|

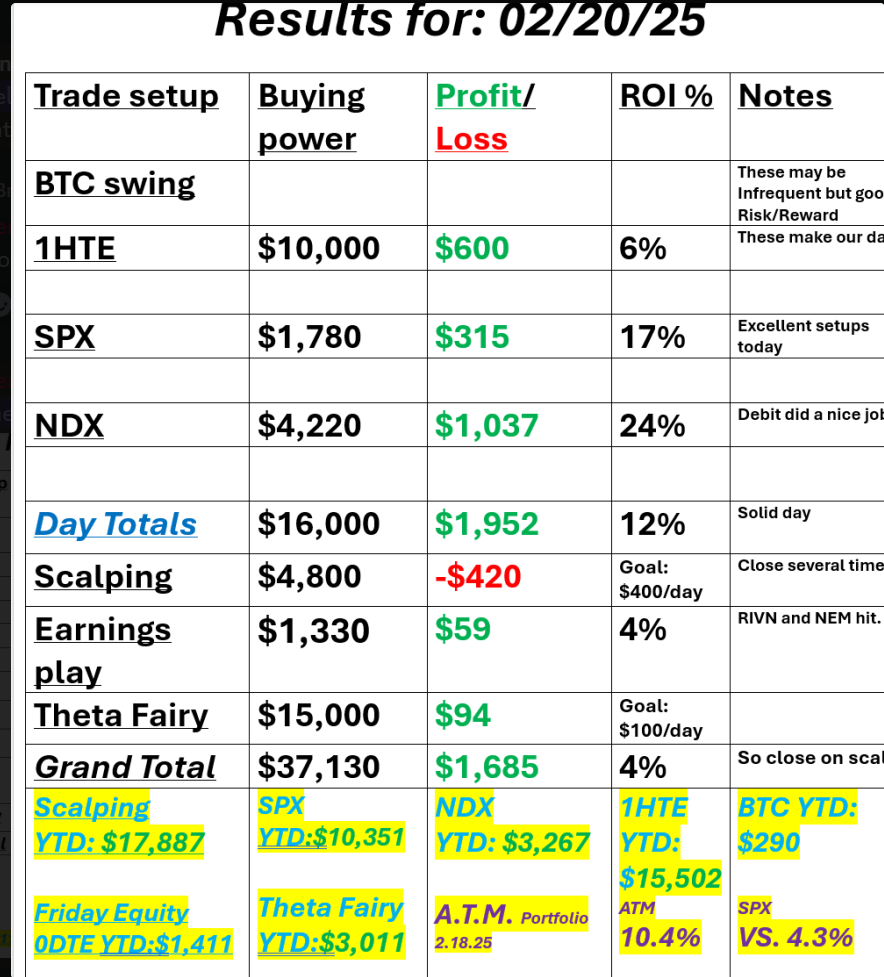

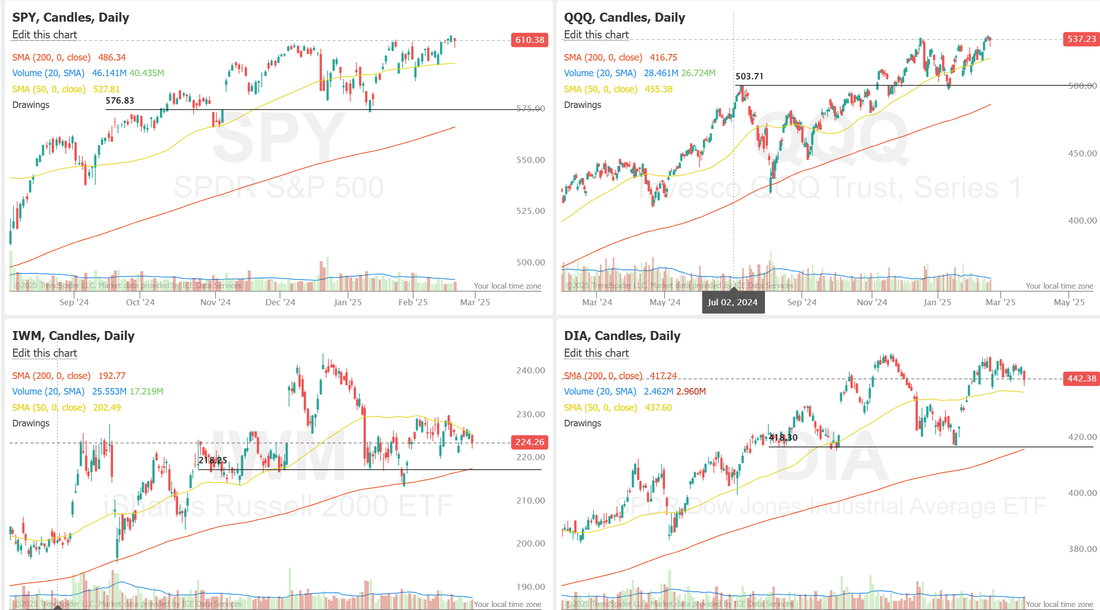

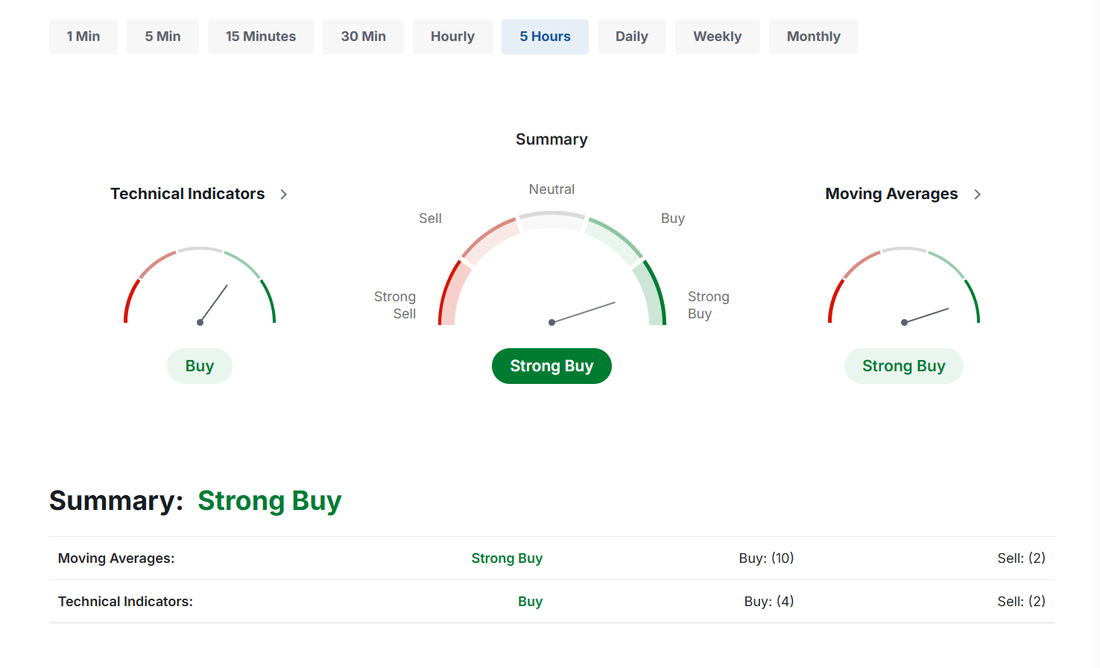

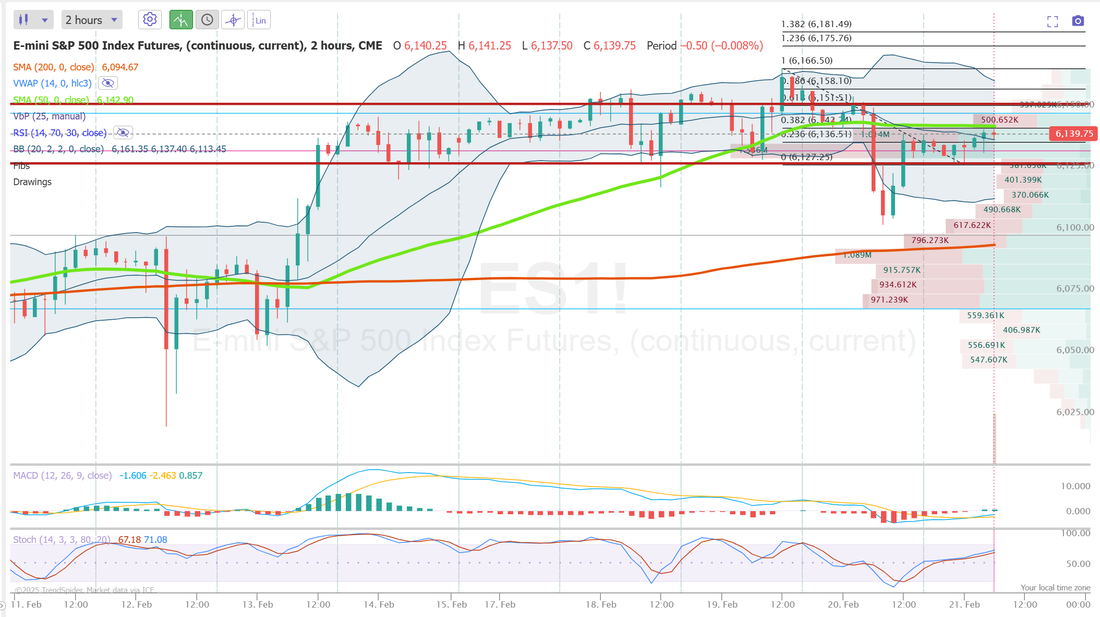

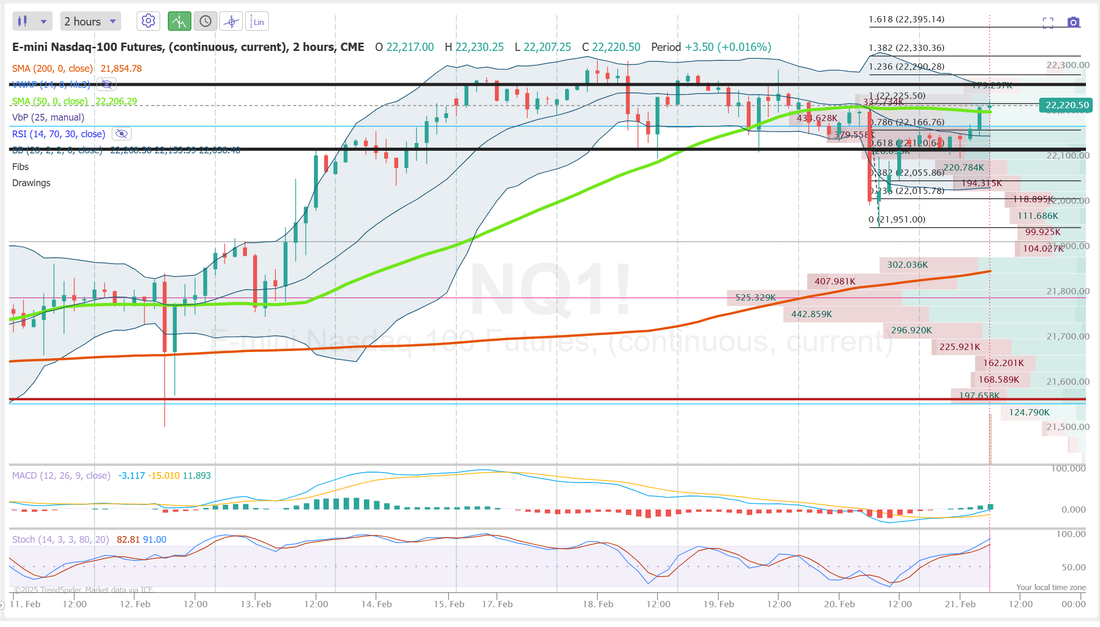

It's Friday! I've got Four vehicles that need registering today. That's my life after the close today! We had a pretty decent week. Here's our results from yesterday. We called the pullback perfectly yesterday so that gave us some good setups to work with. I was close three times to pulling a small profit on scalping and should have done so. We'll see what we can do today. Let's take a look at the markets as we finish out the week. The story for most of the week continued yesterday. The SPY/QQQ are stuck trying to get to new ATH's and the IWM and DIA continue to weaken. Our bearish setups on both of them have performed well for us this week in our ATM portfolio. The market continues to cling to a slight bullish technical outlook. I wouldn't read too much into that unless we can break out of this current range. March S&P 500 E-Mini futures (ESH25) are up +0.11%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.28% this morning, partially rebounding from yesterday’s slump on Wall Street, while investors brace for U.S. business activity data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Walmart (WMT) slid over -6% and was the top percentage loser on the Dow after the world’s largest retailer issued below-consensus FY26 guidance. Also, EPAM Systems (EPAM) tumbled more than -12% and was the top percentage loser on the S&P 500 after the company provided a disappointing full-year EPS forecast. In addition, Carvana (CVNA) plunged over -12% after the company reported a decline in gross profit per vehicle and lower wholesale volumes for the fourth quarter. On the bullish side, Hasbro (HAS) climbed nearly +13% and was the top percentage gainer on the S&P 500 after the toymaker posted better-than-expected Q4 results. “This news out of Walmart raises even more concerns about the state of the consumer. We have already seen some very disappointing numbers on consumer confidence and last week’s retail sales data was much lower than expected. It raises some questions about how strong growth will be over the rest of this year,” said Matt Maley at Miller Tabak + Co. Economic data released on Thursday showed that the U.S. Philly Fed manufacturing index fell to 18.1 in February, weaker than expectations of 19.4. Also, the number of Americans filing for initial jobless claims in the past week rose +5K to 219K, compared with the 215K expected. In addition, the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in January, weaker than expectations of -0.1% m/m. St. Louis Fed President Alberto Musalem said on Thursday that policy should stay “modestly restrictive” until there is clear evidence that inflation is moving toward the central bank’s 2% target, adding that he sees increased risks that progress could stall or even reverse. Also, Fed Governor Adriana Kugler stated that upside risks to inflation persist, indicating support for the central bank to keep its key policy rate unchanged for now. Meanwhile, U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the February Manufacturing PMI will come in at 51.3, compared to last month’s value of 51.2. Investors will also focus on the U.S. S&P Global Services PMI, which stood at 52.9 in January. Economists expect the preliminary February figure to be 53.0. U.S. Existing Home Sales data will be reported today. Economists foresee this figure standing at 4.13M in January, compared to the previous number of 4.24M. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure at 67.8 in February, compared to 71.1 in January. In addition, market participants will be looking toward a speech from Fed Vice Chair Philip Jefferson. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.489%, down -0.22%. My bias or lean today is neutral. Look...we need a catalyst of some kind to come along and shake us out of this range we are stuck in. Will the weak IWM and DIA be able to drag the SPY and QQQ down or will the broader indices pull the weak ones up? Either way, a big directional move is incoming. When and what direction? Your guess is as good as mine but we do have a couple bearish setups we are trading around. I'd really rather be short here vs. long. Well...I missed getting our overnight Vampire trade on! My bad. That looks like it would have cash flowed. We did, however, get a modified Theta fairy on that hit our profit target. For today: PLTR, /NG, BABA, CRNX, CVNA, F, META, NEM, QQQ/SPY, RIVN, 1HTE, 0DTE's. Let's take a look at our intra-day levels...for what it's worth. Not much change happening. /ES: We seem to want to continue channeling in an incredibly tight range. 6152 is resistance with 6127 support. Anything in this range is meaningless chop to me. Above I'm bullish. Below I'm bearish. /NQ: Same story...different index. 22,272 is resistance with 22,124 support. Anything in between is chop. We need a break out move to get a real directional bias working again. BTC: We are getting some movement in Bitcoin. We were finally able to get a 1HTE on yesterday and that $600 profit really helped out the totals for the day. I'd only be interested in playing the support side today. Resistance is 100,795 with support at 98,235. See you all in the trading room shortly! Let's finish the week strong!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |