|

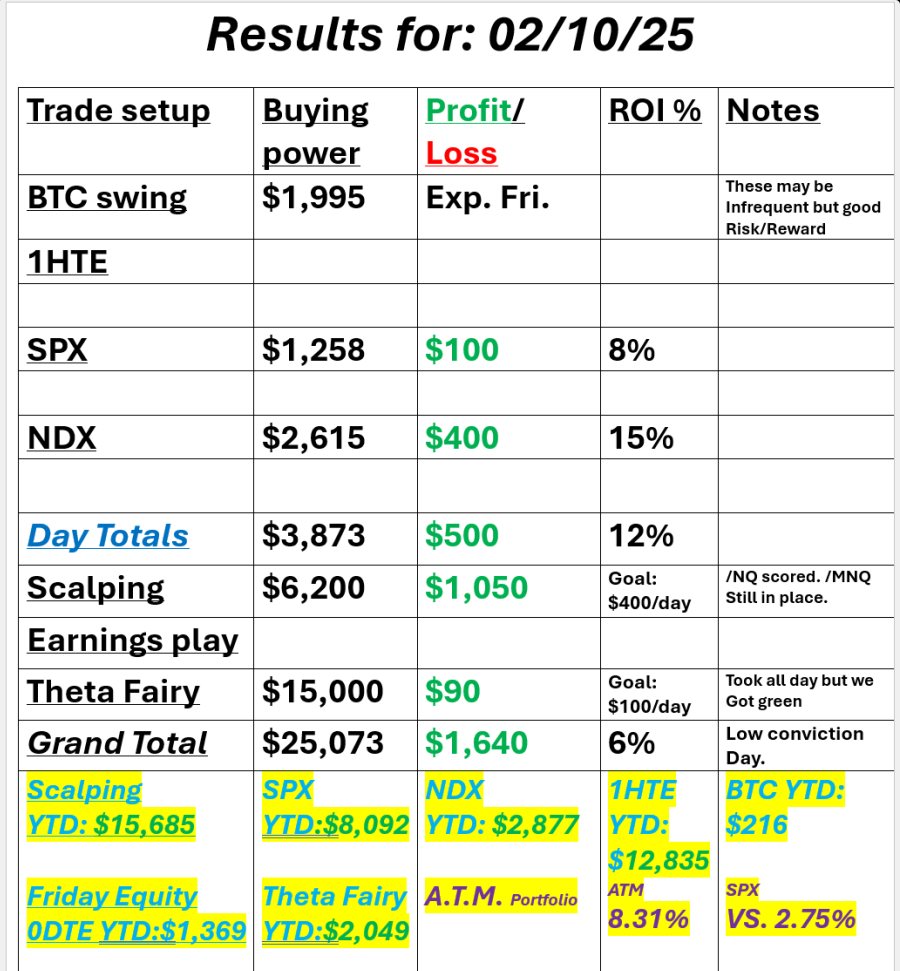

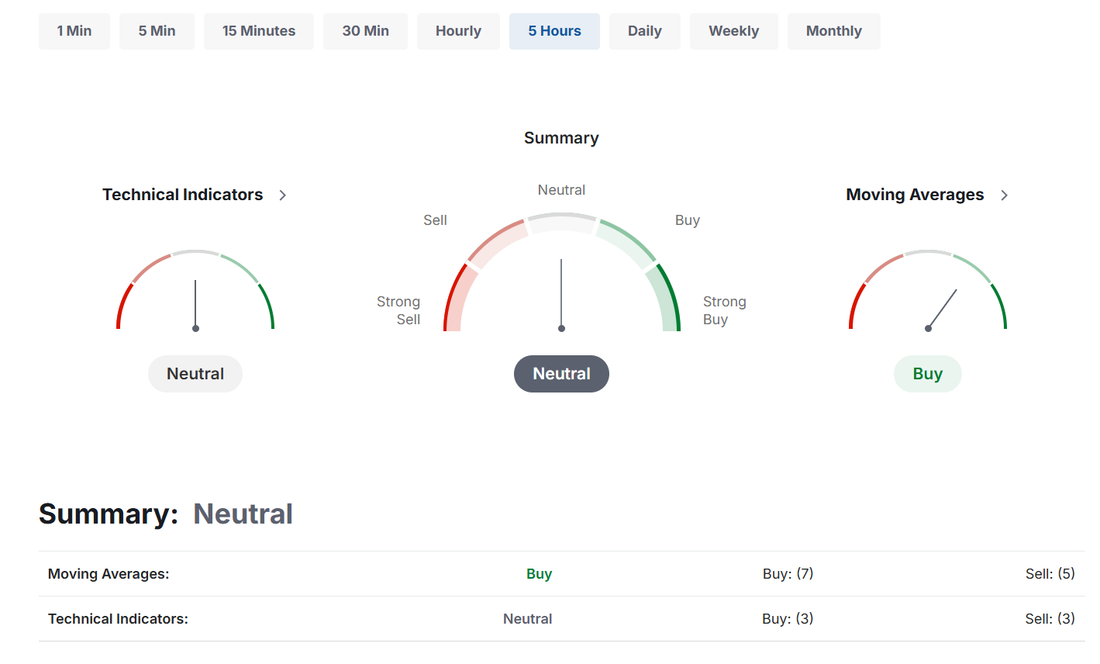

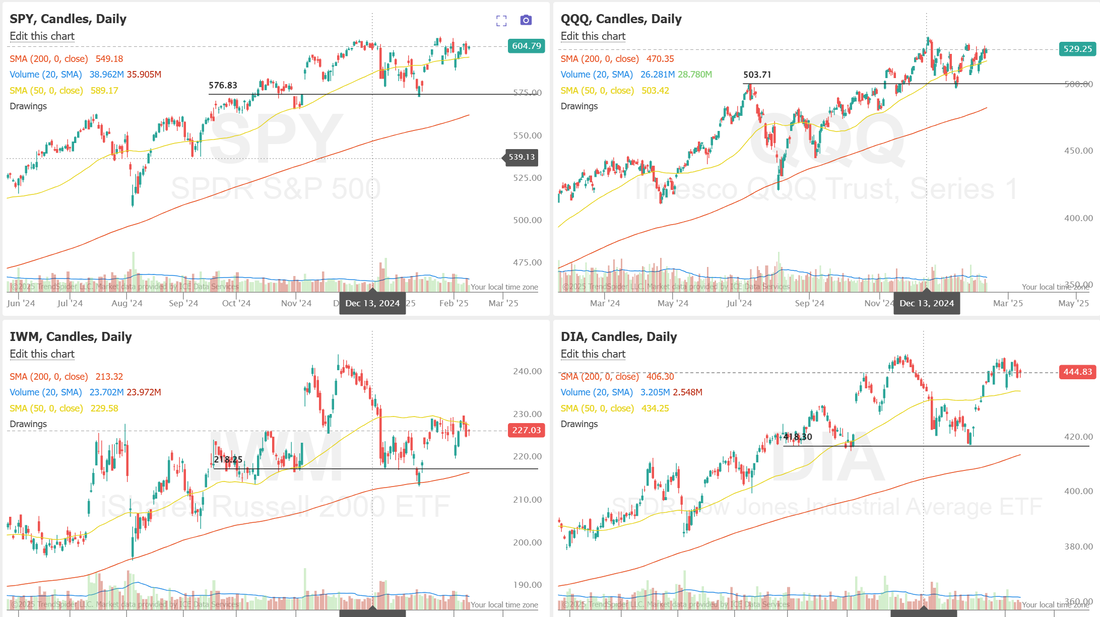

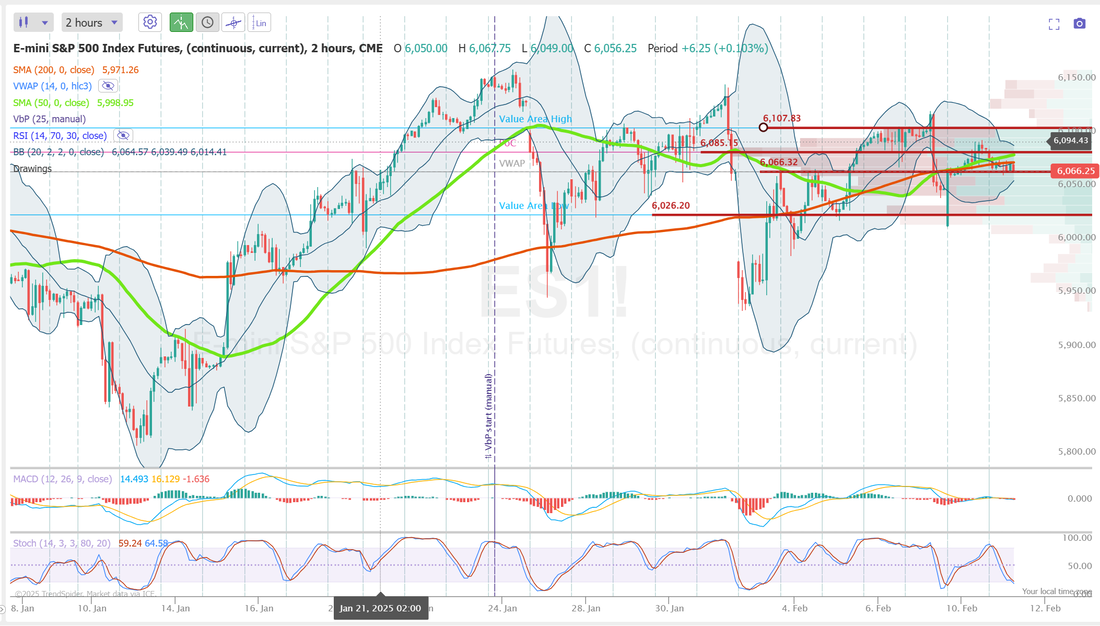

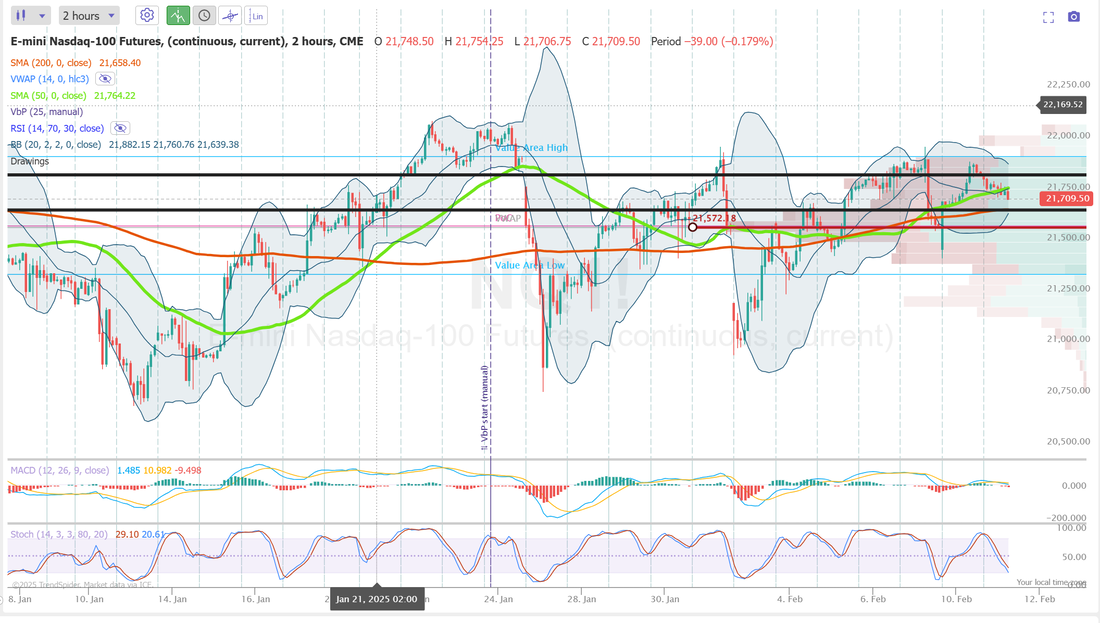

Yesterday day was a good day for us. It was a solid reminder that we don't always need to swing for the fences to have a $1,000+ profit day. I was trading with a bit of "tariff ptsd" yesterday. We've had three days where our trades looked amazing...until they didn't, as soon as tariff news dropped. I simply wasn't willing to trade the puts side yesterday and while that cost us some potential premium capture, I stand by it. It was the right thing to do from a risk management standpoint. It was also a great lesson in how important it is to have multiple, diversified strategies. We still had a solid day, even with the low capital outlay and conservative approach. See our results below. Let's take a look at the market. We start today off with a neutral rating. That seems appropriate as we continue to churn in a tight chop zone. One thing I feel pretty confident about predicting is that we won't stay stuck at this level forever. We have CPI and PPI coming up in the next couple of days. That may be enough to get us moving agian. March S&P 500 E-Mini futures (ESH25) are down -0.33%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.44% this morning as investors digested another round of tariffs introduced by U.S. President Donald Trump and looked ahead to Federal Reserve Chair Jerome Powell’s congressional testimony as well as Wednesday’s release of a key U.S. inflation report. Late Monday, President Trump ordered a 25% tariff on steel and aluminum imports from all countries, including key suppliers Mexico and Canada, effective March 12th, but stated he would consider an exemption for Australia. Trump earlier said he would introduce reciprocal tariffs on countries that tax U.S. imports this week. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended higher. Rockwell Automation (ROK) surged over +12% after the automation products maker reported better-than-expected FQ1 adjusted EPS. Also, aluminum and steel company stocks advanced after Trump announced plans to impose a 25% levy on all steel and aluminum imports into the U.S., with Cleveland-Cliffs (CLF) soaring more than +17% and Alcoa (AA) rising over +2%. In addition, McDonald’s (MCD) climbed more than +4% and was the top percentage gainer on the Dow after the burger chain posted an unexpected increase in Q4 comparable sales. On the bearish side, ON Semiconductor (ON) slumped over -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chipmaker posted downbeat Q4 results and issued below-consensus Q1 guidance. Today, market participants will closely monitor Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the Senate Banking Committee for insights into the rate outlook. Powell will likely emphasize the resilient economy as a primary reason policymakers are not in a hurry to further reduce borrowing costs. Also, investors will likely focus on speeches from Cleveland Fed President Beth Hammack, Fed Governor Michelle Bowman, and New York Fed President John Williams, due later in the day. Aside from Powell’s testimony, the U.S. consumer inflation report for January, scheduled for release on Wednesday, will be a highlight, as it may indicate when U.S. interest rates are next likely to be cut, if at all. The CPI is expected to remain unchanged from December at +2.9% y/y, while the core CPI is projected to ease to +3.1% y/y from +3.2% y/y in December. “Inflation data, Powell’s congressional testimony, and tariffs are poised to drive the market story,” said Chris Larkin at E*Trade from Morgan Stanley. “If the S&P 500 is going to break out of its two-month consolidation, it may need a respite from the types of negative surprises - like DeepSeek, tariffs, and consumer sentiment - that have tripped it up over the past few weeks.” Meanwhile, U.S. rate futures have priced in a 93.5% probability of no rate change and a 6.5% chance of a 25 basis point rate cut at the next FOMC meeting in March. On the earnings front, notable companies like Coca-Cola (KO), Shopify (SHOP), Gilead (GILD), Marriott (MAR), and DoorDash (DASH) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. The U.S. economic data slate is largely empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.521%, up +0.58%. /HG, /MNQ,/NQ scalping, F, MRK, SHOP, TPB, TSLA, VRTX, DASH, SMCI, LYFT, UPST, 0DTE's. My bias or lean today is bearish, just like yesterday. Powell is speaking today but we don't really have any news catalysts today other than the tariff overhang. The market is focused on CPI, PPI coming up. We've carried over a bearish scalp from yesterday and will continue to work that today. Let's take a look at our intra-day levels: /ES: There are some very critical levels today. 6084 is the first resistance with 6107 above that. 6066 is the absolute critical first support. We are sitting on that right now, as I type. If we can't hold that level we could see a move all the way down to 6024. /NQ: 21,832 is resistance with 21,656 acting as support. If we lose that level we could see price action all the way down to 21,572. BTC: Bitcoin continues to channel, making it hard to get a solid 1HTE working. They tend to be better risk/reward when we are trending vs. consolidating. The $100,000 level continues to be big resistance with $97,269 acting as near term support and $95,910 working as the next level down. I look forward to seeing you all in the trading rooms today. We've got a good, bearish scalp on today that could yield us another solid profit day. Lots of earnings trades and of course, our 0DTE's.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |