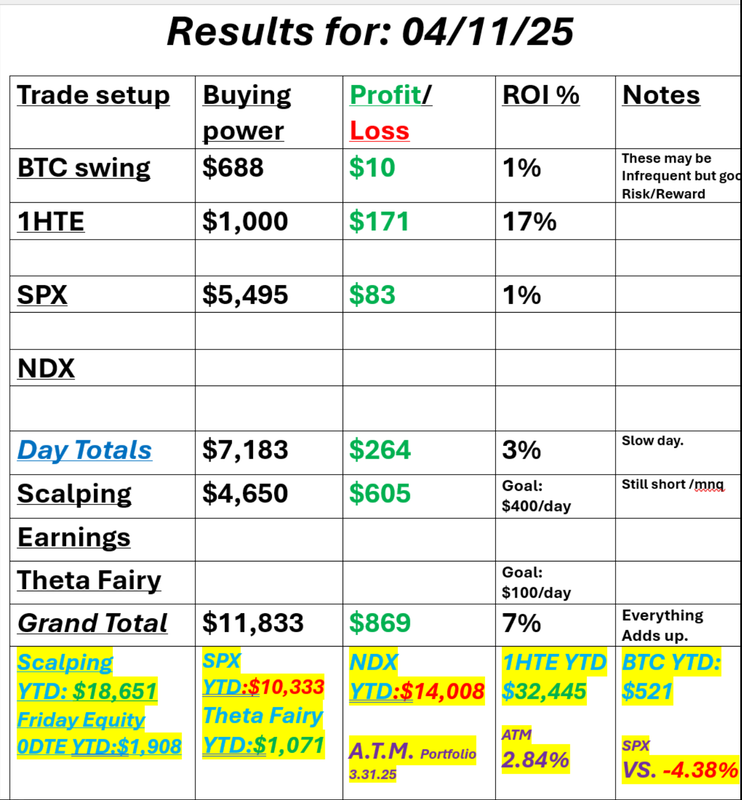

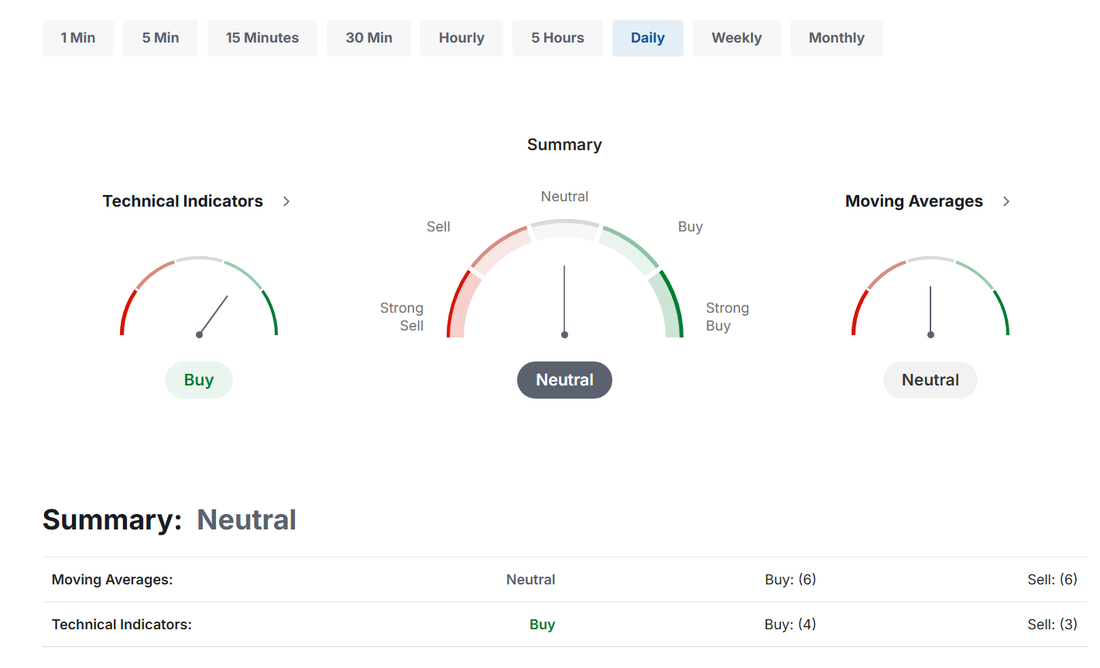

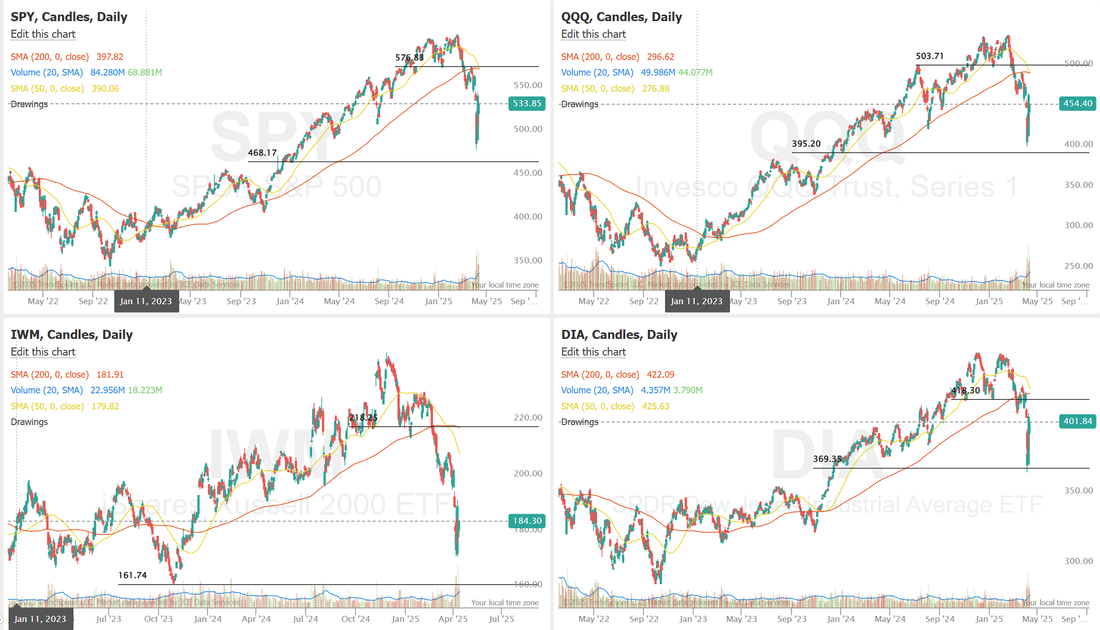

Uncertainty...it's tough to trade.Welcome back traders! It's a new, holiday shortened week. One thing we look at each day as we prepare to trade is the Technical matrix from investing.com. It combines a dozen different indicators and gives us a technical reading for the day. Bullish, Bearish or Neutral. Our best days are bearish as it generally provides the best premium. Bullish is fine as well. Neutral days? I hate them. The market hates a vacuum. It creates uncertainty and that makes it tough to find levels that you have confidence in. Right now there's a lot of uncertainty in this market. The moves are big and hard to see coming. We've had an approach that is working by keeping a low cost debit trade at the core of our setup. It's very asymmetric so the risk is low and the potential profit is solid. Unfortunately they haven't really hit for us. We'll keep the same approach today. Risk management first. Profit second. Even though Friday was a slow day for us, it all added up at the end of the day to a decent finish. Here's a look at our day last Friday. Let's look at the markets: On the smaller time frames we are leaning slightly bullish today but on the daily it's stuck in the dreaded neutral rating. That means don't be surprised with whatever we get today out of the market. There's still a lot of damage the market needs to repair to get a clear bullish trend but some of the damage has been stanched. Those support levels from last years Aug./Sept. zone seem to be holding. June S&P 500 E-Mini futures (ESM25) are up +1.24%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.69% this morning, pointing to a strong open on Wall Street after U.S. President Donald Trump paused import duties on various consumer electronics. Sentiment got a boost after the Trump administration exempted smartphones, laptop computers, hard drives, computer processors and memory chips, as well as flat-screen displays, from its so-called reciprocal tariffs. The exclusions, published late Friday by U.S. Customs and Border Protection, reduce the scope of the levies by excluding the products from President Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries. Still, the White House stated that the pause in the duties is temporary and part of the longstanding strategy to implement a distinct, targeted levy on the sector. Trump on Sunday vowed to unveil new tariffs on semiconductors over the next week. This week, investors look ahead to earnings reports from a stellar lineup of companies, key economic data releases, and remarks from Federal Reserve Chair Jerome Powell and other Fed officials. In Friday’s trading session, Wall Street’s major equity averages ended higher. The Magnificent Seven stocks advanced, with Apple (AAPL) rising over +4% to lead gainers in the Dow and Nvidia (NVDA) gaining more than +3%. Also, gold mining stocks rallied after the price of gold hit a new all-time high, with AngloGold Ashanti (AU) surging over +10% and Newmont (NEM) climbing more than +7%. In addition, JPMorgan Chase (JPM) rose +4% after the biggest U.S. bank posted better-than-expected Q1 results and raised its FY25 net interest income forecast. On the bearish side, U.S. semiconductor stocks slumped after the China Semiconductor Association stated that chip tariffs would be based on the location of manufacture, not the shipping origin, with Texas Instruments (TXN) sliding over -5% to lead losers in the S&P 500 and Nasdaq 100. “Markets remain emotionally charged. Markets are still searching for footing amid unresolved trade tensions, earnings uncertainty, and macroeconomic headwinds,” said Mark Hackett at Nationwide. Economic data released on Friday showed that the U.S. producer price index for final demand came in at -0.4% m/m and +2.7% y/y in March, weaker than expectations of +0.2% m/m and +3.3% y/y. Also, the core PPI, which excludes volatile food and energy costs, arrived at -0.1% m/m and +3.3% y/y in March, weaker than expectations of +0.3% m/m and +3.6% y/y. In addition, the University of Michigan’s U.S. consumer sentiment index fell to a 2-3/4 year low of 50.8 in April, weaker than expectations of 54.0. The Financial Times reported on Friday that Boston Fed President Susan Collins stated the central bank “would absolutely be prepared” to use its capabilities to stabilize financial markets if conditions turn disorderly. Collins noted that “markets are continuing to function well” and that “we’re not seeing liquidity concerns overall.” At the same time, she added that the Fed “does have tools to address concerns about market functioning or liquidity should they arise.” Other Fed officials - Kashkari, Musalem, and Williams - on Friday continued to voice concerns over the impact of U.S. tariff policy on the economy and prices. U.S. rate futures have priced in a 79.3% probability of no rate change and a 20.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. First-quarter corporate earnings season heats up this week, with results expected from several more big banks, including Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C). Also, major companies like Netflix (NFLX), UnitedHealth (UNH), Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Travelers (TRV), CSX Corporation (CSX), Charles Schwab (SCHW), American Express (AXP), and DR Horton (DHI) are set to post quarterly results this week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Market watchers will also be closely monitoring the U.S. March Retail Sales figures this week for indications of how American consumers are responding to President Trump’s trade policies. Economists expect retail sales to be “very strong,” pointing out that consumers made major purchases before the imposition of tariffs. Other noteworthy data releases include the U.S. Export Price Index, the Import Price Index, the Empire State Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Crude Oil Inventories, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, and the Philadelphia Fed Manufacturing Index. In addition, Fed Chair Jerome Powell will provide his assessment of the economy in a speech on Wednesday before the Economic Club of Chicago. A host of other Fed officials will also be making appearances throughout the week, including Barkin, Waller, Harker, Bostic, Cook, Hammack, Schmid, Barr, and Daly. Meanwhile, the U.S. stock markets will be closed on Friday in observance of Good Friday. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.443%, down -1.11%. Let's take a look at the expected moves for this shortened week. That's some absolutely amazing I.V. kicking off the week. SPY closed the week at $533.94 (+5.71%) after reversing at the key 2021 high pivot. The RSI hit its lowest level since 2022, triggering a bright green signal on the Combined RSI Ensemble Indicator, which indicated deeply oversold conditions across three lengths. The sharp bounce that followed suggests a potential short-term bottom is in place—for now. QQQ closed the week at $454.40 (+7.51%), fueled by a historic rebound midweek. Monday saw the highest single-day volume since 2022, while Wednesday delivered QQQ’s second-best day ever, closing up over 12% following the real tariff pause news. Despite the surge, QQQ remains more than 15% below its all-time highs, leaving bulls to debate whether this marks a durable low or just a sharp bounce. IWM closed the week at $184.36 (+1.80%), continuing to lag behind its large-cap peers. It maintained above its 2022 range low, giving small-cap investors relief it didn’t break key support. Despite cooler inflation data, which typically benefits rate-sensitive names, IWM’s muted reaction suggests investors remain cautious on small caps amid broader macro uncertainty. My lean or bias today is bearish. Futures are up strong right now, as I type with the hope that tariffs will be less severe but Trump has stated that more will be incoming. I'd prefer to play the counter trend today. Trade docket today is the same as every day lately. #1. 1HTE's. #2. Scalping with /MNQ and /NQ cover. #3. 0DTE SPX. #4. Adding to our BITO trade. One thing this I.V. has given us is the fact that we still have a reasonable shot at $1,000+ income each day IF our debits hit. Our buying power usage is down but the profit potential is still there. SPX and NDX are still down about 10% YTD. We may still be out be a few weeks out before we get some clarity. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |