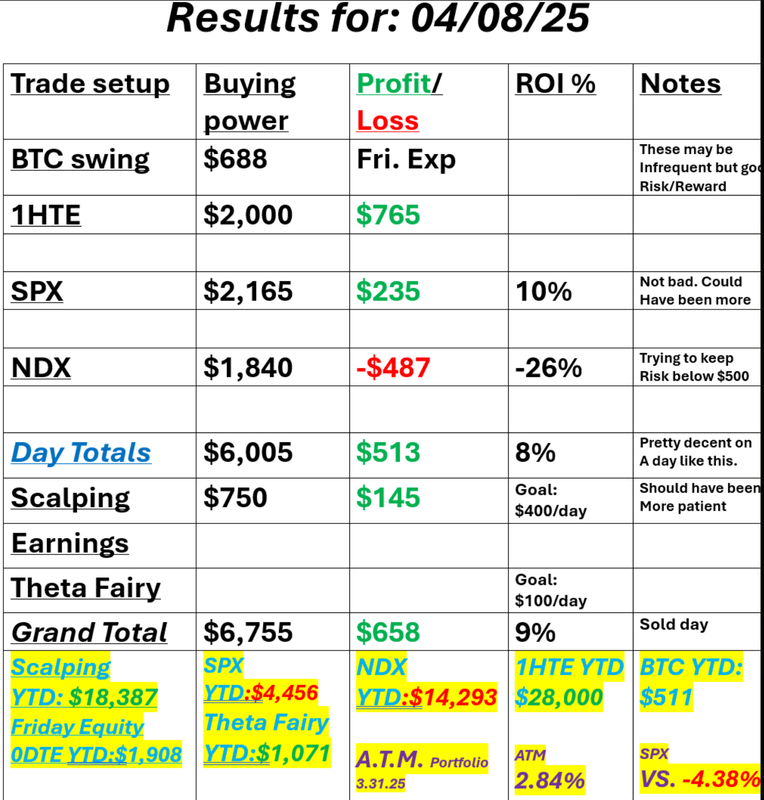

ReciprocationTariffs continue to be the main focus of the markets. We've now moved from the initial shock of them becoming a reality to the next phase which seems to be the reciprocation coming back to the U.S. How high will tariffs go? How long will they last? These are all questions the market and it's participants would like to know. Bad news is not the biggest issue for the stock market. Uncertaintly is and that's where we sit today as I watch the futures bounce from positive to negative. That's not unusual and happens frequently. The size of the moves? That's a different story. Our trading plan continues to prove itself valuable. #1. Trade small. #2. Trade fewer trades. #3. Shorten the duration of trades (we aren't going out past a day trade at this point). #4. Utilize debit (directional) trades as initial anchor positions. #5. Focus on what is working. Yesterday wasn't as smooth for us as we would have liked but our risk was always in check. (We try to keep less than $500 dollars at risk in each setup.) It was a profitable day for us. Our 1HTE Bitcoin trades certainly have been a safe haven for us in these wild times. They allow us to tighten our time horizion to 40 min. in some cases. It's also one of the few places where you can trade small ($20 dollar trades anyone?) and still have 20%-100% ROI potential. If you want unique results you need to be doing unique setups. We have trades no one else is focusing on. Take a look at our day yesterday. As I said...it wasn't the cleanest day but it worked out for us. All in all I'd say yesterday was a home run for us, considering the trading enviroment right now. une S&P 500 E-Mini futures (ESM25) are trending down -1.42% this morning as U.S. President Donald Trump’s sweeping tariffs came into effect and China hiked tariffs on U.S. goods. U.S. equity futures point to another volatile session on Wall Street. Stock index futures initially plunged after President Trump’s so-called reciprocal tariffs came into force today, intensifying concerns about their impact on U.S. economic growth. The measures include a 104% tariff on Chinese imports. Later, stock index futures briefly turned positive after China’s Ministry of Commerce stated that the nation was open to dialogue with the U.S., while noting it possessed “abundant means” to retaliate against the Trump administration’s tariffs. Stock index futures faced renewed selling pressure after China raised tariffs on goods imported from the U.S. to 84%, set to take effect on April 10th. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. The Magnificent Seven stocks slumped, with Apple (AAPL) sliding nearly -5% and Tesla (TSLA) falling more than -4%. Also, chip stocks retreated, with ON Semiconductor (ON) tumbling nearly -9% and Intel (INTC) dropping more than -7%. In addition, RPM International (RPM) plunged over -9% after the building materials company reported weaker-than-expected FQ3 results. On the bullish side, health insurance stocks surged following the federal government’s announcement of an estimated $25 billion increase in payments to 2026 Medicare Advantage health plans, with Humana (HUM) climbing over +10% to lead gainers in the S&P 500 and UnitedHealth Group (UNH) rising more than +5% to lead gainers in the Dow. “The fundamental reason for the drawdown has been policy uncertainty - it’s functionally impossible to put in a bottom until that fundamental reason has been resolved, or at least until there is directional clarity on it,” said Scott Ladner at Horizon Investments. Chicago Fed President Austan Goolsbee stated on Tuesday that tariffs are “way bigger” than he had expected, and policymakers might not be able to wait for the economic impact to be reflected in government data; instead, they should actively engage with businesses to assess the effects in real time. “We just lived through and learned what happens when inflation is raging out of control,” Goolsbee said in an interview with Illinois Public Radio. Also, San Francisco Fed President Mary Daly said the central bank has the flexibility to wait before making any interest rate adjustments as it monitors the effects of trade policy changes. “So, with growth good and policy in a good place, we’ve built the time and the ability to just tread slowly and tread carefully,” she said. U.S. rate futures have priced in a 51.5% chance of no rate change and a 48.5% chance of a 25 basis point rate cut at May’s monetary policy meeting. Meanwhile, market watchers are keenly awaiting the U.S. consumer inflation report for March on Thursday and the start of the first-quarter earnings season on Friday. Today, investors will closely monitor the publication of the Federal Reserve’s minutes from the March 18-19 meeting. With expectations mounting that the Fed will support the economy by cutting rates at least four times this year, starting in June, the minutes could shed light on how justified those expectations may be. On the economic data front, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final February figure to be +0.4% m/m, compared to the January figure of +0.8% m/m. U.S. Crude Oil Inventories data will also be released today. Economists foresee this figure standing at 2.200M, compared to last week’s value of 6.165M. In addition, market participants will be anticipating a speech from Richmond Fed President Tom Barkin. On the earnings front, Delta Air Lines (DAL) is set to report its Q1 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.363%, up +2.42%. While markets are still volatile, they continue to hang out around the consolidaiton zone of April 2024. My bias or lean today: I'm going to go out on a limb ans say bullish. Futures are down -85 points as I type on the /ES. No idea if we can get to positive or not but I think we've got a decent shot at trending higher today off these overnight lows. Regardless of what we get our approach of focusing on risk management first and profit second seems to be working for us. Our trade docket today is the same as everyday lately: #1. Scalping with QQQ's. #2. 1HTE on Bitcoin (we've got an early start on that already today) #3. SPX 0DTE. Probably skip NDX for now. Trading levels are becoming harder to trade off of with these big moves. Let's focus on the /ES for today. 5156 is resistance with 4872 working as support. If we lose 4872 there is lots more downside potential. We'll map it out in the live trading room as the day progresses. Now is the time folks. This is a traders market. Opportunity is there. If you are not aligned with our trading members in our trading group, working together on unique, risk managment type setups then I'd recommend you either join us or join someones team. Do trade alone. Having a team to bounce your ideas off of has never been so valuable. Let's see if we can pull another green day for us today! See you all in the live trading room shortly. Let's make it a profitable day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |