|

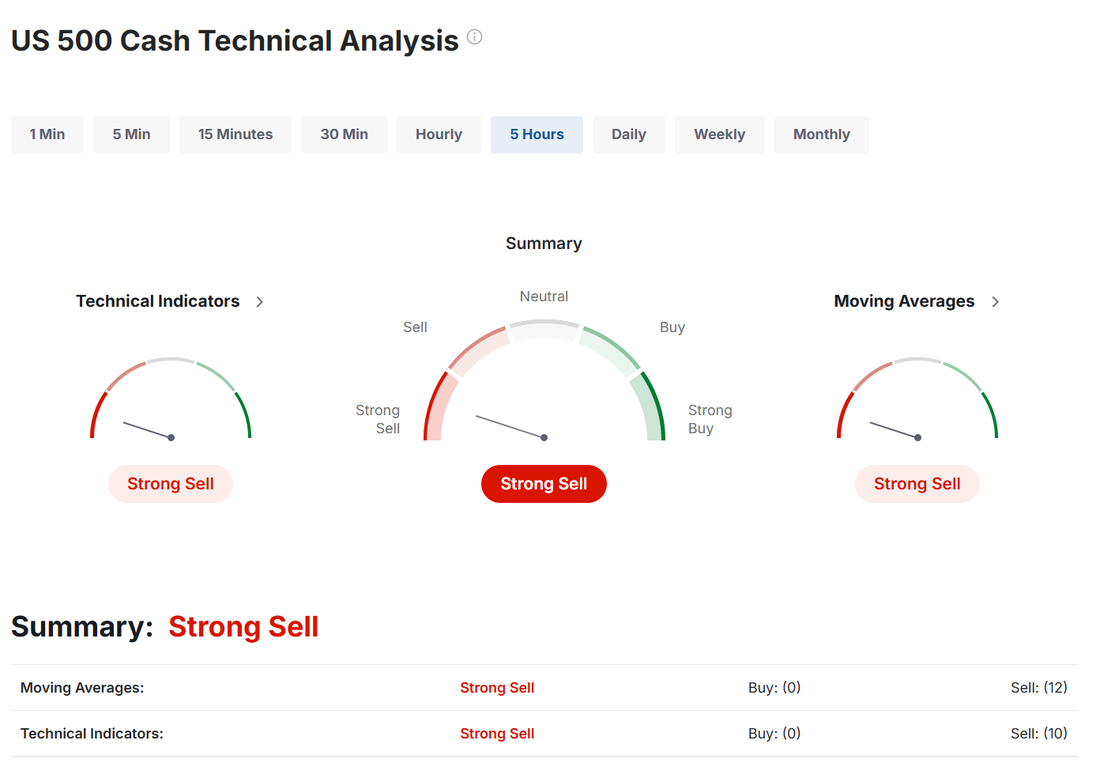

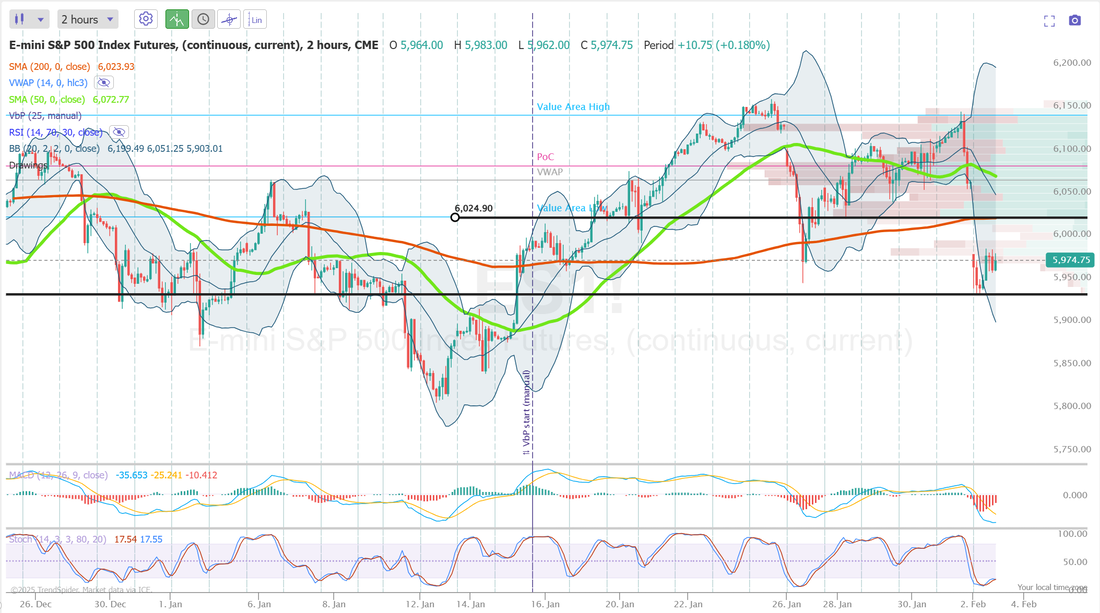

Welcome to a new month of trading and a new set of market catalysts called "tariffs". The market got thrown into turmoil late Friday as the treat of tariffs turned into more of a reality. I say more of a reality vs. an actual reality because there is still a chance (slim?) that this goes away. The tariffs were implemented last Saturday but they are really "implemented" until tomorrow, Tuesday. The EU tariff threat seems like it will be worked out before implementation and Trump has mentioned he will be talking to Canada and Mexico today, one day before D-day. It's a massive game of chicken with huge potential for market swings. Futures certainly look ugly this morning but if PLTR reports the blow out numbers expected today and a resolution is found (possibly after the market closes) Tomorrow could be a big up day...could be. It's a big guessing game right now. Here's our results from Friday. Let's take a look at the markets. Probably not a surprise that the technicals are bearish to start the day. The SPY ETF closed the week in negative territory at $601.82 (-1.00%). Buyers stepped in early Monday morning, absorbing the DeepSeek dip and driving prices higher in a steady grind with Momentum holding a higher low. By Friday, the gap was finally filled—but just as SPY approached new all-time highs, the tariff news hit, triggering a sharp reversal into the weekend. The QQQ ETF closed the week at $522.29 (-1.39%), maintaining a higher low on the daily despite early-week pressure on tech stocks. Notably, the Momentum indicator has regained positive territory after briefly dipping earlier in the week. With major earnings reports from GOOG and AMZN on the horizon, bulls will be watching closely to see if Monday’s low holds. The IWM outperformed its peers this week but closed in the red at $226.48 (-0.96%). The momentum indicator is showing a hidden bullish divergence on the daily, with momentum making a higher high while price did not. This could signal that small caps are primed to take the lead, after proving to be the most resilient of the major indexes this week. My lean or bias today is neutral. Futures are down 100 points on /ES. Depending on the outcome of the negotiations that are planned with Canada and Mexico we could get a big swing one way or the other. To guess right now would be just that, a guess. Trade docket for today will be lighter than a usual Monday. QQQ scalps could provide good opportunities. VIX trade again. ALTR?, ASUR?, TSLA, VALU, /SI, /MCL, PLTR, MRK and PYPL earnings. Possibly some small 1HTE and 0DTE's today. Let's see if we can find some intra-day levels that we like for some small 0DTE's today. /ES: 6024 is resistance this morning with 5935 acting as support. The challenge with all the indices today is, we know there is the catalyst of pending negotiations on tariffs but no idea when today or what the result will be. Levels may not be helpful today. /NQ: Same principal here. Wide range and hard to put much stock in it yet. 21,580 resistance with 20,890 support. BTC: Bitcoin had over a $10,000 drop from Friday! Big move. It appears to have stabilized now with 98,537 working as resistance now and 93,193 acting as support. I look forward to seeing you all in the trading room today. Today should be a light (hopefully easy) day for us as we sit back a bit and let the tariff situation play out.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |