|

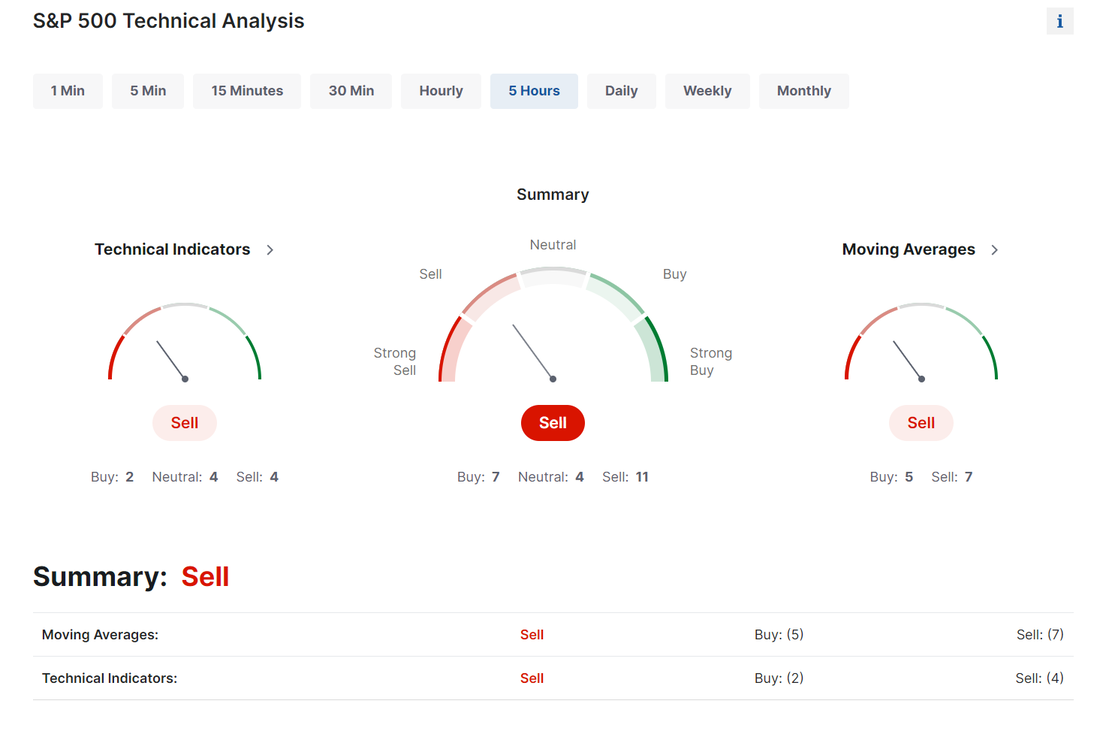

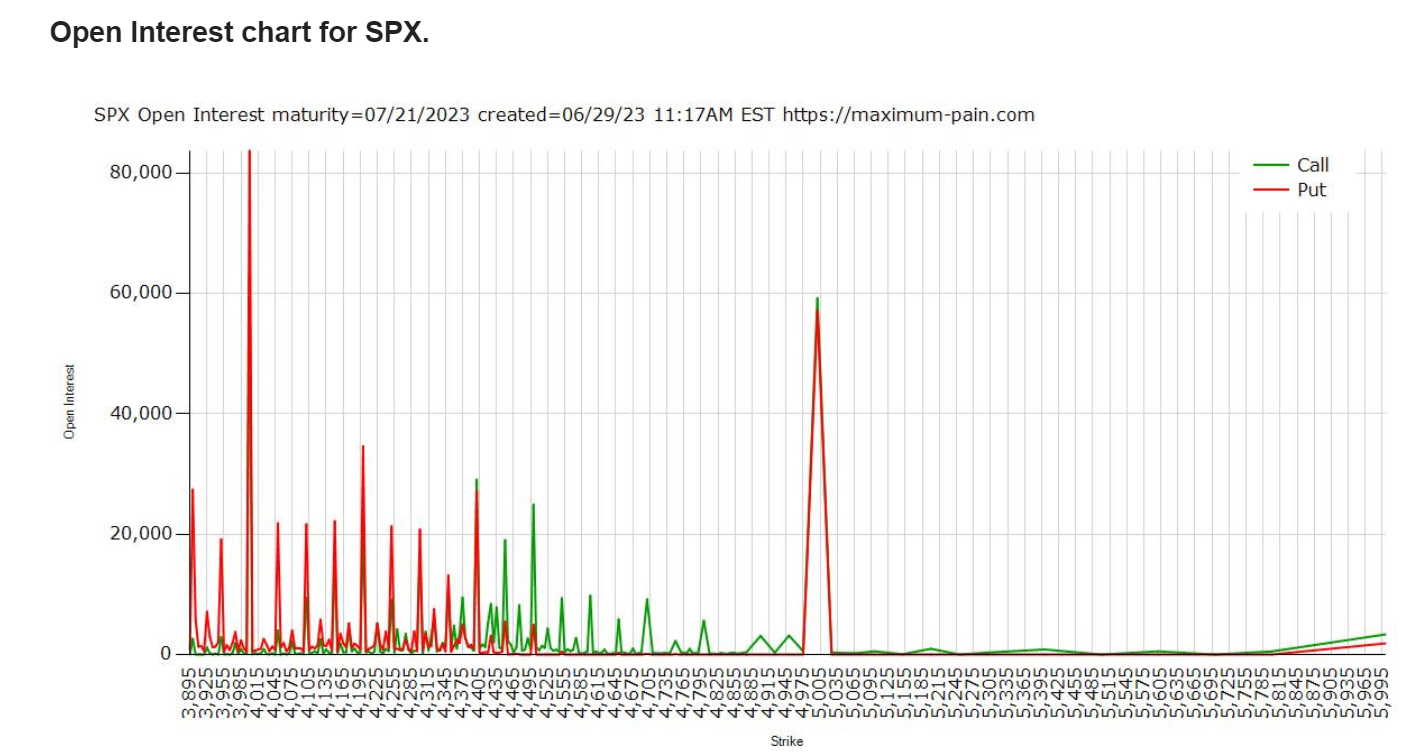

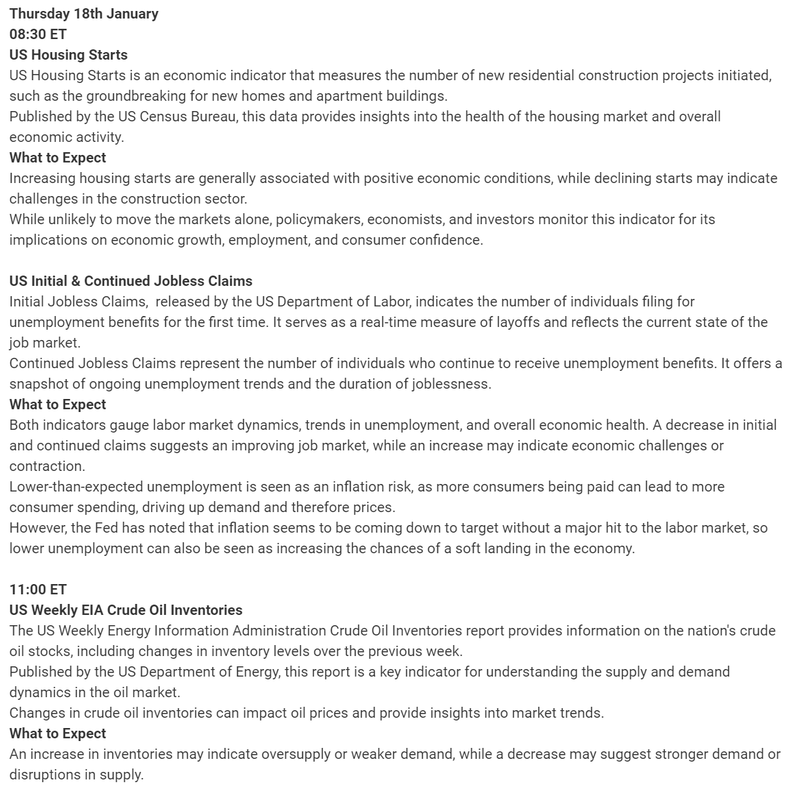

Yesterday was what I'd call a "perfect" day. Net liq was up $1,700 dollars. Perfect. When we get 15k days those are exciting but they also mean we are pretty leveraged to get that and the next day could easily be -15K. Slow and steady...consistency, that's what wins the race. Both our 0DTE's knocked it out of the park again. We are batting 100% success so far this year. The market weakness from yesterday finally got the technicals rolling over, if ever so slightly. 4732 is the key watch level for me on /ES. Below that could signal some bearish future action. Open interest walls are starting to shift. We still have a massive wall above 5000 on SPX but you can see the put side is now building posiitons as well. The market is prepping for a large move. We are back to losses on most the indices for the year. The QQQ's are just hanging on. Selling was broad based yesterday with all major sectors ending down on the day. News catalysts for today: Fed member Bostic will be speaking as well. I'm rolling out the performance reports for all our strategies from 2023. Bookmark this video as I'll drop a link for each individual report in this video so you have a one stop reference point to review them all. Starting tonight with undefined risk, credit strangles. Intra day levels for me: 4800/4815/4831/4842 to the upside. 4772/4761/4746/4735 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |