|

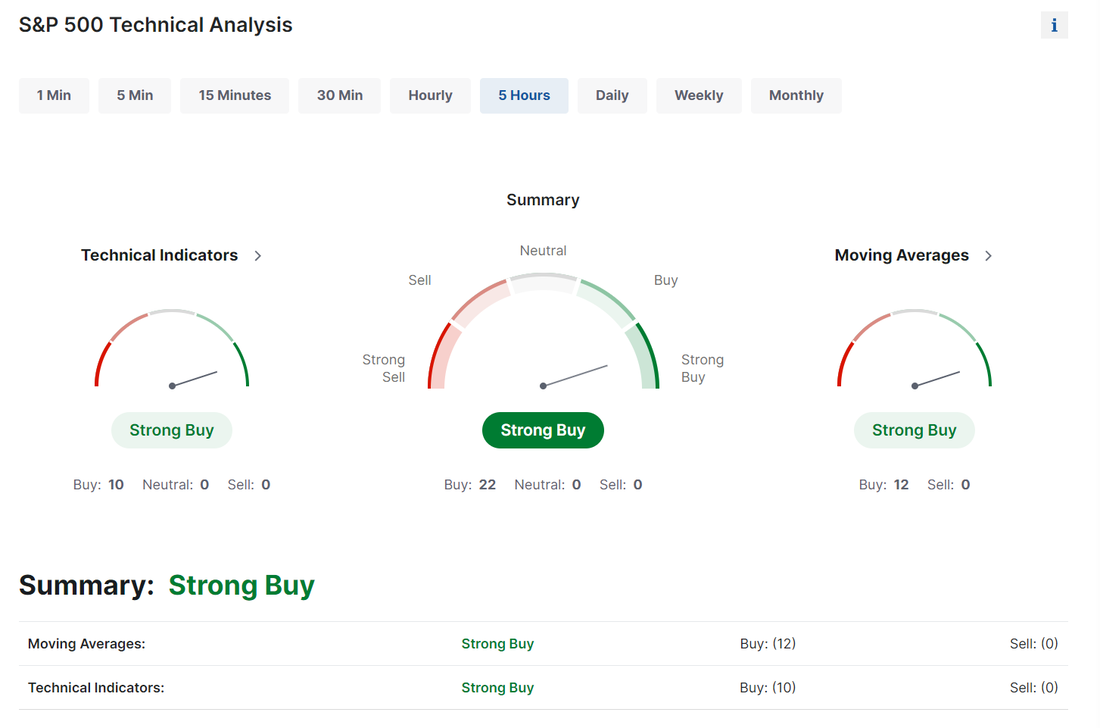

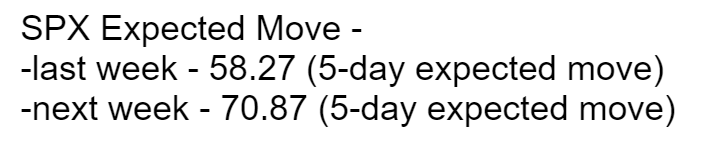

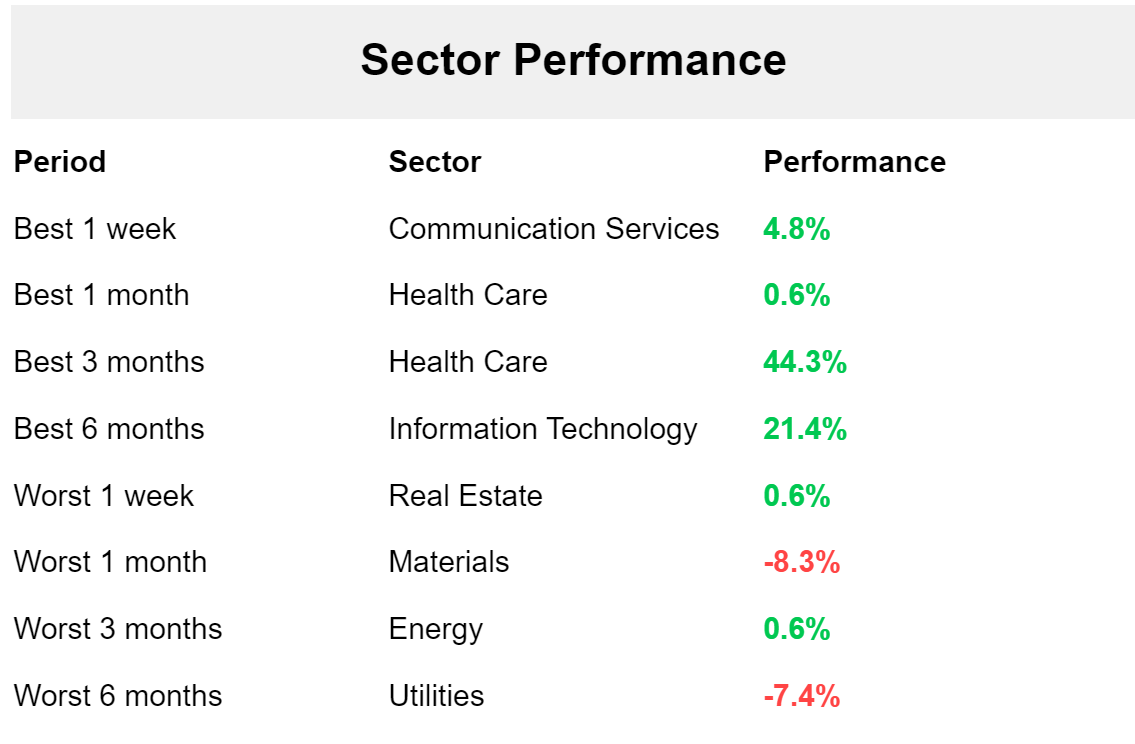

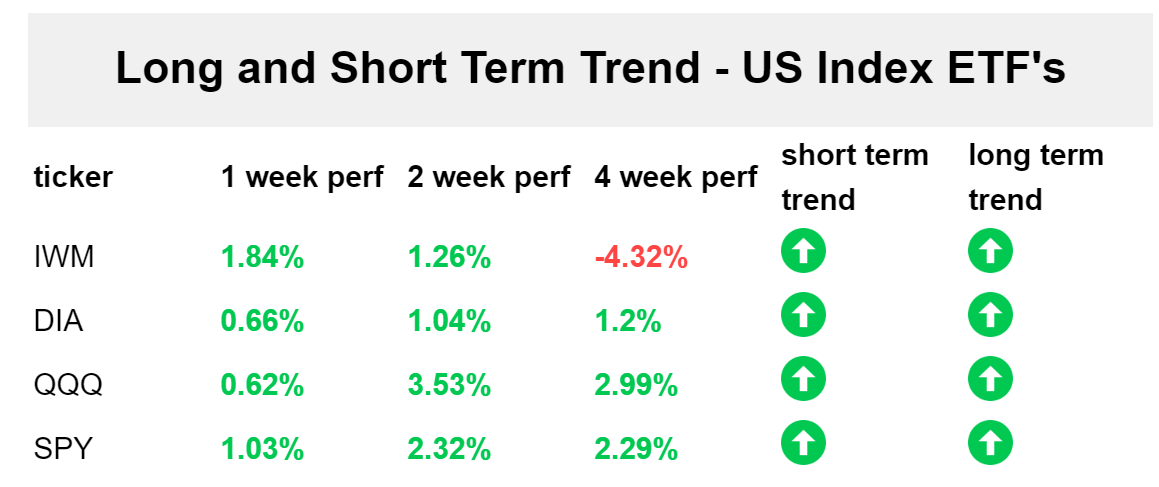

We ended last week on a bang with my net liq up almost $5,000. It was a successful week for us but we had to work for it every....single....day. It was a battle all week. Today should be busy for us with a restart on most of our weekly credit strangles and all of our ladder trades. Bullish bias continues to be in effect. This week should be busy. We don't have much coming today as far as catalysts but this is just the calm before the storm. Maybe the biggest and most anticipated earnings week, with MSFT, GOOG, AAPL, AMZN, META, AMD, FED, SBUX and BA all reporting this week. We'll try to get trades on as many of these as we can. We've also got Non-farm payrolls (which can be a big catalyst for moves) and, of course, FOMC on Weds. Futures are looking for the FED to hold rates at this meeting and then we have a 50.5% chance of a rate cut of 25 basis points at the March meeting and a 91% chance at the May meeting. Performance for the week was mostly positive with the IWM pushing the most. SPY is pushing up onto the 1.618 Fibonacci line. This is a critical level it needs to break through to continue this bullish push. The expected move for the week on SPY is 1.3% which may be way off with all the potential catalysts we have this week. This means we've finally got some I.V. back in this market! We may be back with the Theta fairy setup...finally. Sector performance shows health care and I.T. (tech) are still leading the way this year. Trends accross the board continue to look bullish As far as intra-day levels for our 0DTE setups, we continue to coil...awaiting a big move Levels for me today on /ES are: 4927/4933* (Key level. Would break us out of the current channel)/4941/4946 to the upside. 4914/4908/4901/4894* (Key level. Would break us out to the downside of current channel). On /NQ my intra day levels are: 17628/17669/11735 to the upside. 17527/17497/17458 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |