|

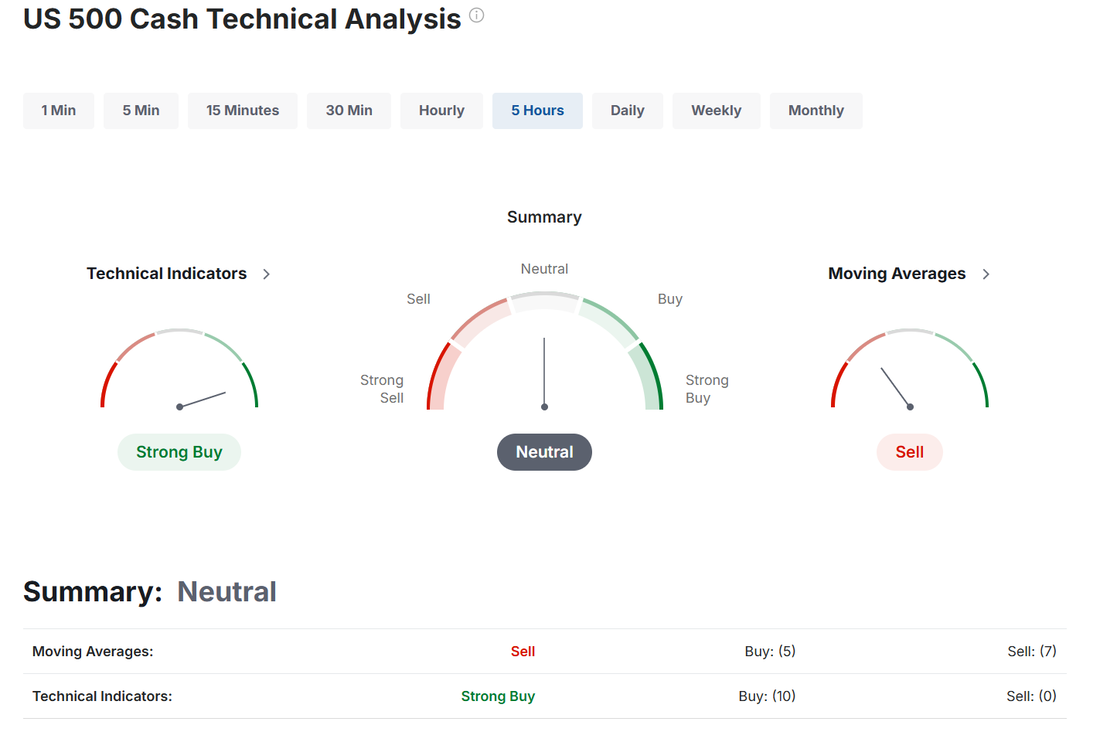

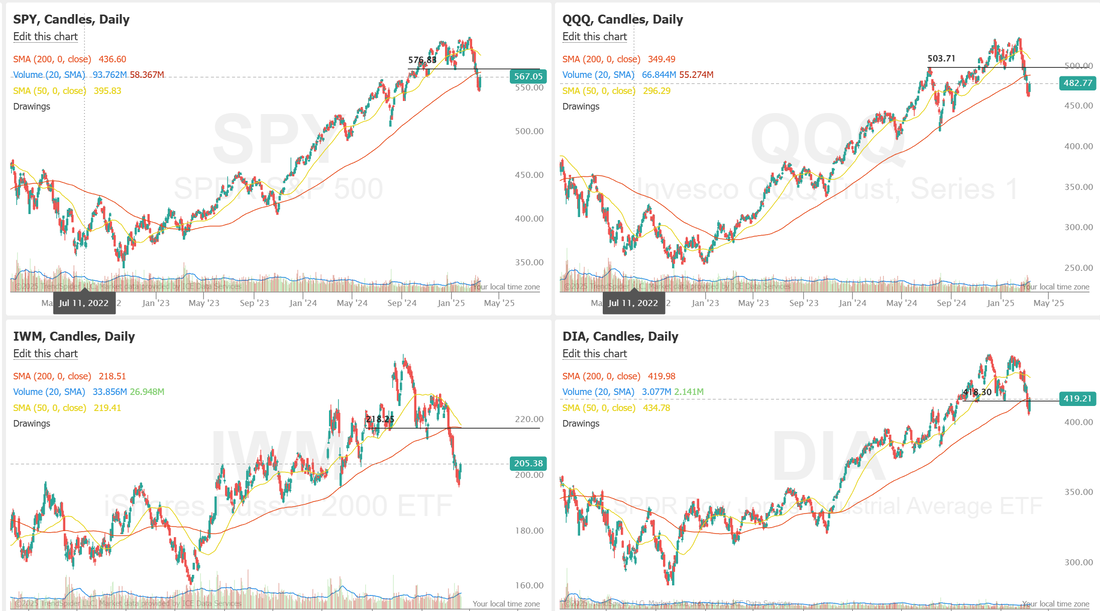

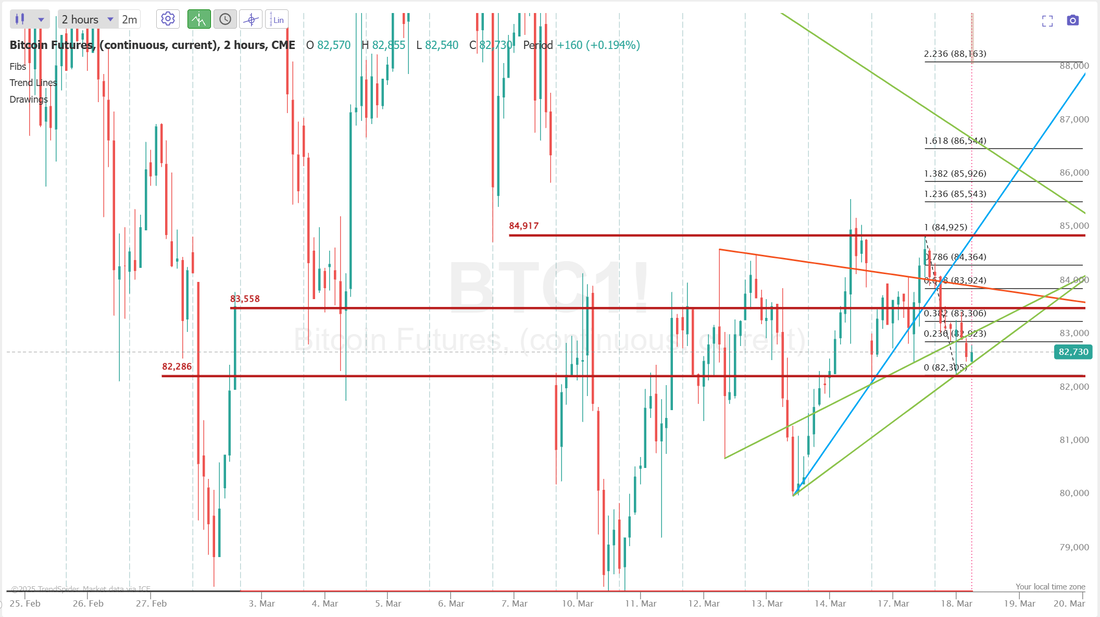

Welcome back traders! We had an excellent start to the week. Our butterflies worked well and we were able to land inside a nice profit zone. I was a little too excited about our prospects this week for Theta fairy's. What looked like some amazing opportunities went away very quickly yesterday as I.V. dropped like a rock! It was amazing to watch. After it held up so well on Friday I thought a "little" 50 point push up in SPX would be fine. Nope. Volatility plummeted. That means, at least for now, No Theta fairys. Bummer. We do contnue to benefit from our combination of broken wing butterflies and credit spreads. I'm assuming we'll use the same approach today. Here's a look at our day. Let's take a look at the markets today as we prepare for FOMC tomorrow. We start the day with a neutral rating, which makes sense. This market is trying to find its footing but good grief, I hate neutral days. Very tough to ferret out a directional bias. We are still stuck well below our 200DMA on most indices but the market it trying to fight back. I'll turn bullish when we can recapture our support lines. March S&P 500 E-Mini futures (ESH25) are trending down -0.19% this morning as investors await the start of the Federal Reserve’s two-day policy meeting and a fresh batch of U.S. economic data. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Intel (INTC) climbed over +6% and was the top percentage gainer on the Nasdaq 100 after Reuters reported that incoming CEO Lip-Bu Tan was considering significant changes to the company’s chip manufacturing methods and AI strategies. Also, Netflix (NFLX) rose more than +3% after MoffettNathanson upgraded the stock to Buy from Neutral with a price target of $1,100. In addition, Science Applications International Corp. (SAIC) gained over +7% after the information technology company posted better-than-expected Q4 results and raised its full-year guidance. On the bearish side, Tesla (TSLA) slid more than -4% and was the top percentage loser on the Nasdaq 100 after Chinese rival BYD Co. introduced a new electric vehicle system capable of charging a car in just five minutes. Economic data released on Monday showed that U.S. retail sales crept up +0.2% m/m in February, weaker than expectations of +0.6% m/m. Also, U.S. February core retail sales, which exclude motor vehicles and parts, rose +0.3% m/m, in line with expectations. In addition, the Empire State manufacturing index tumbled to a 14-month low of -20.00 in March, weaker than expectations of -1.90. “[Yesterday’s] February retail sales report offers evidence of a limited, modest economic slowdown, rather than signaling a gathering recession,” said Jennifer Timmerman at Wells Fargo Investment Institute. The Federal Reserve kicks off its two-day meeting later in the day. The U.S. central bank is widely expected to hold the Fed funds rate steady at 4.25% to 4.50% on Wednesday. The decision comes amid growing concerns about the potential damage that U.S. President Donald Trump’s tariff policies could inflict on the economy. Market watchers will closely follow Chair Jerome Powell’s post-policy meeting press conference and the central bank’s quarterly “dot plot” in its Summary of Economic Projections for clues on the path ahead. Economists expect policymakers’ updated projections to indicate two quarter-percentage-point cuts this year. On the economic data front, investors will focus on U.S. Building Permits (preliminary) and Housing Starts data. Economists expect February Building Permits to be 1.450M and Housing Starts to be 1.380M, compared to the prior figures of 1.473M and 1.366M, respectively. U.S. Industrial Production and Manufacturing Production data will also be closely monitored today. Economists forecast February Industrial Production at +0.2% m/m and Manufacturing Production at +0.3% m/m, compared to January’s figures of +0.5% m/m and -0.1% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.2% m/m and the import price index to be -0.1% m/m in February, compared to the previous figures of +1.3% m/m and +0.3% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.320%, up +0.33%. My bias or lean today is slightly bearish. I don't think the bulls will be able to make much progress on a day where we start our with a neutral rating and FOMC is tomorrow. Trade docket today: I'll probably focus scalping with QQQ's.1HTE BTC setups, SPX 0DTE. No earnings trades until later this week. Let's take a look at the intra-day levels for /ES and BTC. /ES: 5705 is resistance with 5640 working as support. Tight ranges this morning. If we break out of these levels I'll post new ones in the chat room. BTC: Bitcoin didn't give us much in terms of setups yesterday. Today may offer a better support level to work with. 83,558 is resistance with 82,286 working as support. We continue to do a good job of deploying maximum effectiveness in deployment of capital. We've rarely had so much profit potential with such small capital usage. We'll try to be effective again today. See you all in the trading room soon!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |