|

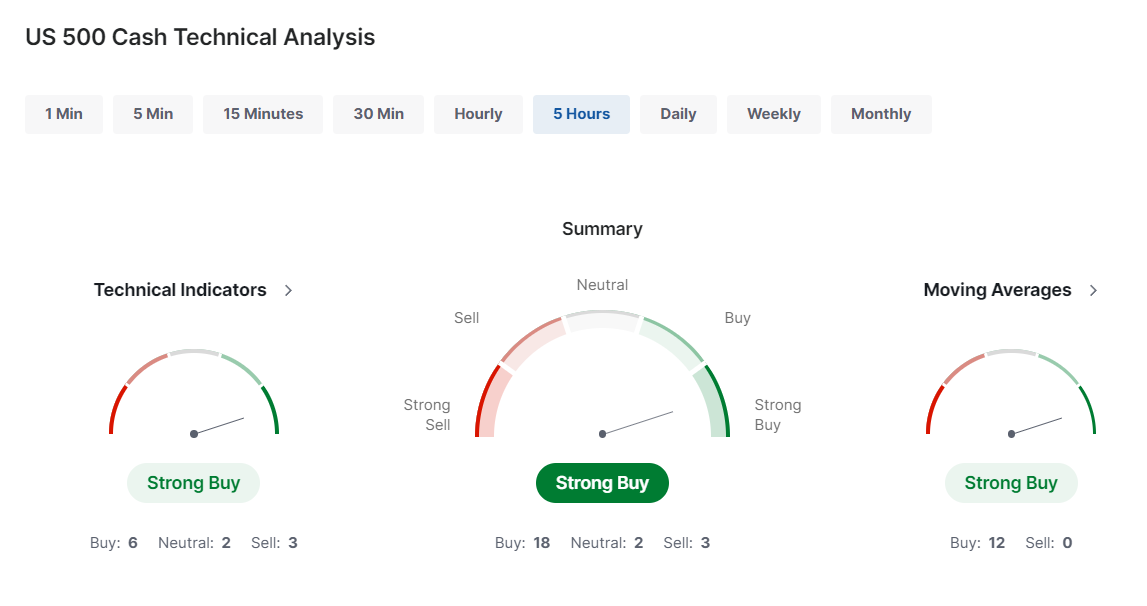

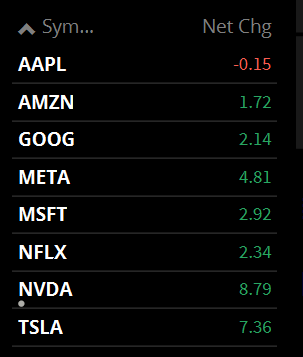

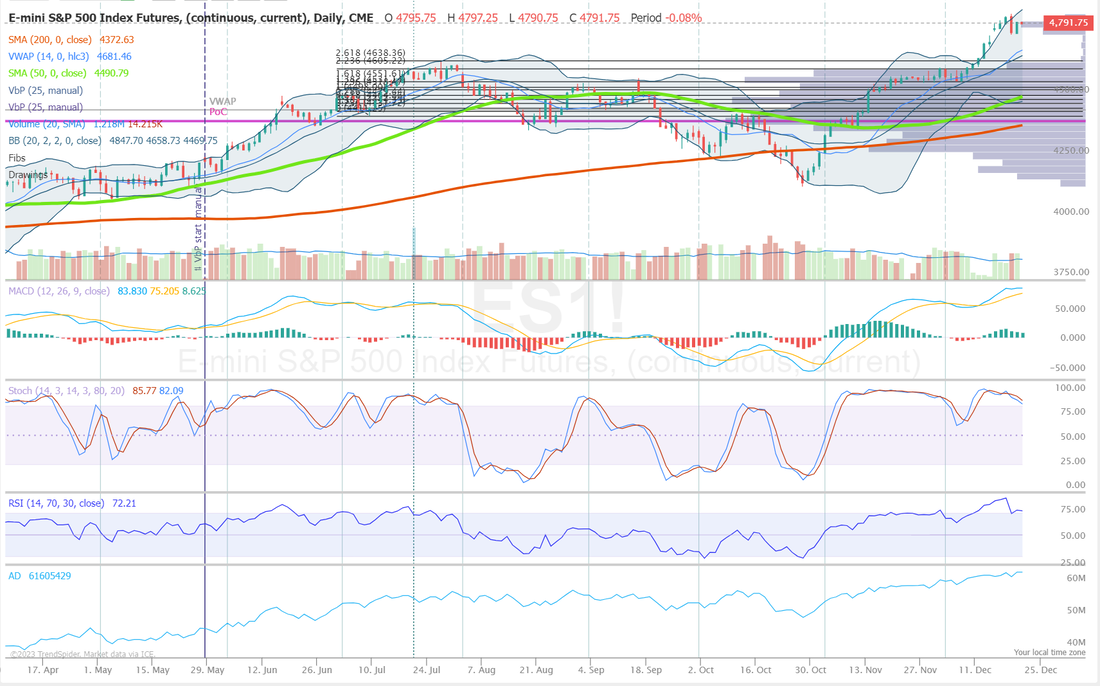

We had a really strong result with our trading yesterday. Both our 0DTE trades scored big wins . Our scalping brought in almost $1,700 dollars with just one trade and our event contract hit for a 35% ROI. The RUT trade continues to pressure us but we have a BF expiring today that looks profitable. We have PCE, Durable goods and Consumer spending out tomorrow morning (chart 1) Technicals are back into buy mode after a one day pause (chart 2). Yesterdays snapback was broad based (chart 3) with all the big tech names participating, sans AAPL (chart 4). Utilities continue to get beat up in this rotation back to tech (chart 5). My analysis continues to be the same. We are bullish. The bulls appear to be running out of steam. We are overstretched to the upside. It looks like we want to roll over. It ain't happening. Every time the bears look like they have a grasp on the controls the bulls come roaring back. (Chart 6) RSI is very overstretched here. Intra day levels for me today: Two key levels (Chart 7) 4831 to the upside (yesterdays high) and 4743 to the downside. (yesterdays low). Between these two levels is just a lot of chop with light, pre-holiday action. That being said, to the upside: 4811/4829/4850/4864. To the downside: 4776/4763/4742/4718 (Chart 8)

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |