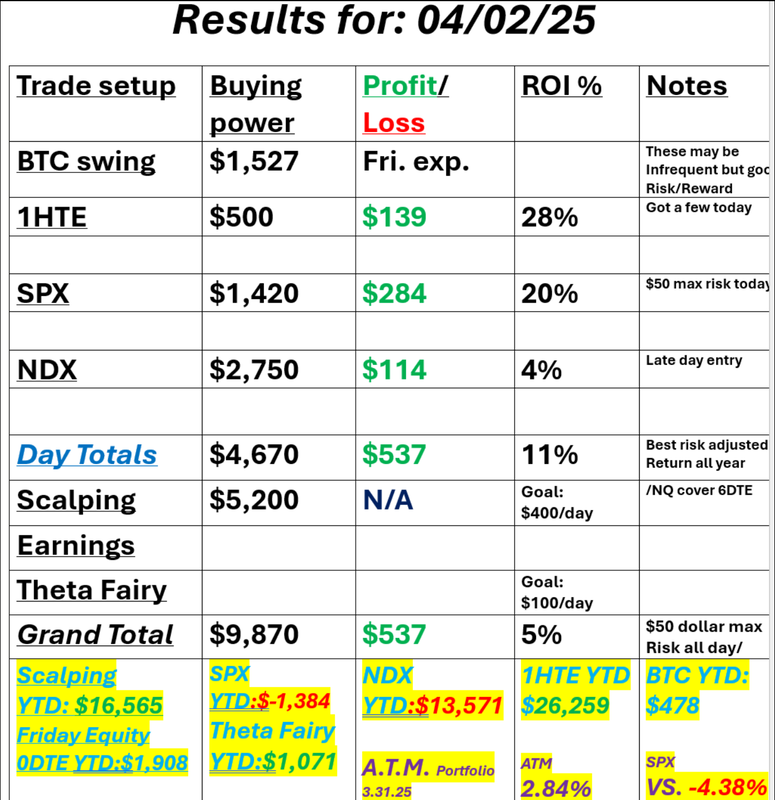

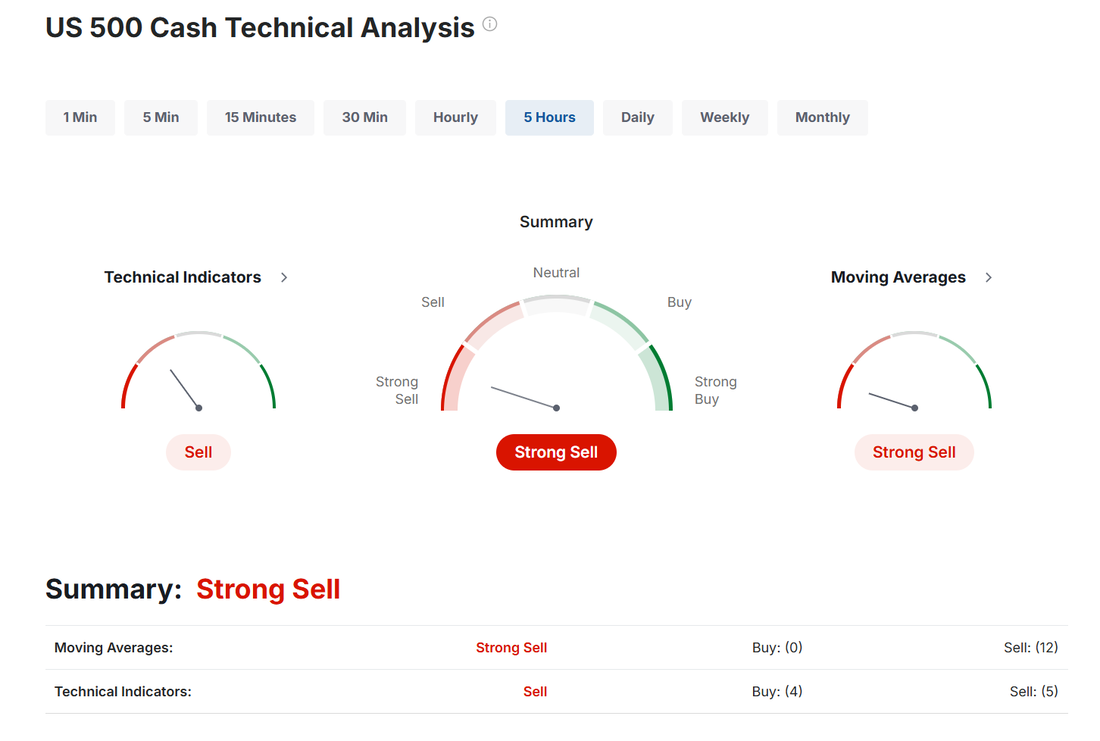

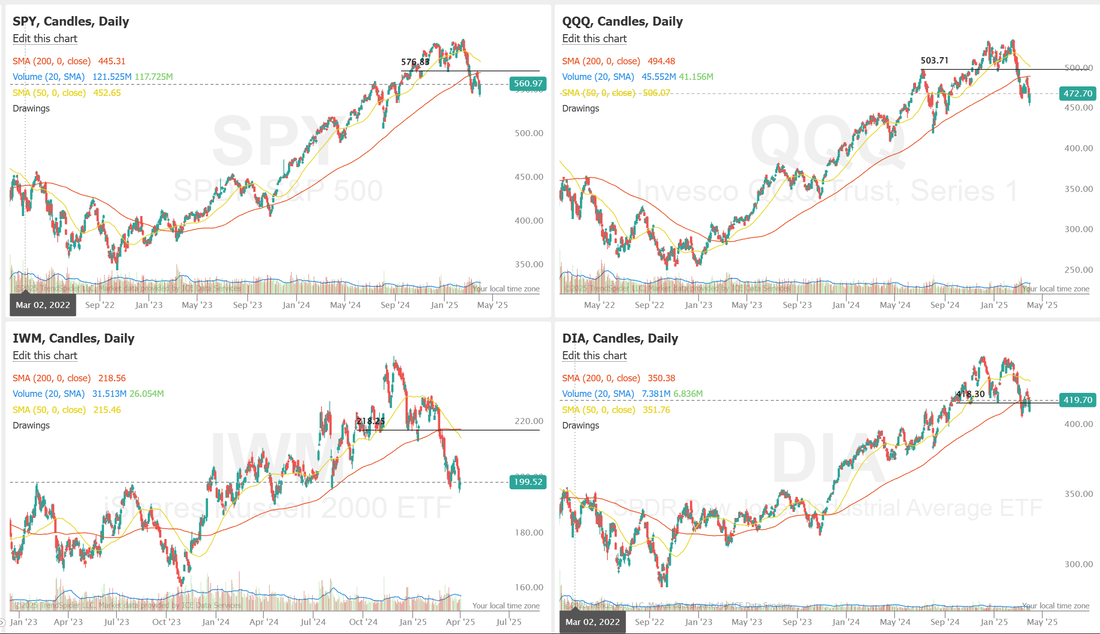

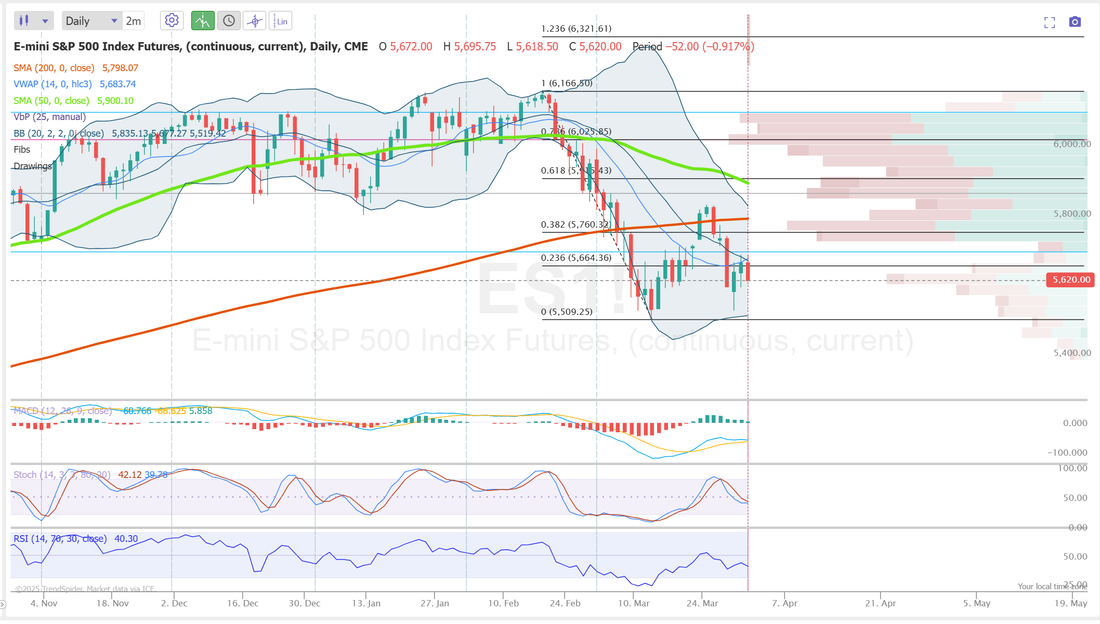

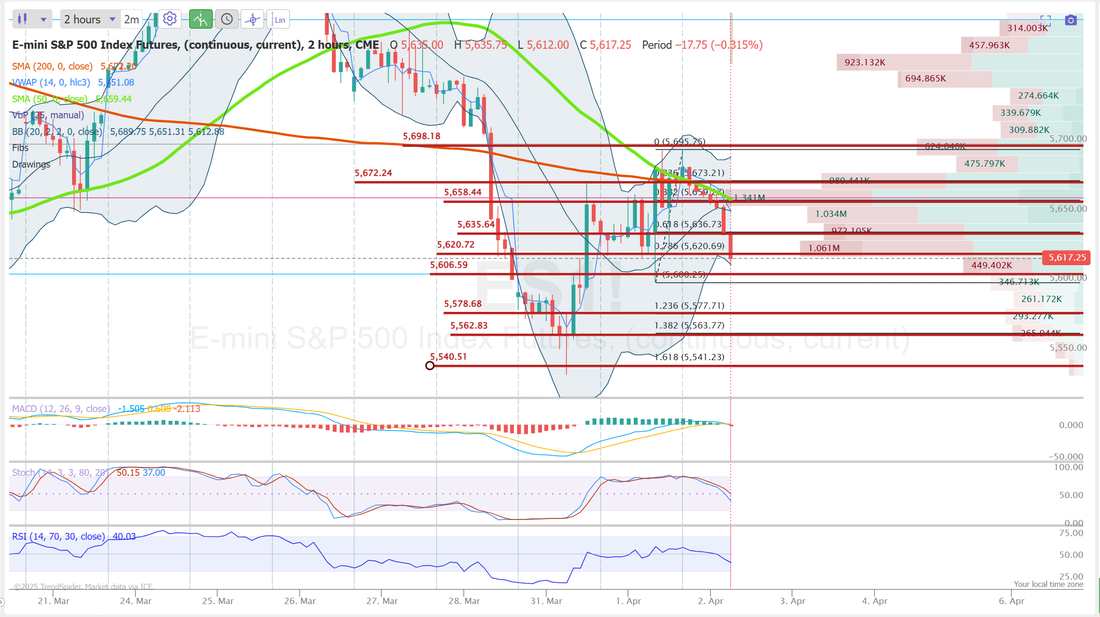

Debits or credits?Good morning traders! Welcome to "Liberation day"...whatever that may mean. It could be a big day. I'm watching 5620 on /ES. That's been a key support level. If we lose that it could be "look out below". We had a great day yesterday. We didn't make our $1,000/day goal but it was our best risk adjusted day all year. Our risk never went above $50 dollars all day. Granted we hit each entry pretty much perfect but it was gratifying, nonetheless. One of the first decisions an option trader needs to make is "Debit or credit?" Debits are pure directional plays. They have much lower probability of success but better risk/reward. Credit trades can be built with incredible probabilites of success of have worse risk/reward. I.V. also factors in. When I.V. is high options are expensive. Generally you want to sell expensive options and buy cheap ones. We've found our best success lately is a combination of both debit and credits setups with butterflies or broken wing butterflies adding nice profit zones. Here's a look at our day: Let's take a look at some of the market metrics: Sell signals all across the board. The bigger picture is starting to look more and more bearish. One quick note here: We love bearish markets. They are unquestionably the best for us. They offer bigger moves and larger premiums as I.V. spikes. If you are stuck in the idea that you want markets to go up you are short changing yourself of a better opportunity. I'm parking my long term money in our A.T.M. program which works like a hedge fund and can profit from down moves and in my trading account I'm trading small each day. Find a plan that works for you in a bear market. Don't complain...adjust. June S&P 500 E-Mini futures (ESM25) are trending down -1.01% this morning as risk sentiment took a hit ahead of U.S. President Donald Trump’s sweeping tariffs announcement. President Trump is set to announce his reciprocal tariff plan at an event in the White House Rose Garden just as U.S. stock markets close at 4 p.m. The White House said on Tuesday that reciprocal tariffs would become effective immediately after Trump announces them, heightening concerns about the economic impact of a trade war. Bloomberg reported that several proposals are being considered, including a tiered tariff system featuring a series of flat rates for countries, along with a more tailored reciprocal plan. Also, a recently announced 25% tariff on auto imports is set to take effect at 12:01 a.m. Washington time on April 3rd. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Tesla (TSLA) rose over +3% after Wells Fargo added the stock to its Q2 Tactical Ideas list. Also, PVH Corp. (PVH) surged more than +18% after the company reported better-than-expected Q4 results, issued above-consensus FY25 guidance, and said it plans to enter $500 million accelerated share repurchase agreements. In addition, Crowdstrike (CRWD) gained over +2% after Stephens initiated coverage of the stock with an Overweight rating and a price target of $450. On the bearish side, Johnson & Johnson (JNJ) slumped over -7% and was the top percentage loser on the S&P 500 and Dow after a federal judge in Texas rejected the company’s third attempt to use the bankruptcy of one of its units to resolve baby powder cancer claims. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to 7.568M in February, weaker than expectations of 7.690M. Also, the U.S. ISM manufacturing index fell to a 4-month low of 49.0 in March, weaker than expectations of 49.5, while the ISM prices paid sub-index rose to a 2-3/4 year high of 69.4, stronger than expectations of 64.6. At the same time, the U.S. March S&P Global manufacturing PMI was revised upward to 50.2, beating the consensus of 49.8. In addition, U.S. construction spending rose +0.7% m/m in February, stronger than expectations of +0.3% m/m. Richmond Fed President Tom Barkin stated on Tuesday that President Trump’s tariffs could drive up both inflation and unemployment, posing a significant challenge for the central bank. Barkin noted that a tariff-driven price shock could lead to a “cage match” between a frustrated consumer unwilling to pay more and a goods and services provider who “really believes” they must pass on increases. Regarding the labor market, the Richmond Fed chief said, “If you are a company that can’t raise prices, then your margin goes down. You’re going to start working on operational efficiencies, and that means headcount.” Also, Chicago Fed President Austan Goolsbee cautioned about the adverse effects of any pullback in consumer spending or business investment stemming from tariff-related uncertainty. “If the consumer stops spending or business stops investing because they’re uncertain or they’re afraid where we’re headed, that would be a bit of a mess,” Goolsbee said in an interview on Fox News. Meanwhile, U.S. rate futures have priced in an 85.5% probability of no rate change and a 14.5% chance of a 25 basis point rate cut at the May FOMC meeting. On the economic data front, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the March ADP Nonfarm Employment Change will stand at 118K, compared to the February figure of 77K. U.S. Factory Orders data will also be reported today. Economists foresee this figure coming in at +0.5% m/m in February, compared to the previous number of +1.7% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -0.400M, compared to last week’s value of -3.341M. In addition, market participants will be anticipating a speech from Fed Governor Adriana Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.174%, up +0.43%. My lean or bias today is bearish. We lose 5620 on /ES and down we go. Nuff said. Very focused trade docket today: We'll look to work the put side of our /NQ scalp for additional income. 1HTE's on BTC for as long as we can find setups. 0DTE on SPX initially and NDX later in the day. RH earnings trade and we'll look again at a re-entry on LULU. Let's look at the /ES today and focus primarily on it. What do we see on the daily chart? Trend? Down. We are in a huge low vol node which means movement (substantial) is coming. Below the 200DMA. MACD, STOC, RSI etc. all flashing sell signals. As I type this we just went below the 5620 level (very bearish) but the big double whammy that could be coming, if bulls can't step in in the Mar. 13th. 5508 key support. IF we get back down there we also have a good chance that the 50DMA (green line) crosses down through the 200DMA (red line). That my friends is a death cross. Below the 200DMA and a death cross? That's the biggest bearish signal I know. I'm not saying it will happen. Just be prepared. On an intra-day basis we will place our trades based on multiple levels. 5620 is really key. Bulls absolutely need to hold this level. Resistance levels above are 5635, 5658, 5672, 5698. If we lose 5620 the first support below is 5606 then 5578, 5562, 5540. Our goal (my my suggestion to you) is to focus today on risk management and let the profit or loss fall where it may. I'll see you all in the live trading room shortly. Let's have a repeat of yesterday. That would be nice.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |