|

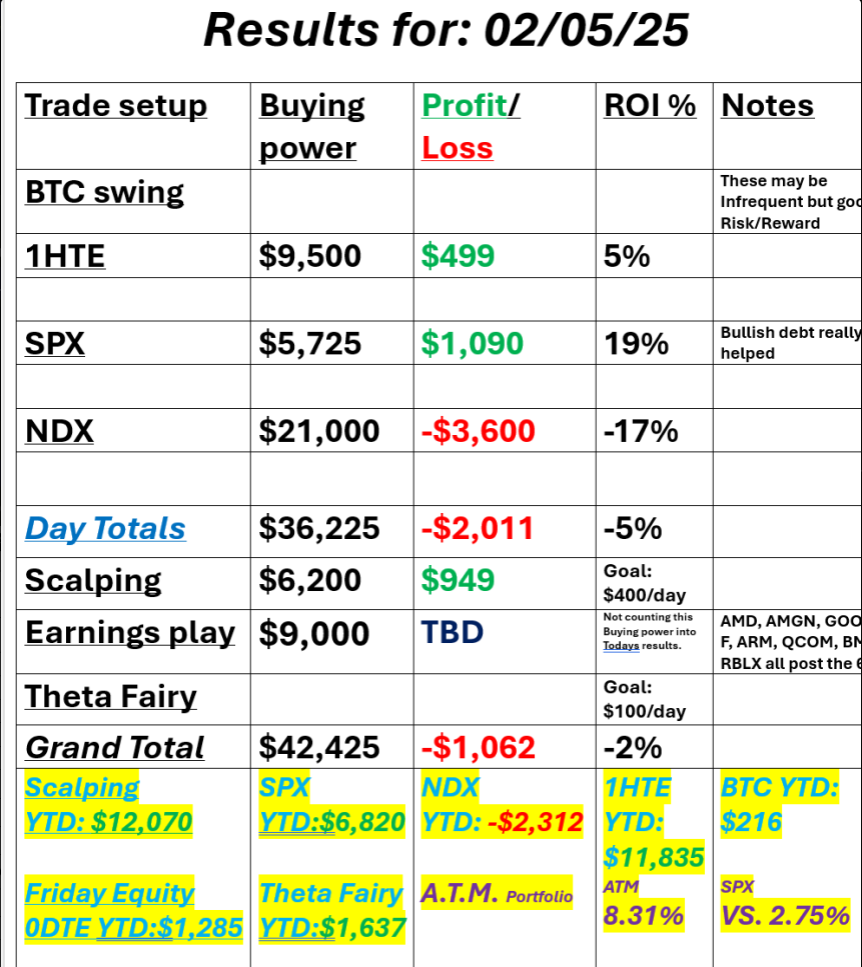

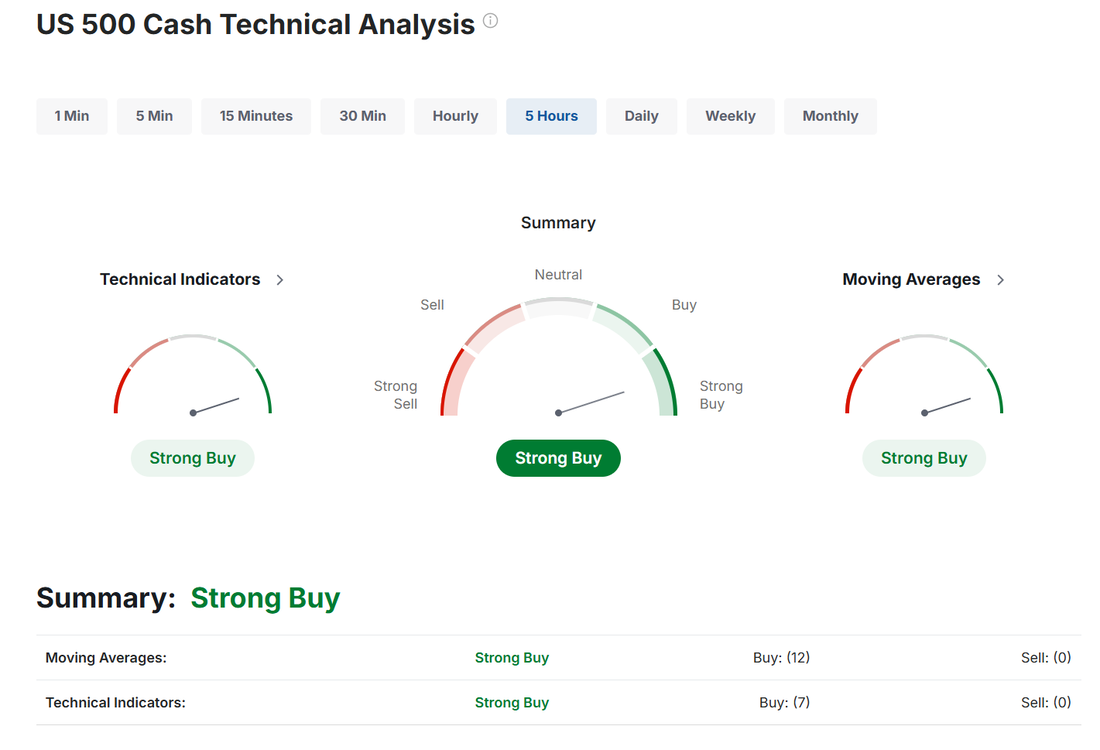

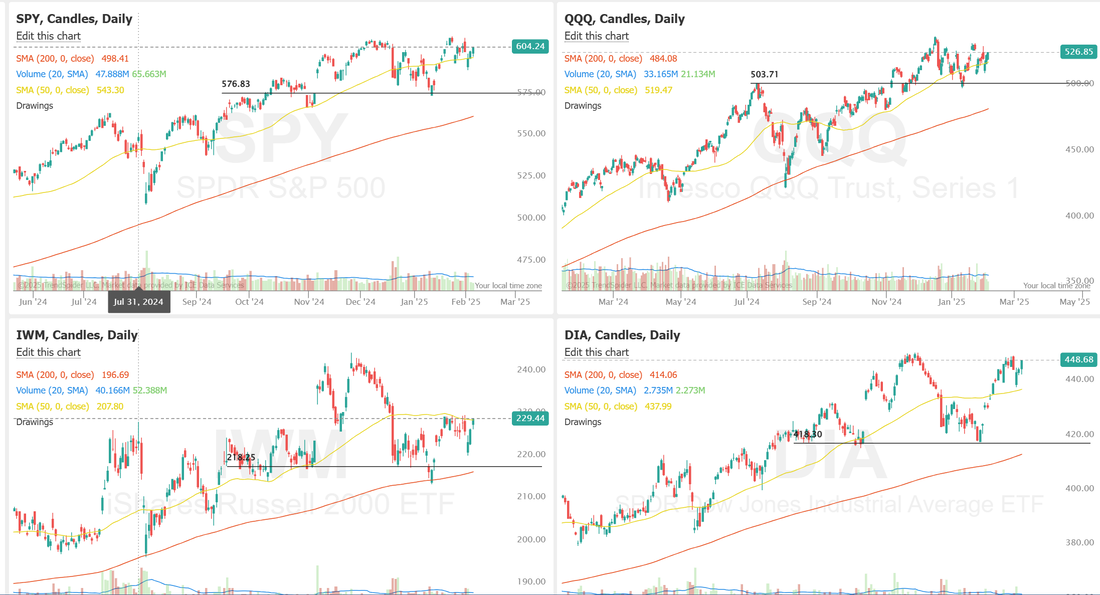

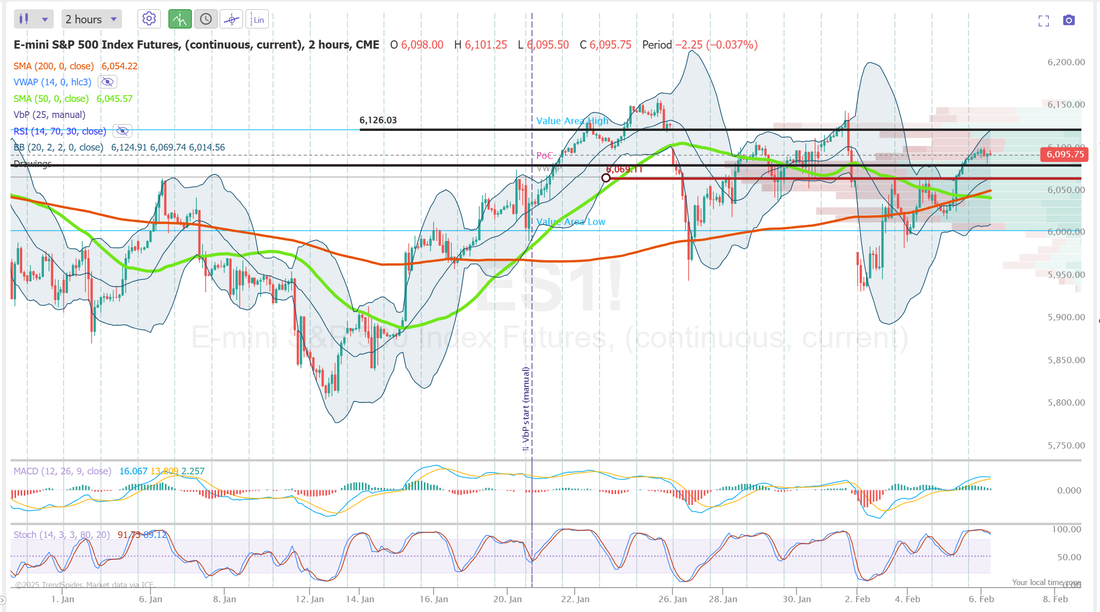

Welcome back traders! We are finally to expiration day of our 15DTE "mistake" NDX trade. For a quick recap, I errantly placed a 0DTE as a 15DTE (I have a habit of doing that!) We've traded around it for the last two weeks and the mistake actually looks pretty profitable. Building more of these (on purpose) may not be a bad way to go in this current enviroment. Here's my results from yesterday. I took a flyer right before the close on NDX that lost but most of our traders skipped it. Otherwise is was a solid day. I'm loving our setups in scalping. I'm really interested to see how we finish out this year with scalping and our ATM program. I think both of these hold a lot of promise. March S&P 500 E-Mini futures (ESH25) are up +0.05%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.08% this morning as investors awaited a new round of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from “Magnificent Seven” member Amazon. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Johnson Controls (JCI) surged over +11% and was the top percentage gainer on the S&P 500 after the company posted upbeat FQ1 results and raised its FY25 adjusted EPS guidance. Also, chip stocks gained ground after the benchmark 10-year Treasury yield fell to a 7-week low, with Marvell Technology (MRVL) climbing more than +6% and Nvidia (NVDA) rising over +5%. In addition, Amgen (AMGN) advanced more than +6% and was the top percentage gainer on the Dow after reporting better-than-expected Q4 results. On the bearish side, Alphabet (GOOGL) slumped over -7% and was the top percentage loser on the Nasdaq 100 after the Google parent reported weaker-than-expected Q4 revenue as growth in its cloud business slowed. Also, Advanced Micro Devices (AMD) fell more than -6% after the chipmaker posted weaker-than-expected Q4 data center revenue, and its full-year forecast for the data center business failed to impress investors. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 183K in January, up from 176K in December (revised from 122K) and beating the consensus estimate of 148K. Also, the final estimate of the U.S. January S&P Global services PMI was revised higher to 52.9 from the 52.8 preliminary reading. At the same time, the U.S. ISM services index fell to 52.8 in January, weaker than expectations of 54.2. In addition, the U.S. December trade deficit was -$98.40B, wider than expectations of -$96.50B and the largest deficit in nearly three years. Richmond Fed President Thomas Barkin stated on Wednesday that policymakers require more time to assess the trajectory of the U.S. economy and inflation amid heightened uncertainty over President Donald Trump’s policies, reinforcing expectations for rates to remain unchanged. Also, Fed Vice Chair Philip Jefferson said he is comfortable keeping interest rates on hold until policymakers gain a clearer understanding of the overall impact of the Trump administration’s policies on tariffs, immigration, deregulation, and taxes. U.S. rate futures have priced in an 85.5% chance of no rate change and a 14.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Meanwhile, U.S. Treasury Secretary Scott Bessent said on Wednesday that the Trump administration’s primary focus in lowering borrowing costs is on 10-year Treasury yields rather than the Fed’s benchmark short-term interest rate. He stated in an interview with Fox Business that regarding the Fed, “I will only talk about what they’ve done, not what I think they should do from now on.” Bessent reiterated his belief that increasing energy supply would aid in reducing inflation. Fourth-quarter corporate earnings season continues, with investors looking forward to fresh reports from notable companies today, including Amazon.com (AMZN), Eli Lilly (LLY), Philip Morris (PM), Honeywell (HON), Bristol-Myers Squibb (BMY), Fortinet (FTNT), and Take-Two Interactive (TTWO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 214K, compared to last week’s number of 207K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q4 Unit Labor Costs to be +3.4% q/q and Nonfarm Productivity to be +1.5% q/q, compared to the third-quarter numbers of +0.8% q/q and +2.2% q/q, respectively. In addition, market participants will be anticipating speeches from Fed Governor Christopher Waller, San Francisco Fed President Mary Daly, and Dallas Fed President Lorie Logan. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.435%, up +0.34%. Yesterdays price action was what I had predicted and it was enough to get us a slightly bullish outlook going into todays session. I'm not going into this session with any real lean or bias. I'll note the demarcation points below for a bullish or bearish trigger. Things for the most part look bullish. It's only the IWM that still can't get back up above it's 50DMA. We had a busy docket yesterday and that should continue today. NVDA and MSTR as 1DTE's to work as 0DTE's tomorrow. AFRM, AMZN, AMAT, PINS, ARM, BMY, F, GOOG, MRK?, QCOM, RBLX earnings trades. Possible TSLA, VIX, 1HTE, 0DTE's and /ZN. Let's take a look at our intra-day levels. /ES: There are three levels I'm watching today. 6126 is resistance with 6069 acting as support but I'm most interested in 6085. It's PoC on the 2hr. chart and may offer a nice entry level for a butterfly. /NQ: Resistance is close at 21,832 but if was firmly rejected yesterday. If we can break above and hold today that would be very bullish. 21,591 is support and also key. It's a convergence of both the 200 and 50 period moving averages. A break below this would be very bearish. We've been channeling for a while now. A big move could be incoming. BTC: We had a nice clean, "one and done" 1HTE yesterday for a $499 profit but I'm less optimistic about todays potential. Resistance stays right at $100,756 with support at $98,491. I'd look to start a new long swing trade around the $96,997 level. I'll see you all in the trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |