|

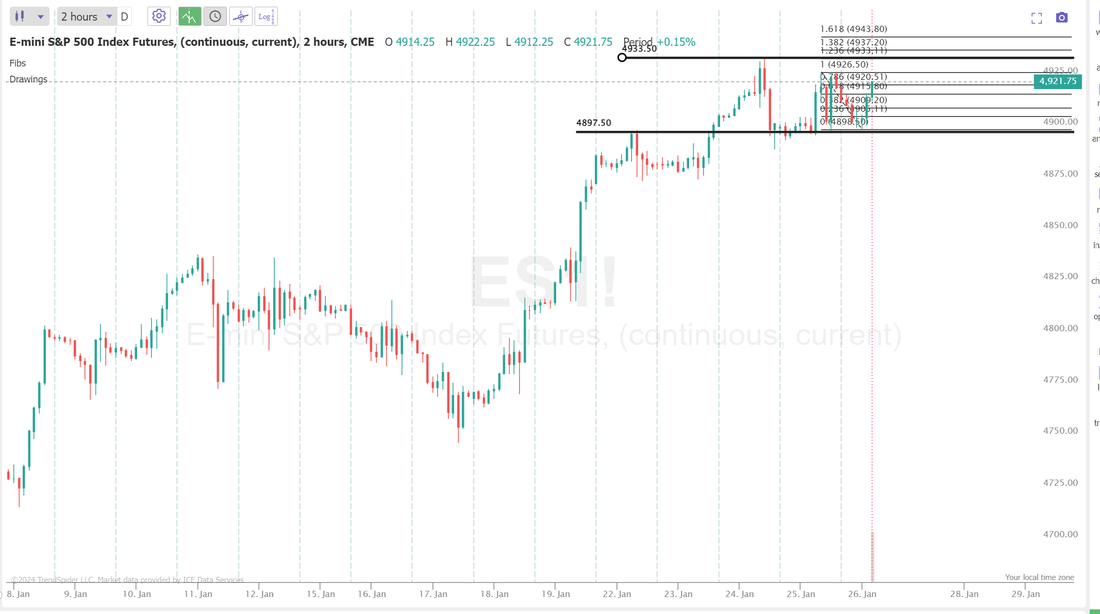

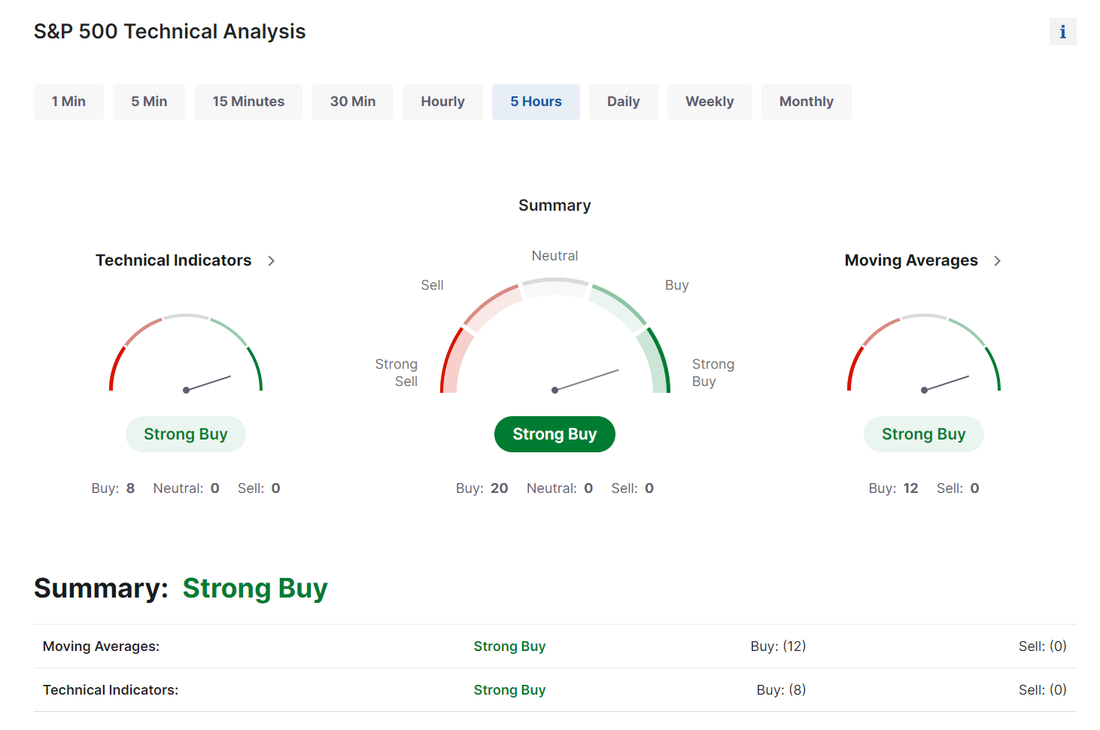

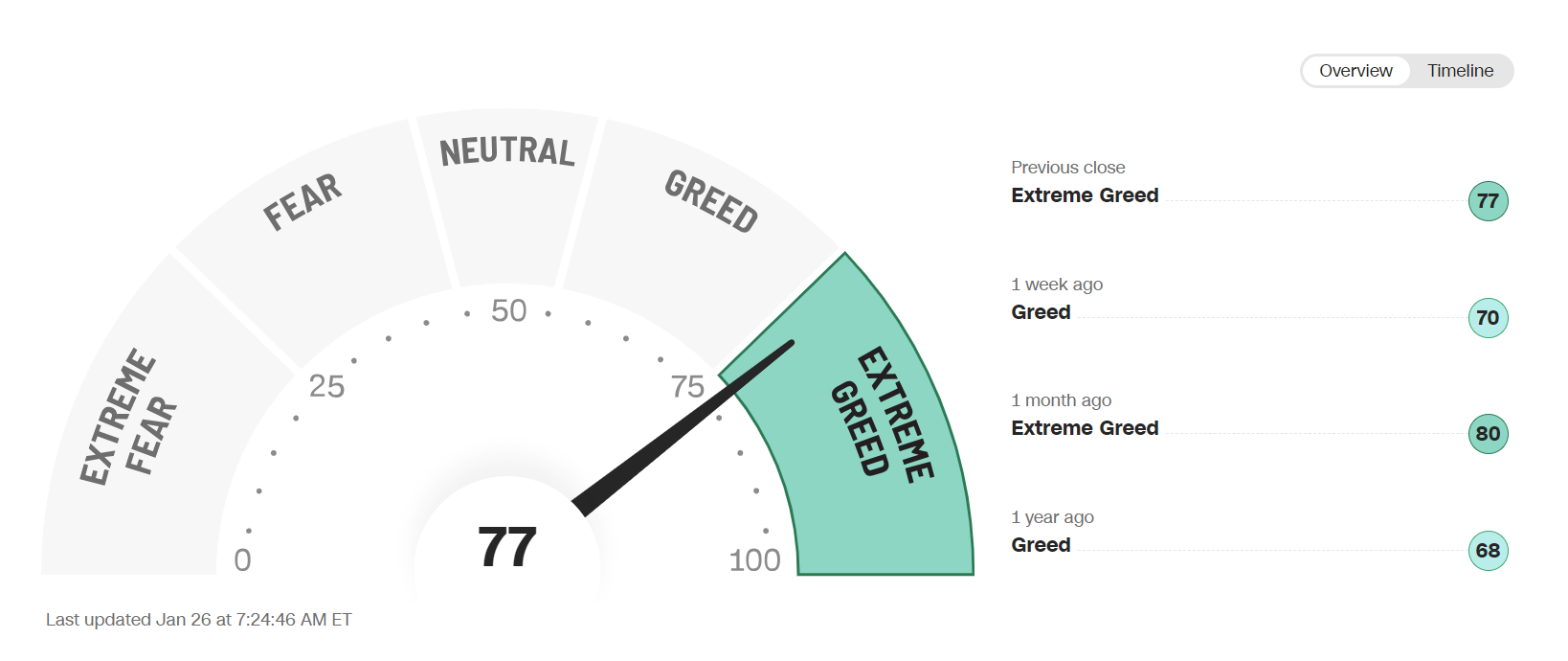

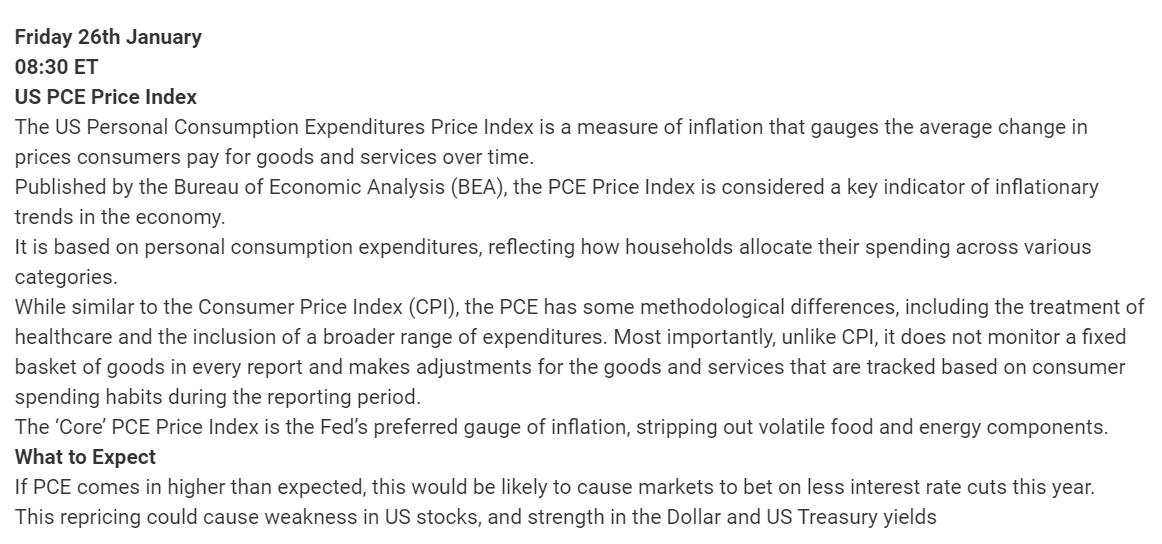

We had a solid day yesterday with our NDX 0DTE returning $5,000 profit. Our biggest 0DTE win of the year so far. Scalping helped out a bit and we brought in a lot of cash flow on our QQQ zebra cover. All in all, a pretty good day. The market continues to churn here.We hit a high on /ES of 4898 on Jan. 22nd. That resistance level then became support and our new resistance now sits at 4932. We've been just bouncing inside this range all week. Technicals are all still firmly bullish To say we are in a "risk on" enviroment is an understatment. Rotation into small caps. VIX hammered down. Fear-greed index pinned. This bull move has been strong but, it might be time to start taking some longs off and adding more shorts. We've added several bearish positions to the model portfolio this week. Futures are ticking down this morning. INTC reported yesterday and tumbled -11% in pre-market. Chipmakers may be hitting a wall. Our TSLA bearish setup was perfect as we get more dissapointing results. PCE is coming in this morning. It should be our main news catalyst of the day. Intra day levels for me: As I mentioned, 4898-4932 is the current chop zone. Price action inside this range is meaningless to me. 4926/4933/4937/4944 to the upside. 4915/4909/4905/4898 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |