|

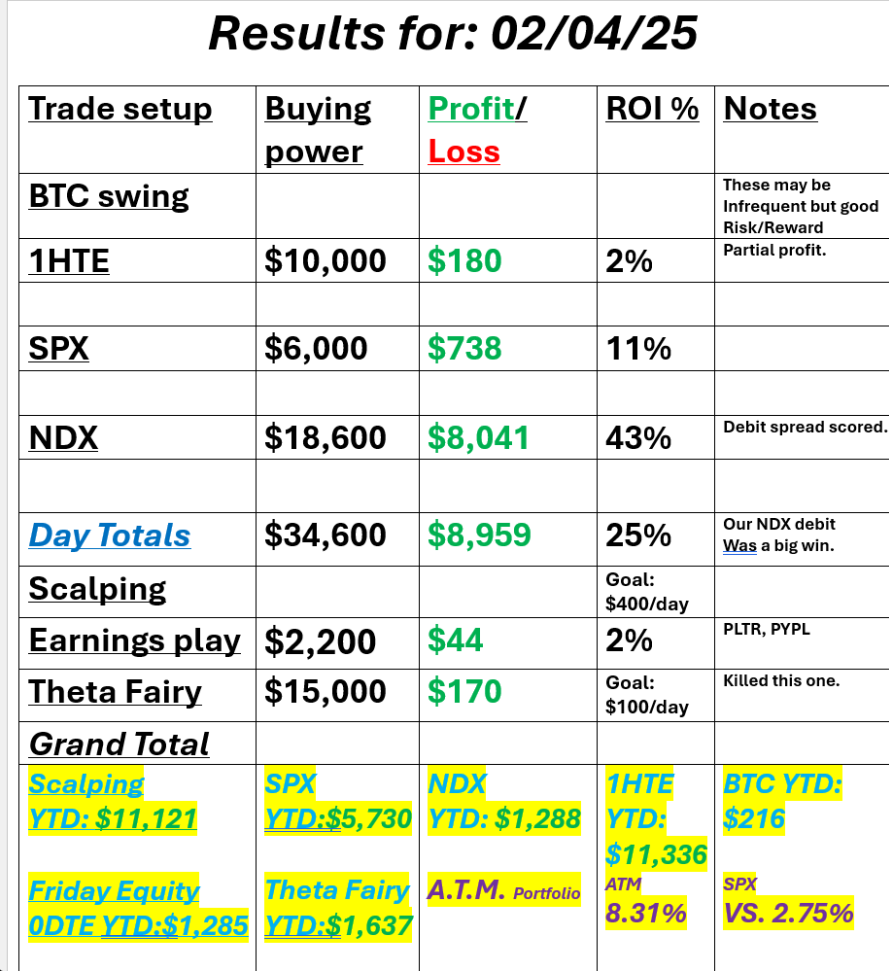

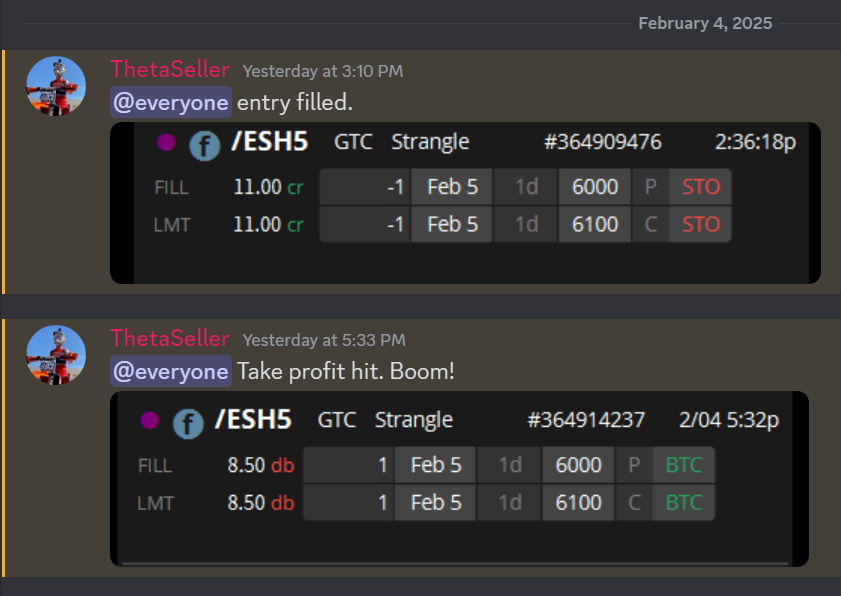

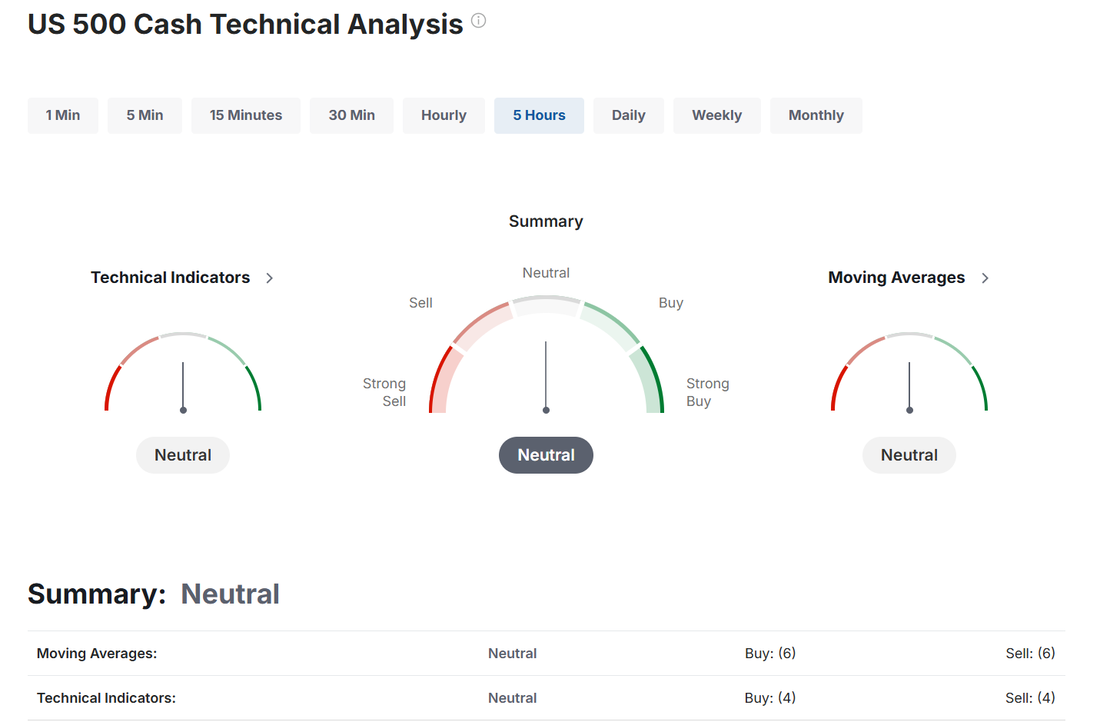

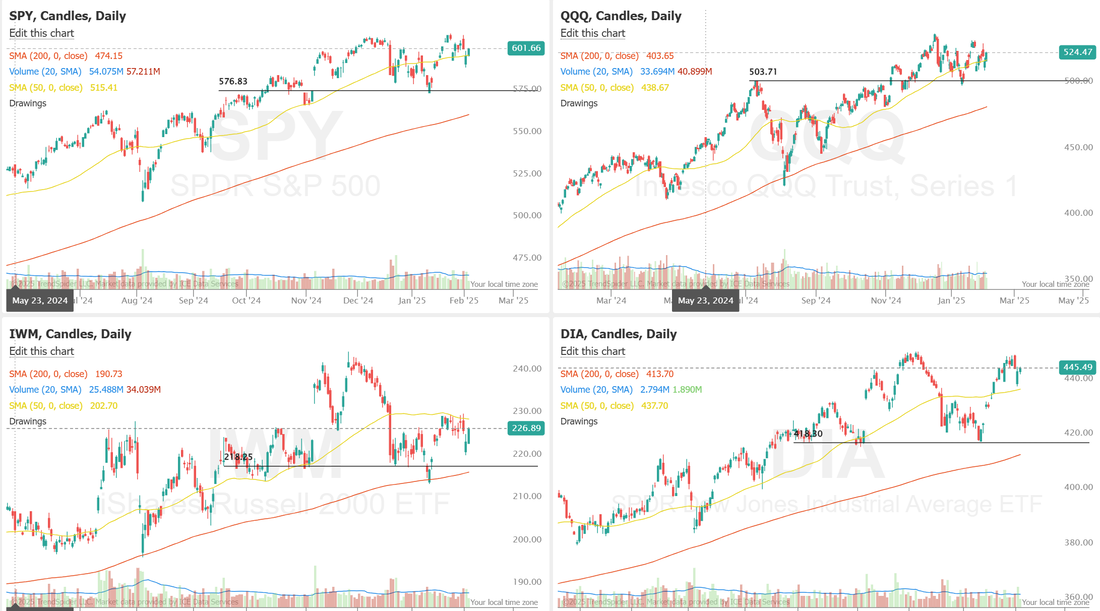

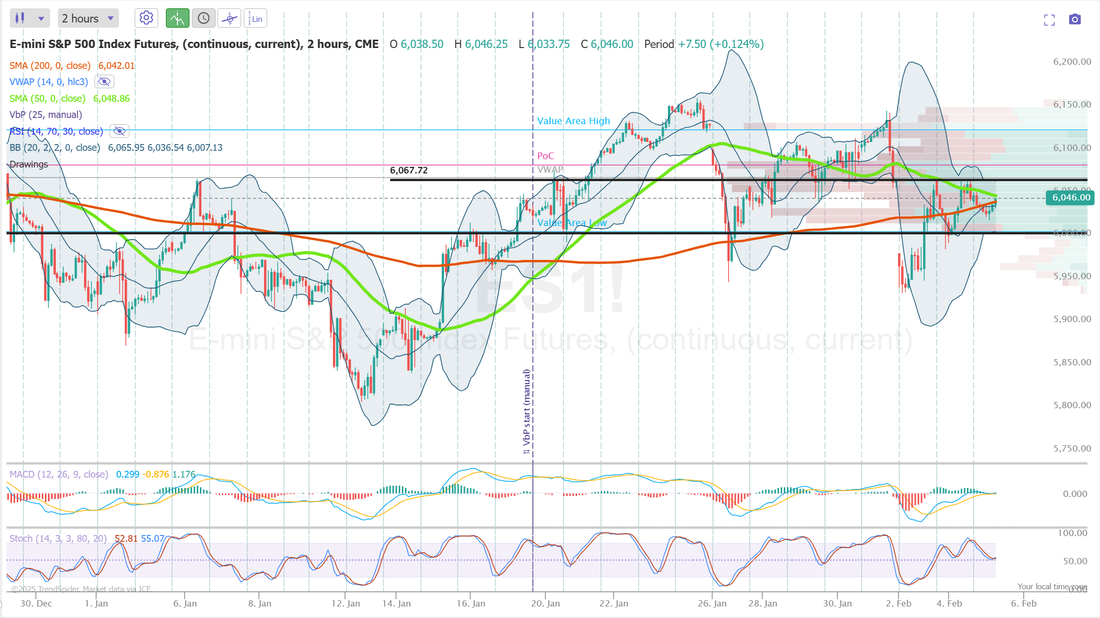

Welcome back traders! We had a great day yesterday. Not a perfect day. Our SPX debit didn't hit but our NDX did. I want to do a training review today on the nine main orderflow indicators we use and what is showing on our live scalping zoom feed. See below: Supertrend, Parabolic SAR, Pivot point, Squeeze indicator, Audible order flow with Tickstrike, $TICK, $ADSPD, $VOLSPD are the ones we'll focus on today. As I mentioned, our results were solid. I want to stress, once again, how important it is to have diversified strategies working each day. I can't remember the last time we've had a day where something wasn't losing money and yet, you'll see our YTD results are impressive. You never know what's going to work. Scalping is one example. We did scalp yesterday but no results were posted because the cover is set to expire this Friday but there's $2,500 potential profit sitting there. Our Theta fairys are another example. We hit a $170 profit last night in a couple hours. Sometimes the cash is pouring in on scalping and Theta fairys and sometimes we go a whole week without a single entry. You just never know what opportunities the market will offer up each day. Let's look at the markets: Poor earnings results from GOOG and AMD as well as China issues with AAPL are dragging the futures down this morning. It's put us back to a neutral rating to start the day which means it will just be a crap shoot about direction (IMHO). Heaven knows we've had plenty of volatility and movement this past week but in terms of actual ranges or directional bias there's absolutely nothing happening! At some point we will move from consolidation to trending. Neutral days can be the trigger days for that to happen. I don't see that taking place today but you never know. March Nasdaq 100 E-Mini futures (NQH25) are trending down -0.91% this morning as disappointing results from Alphabet and Advanced Micro Devices weighed on sentiment. Alphabet (GOOGL) slid over -7% in pre-market trading after the Google parent reported weaker-than-expected Q4 revenue as growth in its cloud business slowed. Also, Advanced Micro Devices (AMD) slumped more than -8% in pre-market trading after the chipmaker posted weaker-than-expected Q4 data center revenue, and its full-year forecast for the data center business failed to impress investors. Market participants now look ahead to a fresh batch of U.S. economic data, comments from Federal Reserve officials, and corporate earnings reports, with a particular focus on results from entertainment giant Disney. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Palantir Technologies (PLTR) jumped about +24% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the data analytics company posted upbeat Q4 results and issued above-consensus Q1 and FY25 revenue guidance. Also, megacap technology stocks advanced, with Apple (AAPL) and Tesla (TSLA) rising more than +2%. In addition, Super Micro Computer (SMCI) climbed over +8% after the artificial intelligence server maker announced that it would provide an FQ2 business update on February 11th. On the bearish side, Estee Lauder (EL) plunged more than -16% and was the top percentage loser on the S&P 500 after the cosmetics and skin care company provided a downbeat FQ3 outlook and announced job cuts. Also, Merck & Co. (MRK) slumped over -9% and was the top percentage loser on the Dow after halting shipments to China of its Gardasil vaccine and offering a weak FY25 forecast. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to 7.600M in December, weaker than expectations of 8.010M. Also, U.S. December factory orders fell -0.9% m/m, weaker than expectations of -0.7% m/m and marking the largest decline in 6 months. “[The latest reading on U.S. job openings] eases upside risks into Friday’s employment report in a way that is helpful for the Federal Reserve and markets,” said Krishna Guha at Evercore. Fed Vice Chair Philip Jefferson said on Tuesday, “As long as the economy and the labor market remain strong, I see it as appropriate for the Committee to be cautious in making further adjustments... I do not think we need to be in a hurry to change our stance.” Meanwhile, U.S. rate futures have priced in an 83.5% chance of no rate change and a 16.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Fourth-quarter corporate earnings season rolls on, and investors await new reports from notable companies today, including The Walt Disney Company (DIS), Qualcomm (QCOM), Arm Holdings (ARM), Uber Technologies (UBER), and Ford Motor (F). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the January ADP Nonfarm Employment Change will stand at 148K, compared to the December figure of 122K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and the S&P Global Services PMI. Economists expect the January ISM Non-Manufacturing PMI to arrive at 54.2 and the S&P Global Services PMI to be 52.9, compared to the previous values of 54.1 and 56.8, respectively. U.S. Trade Balance data will come in today. Economists foresee this figure standing at -$96.50B in December, compared to -$78.20B in November. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be 2.400M, compared to last week’s value of 3.463M. In addition, market participants will be looking toward speeches from Fed officials Barkin, Goolsbee, Bowman, and Jefferson. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.471%, down -0.93%. My lean or bias for today: We nailed our bullish call yesterday. The day played out exactly as I laid out in our pre-market plannning. With credit trades your directional bias doesn't neccessarily need to be right to make money but it certainly helps and makes the day easier. I'm looking for another slightly bullish today. We may not finish in the green but with /ES down -30 points as I type I think we come up from here. Trade docket for today: ARM, QCOM, F?, UBER?, BMY, RBLX, AMD, AMGN, GOOG, MRK?, SPY/QQQ, /MCL, 1HTE, 0DTE's. Let's take a look at our intra-day levels: /ES: Levels for today are the same as yesterday. 6067 is resistance with 6005 support. 6042 is key! This is the convergence zone for both the 50 and 200DMA's on the 2hr. chart. If you are good at chart reading you could look at this pinch point and guess we are starting off the day with a neutral technical reading. This will not last. We'll move off of this level (maybe forcefully) soon. /NQ: Nasdaq levels have moved up from yesterday. 21,625 is resistancewith 21,350 working as new support. BTC: Bitcoin has been a bit tough to trade our 1HTE's lately. We were able to catch a partial profit yesterday. There are three levels I'm watching today. $100,801 is resistance with $97,006 acting as support. $98,130 seems to be the demarcation point. Above I'd look for bullish action. Below, bearish. If we dip to that $97,000 range I'll look to start a new swing trade. We've got a lot of training and other items to talk about today is zoom. I look forward to seeing you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |