|

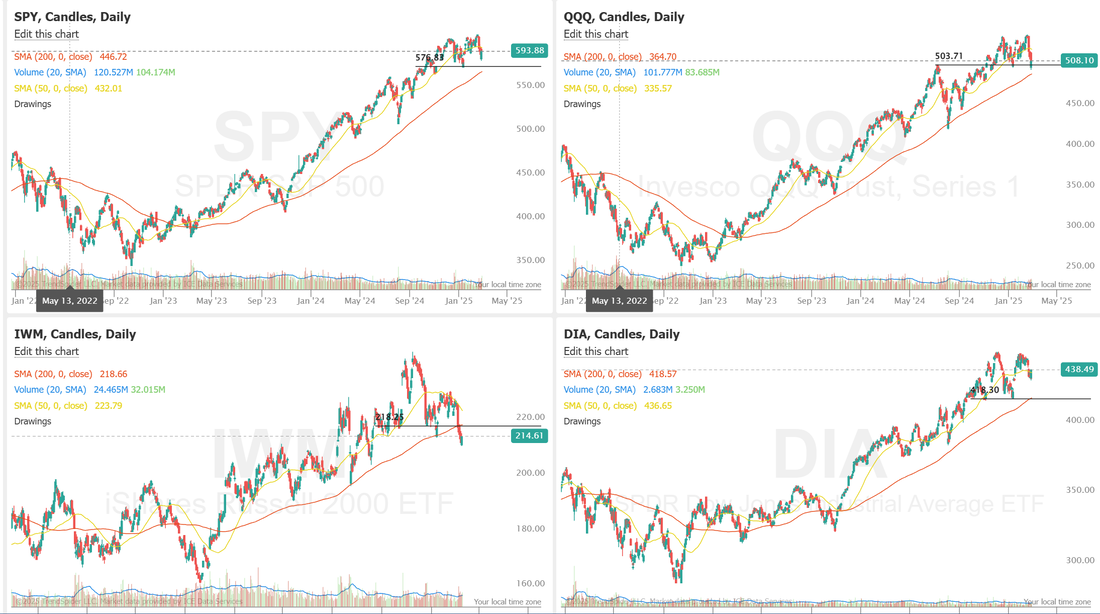

Welcome back traders to a new week and a new month! Friday was another big drawdown for me. This happens but it shouldn't happen this much. This is the third time this year I've had a big drawdown like this. We're goint to talk about a couple new rules today in our zoom to hopefully cut this down. Here's my results from Friday. Just unacceptable, as I said so we'll incorporate a couple new mechanical rules into our trades. On the bright side, our scalping is going well as well as our 1HTE's but I'm also impressed with our ATM passive portolio. We made money last year but lagged the overall market. This year we are outperorming and I think we'll have a really good shot at beating the market once again. Let's take a look at this market. Fridays push higher created a bit more bullish stance than we've had in some time. QQQ's are up off their critical support zone. DIA looks like it's building strength for the first time in a while and while IWM is still under its 200DMA its improving as well. We've had a bearish setup on both the IWM and DIA in our ATM portfolio. We'll be closing those today and opening a bullish position in the VTI. It could be a tad early. Stoch is giving us a buy but MACD and RSI aren't quite there. That's where the cash flow component of the trade will kick in. March S&P 500 E-Mini futures (ESH25) are up +0.23%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.34% this morning, starting a busy week on a positive note. This week, investors look ahead to remarks from Federal Reserve Chair Jerome Powell and other Fed officials, earnings reports from several high-profile companies, as well as a slew of U.S. economic data, with a particular focus on Friday’s nonfarm payrolls report. Investors are also waiting for news of any last-minute negotiations to prevent a further increase in U.S. trade tariffs on Chinese goods, set to take effect on Tuesday, along with levies on Mexico and Canada. In Friday’s trading session, Wall Street’s major equity averages closed higher. AES Corp. (AES) surged over +11% and was the top percentage gainer on the S&P 500 after the company posted better-than-expected Q4 adjusted EPS and issued above-consensus FY25 adjusted EPS guidance. Also, chip stocks gained ground, with Nvidia (NVDA) advancing nearly +4% to lead gainers in the Dow and Intel (INTC) rising more than +2%. In addition, Monster Beverage (MNST) climbed over +5% after reporting stronger-than-expected Q4 revenue. On the bearish side, NetApp (NTAP) plunged more than -15% and was the top percentage loser on the S&P 500 after cutting its full-year adjusted EPS guidance. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.3% m/m and +2.6% y/y in January, in line with expectations. Also, U.S. January personal spending unexpectedly fell -0.2% m/m, weaker than expectations of +0.2% m/m, while personal income grew +0.9% m/m, stronger than expectations of +0.4% m/m. In addition, the U.S. Chicago PMI rose to a 5-month high of 45.5 in February, stronger than expectations of 40.5. “While additional rate cuts are still probably many months away, we believe [January’s PCE report] helps to keep one or two rate cuts on the table for 2025,” said Robert Ruggirello at Brave Eagle Wealth Management. Meanwhile, U.S. rate futures have priced in a 93.0% probability of no rate change and a 7.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. The U.S. February Nonfarm Payrolls report will be the main highlight this week as it could serve as a crucial indicator of the direction of U.S. interest rates. Other noteworthy data releases include U.S. ADP Nonfarm Employment Change, the S&P Global Composite PMI, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Factory Orders, Crude Oil Inventories, Exports, Imports, Initial Jobless Claims, Nonfarm Productivity, Unit Labor Costs, Trade Balance, Wholesale Inventories, Average Hourly Earnings, the Unemployment Rate, and Consumer Credit. Fed Chair Jerome Powell is set to deliver a speech on the economic outlook at the University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum on Friday. A host of other Fed officials will also be making appearances throughout the week, including Williams, Waller, Barkin, Bostic, Bowman, and Kugler. Market participants will also focus on earnings reports from several high-profile companies. Prominent companies such as Broadcom (AVGO), CrowdStrike (CRWD), Hewlett Packard Enterprise (HPE), MongoDB (MDB), and Marvell Technology (MRVL), along with retailers like Target (TGT), Costco (COST), Best Buy (BBY), and Macy’s (M) are scheduled to report their quarterly results this week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Today, all eyes are focused on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the February ISM manufacturing PMI will be 50.6, compared to January’s figure of 50.9. Investors will also focus on the U.S. S&P Global Manufacturing PMI, which stood at 51.2 in January. Economists expect the final February figure to be 51.6. U.S. Construction Spending data will be released today as well. Economists foresee this figure coming in at -0.1% m/m in January, compared to +0.5% m/m in December. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.252%, up +0.54%. My lean or bias today is cautiously bullish. We are switching from our bearish setups in the ATM program to a bullish VTI setup and our 0DTE's today will likely reflect a bullish bias as well. It's Monday so it's busy. We'll be working our normal weekly setups with /GC, possibly /MCL, BITO, maybe /ZN and DIA ladders. BPMC, INTU, WYNN, DHI, ADVS, aCA, ASGN as well as our 1HTE and 0DTE's. The SPY closed lower last week at $594.18 (-0.95%). Bears briefly forced a breakdown below the neckline of its double top, but a strong end-of-month rally reclaimed that level, leaving traders questioning whether this is just an oversold bounce or the start of a meaningful reversal. With the daily RSI curling up from deeply oversold conditions not seen since August 2024, the coming sessions will be critical in determining if bulls can sustain momentum or if further downside awaits. QQQ took the hardest hit last week, sliding to $508.17 (-3.41%) and testing a critical support zone. It now sits at the neckline of a developing double top, which also aligns with its year-to-date low, making this a major battleground for both bulls and bears. With RSI starting to stabilize after hitting oversold territory, momentum signals suggest a potential inflection point. A decisive break lower could accelerate downside pressure, while a hold at this level may open the door for a relief bounce. While IWM sold off the most last week, it ended up bouncing strongly off its falling wedge support and closing at $214.65 (-1.42%). With the daily RSI emerging from oversold territory, the laggard small caps could use this as an opportunity to play catchup with the other major indices. If buyers step in and momentum builds, this laggard may be primed for a much-needed bullish reversal. VIX1D above 18 is not bad I.V. to start the week. Bitcoin (and crypto in general) talk about a "crypto reserve" of the U.S. is heating up. It created quite the bounce. Let's take a look at the market intra-day levels. /ES: Looking more bullish. 6023 is new resistance with 5949 working as support. /NQ: This is the first time in a while that the percentage move potential to the resistance level is greater than the potential move to support. Resistance is now at 21,383 with support at 20,903. BTC: And just like that...Bitcoin is back! One mention of forming a strategic reserve and we get a big pop. We'll have to see how today absorbs the news but right now 95,781 is resistance with 92,340 working as support. Tight range this morning. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |