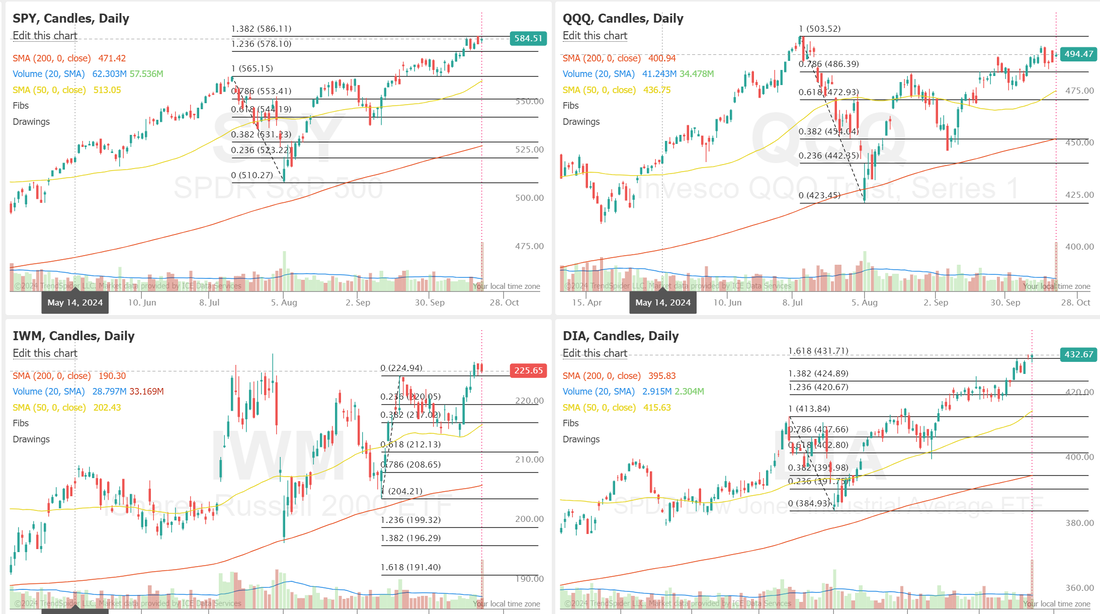

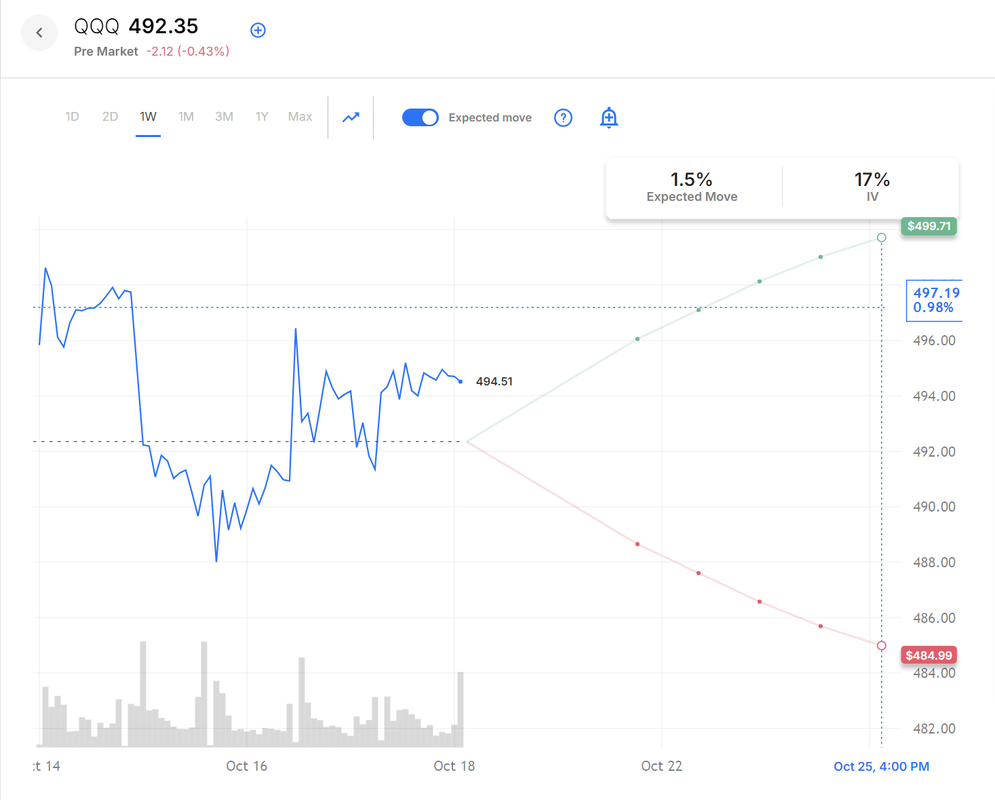

Welcome back traders! It's a new week. Our Friday worked out o.k. It's always a little tougher on overnight Vampire trade days (third friday of each month) as we don't have the 0DTE NDX options to work. Our results are below: We've got a lot of accrued credits in the SPX debit setup. Will today be payoff day? We'll know by this afternoon. Let's take a look at the markets. We would benefit from a slight down day. Futures are dropping slightly at the open. We continue to sit, perched at the ATH's. This week, the SPY closed at another record high of $584.59 (+0.87%), as the price attempts to break free from the rising wedge it’s been trapped in since early August. The CHATS indicator shows a strong uptrend reading that has held steady for nearly a month, and the rising 5-day SMA serves as a key signal to stay the course with bullish positions. Despite a modest gain relative to last week’s close, QQQ ended the week in the red at $494.47 (+0.23%). This index remains the weakest of the bunch, with the price hovering just above a flat 5-day SMA and gravitating toward the bottom of the rising wedge. It’s also struggling to maintain the ‘strong uptrend’ signal from CHATS. IWM delivered the strongest performance this week, closing just below the top of its rising wedge at $225.65 (+1.97%). Historically, each test of this wedge’s upper boundary has coincided with a ‘strong uptrend’ reading on CHATS. However, the recent three-day consolidation is a more constructive pattern than we’ve seen before, suggesting the index could be gearing up for a potential breakout. December S&P 500 E-Mini futures (ESZ24) are down -0.36%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.55% this morning as Treasury yields climbed at the start of a busy week, with investors looking ahead to a fresh batch of U.S. economic data, comments from Federal Reserve officials, and corporate earnings reports. In Friday’s trading session, Wall Street’s major averages ended higher, with the blue-chip Dow notching a new all-time high. Netflix (NFLX) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the streaming giant posted upbeat Q3 results. Also, Intuitive Surgical (ISRG) climbed more than +10% after the company reported stronger-than-expected Q3 results. In addition, Lamb Weston Holdings (LW) gained over +10% after activist investor Jana Partners disclosed a 5% stake in the company and said it plans to push the french-fry maker to explore a sale. On the bearish side, American Express (AXP) fell more than -3% and was the top percentage loser on the Dow after reporting weaker-than-expected Q3 revenue and lowering its full-year revenue growth guidance. Economic data released on Friday showed that U.S. housing starts fell -0.5% m/m to 1.354M in September, stronger than expectations of 1.350M. At the same time, U.S. September building permits, a proxy for future construction, fell -2.9% m/m to 1.428M, weaker than expectations of 1.450M. “Earnings season is off to the races, and despite some mixed signals, appears to be in good shape,” said Liz Young Thomas, head of investment strategy at SoFi. “We’re in the early innings though, and coming up on the final days before the election and the next Fed meeting. Never a dull moment.” Meanwhile, U.S. rate futures have priced in a 90.2% probability of a 25 basis point rate cut and a 9.8% chance of no rate change at the conclusion of the Fed’s November meeting. Third-quarter earnings season kicks into high gear this week, with investors looking forward to new reports from prominent companies including Tesla (TSLA), Coca-Cola (KO), T-Mobile (TMUS), Verizon (VZ), Texas Instruments (TXN), Lockheed Martin (LMT), General Motors (GM), 3M (MMM), IBM (IBM), AT&T (T), Boeing (BA), UPS (UPS), L3Harris Technologies (LHX), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. Market participants will also be monitoring a spate of economic data releases this week, including the U.S. S&P Global Composite PMI (preliminary), the S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), the Richmond Manufacturing Index, Existing Home Sales, Crude Oil Inventories, Building Permits, Initial Jobless Claims, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, and the University of Michigan’s Consumer Sentiment Index. In addition, the Federal Reserve will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. A host of Fed officials will be making appearances throughout the week, including Logan, Kashkari, Schmid, Daly, Harker, Bowman, and Barkin. In other news, Israel is in discussions regarding its response to Iran after a Hezbollah drone exploded near Prime Minister Benjamin Netanyahu’s private residence over the weekend. Today, investors will likely focus on the U.S. Conference Board’s Leading Index, which is set to be released in a couple of hours. Economists expect the September figure to be -0.3% m/m, compared to the previous number of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.121%, up +1.11%. Let's take a look at the expected moves this week: Not much volatility to start the week. My bias or lean today is neutral. Time for a pause, I believe. Trade docket for today: /MNQ, QQQ scalping. VX, TXN, GM earnings trades, /NG, SPY$QQQ 4DTE and 0DTE's We don't have a bunch of economic new today. Maybe today it the payoff day for our SPX debit trade?

See you all in the trading rooms shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |