|

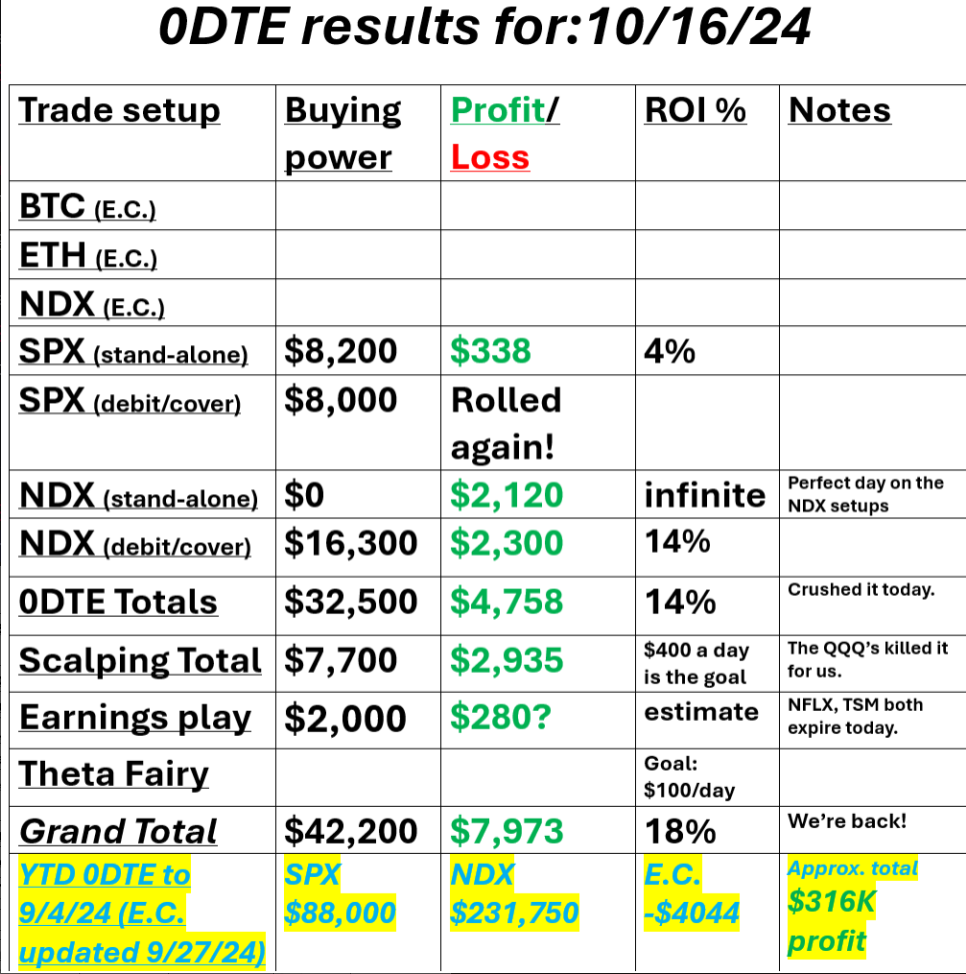

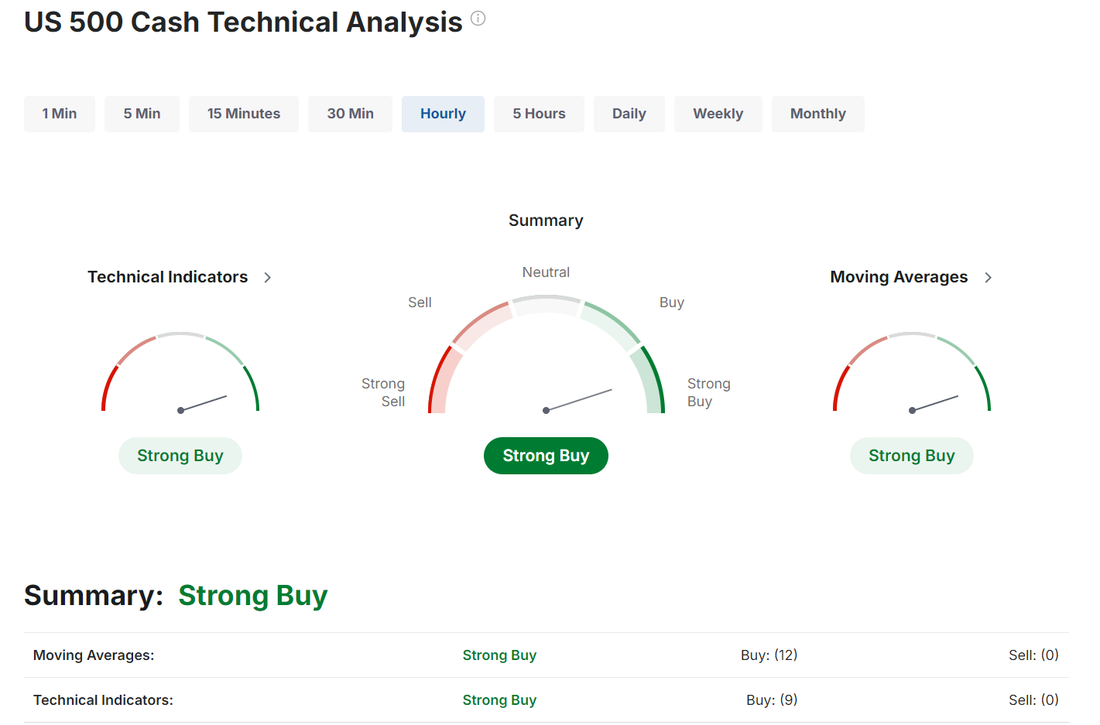

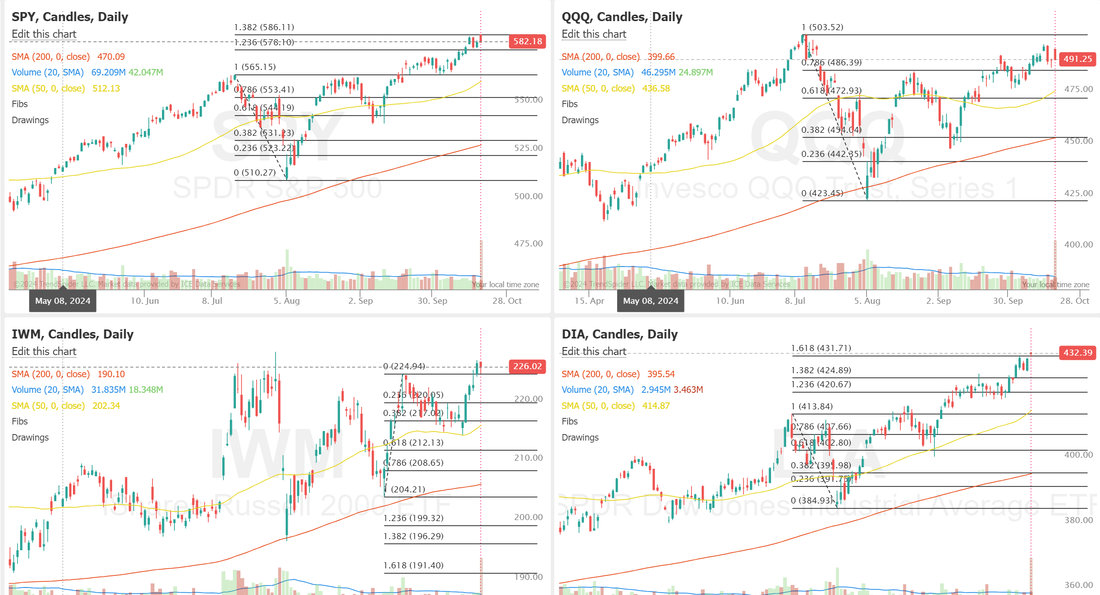

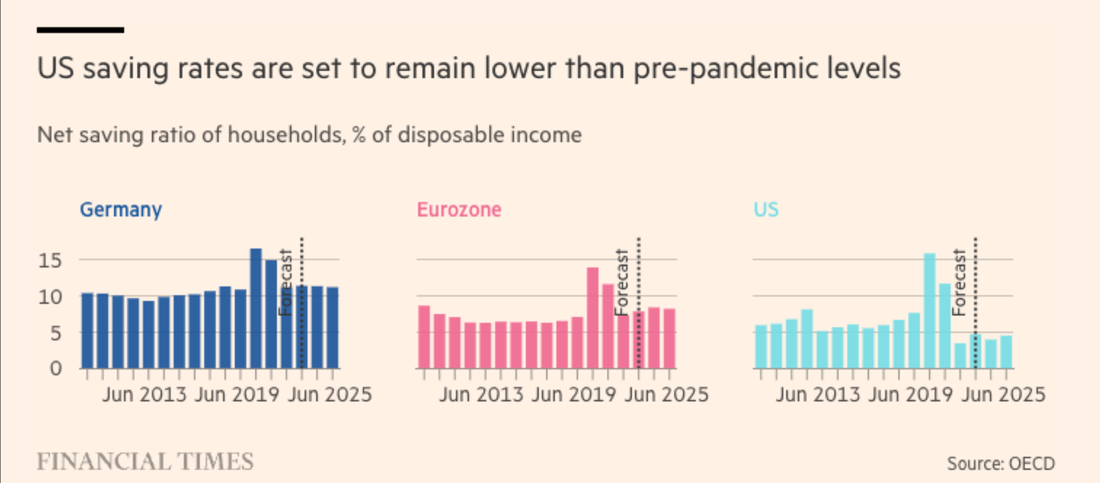

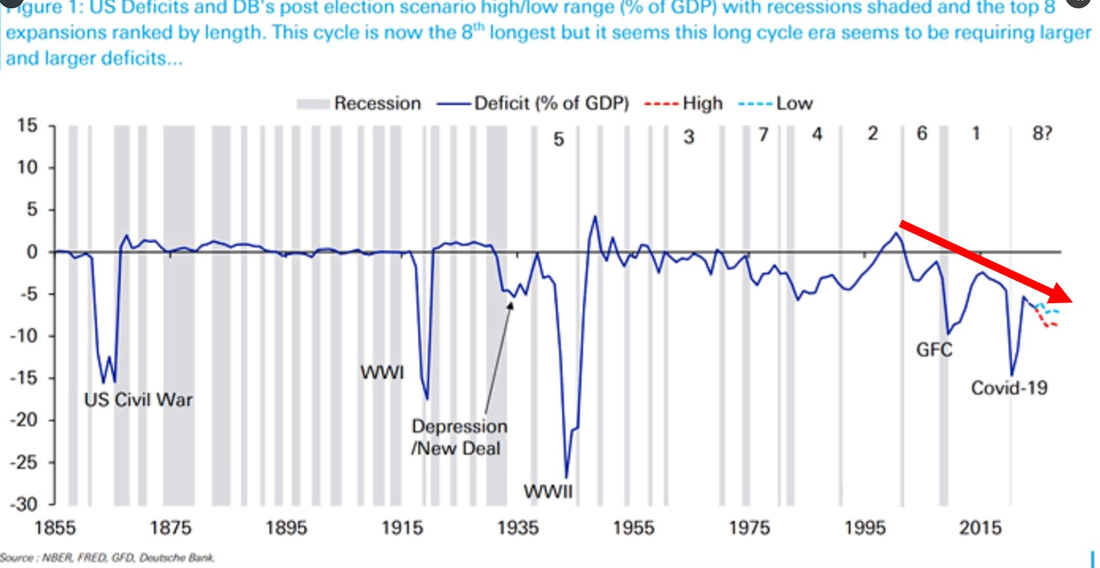

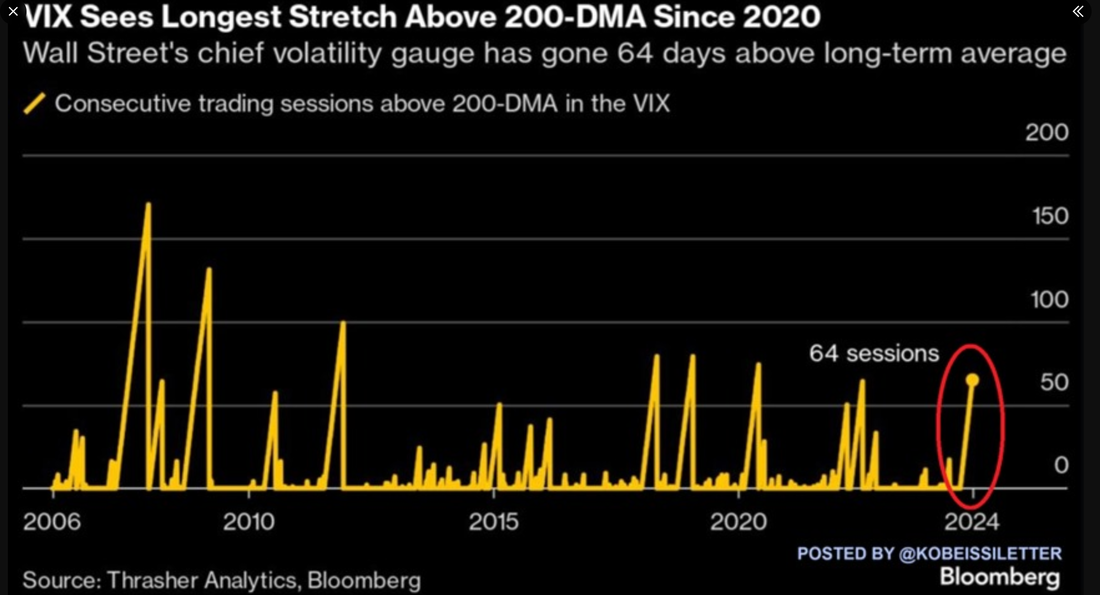

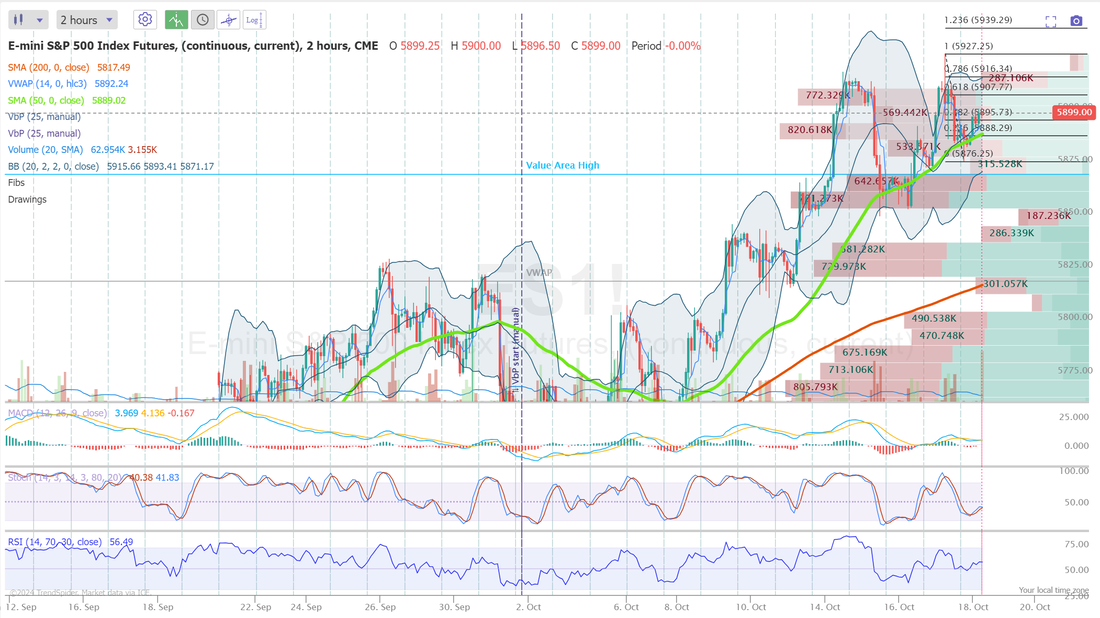

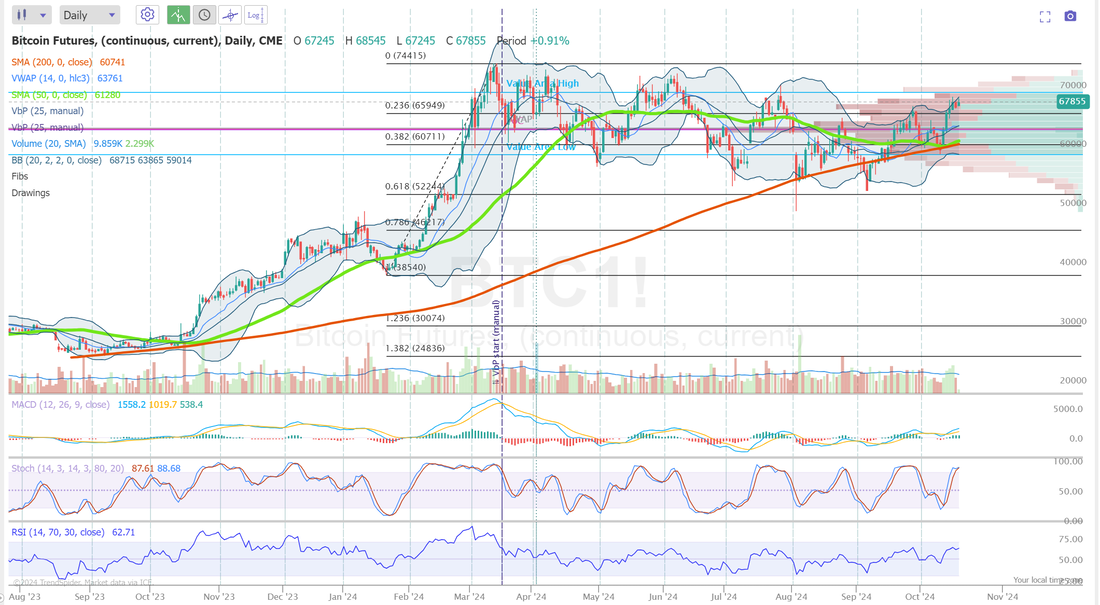

Welcome to a rainy, drizzly Friday, here in Utah. We went from 88 degrees to 45 overnight! Heading into winter I guess. Where has the year gone? Folks...we are back! In the imortal words of the great LL Cool J. Don't call it a comeback! We had an absolutely amazing day yesterday. We almost got our SPX debit to finish in the profit zone too! That was close but no cigar. Maybe today? Either way, that trade contiues to look better and better. Here's our results. Scalping, once again, killed it for us. Let's take a look at this crazy market and a couple things we should be keeping in mind. Buy mode is still in place. Do we look a little "toppy" here? Sure. We usually do when we are hovering around ATH's. That's not neccessarily a bearish indicator. There are a few things, however, I think we should keep in mind. In the cause of fairness and balanced viewing. Even as we push to new ATH's we are starting to see negative divergence with the RSI. US saving rates are in the toilet. Gold hits new all time high despite surging dollar; the precious metal has now completely disconnected from the greenback amid relentless central bank buying US public deficit hit $1.8 trillion in Fiscal Year 2024 or 6.4% of GDP, the largest since 2021. Over the last 200 years, it has been higher only during wars, the Great Financial Crisis, and the COVID Crisis. The Volatility index, $VIX, has been trading above its 200-day moving average for 64 trading sessions, the longest stretch since 2020. This streak is even longer than the one seen during the 2022 bear market. This is all despite the S&P 500 rallying 22.5% and hitting 45 all-time high this year. Meanwhile, bond market volatility has jumped 40% in October and hit its highest level since November 2023. Are volatility metrics trying to tell us something? AT THE PEAK OF THE DOTCOM BUBBLE, CISCO WAS WORTH 5.5% OF THE US GDP AND TODAY $NVDA IS WORTH OVER 11.7% WHICH IS 200% HIGHER WHEN THIS BUBBLE POPS, AND IT WILL, IT WILL LEAD TO A COLLAPSE BIGGER THAN 2008 Buffett valuation indicator of the #stockmarket has NEVER been this high. Higher than ever before, including Nov 2021 and the Dot-Com Bubble. All this isn't to imply we are due a crash but...you never know when the next one is coming. As my wife likes to joke, "Jesus is coming. Look busy everyone!" Best to be prepared so as not to be shocked. My lean or bias today is neutral. Low volume. Friday. Not a lot of news catalysts. We would need something to get us moving today IMHO save for a sell off like we had a few days ago. That could happen on its own with a little nudge. Let's take a look at the intra-day levels for /NQ, /ES and Bitcoin. /ES: It's always tough to pinpoint clear resistance levels when you are breaking ground into new ATH's but 5907 is the first level. 5915 the next. 5926 is the key. It's our ATH and a push above that would keep the bullish party going. 5888 is the first key support. This is the 50 period M.A. 5878 is next. Below that we have some room to move. The Nasdaq, once again, is having a bit more struggle to the upside than the other major indices. 20491 is first resistance with 20533 and 20594 the next two levels. 20426 is the first really key support. It's the PoC on the 2hr. chart. 20387 is the next. BTC: Bitcoin has been on a nice run lately. I've got a decent amount of long term investment capital in both BTC and ETH so I'd like to see those new ATH's everyone keeps talking about but, I've also got an event contract trade on that wins if we DON'T hit new ATH's before Dec. 31st. AND we also have some juicy Iron Condors on in the trading room that could use some stabilization for the next week. We do seem to be stalling here. 68,562 is resistance with 66798 support. Let's make it happen today folks! A strong finish to the week would be sweet! I need to get back to pulling a daily paycheck! Eye surgery is next week and they will want payment! LOL

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |