|

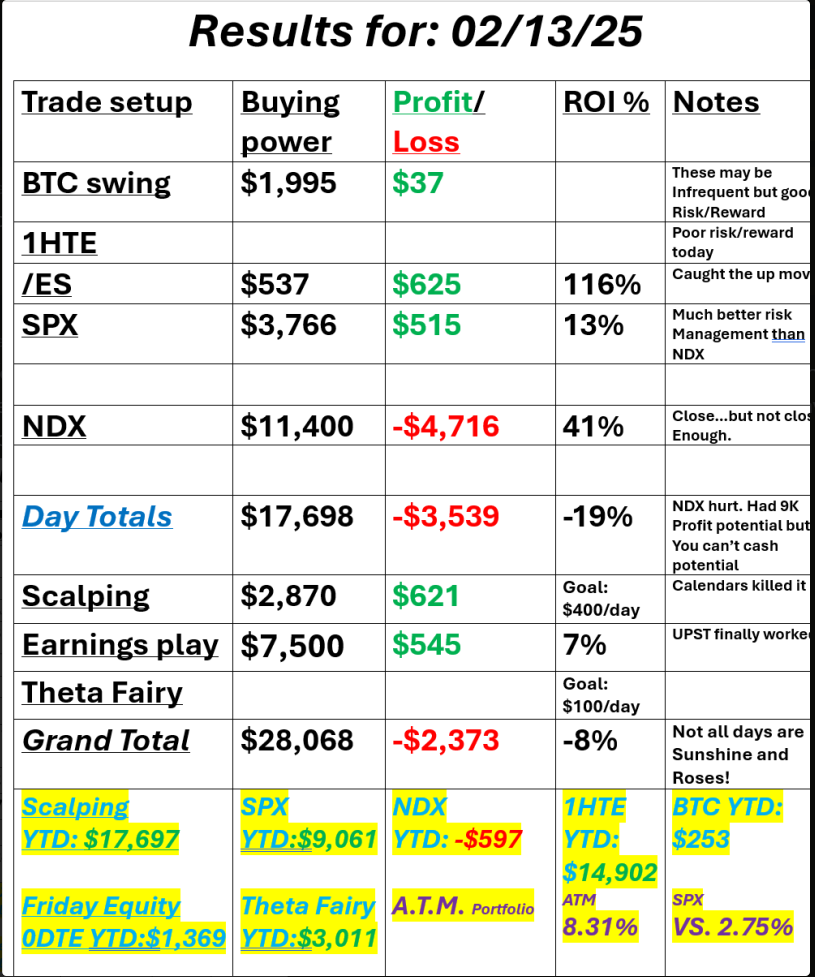

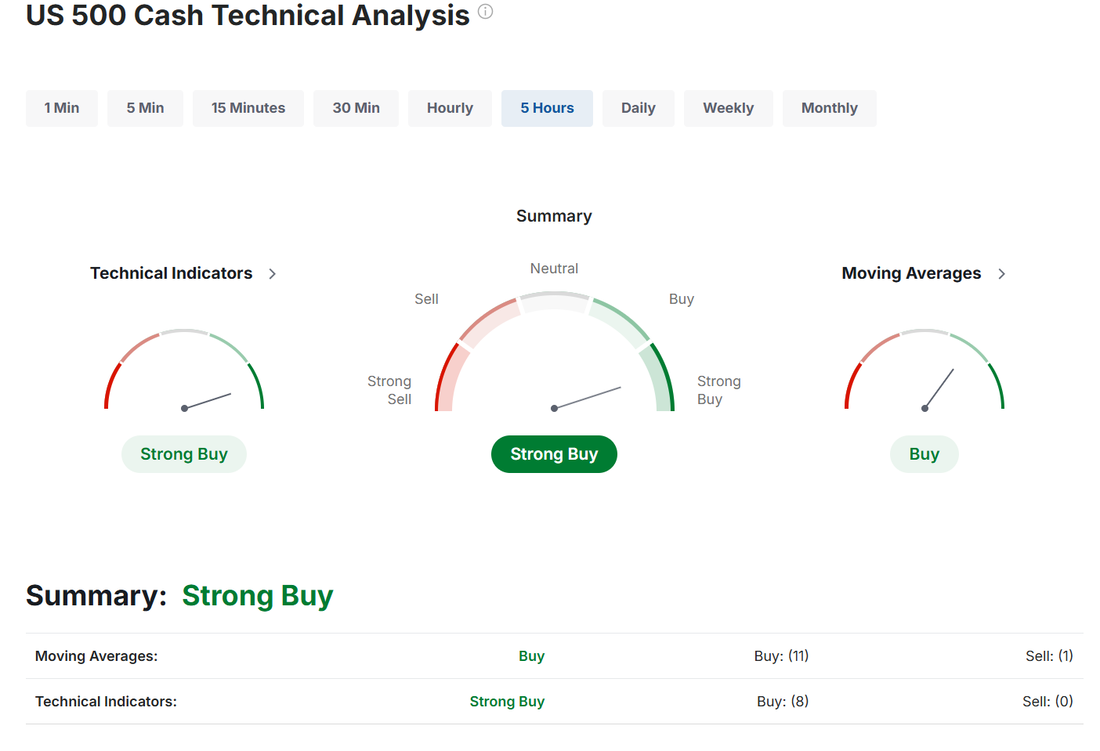

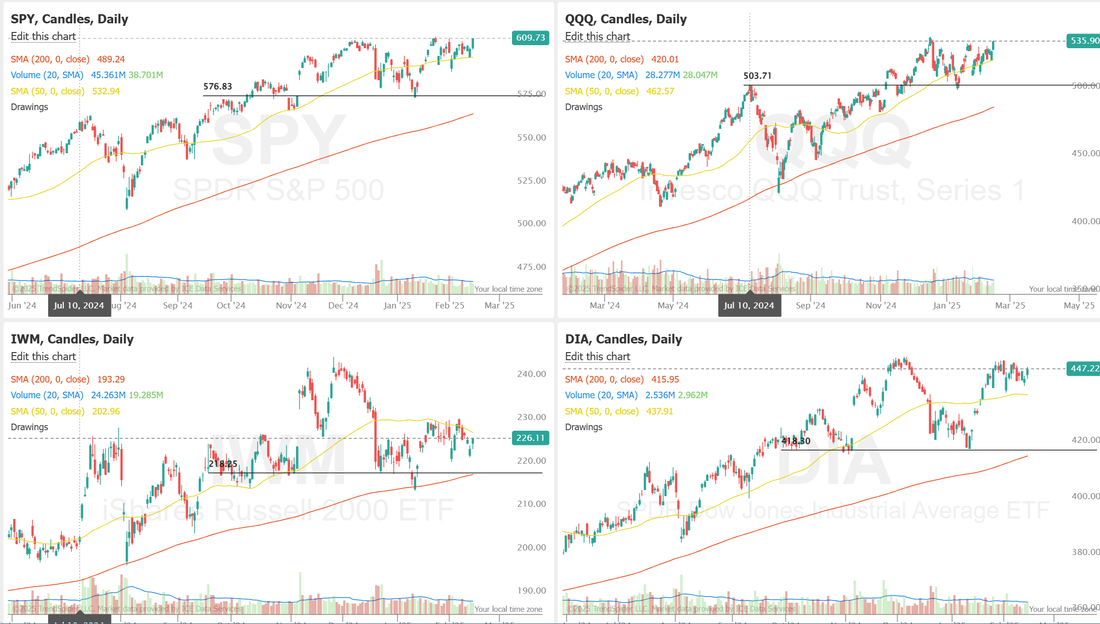

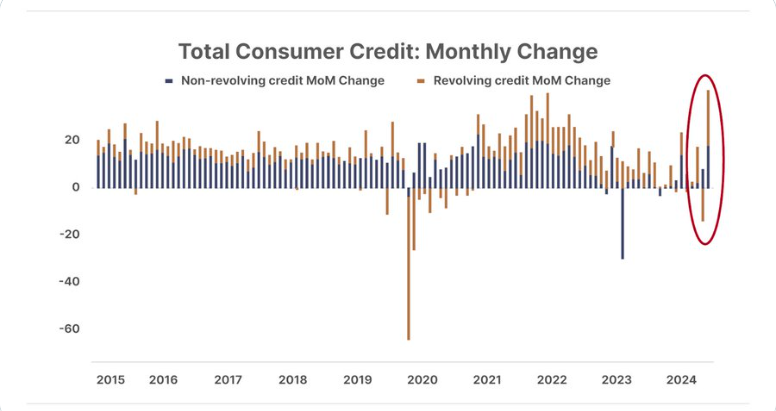

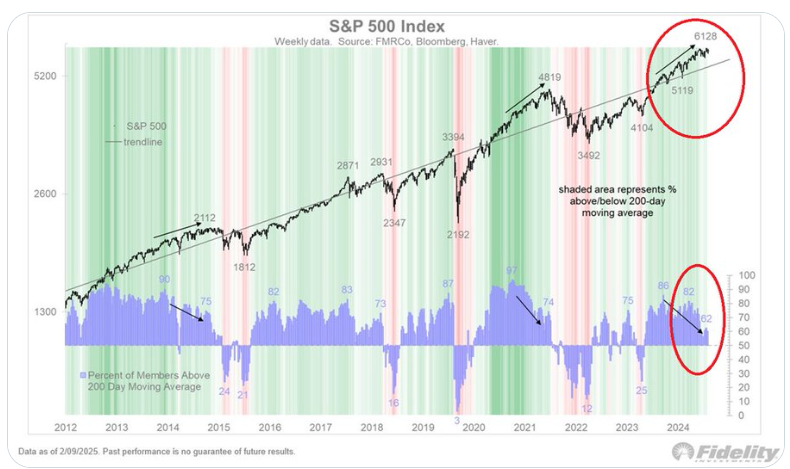

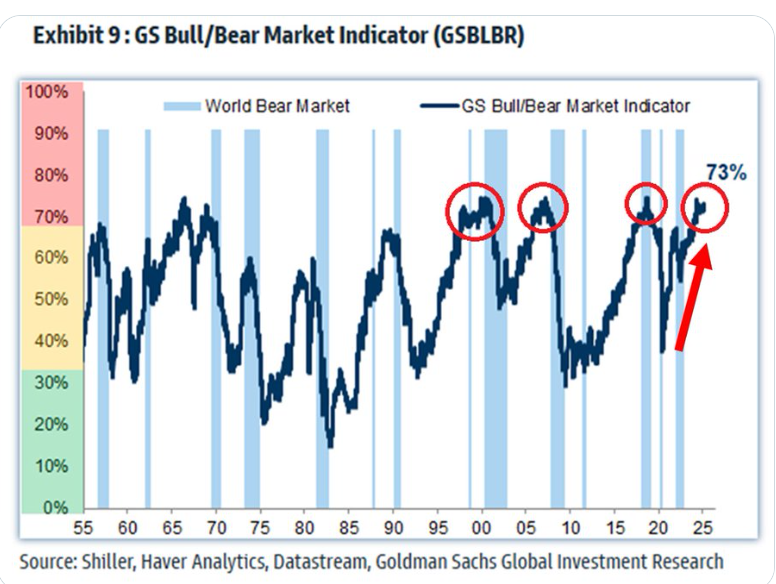

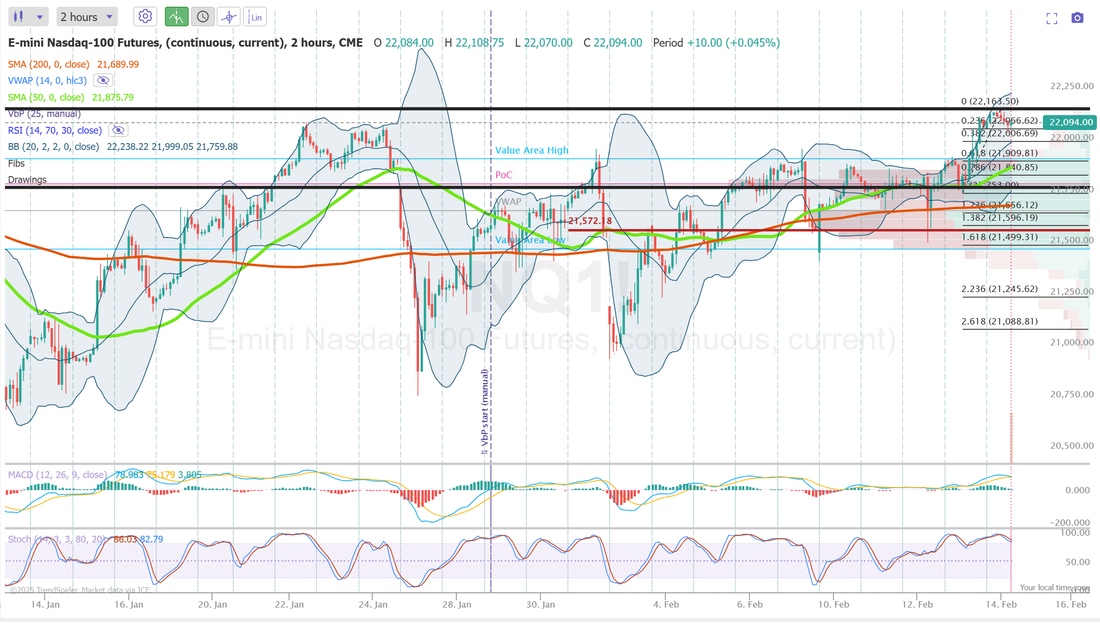

Good morning traders and Happy Valentines (if that's something you celebrate). I'm a lucky man. My wife agrees with me that it's a manufactured holiday and we don't do gifts. Makes it easy if you're a man! I had a losing day yesterday. It's been a while. We've had a nice run but they can't all be winners. Most of our trades did well but the NDX ended up being a loser for me. I was asked by one of our trading members, "in retrospect, would you still do the trade?" My response was, "In retrospect I would NOT do any trade at any time that loses money!" LOL. It seemed pretty obvious to me but thinking deeper it's not that easy. It was a good risk/reward. I was risking about $4,500 for a potential $9,000 profit. It just didn't hit. If you look at our YTD results so far everything has been going well...except the NDX. What are my take aways with regards to that? #1. We just have to, have to, have to be out of these setups before the close. Trying to take the NDX all the way to expiration is like a kamakazi mission #2. I try to constantly remind myself that every trade is a winning trade...of one of the trade participants. That means if you are in a setup that is constantly losing, it may be a great trade! You're just on the wrong side of it. If wild unexpected moves are hurting us in the NDX I'm going to go with the flow today and put on a long vol NDX trade. Let the market do what it will! Here's our results below: Let's take a look at the markets: Technicals are slightly bullish. For the first time in nearly three weeks it looks like the markets are wanting to trend again. We are getting close to pressing on the ATH's on several major indices. My bias or lean today is slightly bullish. That seems to be the push that started yesterday. Yes, we are going to be running into resistance soon but the buyers seem stronger than the sellers right now. March S&P 500 E-Mini futures (ESH25) are trending down -0.15% this morning, taking a breather at the end of a turbulent week, while investors await a raft of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s major indices closed in the green, with the benchmark S&P 500 posting a 1-1/2 week high and the tech-heavy Nasdaq 100 notching an 8-week high. MGM Resorts International (MGM) surged over +17% and was the top percentage gainer on the S&P 500 after the casino operator reported stronger-than-expected Q4 results. Also, chip stocks advanced after Treasury yields retreated, with Intel (INTC) climbing more than +7% and Micron Technology (MU) rising over +4%. In addition, AppLovin (APP) jumped more than +24% and was the top percentage gainer on the Nasdaq 100 after the mobile software company posted upbeat Q4 results and issued above-consensus Q1 revenue guidance. On the bearish side, West Pharmaceutical Services (WST) cratered over -38% and was the top percentage loser on the S&P 500 after issuing below-consensus FY25 guidance. Also, The Trade Desk (TTD) tumbled more than -32% after the ad tech firm posted weaker-than-expected Q4 revenue and provided disappointing Q1 revenue guidance. Economic data released on Thursday showed that the U.S. producer price index for final demand rose +0.4% m/m and +3.5% y/y in January, stronger than expectations of +0.3% m/m and +3.2% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.3% m/m and +3.6% y/y in January, compared to expectations of +0.3% m/m and +3.3% y/y. In addition, the number of Americans filing for initial jobless claims in the past week fell -7K to 213K, compared with the 217K expected. “While PPI was much higher than expected, with even higher revisions, the real data that goes into PCE was weaker. And PCE is the one that Jerome Powell and the Fed look at. So in reality, the numbers are better,” said Andrew Brenner at NatAlliance Securities. U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Meanwhile, U.S. President Donald Trump on Thursday ordered his administration to explore the implementation of reciprocal tariffs on multiple trading partners. Trump signed a measure directing the U.S. Trade Representative and Commerce Secretary to propose new tariffs on a country-by-country basis to rebalance trade relations, a comprehensive process that could span weeks or months to complete. Howard Lutnick, Trump’s nominee for Commerce Secretary, stated that all studies should be finalized by April 1st, allowing Trump to take action immediately thereafter. “The fact this is a slow burn approach from Trump, with the chance many of the tariffs will be extinguished, is supporting market sentiment,” said Kyle Rodda, senior market analyst at Capital.com. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that January Retail Sales will stand at -0.2% m/m, compared to the December figure of +0.4% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.4% m/m in December. Economists expect the January figure to be +0.3% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists forecast January Industrial Production at +0.3% m/m and Manufacturing Production at +0.1% m/m, compared to December’s figures of +0.9% m/m and +0.6% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be +0.3% m/m and the import price index to be +0.4% m/m in January, compared to the previous figures of +0.3% m/m and +0.1% m/m, respectively. In addition, market participants will be anticipating a speech from Dallas Fed President Lorie Logan. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.528%, up +0.07%. /MCL, /ZN, /ZW?, IBIT, MRK, TSLA, VRTX. ABNB, TWLO and COIN as possible equity 0DTE's. NDX 0DTE. I'll focus our 0DTE efforts today on NDX. As I mentioned, markets are finally back to pressing on ATH's. Can the bulls breakthrough and establish a new uptrend? As inflation runs hot, more Americans are relying on debt to get through life. Total consumer debt surged by a record $40.8 billion in December, contributing to a $950 billion increase over the past five years. This brought total consumer debt to over $5 trillion. Financial pressure on households continues to escalate (and meanwhile, job openings are falling… and rents are falling …)... when will they finally reach their limit? $META has now traded green for 19 consecutive days, the longest winning streak in history for any Magnificent 7 stock and one of the greatest runs in history! Is the S&P 500 bull market near an end? ~61% of S&P 500 stocks trade above their 200-day moving average, down from 86% at the peak. According to Jurrien Timmer, Director of Global Macro at Fidelity, this trend shows a negative divergence, feeling like "late innings" to him. The Goldman Sachs Bull/Bear Market Indicator measuring market and economic sentiment hit 73%, one of the largest readings in history. The index uses valuations, yield curve, unemployment, inflation and other metrics. The sentiment has rarely been greater. Let's take a look at our intra-day level on /NQ as that will be our focus for 0DTE today. On a daily chart we are back to ATH! On the 2hr. chart however, we start to see some divergence. Resistance is close and obviously correlates with the ATH. It would be a big feat for the bulls if they could break above 22,161 and hold. There are multiple support levels on the way down. 22,066, 22,008, 21,912, 21,840, 21,782. There's a lot more support levels than resistance. It should be easier for the bears to push down through these levels than for the bulls to push up above the ATH. I'll see you all in the trading room shortly! Let's get a nice finish today to end the week.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |