|

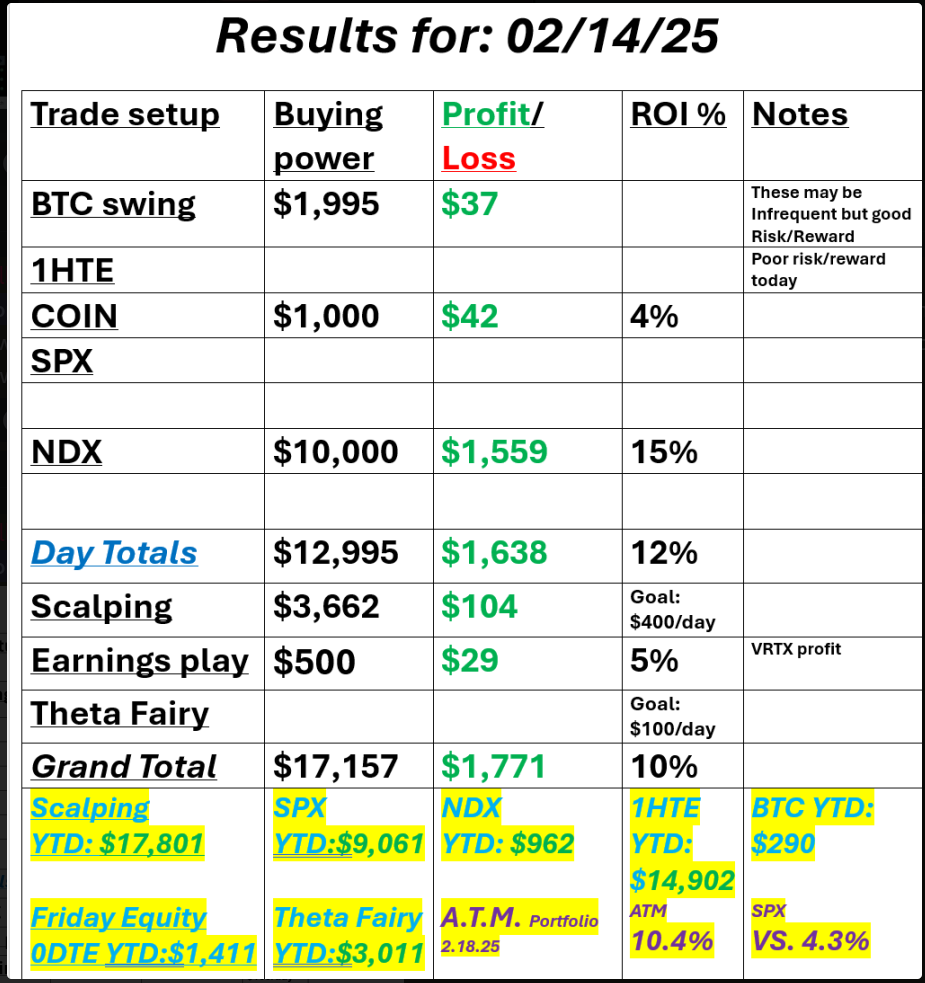

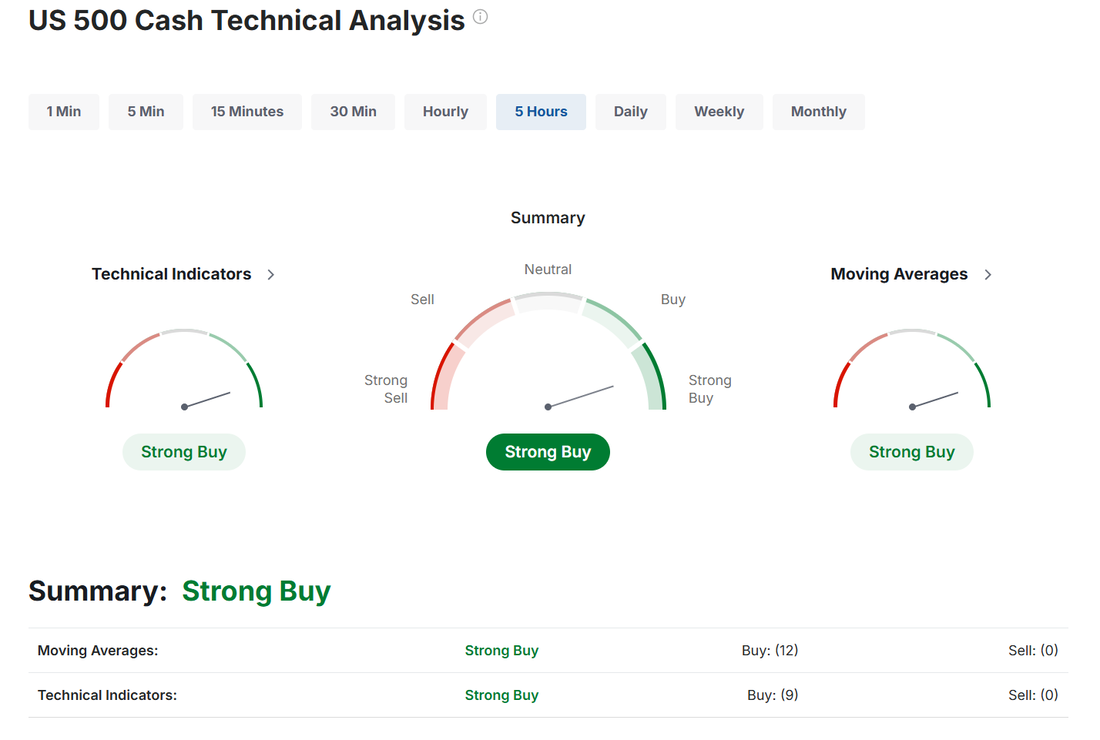

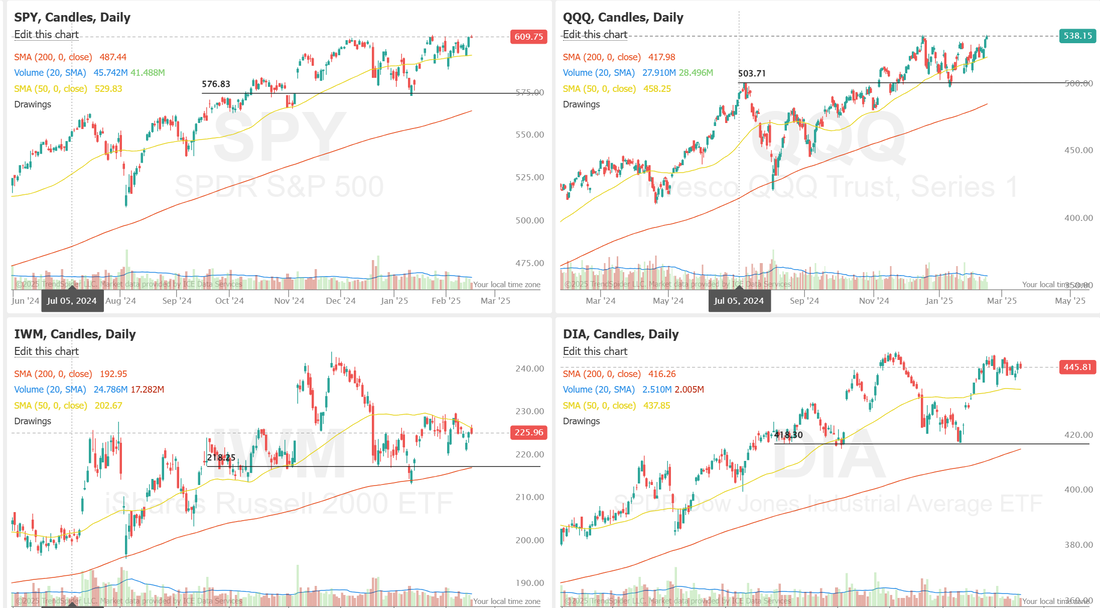

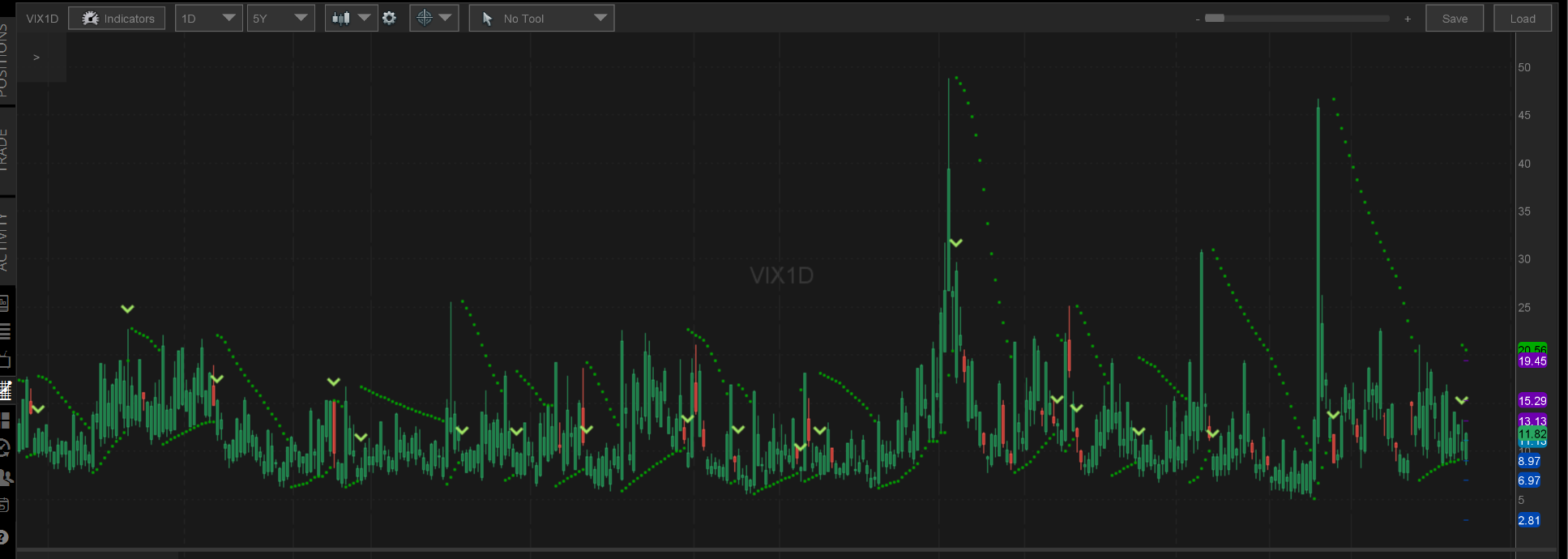

Good morning traders! Welcome back to a shortened holiday trading week. I hope you all had a great break from trading. My wife and I were able to spend some time with some good friends up in the mountains and it was nice to have a break. We had a solid day Friday using very little capital, comparitively speaking. We'll have a very short zoom session this morning to talk strategy and go over our results YTD. Here's a look at how our Friday went. Markets are starting off the week with a slight bullish lean. The SPY and QQQ's are pressing on the ATH's. The IWM and DIA look a tad weaker. We are initiating some bearish cash flow setups today in our ATM portfolio on both of those. March S&P 500 E-Mini futures (ESH25) are up +0.32%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.36% this morning as U.S. and Russian representatives met to negotiate an end to the three-year war in Ukraine. Limiting gains in U.S. stock futures, Treasury yields surged as cash trading resumed following the Presidents’ Day holiday. A rise in bond yields followed hawkish comments from Fed officials. Fed Governor Christopher Waller stated on Tuesday that recent economic data supported maintaining interest rates at current levels until further progress on inflation was observed. Also, Fed Governor Michelle Bowman said on Monday that while monetary policy “is now in a good place,” she wants to “gain greater confidence that progress in lowering inflation will continue as we consider making further adjustments to the target range.” In addition, Philadelphia Fed President Patrick Harker advocated for keeping rates unchanged amid a strong economy but said he anticipates interest rates will gradually decline in the long run. See Next: Meet the Disruptor Shaking Up the $500 Billion Smartphone Industry The Barchart Brief: Your FREE insider update on the biggest news stories and investing trends, delivered middayInvestors’ focus this week is also on the publication of the minutes of the Federal Reserve’s latest policy meeting, remarks from other Fed officials, and a fresh batch of U.S. economic data. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Airbnb (ABNB) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the vacation home rental company reported upbeat Q4 results. Also, chip stocks gained ground after Treasury yields extended declines, with Micron Technology (MU) rising more than +4% and Nvidia (NVDA) advancing over +2%. In addition, Roku (ROKU) climbed more than +14% after the company posted better-than-expected Q4 results and said it aims to be profitable in FY26. On the bearish side, GoDaddy (GDDY) tumbled over -14% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q4 EPS. Also, Applied Materials (AMAT) slid more than -8% and was the top percentage loser on the Nasdaq 100 after the chipmaking equipment maker provided a weak FQ2 revenue forecast. Economic data released on Friday showed that U.S. retail sales slipped -0.9% m/m in January, missing the -0.2% m/m consensus, while core retail sales, which exclude motor vehicles and parts, dropped -0.4% m/m, weaker than expectations of +0.3% m/m. Also, U.S. industrial production climbed +0.5% m/m in January, stronger than expectations of +0.3% m/m, while manufacturing production unexpectedly fell -0.1% m/m, weaker than expectations of +0.1% m/m. In addition, the U.S. import price index rose +0.3% m/m in January, weaker than expectations of +0.4% m/m. “The consumer sentiment report showed people were getting nervous and [Friday’s] weak retail sales number confirmed it. However, the resulting slack is good news for the Fed and tilts the balance a little bit more toward rate cuts,” said David Russell at TradeStation. In this holiday-shortened week, investors will be closely watching the Federal Reserve’s minutes from the January 28-29 meeting, scheduled for release on Wednesday, for further indications that rate cuts remain unlikely in the foreseeable future amid expectations that inflation may remain elevated for longer. Market participants will pay particular attention to any comments on the potential inflationary impact of President Trump’s proposed policies, including trade tariffs. Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Market watchers will also focus on several economic data releases this week, including the U.S. S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), Building Permits (preliminary), Housing Starts, the Philadelphia Fed Manufacturing Index, Initial Jobless Claims, Crude Oil Inventories, Existing Home Sales, and the University of Michigan’s Consumer Sentiment Index. In addition, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michael Barr, Fed Vice Chair Philip Jefferson, Chicago Fed President Austan Goolsbee, Fed Governor Adriana Kugler, and St. Louis Fed President Alberto Musalem will be making appearances this week. Fourth-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Arista Networks (ANET), Medtronic (MDT), Analog Devices (ADI), Booking (BKNG), Rivian Automotive (RIVN), and Occidental Petroleum (OXY). Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February Empire State manufacturing index will come in at -1.90, compared to -12.60 in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.506%, up +0.67%. My lean or bias today is a bit of a mixed bag. I'm still slightly bullish on SPY/QQQ however they are hitting up against ATH's so watch that. I'm also initiating a bearish setup on IWM/DIA today. Let's take a look at volatility and expected moves this shortened week: Nothing impressive I.V. wise. VIX1D is buried. MRK, /MNQ,/NQ scalping, SPY/QQQ 3DTE, IWM, /BTC, OXY, DVN, 1HTE, 0DTE's. Let's take a look at our intra-day levels: /ES: Bullish price action with 6157 being the overhand and nearest resistance. A break above this would take us into unchartered territory. 6139 is support. /NQ: Similar pattern as /ES. 22,317 is resistance with 22,214 working as support. BTC: Bitcoin continues to be range bound. We'll be putting on a 10DTE today with a neutral slant and almost a 11% ROI potential. 97,230 is resistance with 95,574 working as support. I'll see you all in the special zoom session shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |