|

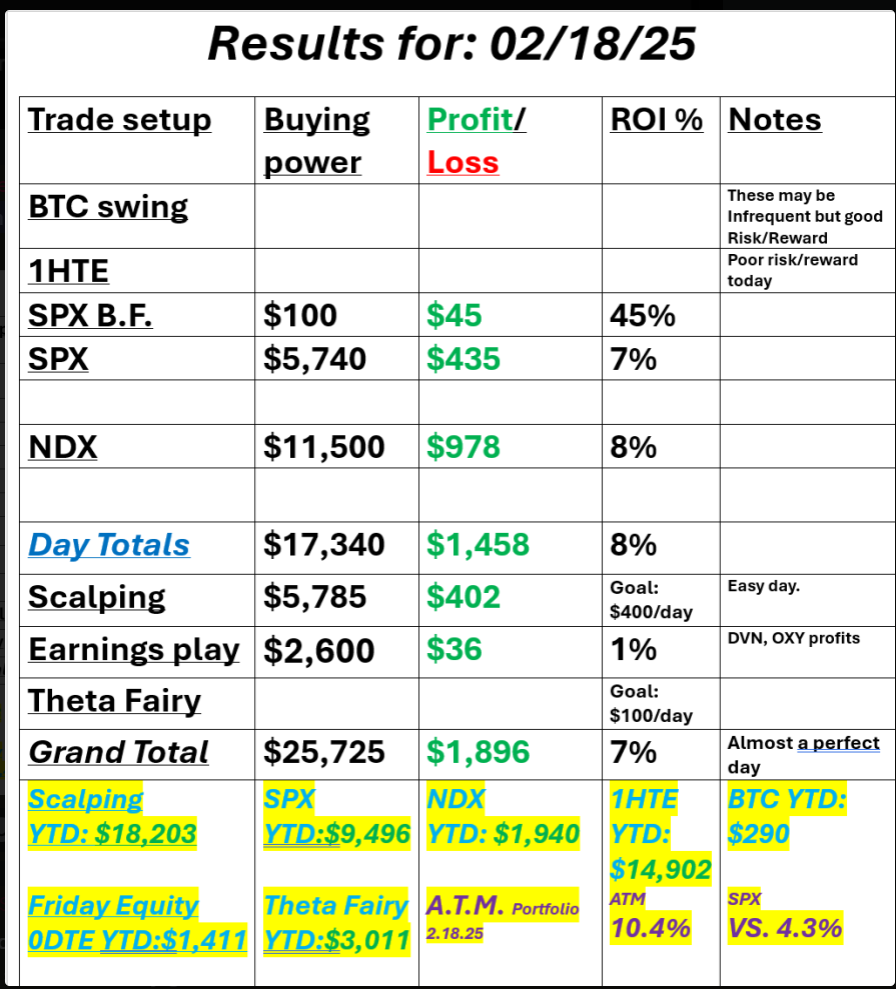

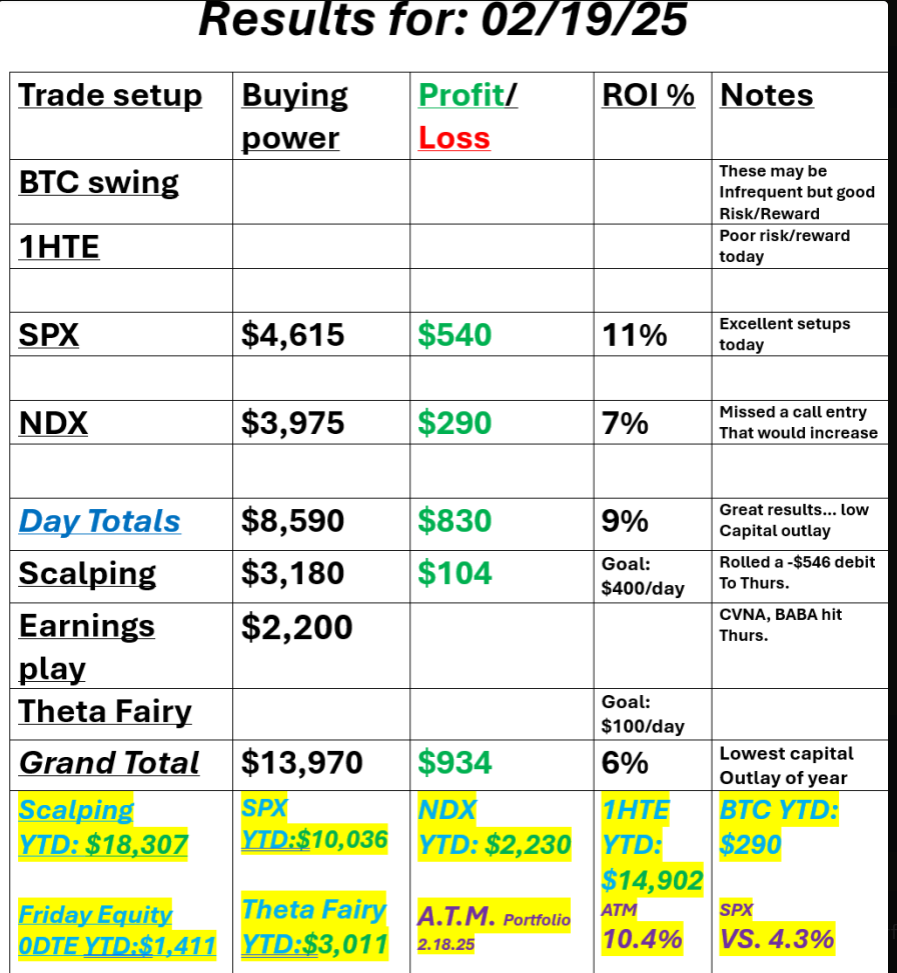

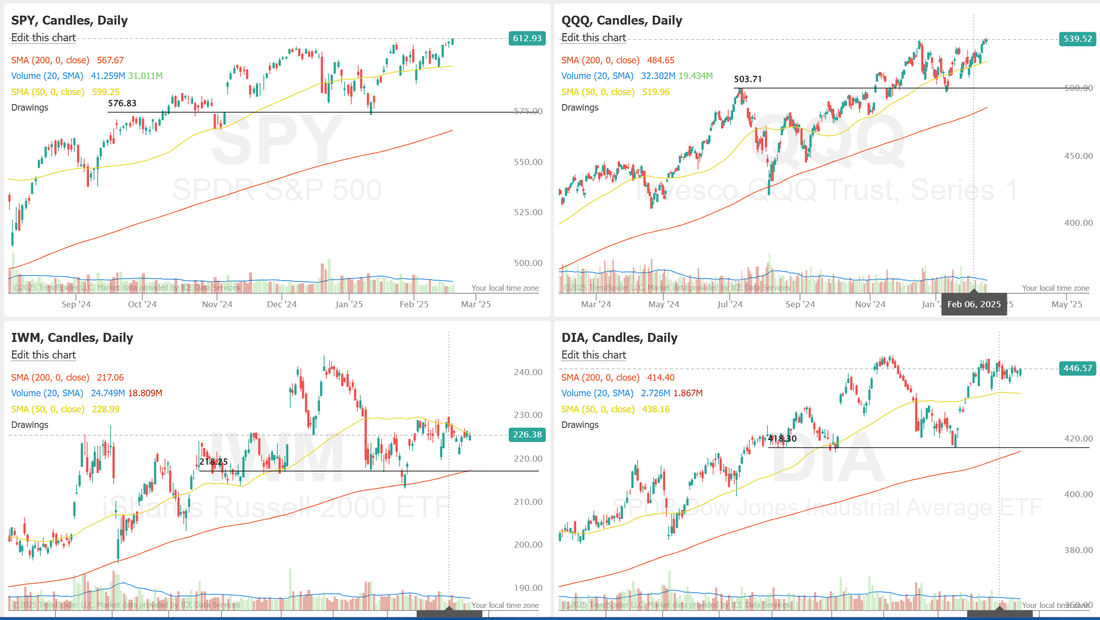

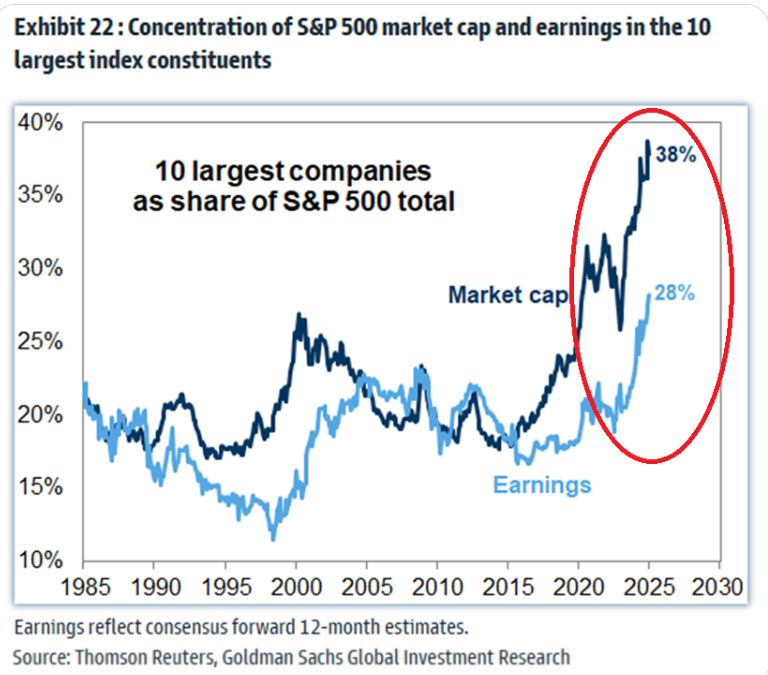

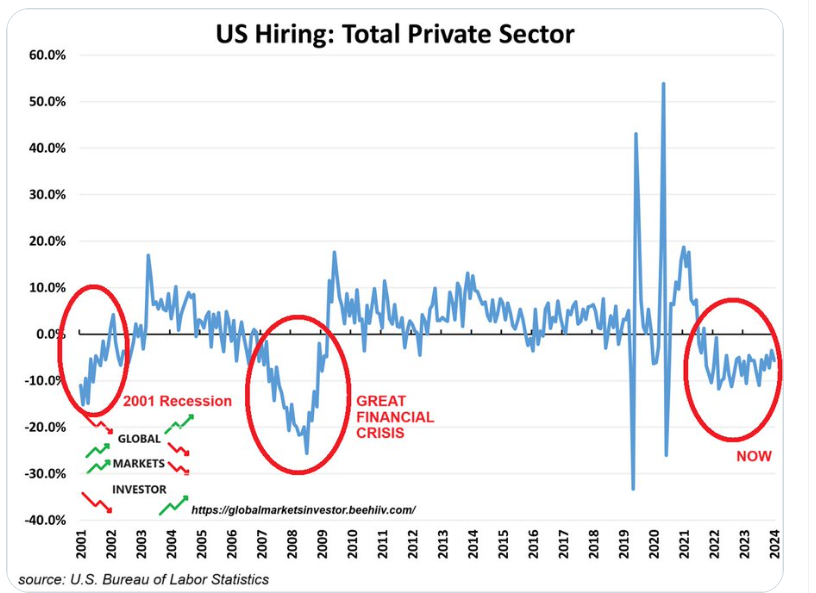

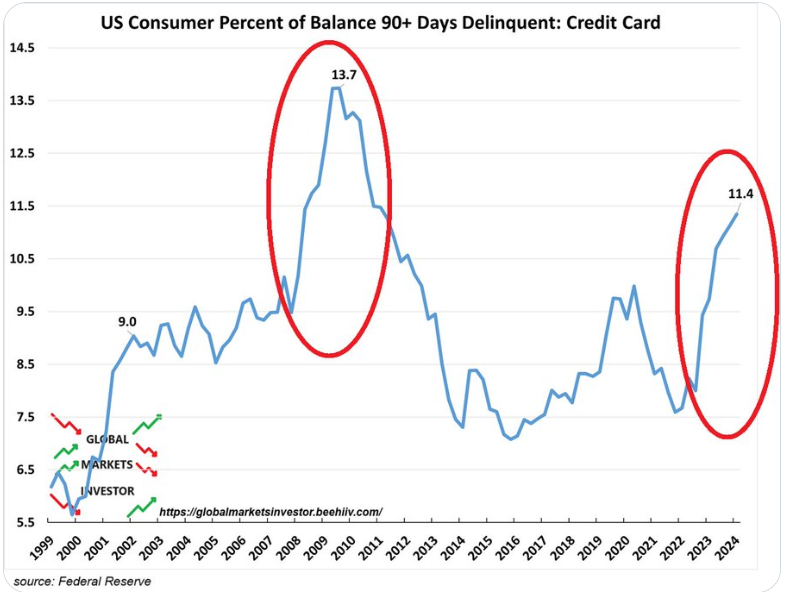

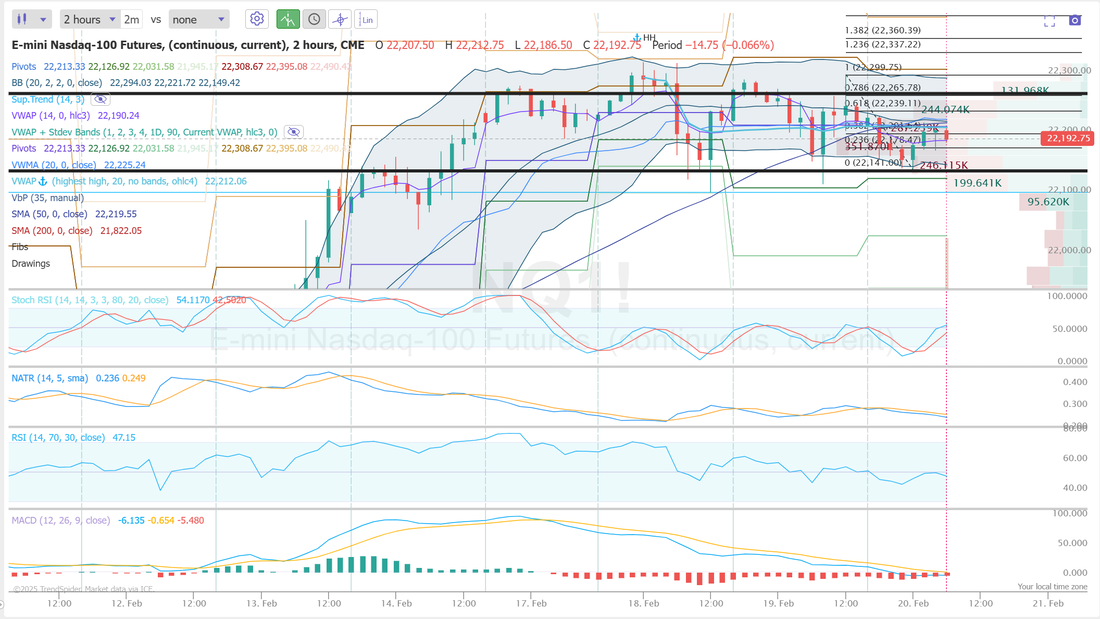

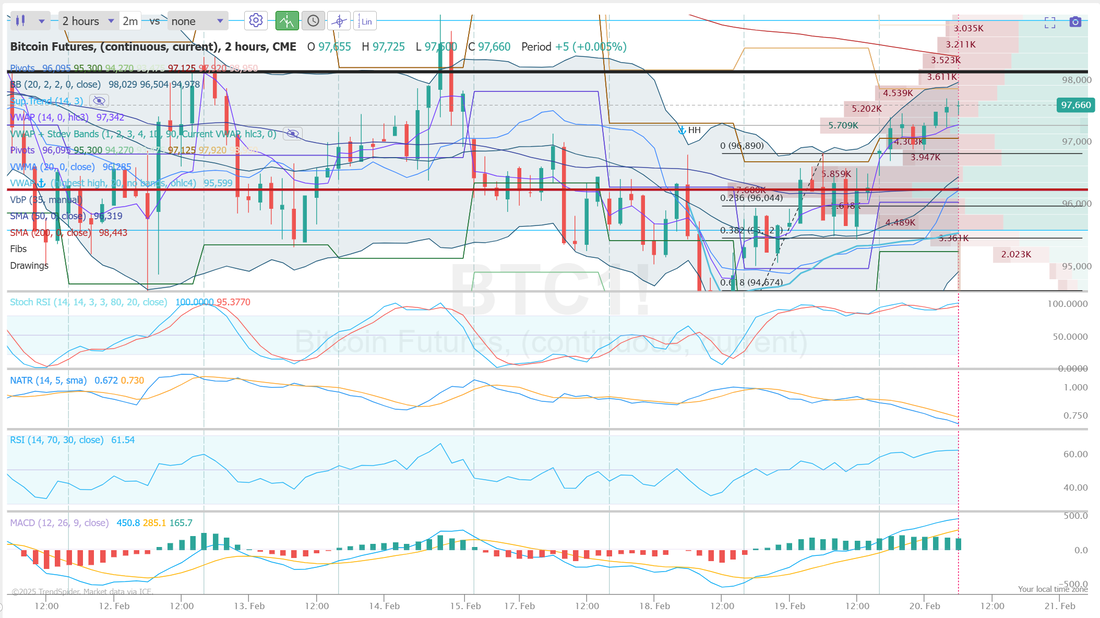

Welcome to Thursday traders! Sorry the blog software was giving me fits yesterday. Here's our results from Tues. Our results from yesterday were solid as well. Impressive even if you consider the low premium and poor price action for the day but it was also our lowest captial outlay of the year. Just not a lot to get behind. Let's take a look at the markets: SPY and QQQ are back to ATH's with the IWM and DIA stuck in a seemingly locked in, tight consolidation zone. March S&P 500 E-Mini futures (ESH25) are down -0.15%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.17% this morning as investors assess tariff and geopolitical risks, while also awaiting a raft of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. Market jitters have been fueled in recent days by U.S. President Donald Trump’s apparent shift away from supporting Ukraine and its European allies, along with his threats to expand tariff plans across multiple sectors. Trump told reporters on Wednesday that he is considering a 25% tariff on lumber, with the import levy potentially coming around April 2nd. Trump also said he would announce tariffs on cars, semiconductors, and pharmaceuticals “over the next month or sooner.” The minutes of the Federal Open Market Committee’s January 28-29 meeting, released Wednesday, showed that officials are in no hurry to cut interest rates amid stubborn inflation and economic policy uncertainty. “Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate,” according to the FOMC minutes. Policymakers are also monitoring the implementation of Trump’s economic policy plans and their potential impact on the economy. “Participants cited the possible effects of potential changes in trade and immigration policy, the potential for geopolitical developments to disrupt supply chains, or stronger-than-expected household spending,” the minutes said. Still, officials anticipated that “under appropriate monetary policy” inflation would continue to move toward their 2% target. “Another ‘nothing burger’ from the Fed. After making a big adjustment in December there is no rush to make other changes. It’s uncharted territory but not necessarily bad for stocks,” said David Russell at TradeStation. In yesterday’s trading session, Wall Street’s major indexes ended higher. Garmin (GRMN) surged over +12% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected Q4 results and provided solid FY25 guidance. Also, quantum computing stocks soared on Microsoft’s new chip, with D-Wave Quantum (QBTS) jumping more than +8% and Quantum Computing (QUBT) climbing over +7%. In addition, Analog Devices (ADI) rose more than +9% after the chipmaker posted upbeat FQ1 results and issued above-consensus FQ2 guidance. On the bearish side, Celanese (CE) plummeted over -21% and was the top percentage loser on the S&P 500 after the specialty chemicals company swung to a quarterly loss. Economic data released on Wednesday showed that U.S. housing starts fell -9.8% m/m to 1.366M in January, weaker than expectations of 1.390M. At the same time, U.S. building permits, a proxy for future construction, rose +0.1% m/m to 1.483M in January, stronger than expectations of 1.460M. Fed Vice Chair Philip Jefferson said on Wednesday that a strong U.S. economy gives policymakers the flexibility to wait before considering further interest rate cuts. Also, Atlanta Fed President Raphael Bostic said, “I’ve been really comfortable with the idea that we would take a pause and wait and see how the economy’s evolving and then use that information to guide what our policy should look like over the next several months.” Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the March FOMC meeting. Today, retail giant Walmart (WMT) and notable companies like Booking (BKNG), Copart (CPRT), Block (XYZ), and Rivian Automotive (RIVN) are slated to release their quarterly results. On the economic data front, all eyes are on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February Philly Fed manufacturing index will stand at 19.4, compared to last month’s value of 44.3. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 215K, compared to last week’s number of 213K. The Conference Board’s Leading Economic Index for the U.S. will be reported today. Economists forecast the January figure at -0.1% m/m, the same as the previous reading. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be 3.200M, compared to last week’s value of 4.070M. In addition, market participants will be anticipating speeches from Fed officials Goolsbee, Jefferson, Musalem, Barr, and Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.524%, down -0.24%. CVNA, BABA, META, QQQ's, /MNQ scalping, VALU?, RIVN, NEM, 1HTE, 0DTE's. Top 10 US stocks' market cap and earnings GAP is INSANE: The largest 10 firms as a share of the S&P 500 hit 38%, near an all-time high. Their earnings account for 28% of the S&P 500 profits and have not kept up with the market cap expansion. The gap will eventually close. US private sector hiring is in a RECESSION: US hiring in the private sector has declined for 29 months STRAIGHT, the longest streak since the Great Financial Crisis. Hiring rate dropped to 3.6% in December, the second-lowest in 10 YEARS, nearly in line with the 2020 low. Americans are MISSING debt payments as if there is a RECESSION: US consumer serious delinquency rates (90+ days) in credit card debt have jumped to 11.4%, the highest in 13 YEARS. They have risen at the pace recently seen in the Great Financial Crisis of 2007-2009. Serious delinquencies have also exceeded the 2001 recession levels. US consumers are struggling. My bias or lean today is neutral to bearish. I'm not seeing the catalyst that can push the SPY/QQQ's to new ATH's and the IWM/DIA are stuck. We've had a nice run. The tecnicals are still bullish but I think we are due a pause. Let's take a look at our levels today: /ES: Another day of very low expected moves. 6157 is resistance with 6132 support. Very tight range today. /NQ: Same situation. The zone is incredibly tight. It's almost like the market shut down on Feb. 13th and hasn't moved since. We'll get a break out at some point. Resistance is 22,270 with support at 22,140. BTC: Bitcoin is finally getting a bit of movement. $98,171 is now resistance with $96,318 support. I'm not sure what premium will look like this morning with 1HTE's but we may be able to get one working. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |