|

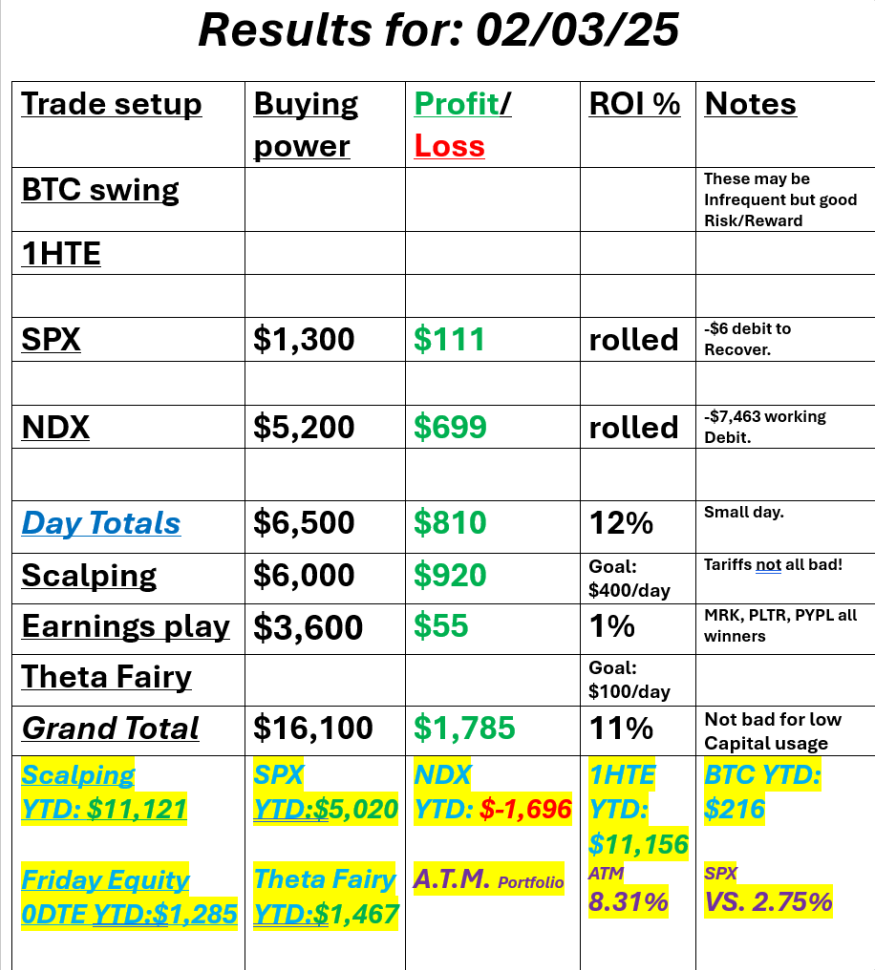

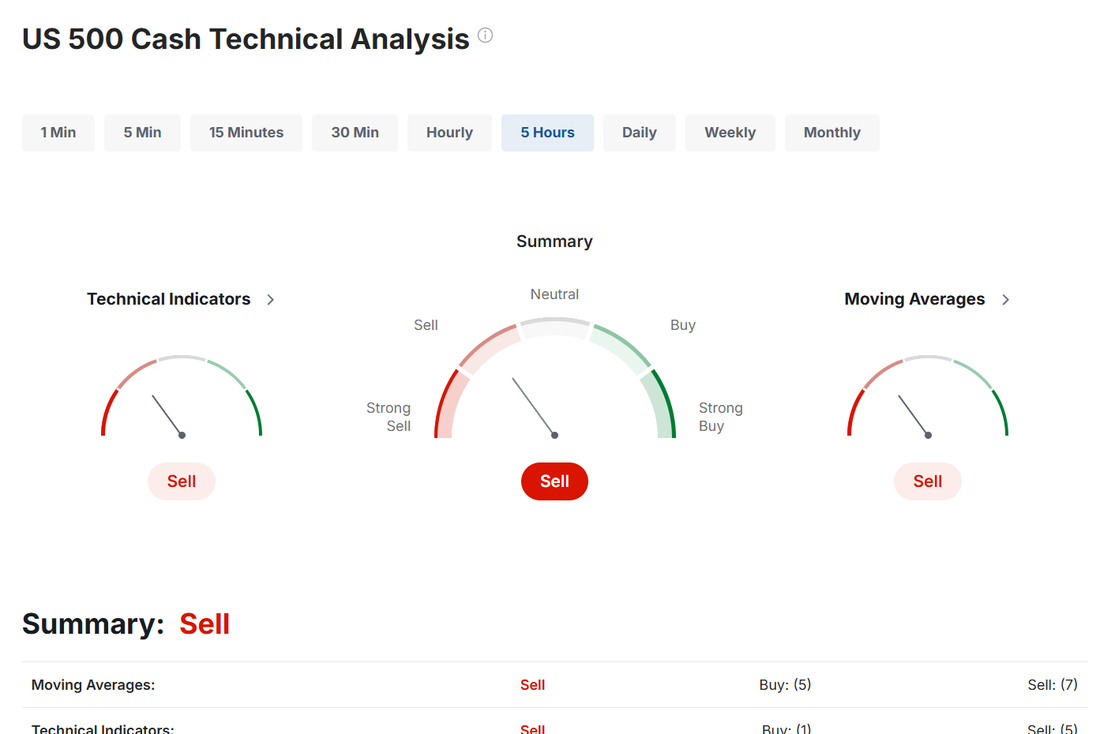

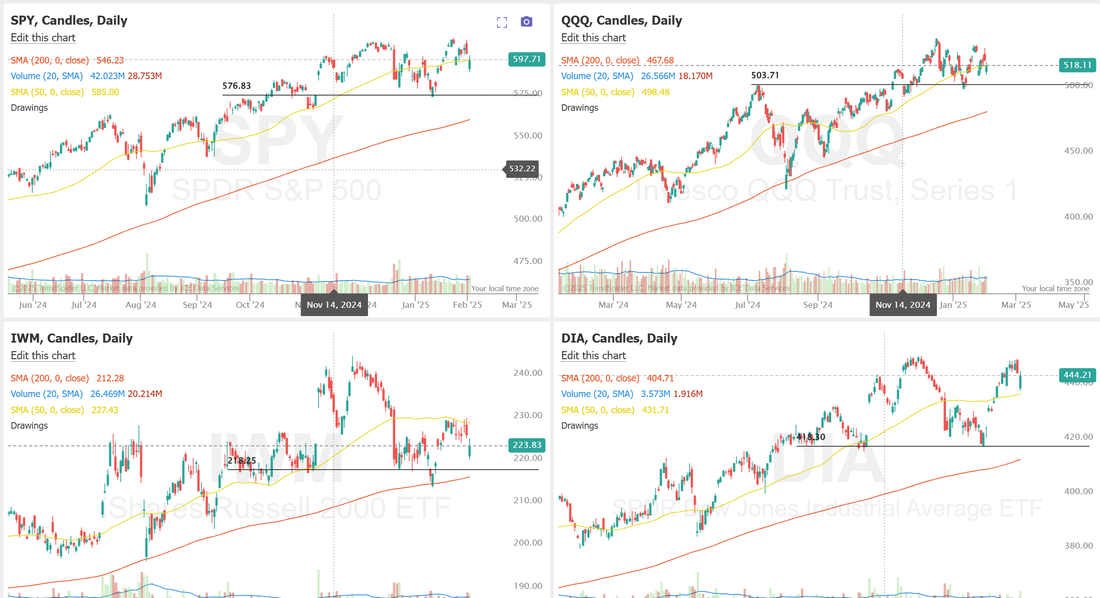

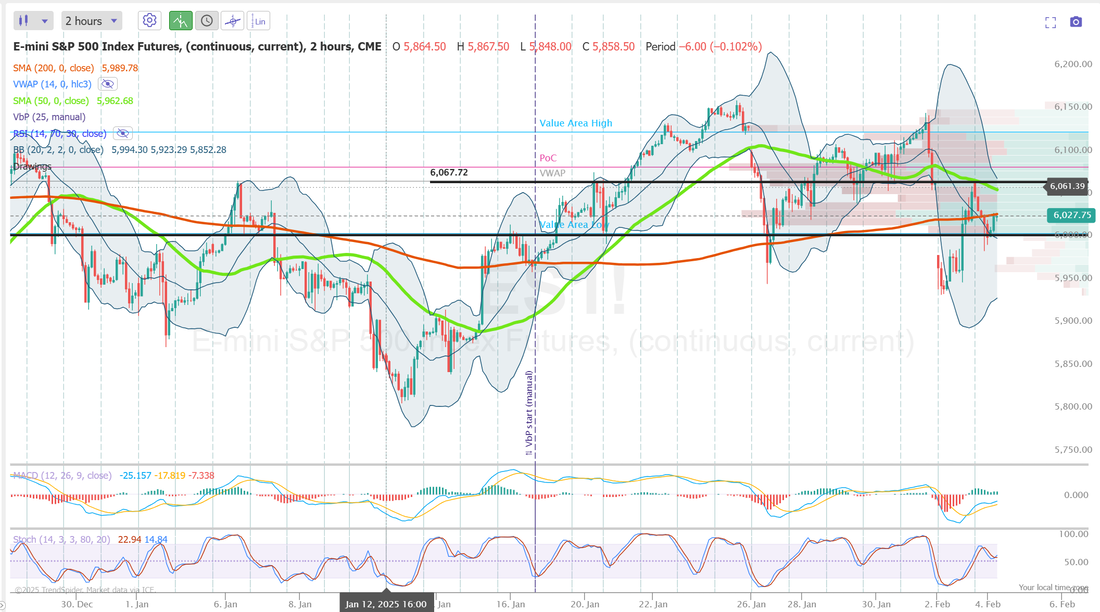

Welcome to Tues. traders! Are we getting a little stability, post tariffs? I'm looking for a bullish day today. More on that in a minute. We had a good day yesterday considering we had no idea (no one did, no matter what they said) about the tariffs. Would they or wouldn't they be implemented. How would the market be effected? Yesterday was going to be a big unknown so we traded really small (in comparision to a normal day) and waited most of the day before entering our trades. We still netted an 11% gain on the day. It brings up the ever present question...what's more important, transparency or premium? You'll usually get the best premium on your credit trades if you establish them right at the open but you lack transparency and a lot can happen those next 6.5 hrs. before the market closes. If you wait, like we did yesterday where we only had 1-2 hours left in the day, you get much better transparency but much less premium. I think it tough to apply a universal rule that one is always better than the other. There was enough volatility yesterday that we picked transparency over premium. Every day this is one of our main questions we ask ourselves. Here's our results from yesterday. One last comment...on days that are "scary" or uncertain or volatile, scalping can yield great risk/reward setups. I'm a firm believer that you need as many tools as possible. Let's take a look at the markets Technicals are still bearish after the weak last couple of days but I'm looking for that to change today. Yesterday was incredibly bullish. Yes I know technicals are bearish. Yes I know we finished down on the day but...we spent most of the day climbing out of the hole that futures dug. Note the green candles. March S&P 500 E-Mini futures (ESH25) are down -0.01%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.08% this morning as investors awaited the latest reading on U.S. job openings, comments from Federal Reserve officials, and corporate earnings reports from heavyweight names. Stock futures initially moved lower after China retaliated to new U.S. tariffs. China’s Customs Tariff Commission of the State Council announced on Tuesday that it will impose a 15% tariff on U.S. coal and liquefied natural gas, and 10% tariffs on crude oil, agricultural machinery, large-displacement vehicles, and pickup trucks. The measures are set to take effect on February 10th. China’s commerce ministry also announced that starting Tuesday, the country will implement export controls on tungsten, tellurium, bismuth, molybdenum, and indium products. In addition, China said it would launch an antitrust probe into Google. This marked the resumption of a trade war between the world’s two largest economies, though China’s response was seen as restrained. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Moderna (MRNA) sank over -7% and was the top percentage loser on the S&P 500 as vaccine makers retreated amid expectations that vaccine skeptic Robert Kennedy Jr. would be appointed to lead the U.S. Department of Health and Human Services. Also, automobile stocks dropped after President Trump announced tariffs on U.S. imports from Canada, Mexico, and China, with Tesla (TSLA) sliding more than -5% and General Motors (GM) falling over -3%. In addition, FedEx (FDX) slumped more than -6% after Loop Capital downgraded the stock to Hold from Buy. On the bullish side, IDEXX Laboratories (IDXX) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the pet healthcare company posted upbeat Q4 results and issued solid 2025 EPS guidance. Economic data released on Monday showed that the U.S. ISM manufacturing PMI rose to 50.9 in January, stronger than expectations of 49.3 and marking the highest level in 2-1/3 years. Also, the U.S. January S&P Global manufacturing PMI was revised upward to 51.2, beating the consensus of 50.1. In addition, U.S. construction spending rose +0.5% m/m in December, stronger than expectations of +0.3% m/m. Chicago Fed President Austan Goolsbee stated on Monday that the central bank should be more cautious in reducing borrowing costs due to increasing uncertainty stemming from the Trump administration. “Now we’ve got to be a little more careful and more prudent of how fast rates can come down because there are risks that inflation is about to start kicking back up again,” Goolsbee said. Also, Atlanta Fed President Raphael Bostic stated that he wants to wait “a while” before lowering interest rates again following last year’s cuts, given the uncertainty surrounding the direction of the U.S. economy in 2025. In addition, Boston Fed President Susan Collins said, “There’s no urgency for making additional adjustments.” Meanwhile, U.S. rate futures have priced in an 86.5% probability of no rate change and a 13.5% chance of a 25 basis point rate cut at the next FOMC meeting in March. Fourth-quarter corporate earnings season continues in full flow, with investors anticipating fresh reports from major companies today, including Alphabet (GOOGL), Advanced Micro Devices (AMD), PepsiCo (PEP), Merck (MRK), Amgen (AMGN), Pfizer (PFE), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the December JOLTs Job Openings will arrive at 8.010M, compared to the November figure of 8.098M. Investors will also focus on U.S. Factory Orders data. Economists expect this figure to be -0.7% m/m in December, compared to the previous number of -0.4% m/m. In addition, market participants will be anticipating speeches from Atlanta Fed President Raphael Bostic, San Francisco Fed President Mary Daly, and Fed Vice Chair Philip Jefferson. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.579%, up +0.79%. My lean or bias today is firmly bullish. Yeah, China retaliated with their own tariffs. That knocked the futures a bit but I think the market fundamentals were clearly bullish before Friday's tariff news and I think the smoke is clearing today and we'll return to that same bullish bias. Trade docket for today: MRK, PLTR, PYPL, GOOG, AMGN, AMD, /ZN, 0DTE's Let's take a looks at our key levels for todays 0DTE's. One reason for my bullish bias today is the fact that we bumped up along our resistance level all day long yesterday and overnight we've now broke above it. Resistance is now 6058 with support at 6005. /NQ: The Nasdaq came back as well but wasn't as strong. It's running into it's 200 period M.A. on the 2hr. chart right now. That may be a tough nut to crack. Resistance is at 21,587 with support at 21,280 but that key 21,483 200 period M.A. on the 2hr. chart is my main focus for today. Above could be bullish. Below is bearish. It's a key demarcation level. BTC: I certainly missed the opportunity yesterday to catch the falling knife and initiate one of our Bitcoin swing trades. We could have picked it up $7,000 dollars lower than current levels but that's how hindsight works. New levels seem to be $102,658 resistance with $98,408 support. I look forward to our live zoom session today. See you all soon!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |