|

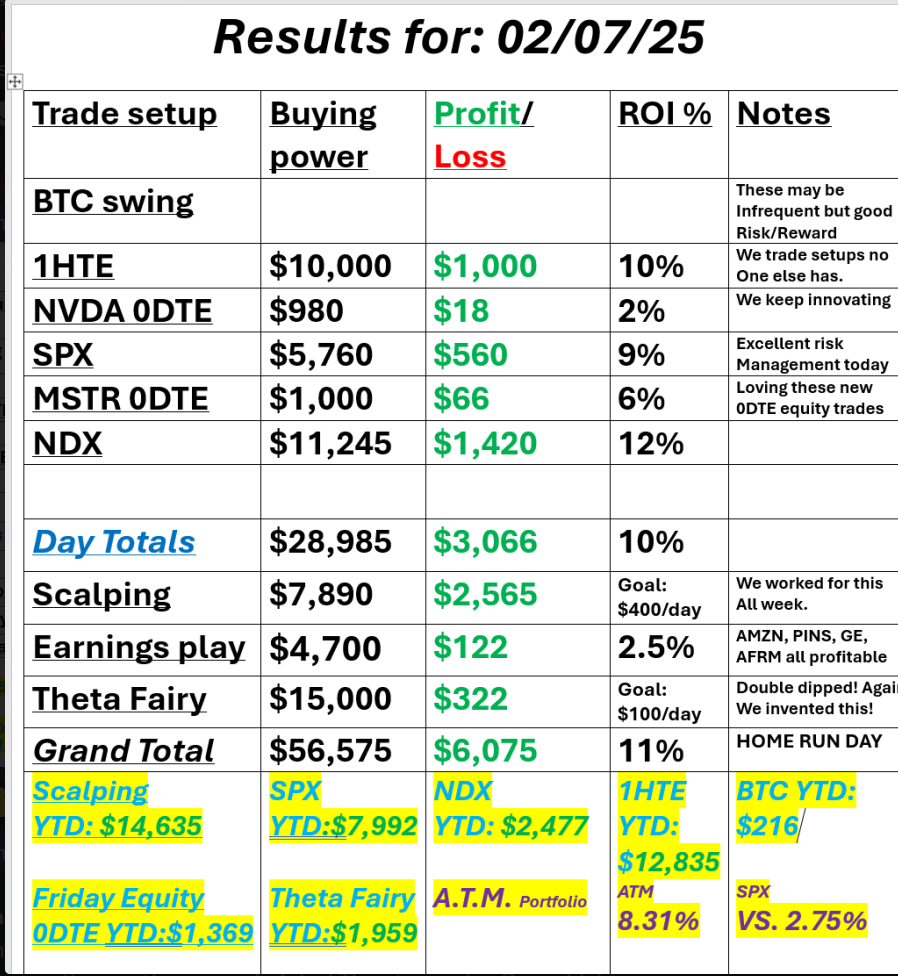

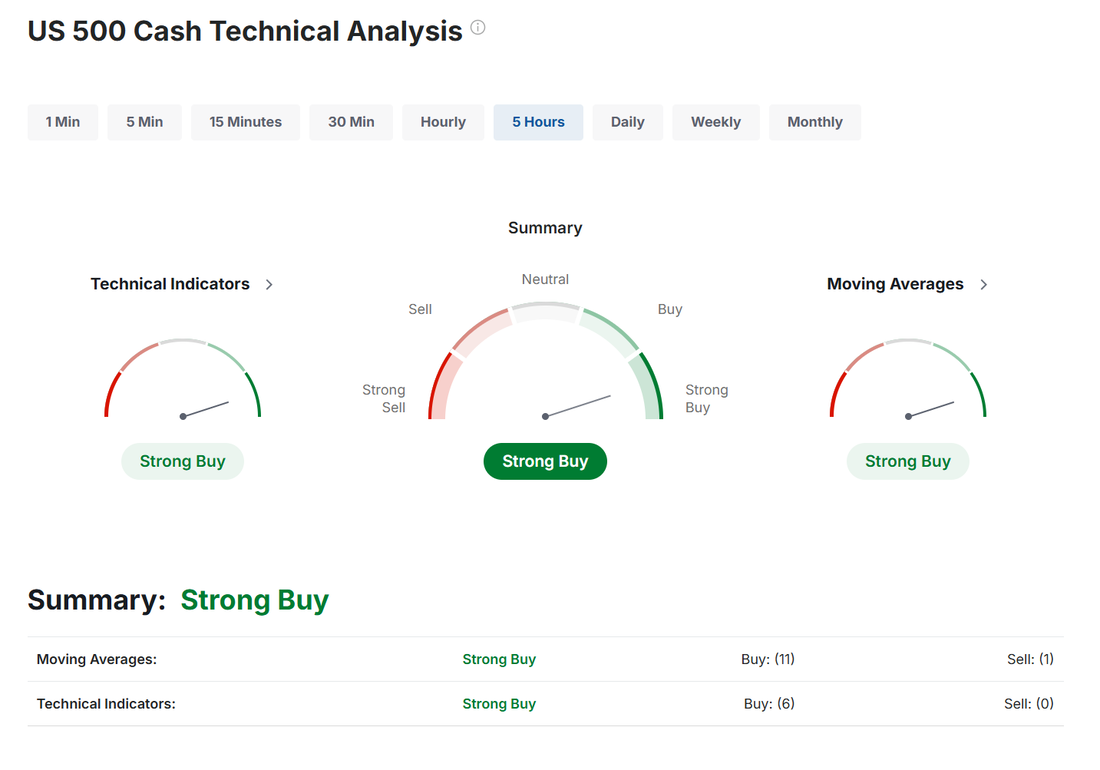

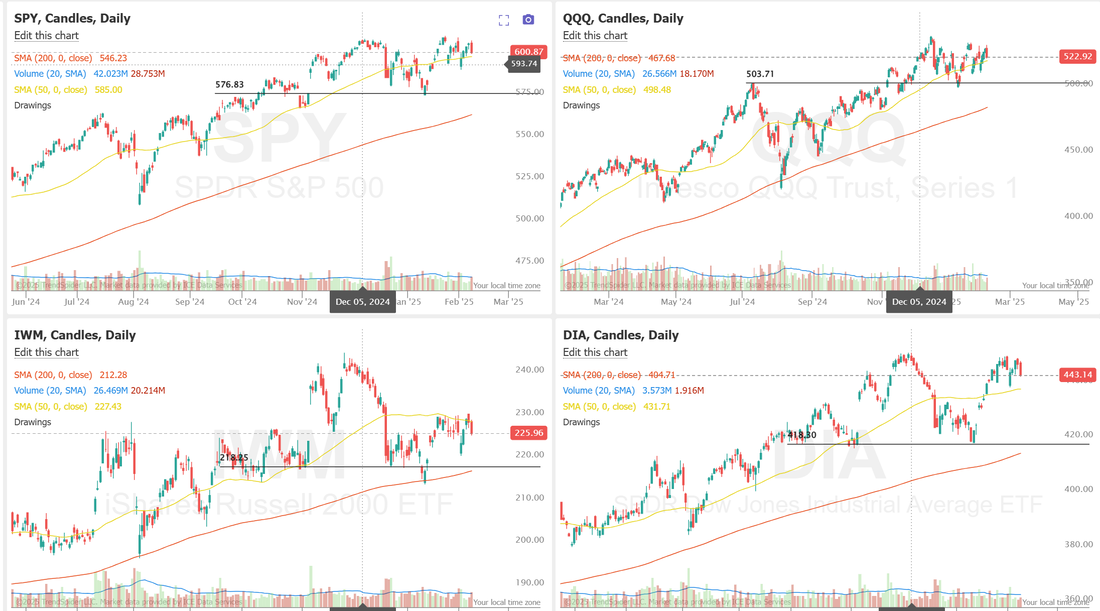

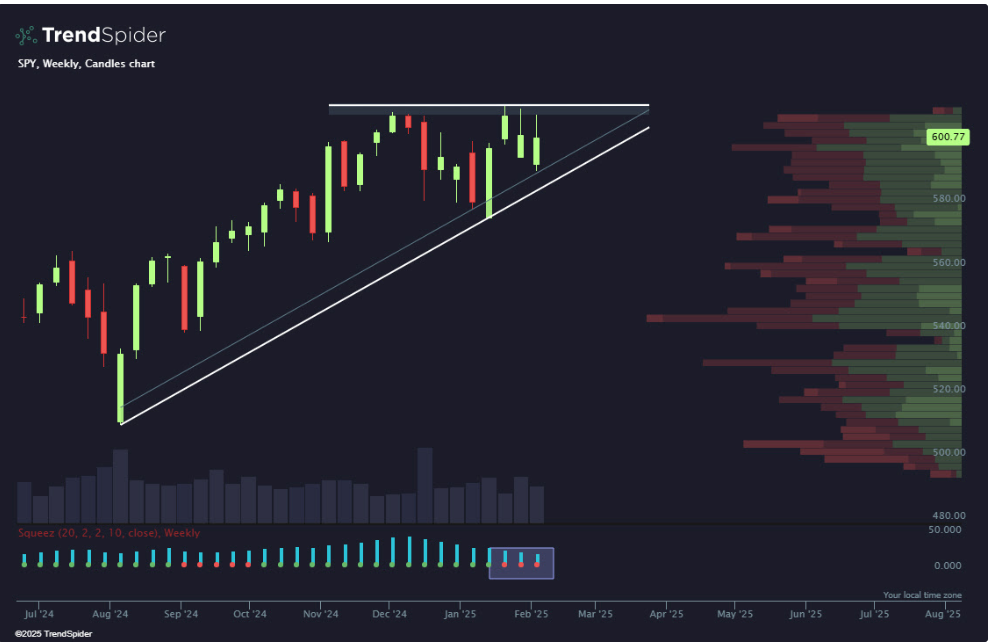

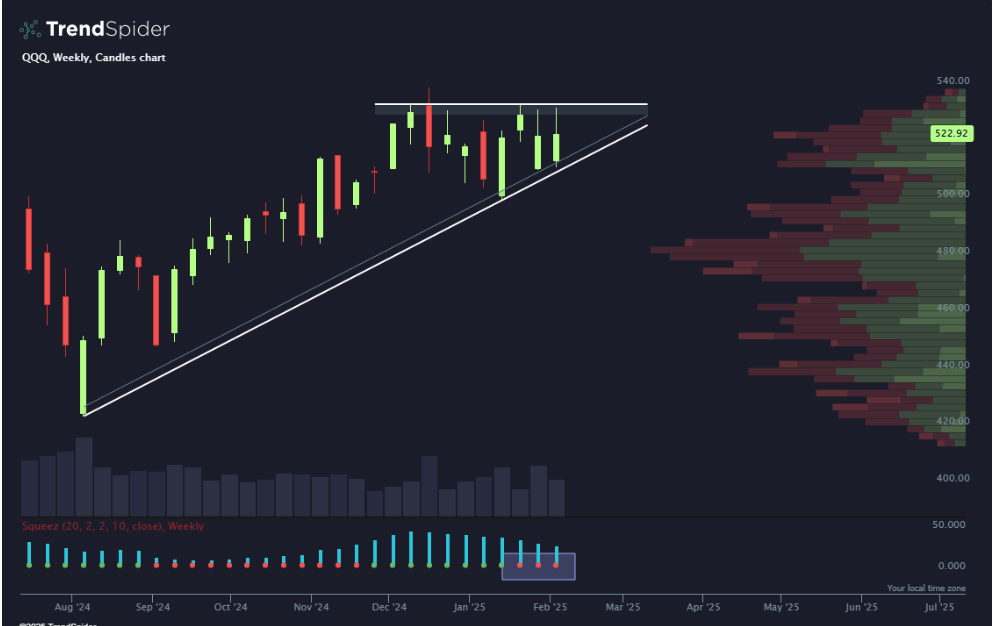

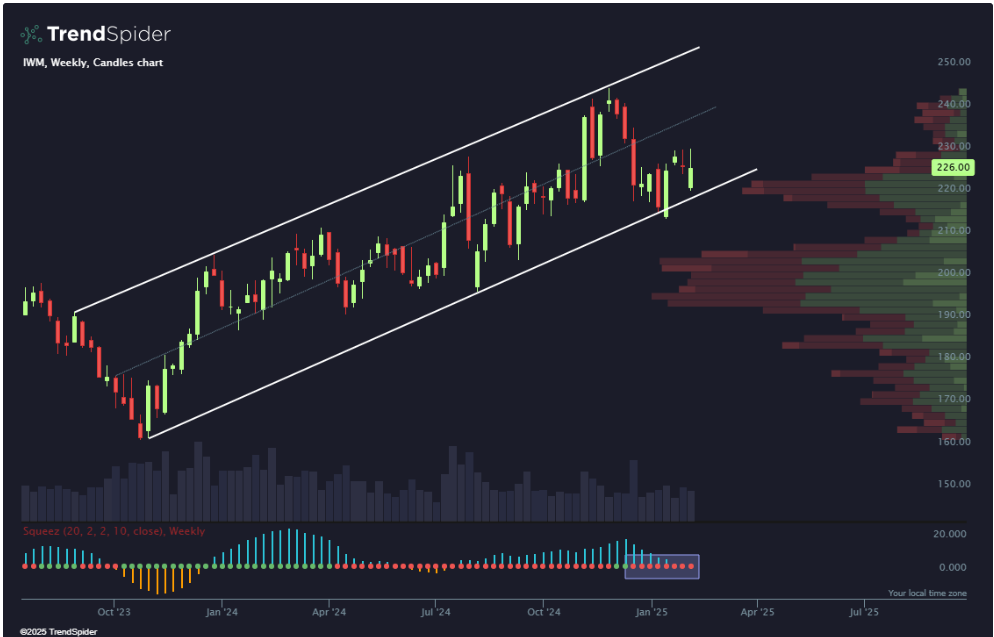

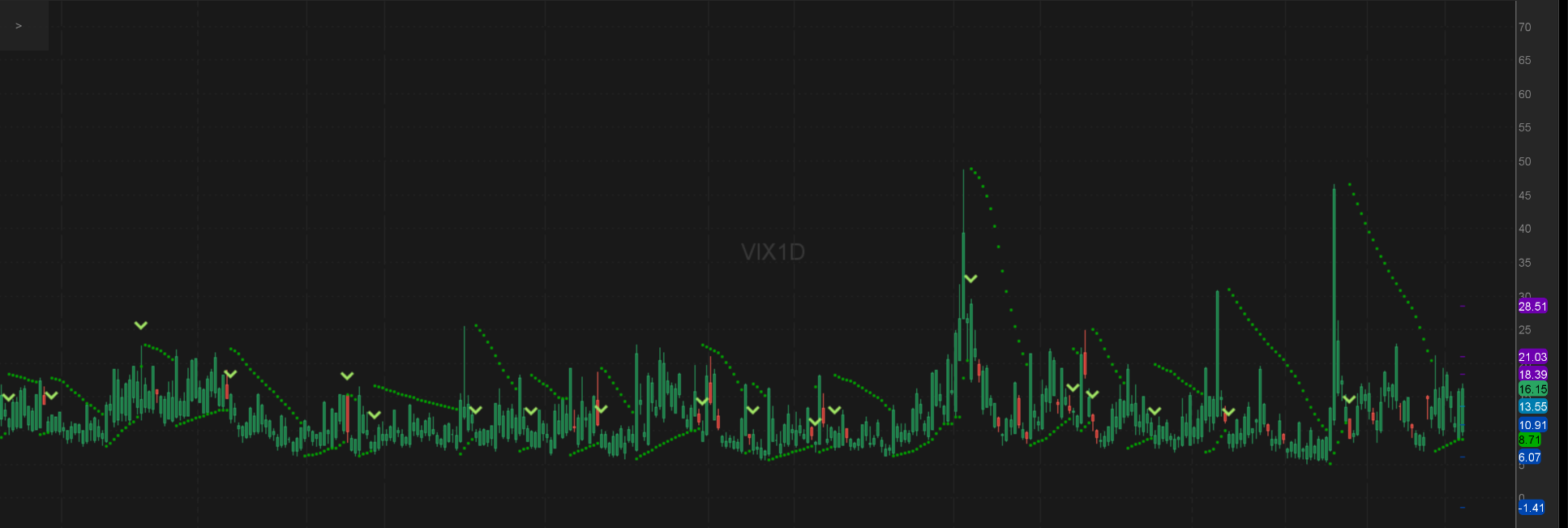

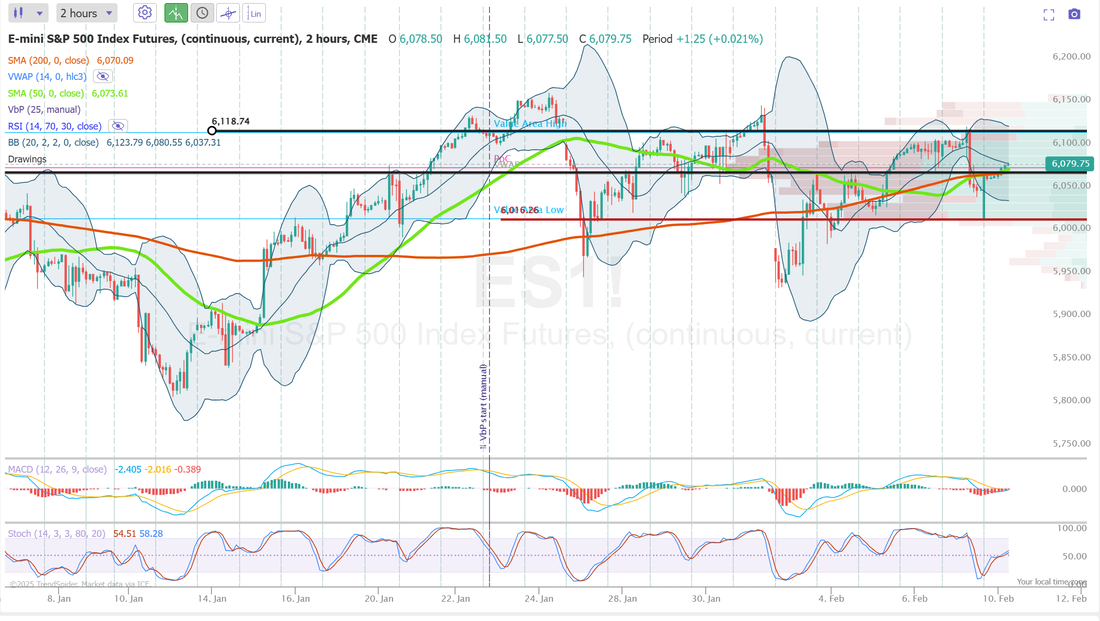

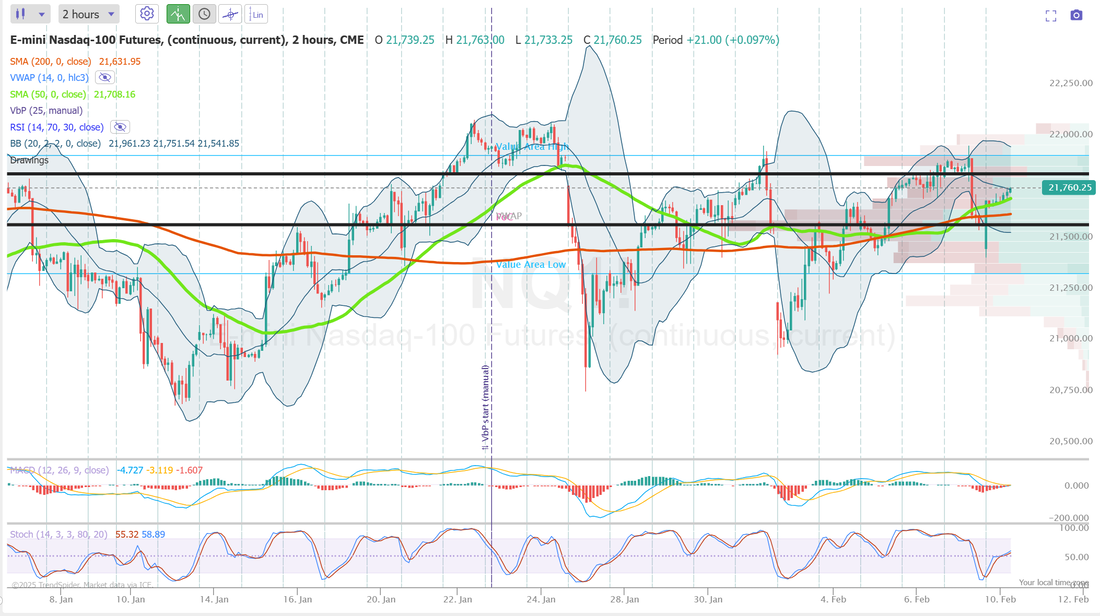

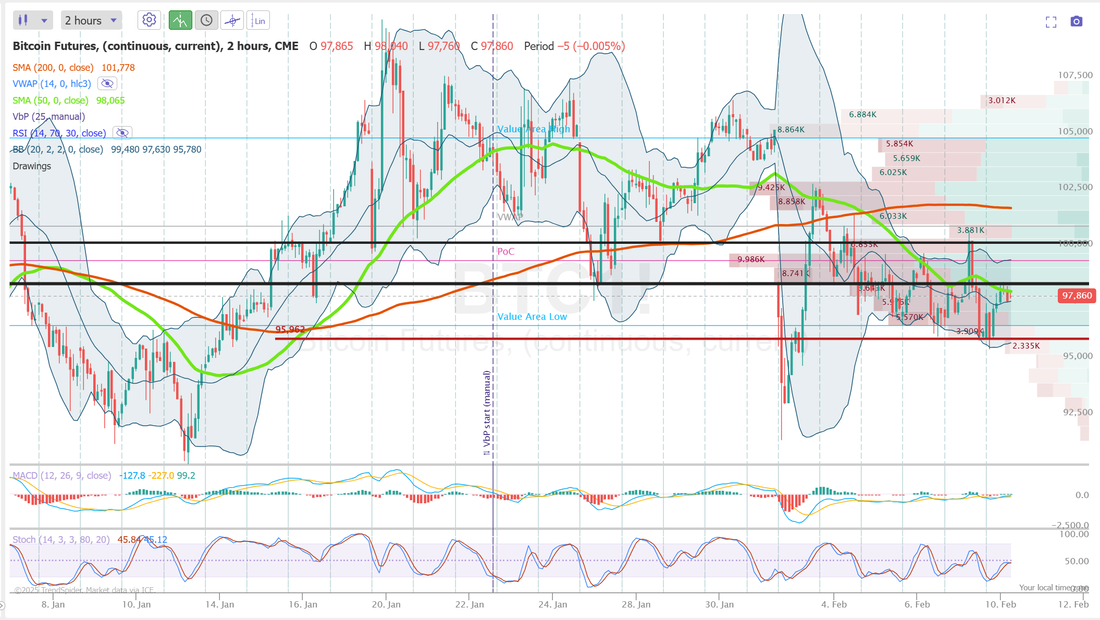

Good morning traders! Welcome back to a new week. I hope everyone had a nice weekend. We spent some time with our neighbors watching the Superbowl. I'm not a stick and ball fan but it was nice to hang out with friends. We had an exceptional day Friday. It was a nice way to end the week. Take a look at our results below: There's honestly not much to be unhappy about with our YTD performance. I've mentioned this before but Scalping cotinues to be a huge help for us as well as the 1HTE's. I'm also really happy with how many Theta fairies we've been able to get on. I'm entering today with a short /MNQ scalp and a Theta fairy that only has the call side working. I'm currently down on both of these but I think with regards to tariffs, "Fool me once, shame on you. Fool me four times? Come on!" I just think I'd rather be bearish here and need to roll up and out vs. bullish and need to roll out and down. Let's take a look at the technicals to start the week. Bullish bias and futures are up this morning but...I'm positioning for some bearish moves. CPI and PPI are out this week. "policy volatility" is coming into play and we'll take about systemic vs. unsystemic risk and how, regardless of technicals, I'd rather have some bearish exposure right now. Overall, I don't seem much to be impressed about in this price action. This week, the SPY closed marginally lower at $600.77 (-0.16%). After three weeks of tight price action paired with a squeeze, next week’s CPI and PPI data could be the catalyst for the next major move. This index will have to gain the top of the ascending triangle to push higher, while the rising trendline from the August 5th lows could act as a critical support level if sellers take control. QQQ posted a modest gain this week, closing at $522.92 (+0.12%), as it continues to inch higher within a well-defined ascending triangle. Monday’s bounce off the lower trendline reaffirmed key support, keeping bullish momentum intact. Now in the third week of its squeeze, QQQ is nearing the triangle’s apex, potentially setting up for a decisive move on next week’s CPI announcement. IWM lagged behind its index peers this week, closing lower at $226.00 (-0.21%) and testing the lower boundary of its ascending channel, a key level since October 2023. Now, in a prolonged squeeze that has turned negative for the first time since last summer, the stage is set for a decisive move. Will this extended squeeze lead to a breakdown, or will buyers dig in here at support? Let's take a look at the expected moves for the week.. I.V. for the week isn't horrible and it's not amazing. We should be o.k. to get both debit and credit setups working this week. The VIX1D at 16 is agian, middle of the road levels. Not great...not horrible. My bias or lean is a little contrary today. We've got bullish technicals and bullish futures price action this morning We've also got the pinching wedge channels I detailed above which usually precede a big move. With "plicy volatility" in play, once again this week, I think I'd rather have some bearish positions on. I'm slightly bearish today. CSGS, /ZW, /HG, /ZN, TPB, HIMS, /es, /MCL, /MNQ scalping, CRNX, F, MRK, TSLA, VALU, VRTX, KO, SHOP, BITO Let's take a look at our intra-day levels for 0DTE setups. /ES: There are a couple interesting levels. 6116 is resistance with a close 6079 acting as support. This is a key support. It's close and it also aligns with the 50/200 period M.A. on the 2hr. chart. 6010 is also on my radar. This is the dip that futures opened up at Sunday night and bounced hard. /NQ: 21,828 is resistance with 21,829 being the next interesting level higher up. 21,528 is support with 21,445 just down below that. BTC: $160,100 is resistance with a key area of interest being $98,377. This is a big demarcation point. Above would be bullish and below would be bearish. $95,977 seems to be a solid support level. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |