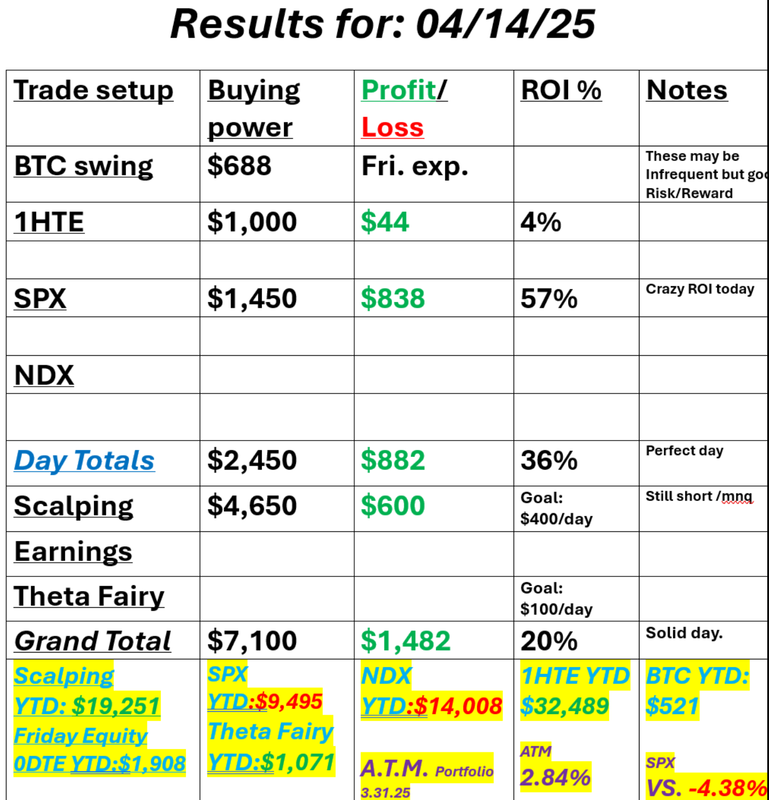

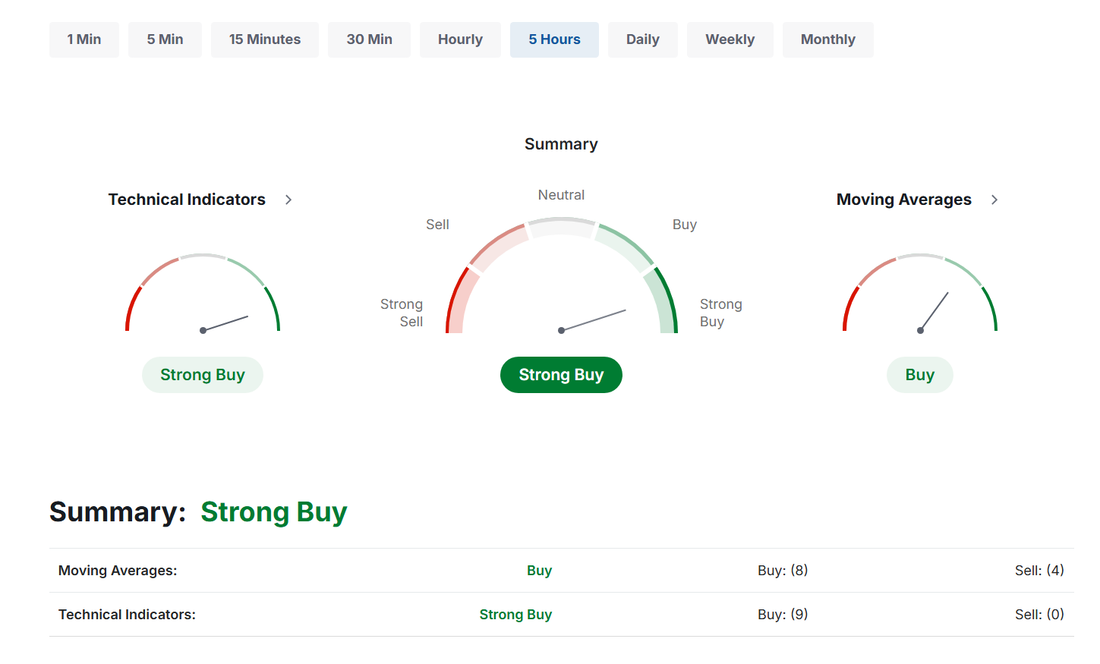

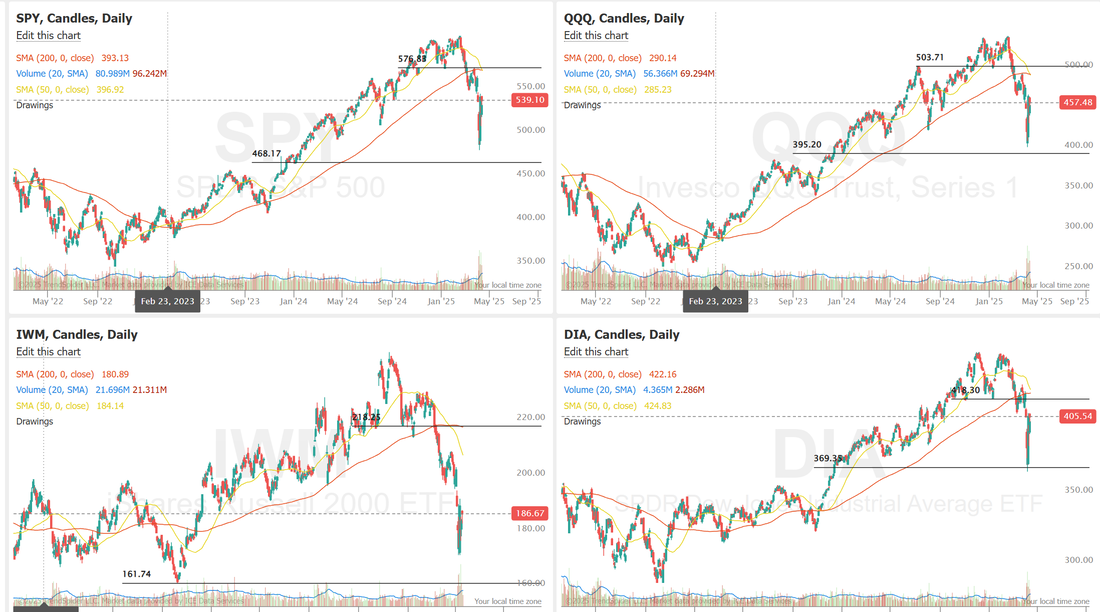

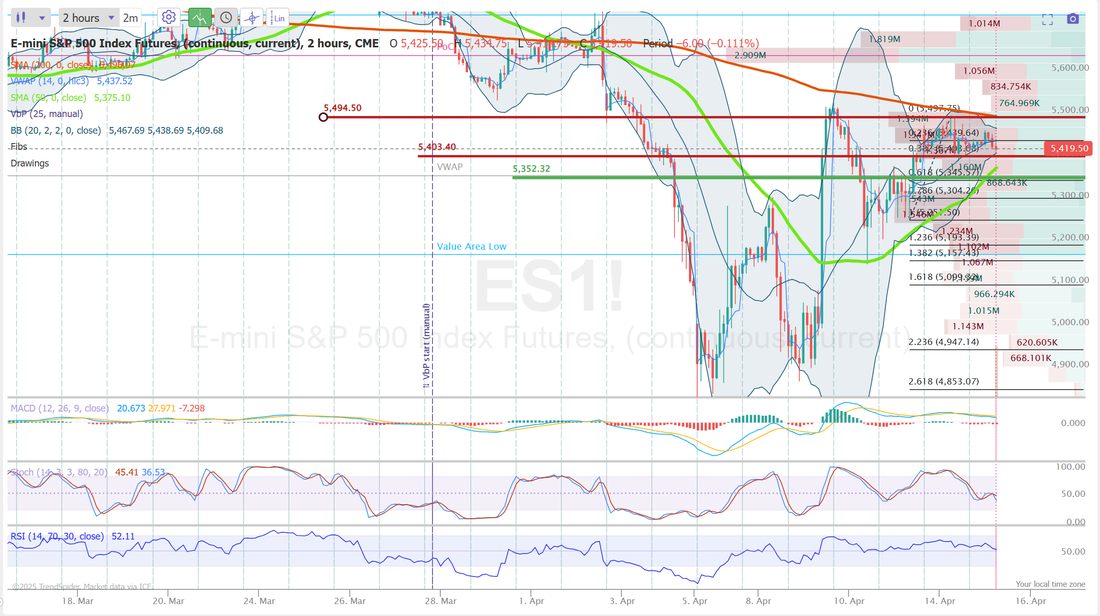

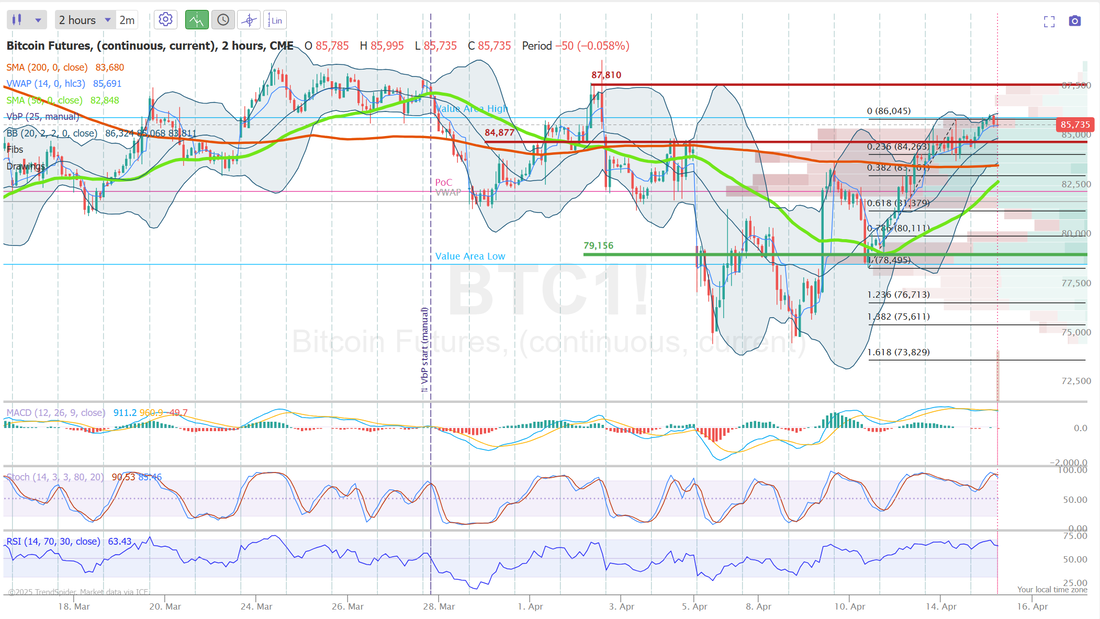

Has calm returned?It may be a bit early to call it. I.V. is still elevated and 5min. candles are still looking pretty big on our daily charts but yesterday seemed about as "normal" a day as we've had in a while. If you want unique results you'll need unique setups. They don't work all the time...nothing does but I do pride myself on the setups we use. Our daily combination of scalping setups with 1HTE's and our approach to 0DTE IS UNIQUE. When it works it's a thing of beauty. Yesterday was beautiful. Our 0DTE consisted of a bearish debit spread. A bullish debit spread. An Iron Condor. A broken wing butterfly and an Iron Fly. All this and we only used $1,450 dollar of capital for $835 of profit. See our results below: $1,000 a day profit is absolutely possible. Lot's of traders do it but I don't think we've ever had this type of gain on this small of capital allocation. It was a really gratifying day. We have now adding working an long Iron fly into our setup near the close and I'm hopeful it will continue to pay off as it did for us yesterday. Let's take a look at the markets: Yesterdays push up flipped the tecnicals to positive. Will it hold? Too early to tell but I'm thinking we have a good chance to give some of yesterdays gains back today. This last week really saved the indices however, it just brings us back to a previous consolidation zone. Let's be clear. The overall trend is still down. June S&P 500 E-Mini futures (ESM25) are up +0.05%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.14% this morning, pointing to a muted open on Wall Street, while investors await U.S. economic data, quarterly reports from more big banks, and remarks from Federal Reserve officials. Stock index futures initially posted solid gains amid hopes for more U.S. tariff exemptions after President Donald Trump floated a possible pause in auto tariffs. President Trump stated on Monday that he is considering possible temporary exemptions for his tariffs on imported vehicles and parts to provide auto companies additional time to set up U.S. manufacturing. “I’m looking at something to help car companies with it. They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump told reporters in the Oval Office. At the same time, the U.S. moved ahead with plans to impose tariffs on semiconductor and pharmaceutical imports by launching trade investigations led by the Commerce Department. In yesterday’s trading session, Wall Street’s major indexes closed in the green. Apple (AAPL) rose over +2% following a U.S. tariff exemption for a range of consumer electronics. Also, automobile stocks gained ground after President Trump said he was “looking at something to help some of the car companies,” with Ford (F) climbing more than +4% and General Motors (GM) rising over +3%. In addition, Palantir Technologies (PLTR) advanced more than +4% after NATO acquired an AI-powered military system from the company. On the bearish side, DaVita (DVA) slid about -3% after disclosing a ransomware incident that encrypted certain parts of its network. “The worst may be over, but the coast is not clear. The 90-day pause on reciprocal tariffs and further concessions over the weekend lessen the near-term probability of a recession, but uncertainty remains high, the Fed is on hold, and back-end rates are a headwind,” said Michael Wilson at Morgan Stanley. Fed Governor Christopher Waller stated on Monday that he anticipates the impact of tariffs on inflation to be temporary. Still, Waller described the new tariff policy as “one of the biggest shocks to affect the U.S. economy in many decades.” Should there be a minor tariff impact on prices, rate cuts would “very much” be considered for the latter half of 2025, he said. Meanwhile, U.S. rate futures have priced in an 81.0% chance of no rate change and a 19.0% chance of a 25 basis point rate cut at May’s monetary policy meeting. First-quarter corporate earnings season is gathering pace, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC) and Citigroup (C) as well as prominent companies like Johnson & Johnson (JNJ), Interactive Brokers (IBKR), and United Airlines Holdings (UAL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Export and Import Price Indexes, set to be released in a couple of hours. Economists anticipate the export price index to be +0.1% m/m and the import price index to be +0.1% m/m in March, compared to the previous figures of +0.1% m/m and +0.4% m/m, respectively. The Empire State Manufacturing Index will also be reported today. Economists foresee this figure coming in at -12.80 in April, compared to -20.00 in March. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and Fed Governor Lisa Cook. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.360%, down -0.09%. My bia or lean today is bearish. I've been thinking back to the crash of 2008. There were so many, "rip your face off" short covering rallies during that downturn. This last week has be great for the bulls but the big picture is still down. I continue to hold my short /MNQ futures postion and cash flow it daily. Same as yesterday. Scalping could yield us a home run today if we can get the cover on at the right time of day. 1HTE's look good today. We already have one working. 0DTE on SPX. We'll work our magic with our multi step process again today. Let's take a look at the intra-day levels: /ES: I don't see us getting above resistance today which is 5498. Support is 5403 with 5352 below that. BTC: Bitcoin gave us only one setup yesterday. It was a nice one but not much return. Today is looking better. We've already got one 1HTE working with a nice 10% ROI potential. Let's see how many we can get today. 87,810 is resistance with 84,877 working as support. It should be an interesting day. The premium is there to have a blow out day with scalping. Likewise with our SPX. In other words, the market looks like it's offering itself up on a platter for us today. Now it's up to us to get our entries and exits right. See you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |