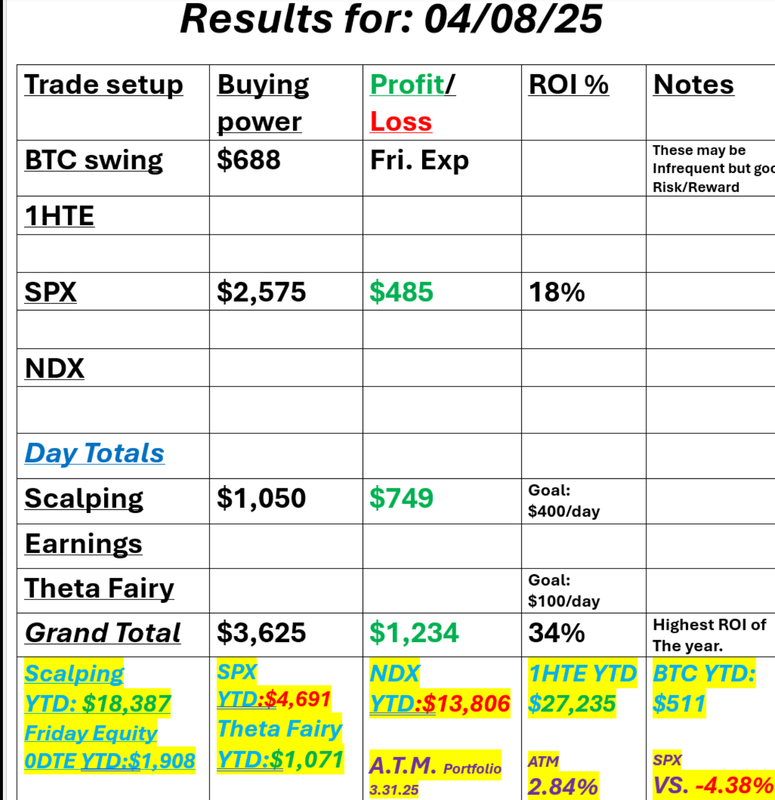

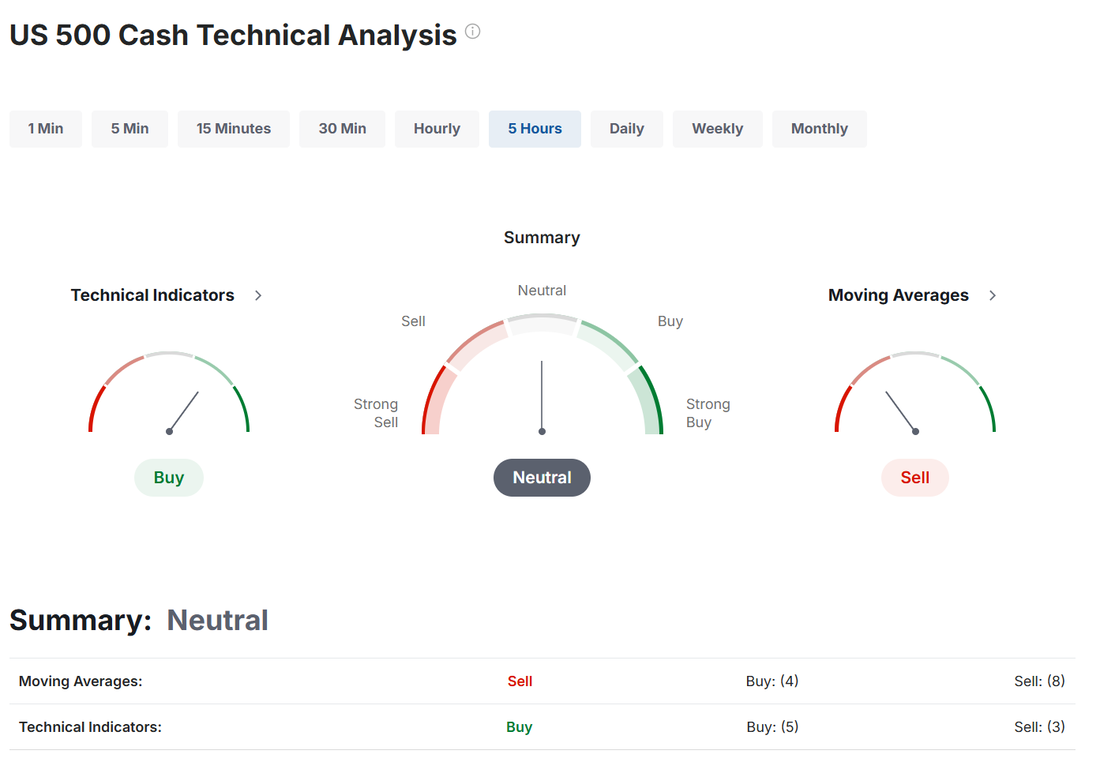

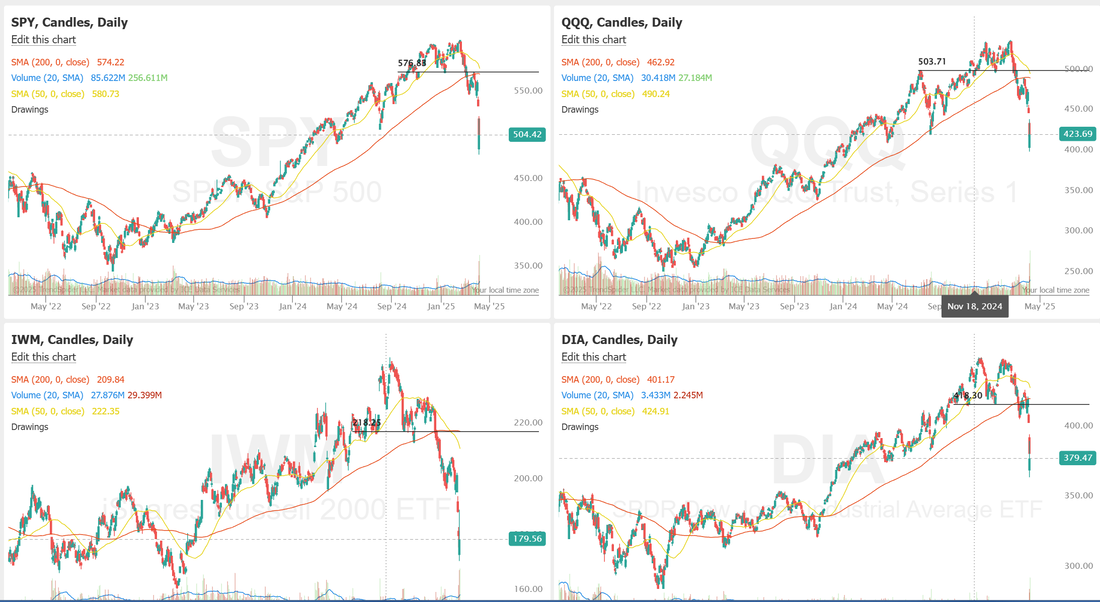

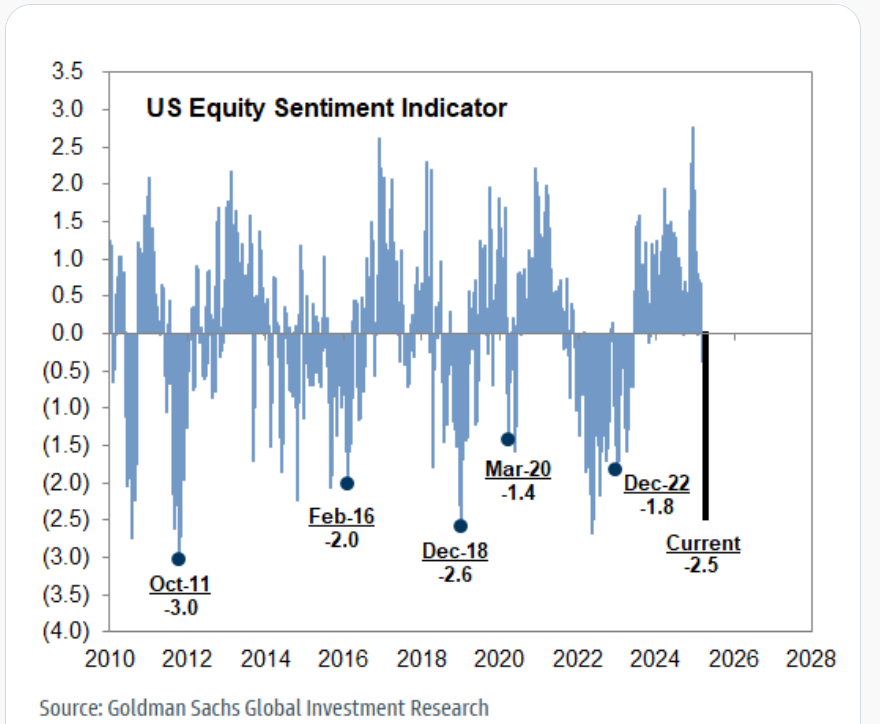

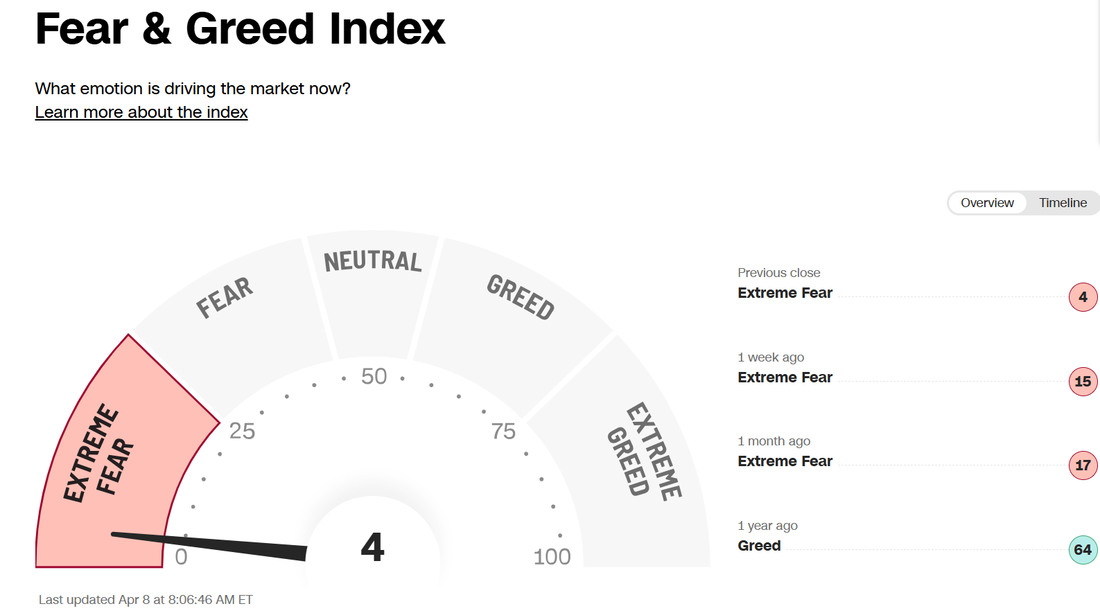

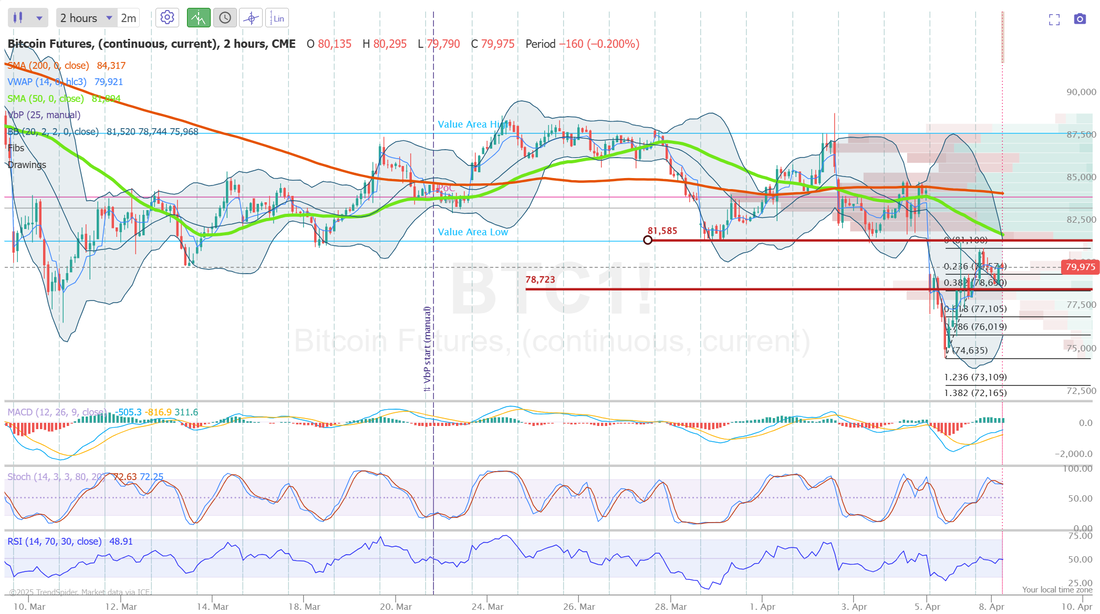

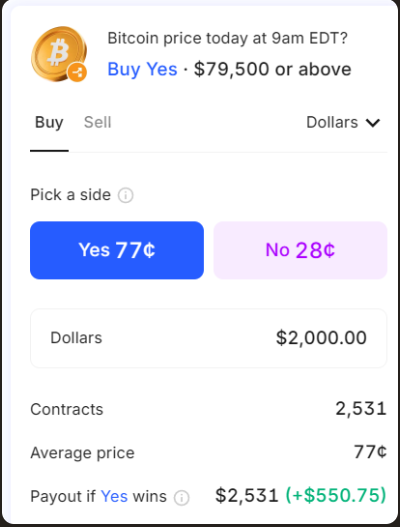

Melting ice cubes.U.S. Treasury Secretary Bessent kicked off the upward push in futures with the comment, "Tariffs will be a melitng ice cube if successful". We spent quite a bit of time in our trading room yesterday talking about where the tariffs may be going and what their true purpose was. I believe they are just that. Tools to extract better terms. We'll see but so far this morning the futures are loving it. We had a perfect day yesterday. Stress free and what was most interesting, it was our highest ROI day of the year. Never have we ever deployed less capital for a $1,000+ profit day. I've said it over and over but UNFORTUNATELY the markets will stabilze as some point and all this wonderful premium will disappear as quickly as it showed up. A long, protracted bear market is best for us (bigger moves, better premium). Yesterday was a big snap back and today looks strong, out of the gate but I wouldn't write off the bears just yet. Here's a look at our easy day yesterday. I'm not sure that we've ever had a 34% ROI day before. Sure, we've had some directional debit setups hit for a 200%+ gain but directional trades aside, it was a stellar (and easy) day. I'm super proud of how we've managed this downturn. Moving mostly to cash. Trading small. Reducing the number of trades we do. My only regret is that we seriously talked about leaving a long QQQ call on in the scalping room. That would have been a nice start to our day...if we would have. Woulda, coulda, shouda I guess. Let's take a look at the markets. They are certainly interesting right now. We'be quickly moved from full sell mode yesterday to a slight sell mode earlier this morning (as I posted our ATM portfolio) now to a neutral stance. Today surely has the makings for a pivot type day. For now the April lows of last year seem to be holding. June S&P 500 E-Mini futures (ESM25) are up +1.50%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.28% this morning, pointing to a modest recovery on Wall Street as investors seek dip-buying opportunities while waiting for clarity on how U.S. President Donald Trump’s trade policies will play out. President Trump made a series of remarks on Monday regarding his proposed tariffs on global trading partners. However, he provided scant detail about what he wants in return for reducing tariffs or whether he intends to offer any relief at all. Investors took some comfort after Japan pushed ahead with talks on a potential tariff deal. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. Some of the Magnificent Seven stocks continued to fall, with Apple (AAPL) dropping over -3% and Tesla (TSLA) slumping more than -2%. Also, energy stocks tumbled after the price of WTI crude fell to a 4-year low, with Schlumberger (SLB) and Occidental Petroleum (OXY) sliding over -4%. In addition, Caterpillar (CAT) fell more than -2% after UBS downgraded the stock to Sell from Neutral with a price target of $243. On the bullish side, chip stocks gained ground, with Broadcom (AVGO) and Micron Technology (MU) climbing over +5%. Economic data released on Monday showed that U.S. consumer credit unexpectedly fell -$0.81B in February, weaker than expectations of +$15.20B. Fed Governor Adriana Kugler stated on Monday that President Trump’s trade policy currently has more significant implications for inflation than for economic growth. Kugler said that consumers’ actions to buy goods before recently announced tariffs take effect may be bolstering economic activity in early 2025, while there are indications that the trade policy changes are beginning to exert upward pressure on prices. “The takeaway is that I view, right now, inflation as being more pressing as far as the effects of tariffs that we’re already seeing,” she said. Kugler also noted that policymakers “have to be very careful in how we navigate this period.” Chicago Fed President Austan Goolsbee said during an interview on CNN, “The anxiety is if these tariffs are as big as what are threatened on the U.S. side, and if there’s massive retaliation, and then if there’s counter retaliation again, it might send us back to the kind of conditions that we saw in ‘21 and ‘22, when inflation’s raging out of control.” U.S. rate futures have priced in a 71.4% probability of no rate change and a 28.6% chance of a 25 basis point rate cut at the next FOMC meeting in May. Meanwhile, market watchers are keenly awaiting U.S. inflation data, the Fed’s minutes from the March meeting, and the start of the first-quarter earnings season this week. Investors also continue to assess the potential economic impact of Trump’s tariffs and remain alert for any announcements of retaliatory measures. On Friday, China retaliated against new U.S. tariffs by imposing a 34% tariff on all U.S. imports beginning April 10th. Trump on Monday threatened to slap “ADDITIONAL Tariffs on China of 50%, effective April 9th,” if Beijing fails to retract its retaliatory tariffs by April 8th. “For now, it looks like news out of Washington will continue to drive the market’s swings, one way or the other. Some notable lows over the past few decades have been preceded by similar levels of volatility, although it’s always impossible to know when prices will eventually find their bottom,” said Chris Larkin at E*Trade from Morgan Stanley. The U.S. economic data slate is largely empty on Tuesday. However, investors will focus on a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.170%, up +0.31%. Are you a contrarian trader? US stock market sentiment has rarely been this BAD: Goldman's US equity sentiment indicator dropped to -2.5 on Friday, the lowest since the December 2018 sell-off. In the past, such a negative reading triggered two-week positive returns. Time for a short-term bounce? The feat and greed index is pinned as well. I forget this guys name but he seems to have good instincts. Who knows? It's still too early to tell. One solid day along with futures being up this morning don't undo all the damage that started last Thursday. Our trade docket will continue along the same path for the foreseeable future. #1. Try to get as many 1HTE Bitcoin trades packed into the day as possible. To say these have been amazing for us is a huge understatement and I proud to say, I don't know anywhere else where you can get these hourly setups. #2. Scalping: I'll continue to focus on the QQQ's for today. If this isn't a great scalping market I don't know what is. #3. 0DTE's. We weren't able to get an NDX working yesterday but our plan is always to start with an SPX setup and then look to add an NDX later in the day. My lean or bias today is for more bullish price action. I said yesterday, when futures were printing big red numbers that I thought we could reverse with some bullish price action. We didn't have the phrase, "meliting ice cubes" but our thoughts went in the same direction. I think today could be more of the same. Really it's still anyones guess. Look at how news driven the market was yesterday Let's take a look at our intra-day levels. Our levels from yesterday were spot on and that gave us a lot of confidence in entering our strikes. /ES: Admttedly these levels are incredibly wide. It doesn't help that futures are already up 120+ points as I type. 5312 is first resistance with 5409 next. 5194 is first support with 5052 next. /NQ: I'm a bit more narrowly focused here with resistance at 18,380 and support at 17,643. BTC: We weren't able to get any setups working yesterday and that hurt our overall profit potential. Bitcoin is usually pretty good to use and we've come to depend on some daily income from it. The range is tight this morning with resistance at 81,585 and support at 78,723. We've got a good sized 1HTE working right now that expires in 10 min. If that hits for the $550 profit that is its potential we may be done for the day. By the way. If you are looking for ways to take your trading to a higher level you may want to come trade the 1HTE's with us. Again...I don't know where else you can go and get these hourly setups.

I look forward to seeing you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |