|

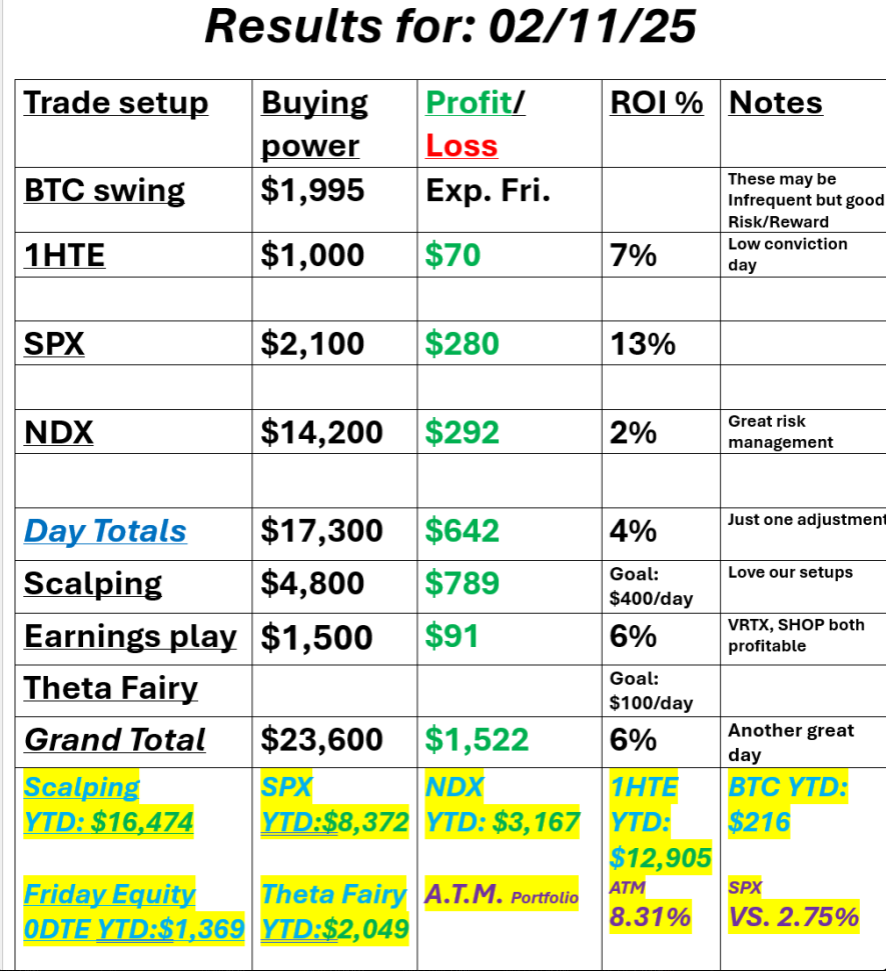

Welcome to CPI day! We've got PPI coming up tomorrow. Will these two days of data be enough to get us trending out of this chop zone? I'd love to see a down move to get some premium back in our trades. We had another solid day yesterday. Risk management was on point. It almost always costs us some potential when we are super risk focused. Pulling legs early or repositioning almost always costs money which comes out of the max potential profit but I made the statement Sunday night in our trading room that I wanted to pull $1,000 a day out of my account this week and still keep the value growing so we have no room for error and so far so good. Take a look at our results below. Also, our YTD numbers are looking pretty good. I only update our ATM program once a month but that asset allocation model is up over 11% so far YTD. I continue to think we'll have a really good shot at a good result this year vs. the SP500, which I think is going to have some headwinds. March S&P 500 E-Mini futures (ESH25) are trending down -0.12% this morning as investors braced for the release of key U.S. inflation data while also awaiting further testimony from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. DuPont de Nemours (DD) climbed over +6% and was the top percentage gainer on the S&P 500 after the industrial materials maker reported better-than-expected Q4 results. Also, Coca-Cola (KO) advanced more than +4% and was the top percentage gainer on the Dow after the beverage maker posted upbeat Q4 results. In addition, Intel (INTC) rose over +6% after U.S. Vice President JD Vance said the Trump administration would ensure that advanced artificial intelligence chips are manufactured in the country. On the bearish side, Fidelity National Information Services (FIS) plunged more than -11% and was the top percentage loser on the S&P 500 after the payment technology company issued below-consensus Q1 guidance. Don't Miss: Own a piece of the world’s most iconic characters—invest now before this opportunity disappears! The Barchart Brief: Your FREE insider update on the biggest news stories and investing trends, delivered middayIn prepared remarks for a Senate hearing Tuesday, Fed Chair Jerome Powell reiterated that the central bank is not in a hurry to cut rates. “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” he said. Also, Powell described the labor market as “not a source of significant inflationary pressures.” In addition, the Fed chief noted that speculating on tariff policy at this time would be unwise. “He’ll want to see the February jobs and inflation data, and align with other policymakers before saying much,” said David Russell at TradeStation. Cleveland Fed President Beth Hammack stated on Tuesday that keeping interest rates steady for “some time” is appropriate as policymakers wait for further progress on inflation and assess the economic impact of new government policies. Also, New York Fed President John Williams said that “the modestly restrictive stance of policy should support the return to 2% inflation while sustaining solid economic growth and labor market conditions,” but cautioned that policy-related uncertainty casts a shadow over the economic outlook. Meanwhile, U.S. rate futures have priced in a 95.5% probability of no rate change and a 4.5% chance of a 25 basis point rate cut at the March FOMC meeting. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report may indicate when U.S. interest rates are next likely to be cut, if at all. Economists, on average, forecast that the U.S. January CPI will come in at +0.3% m/m and +2.9% y/y, compared to the previous numbers of +0.4% m/m and +2.9% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.1% y/y in January, compared to December’s figures of +0.2% m/m and +3.2% y/y. A survey conducted by 22V Research revealed that 41% of respondents anticipate a “risk-off” market reaction to the CPI report, 31% predict “risk-on,” and 28% expect it to be “mixed/negligible.” Investors will also focus on Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the House Financial Services Committee, due later in the day. Atlanta Fed President Raphael Bostic and Fed Governor Christopher Waller are scheduled to speak today as well. On the earnings front, notable companies like Cisco (CSCO), AppLovin (APP), CVS Health Corp. (CVS), The Trade Desk (TTD), Robinhood Markets (HOOD), and Reddit (RDDT) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.549%, up +0.26%. /ES, CRNX, DASH, LYFT, QTTB, SMCI, UPST, VALU, VRTX, CSCO, MGM, HOOD, RDDT, 0DTE's. With CPI today and PPI tomorrow I don't express a lean or bias and I don't look at levels until the day is a few hours in. These are days that the Algos will determine the moves and its important to be flexible.

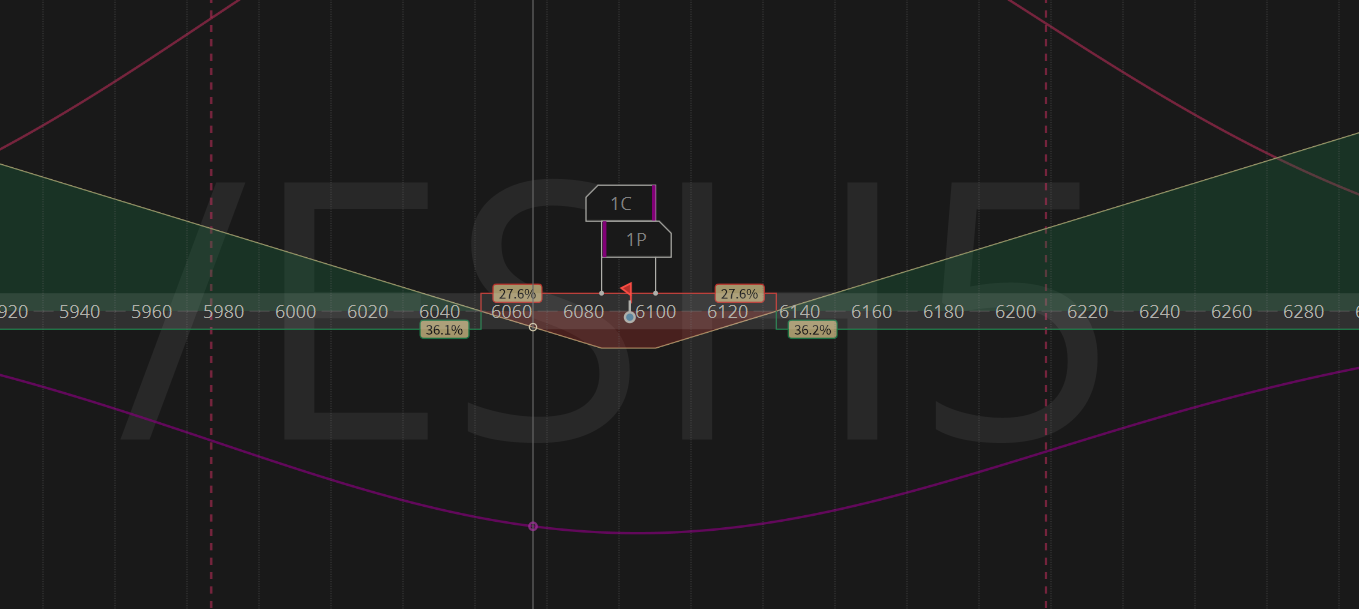

I'll see you all in the live trading room shortly. We'll be working our /ES trade quite a bit today. We've already got the anchor position in place.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |